On Sunday, there was an independence vote in Spain’s Catalonia. What does it mean for the gold market?

First of all, let us offer sincere condolences to the families and friends of the victims of the shooting spree in Las Vegas and of clashes with police in Catalonia.

According to preliminary results, 90 percent of voters in Sunday’s were in favor of independence. The electoral turnout was about 43.5 percent, as about 2.26 million of 5.3 registered Catalans went to the ballot box.

But let’s provide some context. Catalonia is an autonomous community of Spain with its own culture and language. Its capital is Barcelona, the second-most populated city in Spain. In a 2014 referendum, Catalans supported the region’s transformation into a state. At the end of 2015, the Catalan parliament approved a plan for secession from Spain before 2017, despite the fact that the Spanish Constitutional Court suspended it as illegal. Similarly, the Spanish government and courts declared the referendum illegal, as the Spanish constitution excludes the possibility of a secession. Section 2 states:

“The Constitution is based on the indissoluble unity of the Spanish Nation, the common and indivisible homeland of all Spaniards; it recognises and guarantees the right to selfgovernment of the nationalities and regions of which it is composed and the solidarity among them all.”

This is why the Spanish police seized millions of ballot papers and closed hundreds of polling places. But it only caused violent clashes with at least 800 people hurt.

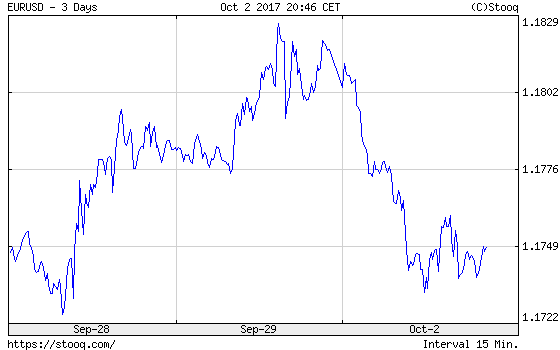

What does it all mean for the gold market? Well, Sunday’s events are the biggest political crisis in Spain in decades. After the results and the violent reaction of the Spanish police, Catalonia’s regional lawmakers may now declare independence. The crisis over the legal status of a fifth of Spain’s economy rattled the financial markets. Spain’s borrowing costs surged, while Spanish equities declined. And the euro slipped against the U.S. dollar on Monday, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last three days.

Hence, the tumultuous political situation in Spain is negative for the gold market, as increased political risk in Europe supports the greenback. Indeed, the yellow metal continued its downside trend on Monday, as the next chart shows.

Chart 2: Gold prices over the last three days.

The key takeaway is that there was an independence vote on Monday in Spain’s Catalonia. The preliminary results show the huge support of secession, but Madrid considered the referendum as illegal and decided to make a show of force. The crisis may be temporary (depending how the politics will resolve it), but it seems that the U.S. dollar should strengthen further against the euro in the short-term, despite the massacre in Las Vegas. This is because the Fed is going to hike in December and there are also some renewed hopes that Donald Trump will provide fiscal stimulus. This is why the short-term outlook for gold does not look positive. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview