On Thursday, the European Central Bank released its most recent monetary policy statement. What does it say about the ECB’s stance and what does it imply for the gold market?

As expected, the ECB kept its monetary policy unchanged at its last meeting, but altered its quantitative easing program. In line with expectations, the bank cut the volume of monthly purchases, but extended the duration of the program until September 2018:

“From January 2018 the net asset purchases are intended to continue at a monthly pace of €30 billion until the end of September 2018, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim.”

The recalibration of the ECB’s quantitative easing program reflected growing confidence in the Eurozone economy, while the extension of the program was caused by the still subdued inflation rate. As markets expected a tinier reduction in the volume of monthly purchases (to €40 billion), the decision was a little bit more hawkish than expected.

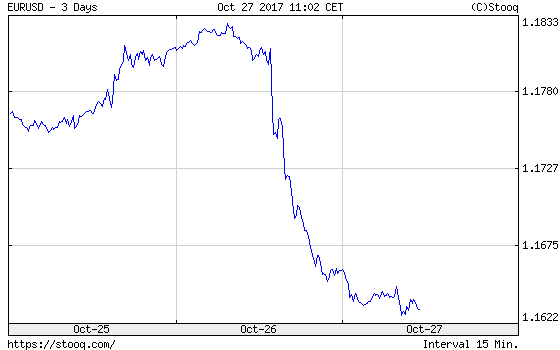

However, at the press conference, Draghi said that the large majority of the Governing Council members preferred to keep quantitative easing open-ended rather than to announce an end date. He even added that the asset purchase program was not going to stop suddenly. Draghi also pointed out the importance of reinvestment, as its level is sizable, about €10 billion per month. Hence, as we predicted yesterday, the ECB meeting was considered more dovish than expected, on balance. The euro plunged against the U.S. dollar, as one can see in the chart below.

Chart 1: EUR/USD over the last three days.

The depreciation of the euro against the greenback was a headwind for the gold market. As the next chart shows, the price of the yellow metal also declined in the aftermath of the ECB meeting.

Chart 2: Gold prices over the last three days.

To sum up, the important ECB meeting is behind us. The bank downsized its asset purchase program, but it simultaneously extended its duration. Although the decision was generally in line with expectations, the tone of Draghi’s remarks was rather dovish. This is bad news for the gold market, as it turned out that the ECB will not help the yellow metal rally. Actually, the current sentiment (tax reform, more hawkish Fed, more dovish ECB) seems to be negative for gold prices. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview