The gold futures contract lost 0.83% on Tuesday, as it extended its short-term consolidation following recent decline below $2,000 price level. Gold reversed lower on August 7 after much better than expected Nonfarm Payrolls release, among other factors. The following upward correction reached a local high of $2,024.60 a week ago on Tuesday.

Gold is 0.6% lower this morning, as it is trading along its short-term local lows. What about the other precious metals? Silver lost 1.26% on Tuesday and today it is 0.9% lower. Platinum gained 1.03% and today it is 1.5% lower. Palladium gained 0.30% on Tuesday and today it's 0.6% lower. So precious metals' prices are going down this morning.

Yesterday's CB Consumer Confidence release has been worse than expected. However, financial markets remained risk-on, as stocks extended their multi-year bull market. Today we will get Durable Goods Orders number at 8:30 a.m. But investors will be waiting for tomorrow's Fed talk and the U.S. preliminary GDP release.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, August 26

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

Thursday, August 27

- 8:30 a.m. U.S. - Preliminary GDP q/q, Unemployment Claims

- 9:10 a.m. U.S. - Fed Chair Powell Speech

- 10:00 a.m. U.S. - Pending Home Sales m/m

- 11:15 a.m. Canada - BOC Governor Macklem Speaks

- All Day, U.S. - Jackson Hole Symposium Day 1

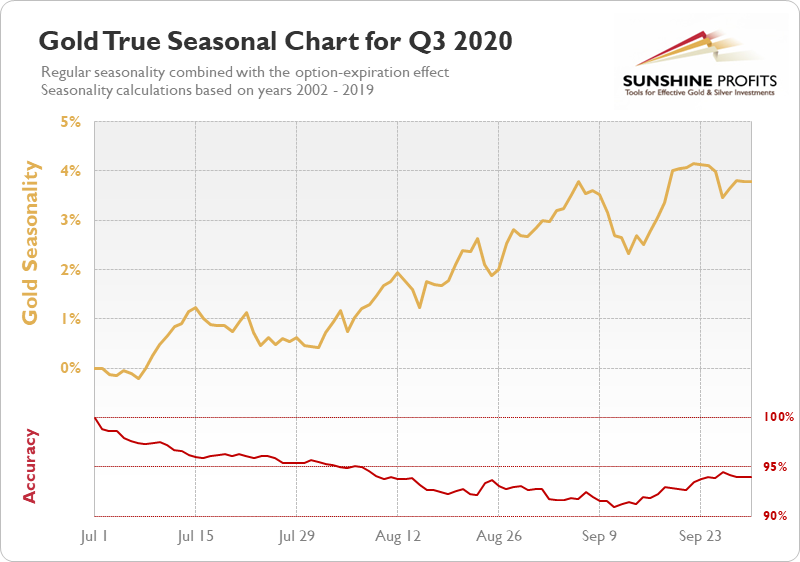

What future gold price behavior may be? Let's take a look at our proprietary Gold True Seasonality for the third quarter of 2020 where we combined the regular seasonality with the effect of the expiration of options and accuracy estimation. The yearly seasonal pattern of the price of gold was calculated using a 18-year-long period from 2002 to 2019 and then adjusted for the expiration of options that we observed between 2009 and 2019.

We can see that gold is usually going higher in the end of August. However, notice the declining accuracy in that period too. Then in September the market is trading within a consolidation.

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.