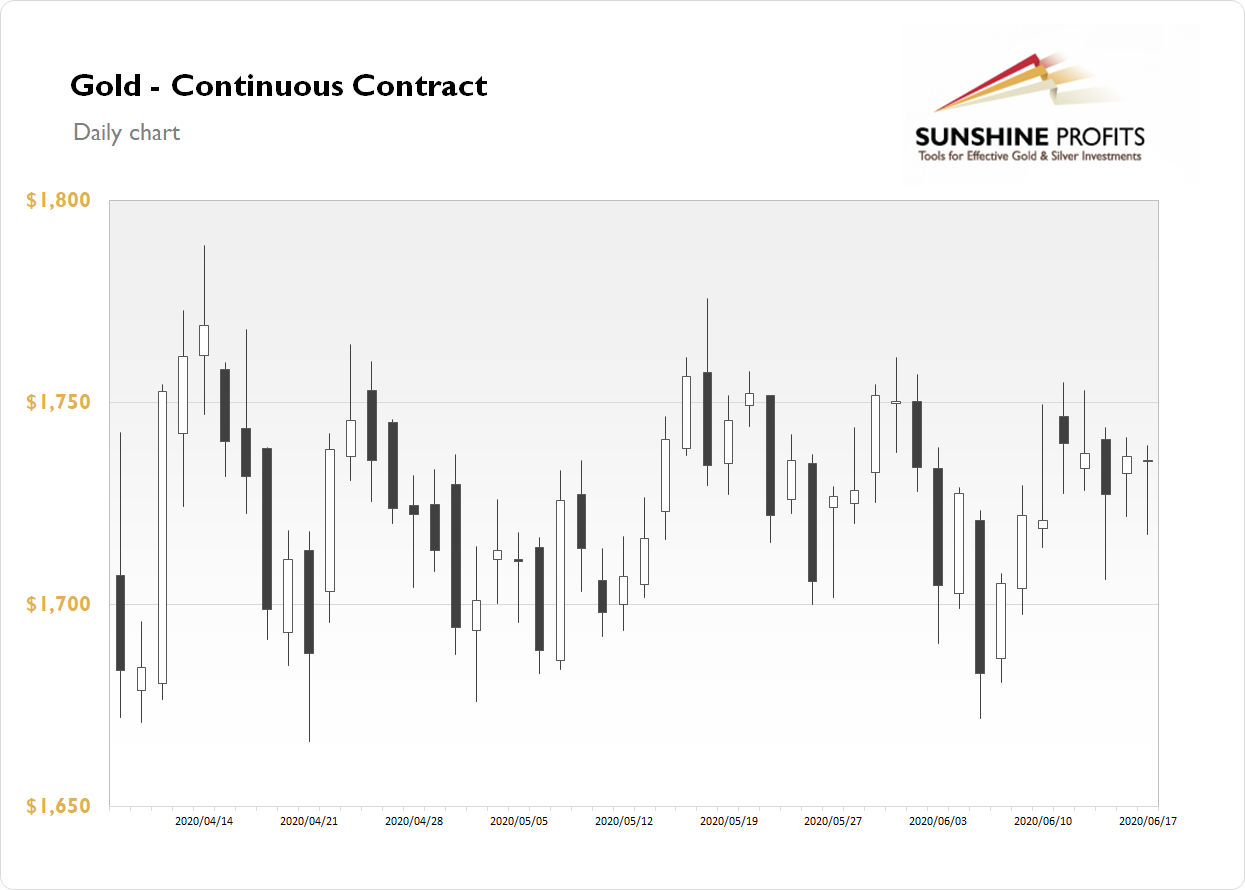

The gold futures contract lost 0.05% on Wednesday, as it extended its short-term consolidation above the price level of $1,700. Gold has been breaking slightly above $1,750 mark recently. But it came back closer to $1,700 on Monday. Last Wednesday's FOMC Statement came out as a short-term game-changer. Stock prices reversed lower and gold spiked higher. However, it is still trading within a medium-term consolidation, as we can see on the daily chart:

Gold is trading 0.3% lower this morning following an overnight advance. What about the other precious metals? Silver gained 0.7% on Wednesday and today it is 0.5% lower. Platinum lost 0.68% and today it is 0.9% lower. Palladium lost 0.89% yesterday and today it is trading 0.5% lower. So precious metals continue to trade within a short-term consolidation.

Yesterday's U.S. Builiding permits and Housing Starts releases have been mixed. And the Fed Chair Powell's testimony haven't been much of a market mover. Today we will have the Philly Fed Manufacturing Index and the Unemployment Claims releases at 8:30 a.m. and then the CB Leading Index release at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, June 18

- 7:00 a.m. U.K. - Official Bank Rate, Monetary Policy Summary

- 8:30 a.m. Canada - ADP Non-Farm Employment Change, NHPI m/m, Wholesale Sales m/m

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index, Unemployment Claims

- 10:00 a.m. U.S. - CB Leading Index m/m

Friday, June 19

- 8:30 a.m. U.S. - Current Account

- 8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

- 1:00 p.m. U.S. - Fed Chair Powell Speech

- All Day, Eurozone - EU Economic Summit

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.