On Tuesday, Democrats won some regional elections. What does it mean for the gold market?

Election night 2017 was positive for Democrats. They won convincing victories in governor races in Virginia and New Jersey. They also took control of the Washington state Senate and picked some seats in the Virginia House of Delegates. Democrats also triumphed in some mayoral races, most notably in New York City.

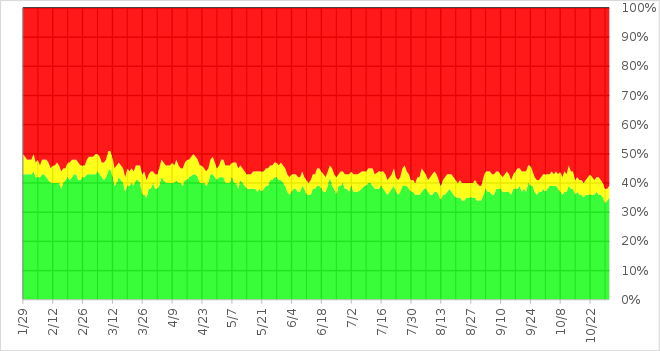

The elections were seen by many analysts as referendums on Trump and his policy. The results are considered as the reflection of the president’s weak approval rating. As one see on chart below, his popularity started a downward trend in September.

Chart 1: Trump’s approval rating (taken from Wikipedia).

However, the incumbent president’s party always struggles to defend its position in off-year and midterm elections. Anyway, the results are a warning for Republicans who have to prepare for the mid-term elections next year.

What does it all mean for the gold market? First of all, the chart above shows that the price of gold is not necessarily the gauge of (dis)trust in Trump. Gold prices have declined since September, despite the waning popularity of the incumbent president.

But what is really important is how the 2017 elections will impact the prospects of tax reform. If some Republicans use them (and an increasingly unpopular president) as cover to vote against the tax plan, then the U.S. dollar would decline and the yellow metal should shine. However, these elections may be a wakeup call for Republicans that they really need to deliver their campaign promises and deliver tax cuts. In that case, the greenback should rise, while the price of gold could struggle.

Which scenario is more likely? We bet that the latter, as it’s too early to abandon the president (not even a year has passed) and Republicans should feel the pressure to deliver at least some of their promises before the midterm elections. They failed to reform healthcare, so they should be more motivated to change the tax code.

Meanwhile, a U.S. Senate tax-cut bill is expected to be unveiled today. As it differs from the version of the House of Representatives, it may complicate Republican efforts. If Wall Street becomes more skeptical about tax reform, gold may rise (and vice versa). Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview