Yesterday, gold hit a three-week high. What does it mean for the precious metals market?

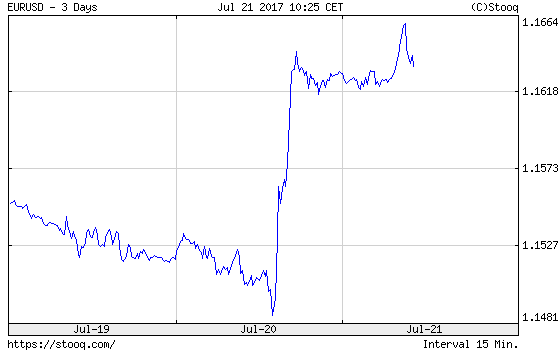

The ECB kept its monetary policy unchanged yesterday. And Draghi said that the ECB had made no plans regarding tightening its monetary policy stance. Although he did not give any hints about the bank’s next move, the euro soared, as one can see in the chart below. The probable reason is that although Draghi was not especially hawkish, he didn’t sound too dovish either. And its means that market expectations that the ECB would announce a tightening tweak to its policy stance in September remained unchanged.

Chart 1: EUR/USD exchange rate over the three last days.

Actually, the common European currency jumped to its highest level against the U.S. dollar since early 2015. Although this kind of bullishness in the euro may be only temporary – Draghi did not sound as hawkish as in Sintra – the ECB meeting added more pressure on the already weak greenback. The U.S. dollar has depreciated recently also because of Trump administration’s failure to get the healthcare reform bill through Congress. Republicans now try just to repeal Obamacare after it turned out that the bill which would repeal and replace the current healthcare system had no chances to pass. Hence, Trump’s failure to get enough support for the healthcare bill in the Senate this week raised concerns about whether he would be able to pass his stimulus and tax reform agenda. In other words, the confidence in the ability of Trump and Republican Congress to get anything of substance done declined to new lows. In consequence, the price of gold jumped yesterday, as the next chart shows.

Chart 2: Gold price over the three last days.

If faith in Trump’s ability to implement his pro-growth agenda remains low, while the bullishness of the euro persists, the upward trend in the gold market may continue, but let’s keep in mind that gold’s reaction to the USD’s movement is quite weak and the gold stocks’ reaction is even weaker, which is bearish. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview