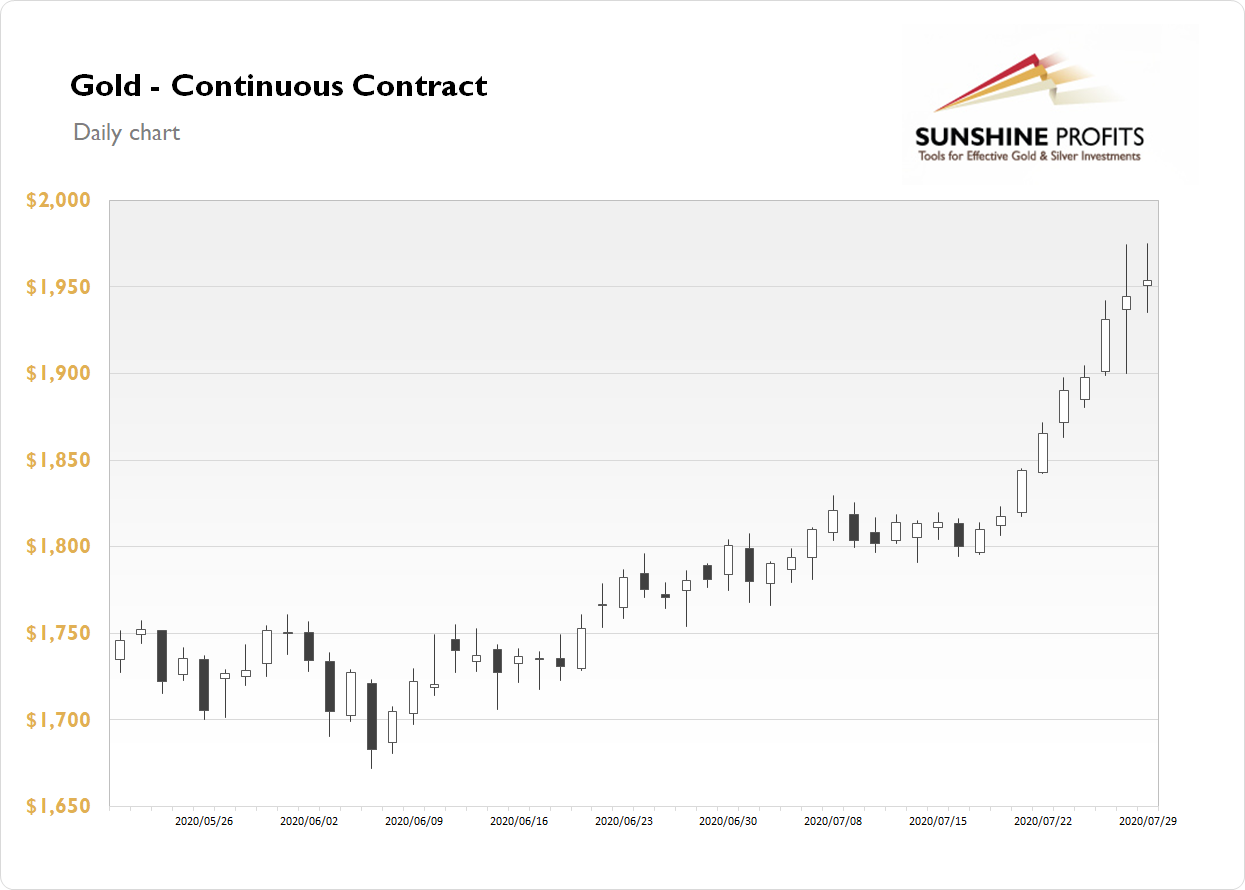

The gold futures contract reached new record high of $1,974.90 on Wednesday, as it slightly extended its recent advance. But the market has closed just 0.45% higher and over $20 below yesterday's daily high. Gold reached the highest in history following U.S. dollar sell-off, among other factors.

Gold is 0.9% lower this morning as it is trading within a short-term consolidation following record-breaking advance. What about the other precious metals? Silver gained 0.09% on Wednesday and today it is 3.9% lower. Platinum lost 2.81% and today it is 2.5% lower. Palladium lost 4.41% on Wednesday and today it's 5.3% lower. So precious metals are retracing some of their recent rally this morning.

Yesterday's U.S. Pending Home Sales number release has been slightly better than expected. At 2:00 p.m. we got the FOMC Statement announcement that has led to an increased volatility. Gold went higher before retracing the whole intraday advance.

Today we will get the important U.S. Advance GDP number, among others. The GDP is expected to decline by a stunning 34.5% q/q!

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, July 30

- 4:00 a.m. Eurozone - German Preliminary GDP q/q, ECB Economic Bulletin

- 5:00 a.m. Eurozone - Unemployment Rate

- 8:30 a.m. U.S. - Advance GDP q/q, Advance GDP Price Index q/q, Unemployment Claims

- 9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

Friday, July 31

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m, Core PCE Price Index m/m, Employment Cost Index q/q

- 8:30 a.m. Canada - GDP m/m, IPPI m/m, RMPI m/m

- 9:45 a.m. U.S. - Chicago PMI

- 10:00 a.m. U.S. - Revised UoM Consumer Sentiment

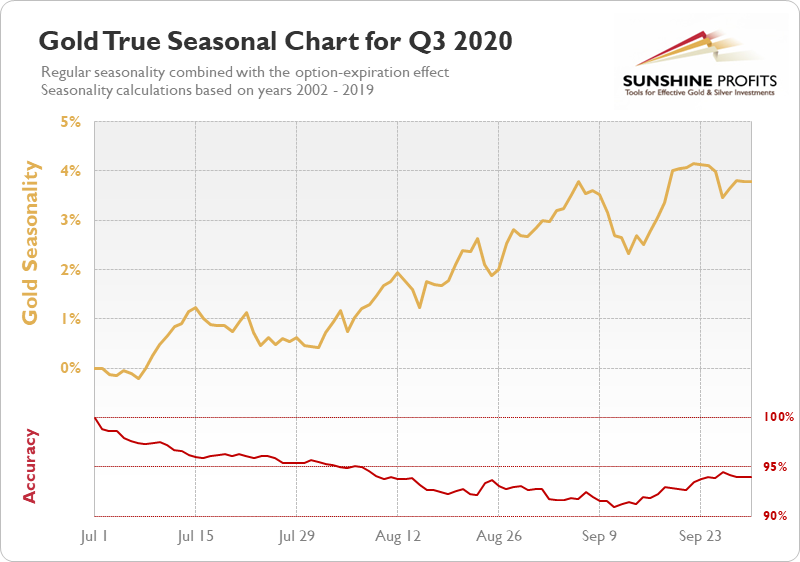

What future gold price behavior may be? Let's take a look at our proprietary Gold True Seasonality for the third quarter of 2020 where we combined the regular seasonality with the effect of the expiration of options and accuracy estimation. The yearly seasonal pattern of the price of gold was calculated using a 18-year-long period from 2002 to 2019 and then adjusted for the expiration of options that we observed between 2009 and 2019.

We can see that gold is usually going higher in August and September. But will the market continue upwards despite some clear technical overbought conditions and a possible uptrend exhaustion?

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.