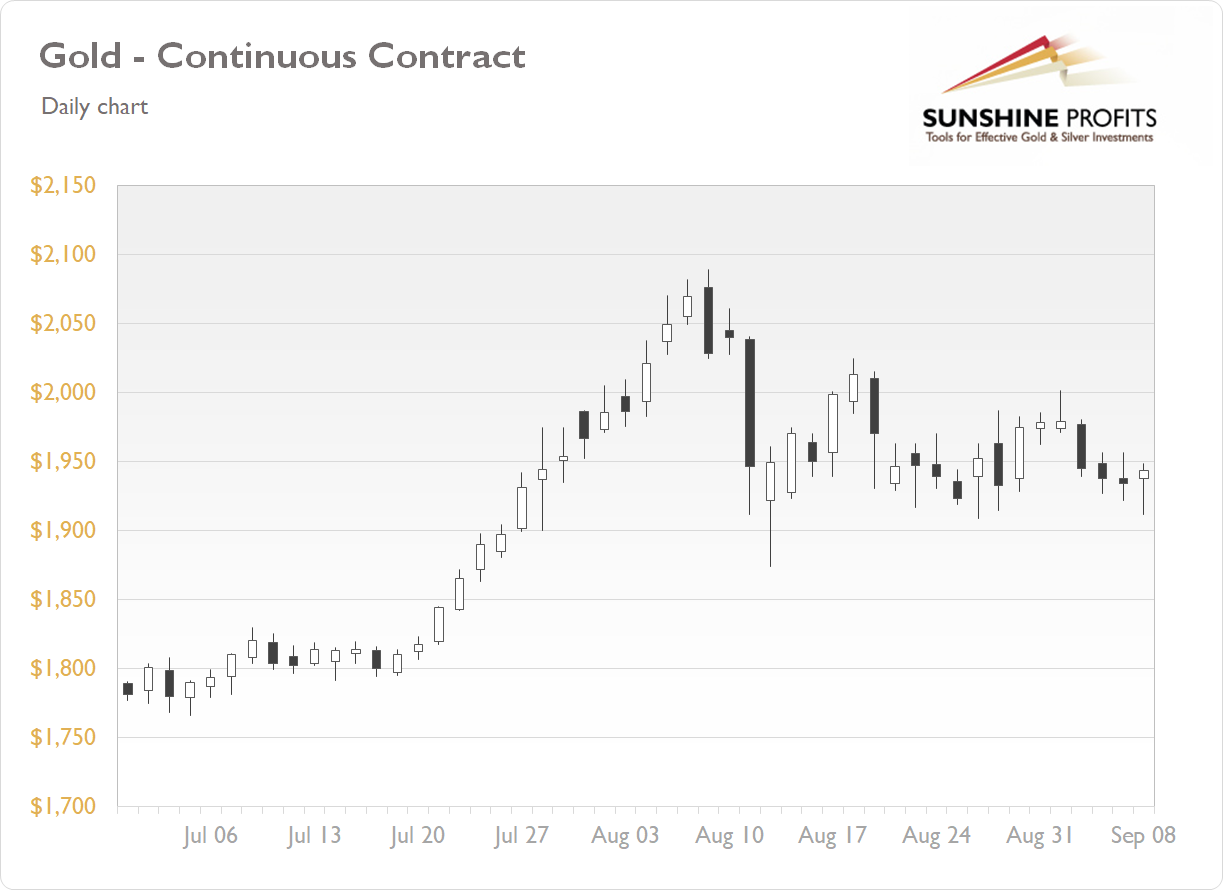

The gold futures contract gained 0.46% on Tuesday, as it extended its short-term consolidation following last week's Wednesday's decline of over 1.7%. The market bounced off $2,000 resistance level. On Friday the intraday volatility has been relatively low despite monthly jobs data release. And the stock market's rout didn't trigger any significant move in gold recently. Gold price is trading within a month-long consolidation, as we can see on the daily chart:

Gold is 0.5% lower this morning, as it is trading within yesterday's range. What about the other precious metals? Silver gained 1.04% on Tuesday and today it is 0.7% lower. Platinum gained 1.35% and today it is unchanged. Palladium lost 1.60% on Tuesday and today it's 1.0% lower. So precious metals are lower this morning.

Today we will get the JOLTS Job Openings release at 10:00 a.m. At the same time, Bank of Canada's monetary policy update will be released.

The market will wait for Thursday's ECBMonetary Policy Statement along with the ECB Press Conference.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, September 9

- 10:00 a.m. U.S. - JOLTS Job Openings

- 10:00 a.m. Canada - BOC Rate Statement, Overnight Rate

Thursday, September 10

- 7:45 a.m. Eurozone - Main Refinancing Rate, Monetary Policy Statement

- 8:30 a.m. Eurozone - ECB Press Conference

- 8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Unemployment Claims

- 10:00 a.m. U.S. - Final Wholesale Inventories m/m

- 12:30 a.m. Canada - BOC Governor Macklem Speech

- 1:00 p.m. Eurozone - ECB President Lagarde Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.