The long-awaited second Fed hike has finally arrived! What does it mean for the gold market?

As widely expected, the U.S. central bank delivered the second rate hike in almost a decade. Investors waited a year for this move, as the Fed postponed it again and again. The key paragraph of the released statement is as follows:

“In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1/2 to 3/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.”

In line with expectations, the FOMC members pointed out the recent strength in the labor market and the rise in economic growth and inflation expectations, but maintained the description of risks as “roughly balanced”. Importantly, the vote was unanimous, and the decision about hiking was associated with a dovish assurance that the path of future rate hikes will be gradual.

As the U.S. central bank increased the federal funds rate, it also lifted its other interest rates by 25 basis points. In particular, as we can read in an implementation note, the Fed raised interest paid on required and excess reserve balances to 0.75 percent, the overnight reverse repo rate to 0.50 percent and the discount rate to 1.25 percent.

When it comes to the Summary of Economic Projections, the FOMC members revised up slightly the GDP growth and inflation, and revised down the unemployment rate. The most important change is, however, the increase in projections for the federal funds rate from 1.1 percent to 1.4 percent in 2017, from 1.9 percent to 2.1 percent in 2018, and from 2.6 percent to 2.9 percent in 2019. The upward revision implies three hikes next year compared to two moves expected in September. Markets also expected only two hikes in 2017. The steeper path of the federal funds rate is bad news for the gold market.

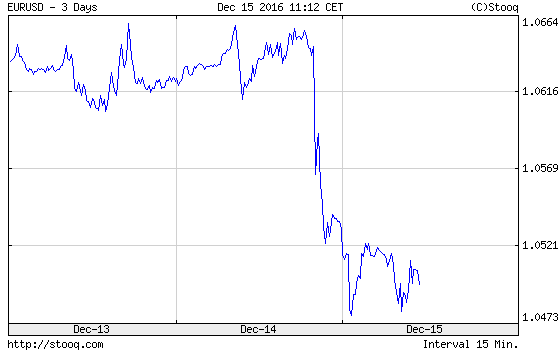

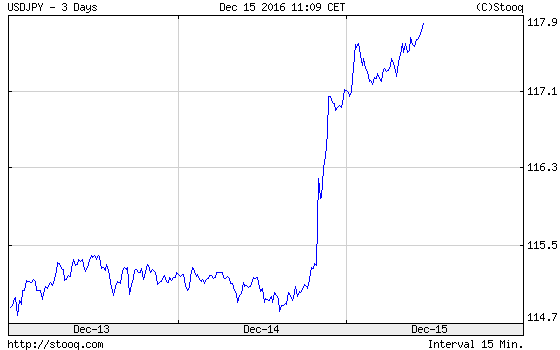

Therefore, the bottom line is that the combined statement and the economic projections were hawkish. This is why the U.S. dollar surged to its highest in 14 years (see the charts below), while the price of gold plunged to its lowest in over 10 months.

Chart 1: The EUR/USD exchange rate over the last three days.

Chart 2: The USD/JPY exchange rate over the last three days.

Indeed, as one can see in the next chart, gold lost more than 2 percent, declining from $1,160 to $1,135 initially after the release of the statement.

Chart 3: The price of gold over the last three days.

The upward revision of the federal funds rate next year is negative for the price of gold, which should remain under downward pressure due to a more hawkish Fed, at least in the near future. Although we are a bit skeptical about three rate hikes next year, given the Fed’s poor track-record, the more hawkish comments from the Fed should be a headwind for gold in the short term.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview