Briefly: Outlook for the precious metals market remains bearish for the following few weeks, and bullish for the following months and years.

You probably didn't expect to get analysis from us until Monday, and we haven't previously planned to write it either... But as I (PR) started to think about the Easter wishes that I would like to send you today, I realized that given Friday's volatility, you'd probably much more welcome reading about what changed and what didn't... So, we decided to do something differently this week(end).

We usually post our analyses Monday, but since many moves that we saw on Friday are not confirmed yes and are very vulnerable to a reversal, it seems that posting it on Monday would not make much sense. It could get outdated very soon. Consequently, we decided to move the publication of the flagship analysis to Wednesday, but at the same time provide you with an extra analysis right away.

Having said that, let's get to the core of today's analysis. It's not really about charts, but about the situation in general. We'll comment on the charts as well, but it is the "behind the scenes" that is most important right now.

In the previous analyses, we wrote that the Covid-19 US death toll might be counted in millions, and we wrote that the peak panic is likely to be reached when people are dying by more than a hundred thousand per day.

We made calculations based on several simple statistics, and we then adjusted them based on the possible improved treatment and decreased mortality rate. Long story short, it still looked very bad.

Today we will like to supplement the above with a very important observation, and links to research supporting it.

The observation is that the real numbers and the reported numbers might not be the same thing. In fact, it's neither likely, or even possible that they are equal.

First of all, it's really difficult to assess if someone died from Covid-19 or something else, if they were not tested before they died and too much time passed since their death to know if it was from Covid-19 or something else. The symptoms are similar to other illnesses, so it's particularly difficult. Moreover, if someone had some sort of pre-existing illnesses or conditions, it's difficult to say if their death is due to Covid-19 or that condition. The definitions of what should be counted as a Covid-19 death and what not can also vary.

This article from Washington post provides many details.

Quoting:

"Scientists who analyze mortality statistics from influenza and other respiratory illnesses say it is too early to estimate how many fatalities have gone unrecorded. For a disease with common symptoms such as covid-19, they said, deaths with positive results almost certainly represent only a fraction of the total caused by the disease."

Here's one more important quote that we will get back to later:

"On Wednesday, the White House estimated that 100,000 to 240,000 Americans may be killed by covid-19, far exceeding the nearly 60,000 combat troops killed in the Vietnam War. Scientists said they did not know how the White House had arrived at its projection, and the White House has declined to provide details."

So... how can one really tell what the impact of Covid-19 really is? Maybe it is just a flu after all?

While it's difficult to estimate what number of people died precisely from Covid-19 (and nothing else), it is not that difficult to estimate how much more people are dying right now, then then died in the previous years at the same time. After all, what difference does it make if one dies only from Covid-19, or dies from absolutely anything if Covid-19 is the factor without which a given person would still be alive? It is the latter number that really matters, not the former.

The real impact of Covid-19 could therefore be calculated by checking how many people are usually dying in a given period compared to how many people are dying in the same period this year.

After all, the death toll statistics are relatively stable in the US and nothing else major happened this year that could materially alter this statistic. Actually, the quarantine itself should have a positive impact on the total death toll, for instance because far fewer people drive cars and get into car accidents.

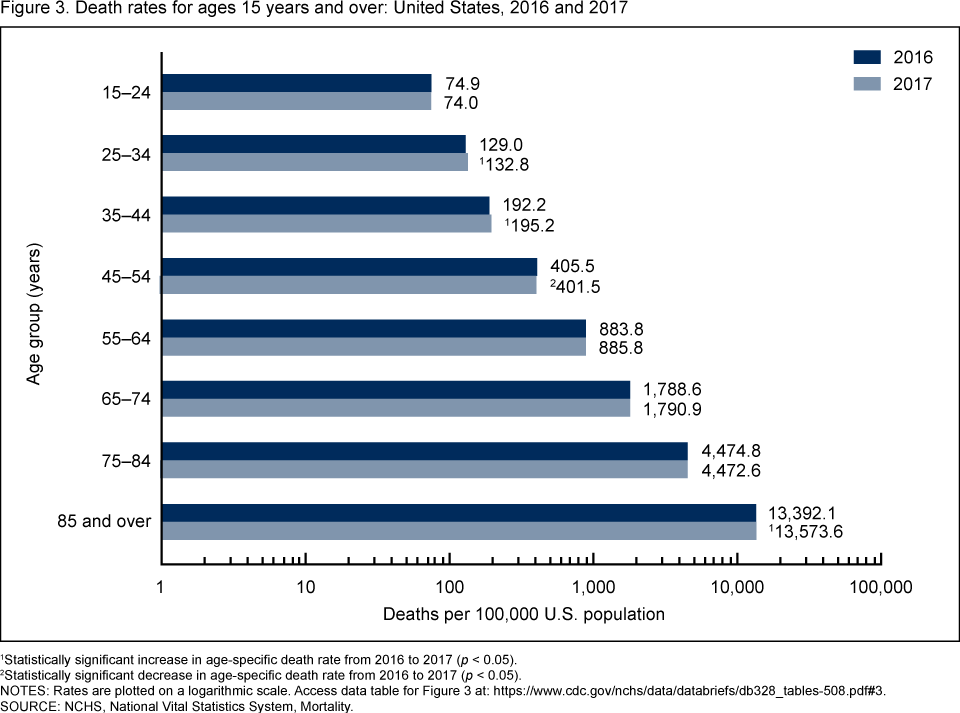

The chart below indicates that the death statistics are indeed stable also per age group.

Also, while the total death toll comparison is far from perfect, it is excellent in a way. Namely, it puts an end to the discussion of whether reporting is really understated or overstated. A few pictures from few overwhelmed hospitals vs. a few pictures of few calm hospitals might make one confused, but the death statistics are quite self-explanatory and more difficult to manipulate. There's very little left to subjective opinion here. While one might debate what was the main cause of death of a given person, it is not debatable that they are dead. And that due to some reason there are many more deaths this year than there were last year.

And this is when things get particularly interesting. If we take the data from Italy and Spain into account, it turns out that the total number of deaths in March 2020 compared to the total number of deaths in March 2019 are over twice as big. Less than half of it is officially attributed to Covid-19. Consequently, the real numbers in the current statistics might be actually over twice as big as they are being reported.

Ok, you might be thinking that this could be just a European thing and that the US reports are more accurate. Well, not necessarily. This NY Times article from April 10 starts with the following:

"Over the 31 days ending April 4, more than twice the typical number of New Yorkers died."

It seems that the death toll is really at least twice as big as it is reported.

We put "at least" in bold intentionally.

Here's another quote from the above article:

"The numbers for the last two weeks of the period are even more stark: nearly 7,000 dead, more than three times as many deaths as would normally be expected this time of year."

So perhaps the real death toll is at least three times as big as the official statistics.

Ok, that's what we know. Now for some speculation about what we don't know, but that might actually be taking place.

Everyone knows that the initial data might be understated. However, just how understated it could get, might be beyond belief.

Remember the H1N1 (swine flu) pandemic of 2009?

Back then, the World Health Organization recorded 18,631 people with laboratory-confirmed diagnoses dying of that disease.

However, in 2012, the CDC team concluded that these numbers actually underreported the real number and that the real death toll was probably about 15 TIMES BIGGER.

Let's re-cap:

1. The death toll is likely already underreported with the real death toll likely being at least 2-3 times the official number

2. The recent pandemic actually had numbers 15 times greater than those that were initially estimated.

Now, let's assume that you're the one leading the nation, and you want to somehow deal with the situation. If you do too little, millions will die and you will be blamed, and if you do too much, bring soldiers to the streets etc. you risk massive riots, perhaps open fights, protests, or even a civil war. What do you want people and the economy to do?

Of course, you want the economy to get back on its track as soon as possible, but you can't risk the virus getting out of hand, due to the above. So, what do you do? You want to make sure people are scared exactly as they should be scared - not more, not less. People have to be scared to obey the lockdown and prevent the virus from spreading. However, if they are too scared, nobody will go to work - not even those who are now called "essential". Ultimately the economy would grind to a halt, and the people would get out on the streets, rioting anyway.

People are definitely scared already - about 2,000 Americans are reported (!) to die from Covid-19 each day - the real number might be about 5,000 or more. So, what should one expect from the leader of the nation? To try to calm people providing some optimistic projections and encouraging news.

Let's recall what the official death toll prediction from the White House was.

It was between 100k and 240k Americans.

Let's also recall how much the data was underreported in case of the swine flu (H1N1) - 15 times. The data was underreported 15 times and it was generally accepted by the world without negative consequences to anyone. "Oh well, estimation mistakes happen, carry on..."

Combining both gives us the situation in which it might be a reasonable decision to tell people that the likely death toll is about 15x smaller than the really realistic expectation. It was already done, so it should have no negative consequences when it turns out that the numbers were way off. At the same time, it gives people hope, as this number - while big - is considerably smaller than the cancer death toll for example. It doesn't look extreme - it looks bad but rather relatively "normal".

Remember our estimation of the US death toll for Covid-19 at about 2M Americans? Well, if we divide it by 15, we'll get... about 133k Americans. Let's reverse the order. Multiplying the official prediction by the factor of 15, we get 1.5M - 3.6M Americans.

This could be White House's realistic expectation of the total Covid-19 death toll, while the 100k - 240k was what they found to be optimal to report.

Please note that the White House declined to provide the explanation behind this prediction. Obviously "you know, we took the real estimation and divided it by the biggest number we know that we can easily get away with" is not an acceptable explanation. Of course, we are not making any accusations here, just speculating on what might have or might have not been the case...

So, while we continue to think that the peak panic might take place when the daily US death toll exceeds the 100k Americans, it seems that we should adjust it to what kind of numbers we should expect in the official reports. It seems that the peak panic might take place when we see the official daily US death toll between 6k and 30k per day. The first number is based on the 15x multiplier and the latter is based on the 3x multiplier.

There's also another reason why we might not see much bigger increases in the numbers of infected patients and in the official Covid-19 death toll. It might not be the case that the infections slowed down, but rather that the testing has slowed down. There are huge logistical problems with the Covid-19 tests.

And this is just the tip of the iceberg. Quoting this NY Times article (note: it's from March 27th):

"In three to four weeks, there will be a major shortage of chemical reagents for coronavirus testing, the result of limited production capacity, compounded by the collapse of global supply chains when the epidemic closed down manufacturing in China for weeks."

Here's another article confirming the same thing on the other side of the planet.

The situation with tests' availability is already bad, and it will get worse. Consequently, you might see a decline in the official numbers that are reported with regard to Covid-19 (both: the number of infected people, and the death toll). However, at the same time it might "turn out" that the total death count for a given week in a year is several times greater than the analogous number from the previous years, especially in case of the older people. And this specific multiplier might keep increasing despite the decline in the official numbers.

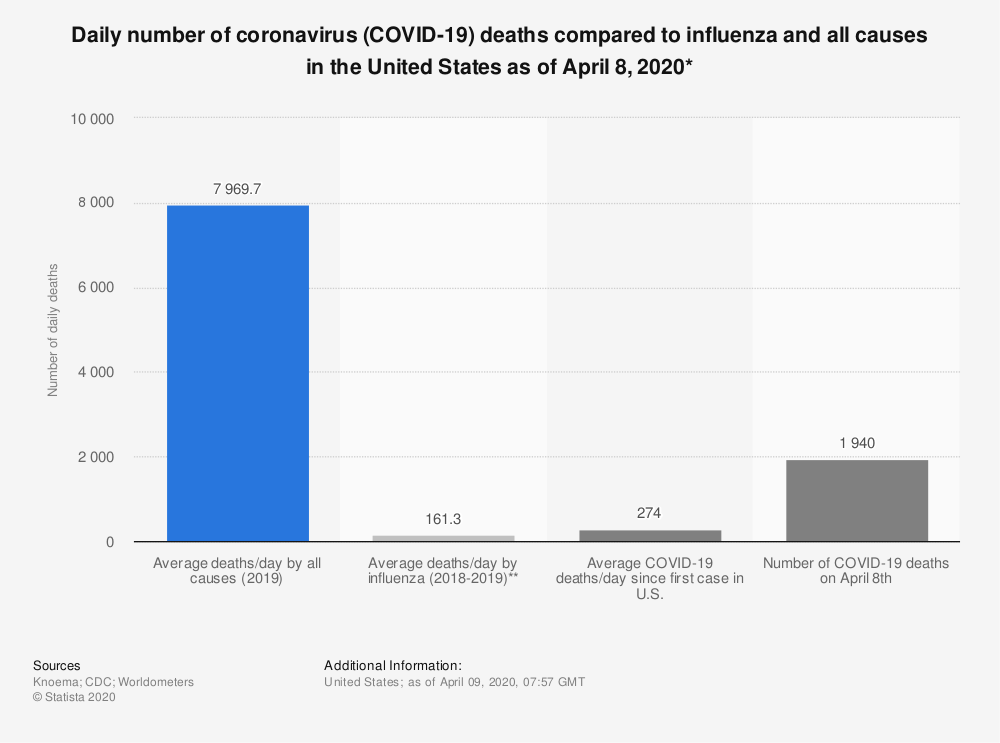

Oh, and one more chart if anyone doubted that Covid-19 is indeed something more than "just a flu".

The comparison of the total yearly deaths of both is pointless as the situation regarding Covid-19 has not even stabilized, so it's way too early to compare the yearly numbers. But, it's interesting to note the average daily flu US death toll - it was about 161 people per day. On April 8th, the US Covid-19 death toll alone was 1940 (even using the official numbers that is). That's about one fourth of the average daily deaths for ALL CAUSES in the US.

And please remember that it's just the official data that is likely significantly understated. It's not "just a flu". It's a disaster.

What does this all mean? It means that the US stock market (and other stock markets) are likely to fall further and the huge stimulus is unlikely to prevent it. The only thing that it is likely to do is to delay the slide.

The stock market is likely slide based on the fear triggered by the increasing death toll, but that's not all that people will consider while determining whether to sell or buy stocks. They will also pay attention to how long will the quarantine take place, as it severely limits the economic activity. And it will remain in place for much longer than a few weeks.

Let's assume that the situation stabilizes somewhat, and the daily death toll reaches (officially) 3k, but then stalls and even drops to 2.5k per day. Or even to 2k per day.

Would you now want your loved ones to get back to their office, go to sport events, or music festivals? Of course not. You'd want to be reasonably sure that it's all over. The officials want to know that too, because lifting the quarantine too soon will result in the immediate comeback of the virus and everything starts all over again. The limitations to daily life could get lifted slowly (!) and gradually, but it will take a long time before things truly get back to normal.

Singapore was viewed as the "golden example" of a country that made it. And... The second wave of the virus just hit it. Singapore just posted a record daily growth of new infections.

That's what happens if the restrictions are lifted too early. And the officials know that. The lockdown and enormous damage to the economy is growing regardless of whether people want to focus on it, or on the money that they are being handed or lent by the fiscal or monetary authorities.

Also, if you read about lower hospitalization rates this week, please note that it's quite likely that people simply didn't want to get help right before the Easter Holidays, wanting to spend them with their families instead of being in a hospital...

Here's the current "official" point of view. Quoting BBC's article:

"

The US now has at least 18,693 deaths and 500,399 confirmed cases, according to Johns Hopkins, which is tracking the disease globally. About half of the deaths were recorded in the New York area.

Italy has reported 18,849 deaths while globally more than 102,000 people have died with the virus.

Researchers had predicted the US death toll would hit its peak on Friday and then gradually start to decline, falling to around 970 people a day by 1 May - the day members of the Trump administration have floated as a possible date to start reopening the economy.

"I want to get it open as soon as possible," Mr Trump said at a Good Friday briefing at the White House. "I would say without question it's the biggest decision I've ever had to make."

However, no action would be taken until the government knew the "country [was] going to be healthy", he said. "We don't want to go back and start doing it over again."

"

The above fits our previous comments. Practically the only possible way in which the US daily Covid-19 death toll falls to about 1000 is due to limited testing. There's no doubt that Trump will keep on repeating that he wants to re-open the US economy to its full capacity as soon as possible - and it's no doubt that he does want that.

Are things even close to being as good in the US as they were in Singapore? Absolutely not. And Singapore just saw the second wave of the virus.

There's almost zero chance that the US economy will be fully re-opened by the end of April, and quite many people appear to believe that it's very likely... Which explains why the rally in the stock market did not end yet.

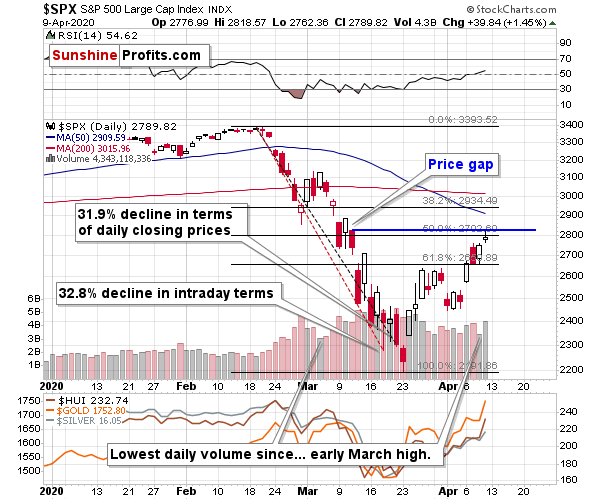

Actually, it might have just ended on Friday, as stocks were up by just 1.45% despite another massive wave of stimulus from the Fed, which is a very weak reaction.

The S&P 500 managed to move to the lower border of the mid-March price gap and temporarily (!) move above the 50% Fibonacci retracement based on the February - March decline. This breakout was invalidated before the end of the day. The doji candlestick that formed on relatively big volume (biggest in April) doesn't mean much, but if stocks open lower on the next trading day and decline during the day, the last three candlesticks will create an "evening star" candlestick pattern (based on these three sessions), which is one of the rarer, but also one of the most reliable bearish (reversal) signs. Of course, stocks would have to decline...

If there only was any news that could make the stock market slide. Something big, for example the official US Covid-19 death toll surpassing Italy (thus being 1st in the world in terms of Covid-19 deaths) and also be the first country to break the 20,000 death mark. Oh wait, that's exactly what just happened. The US just exceeded Italy in terms of the Covid-19 death toll, which currently stands at 20,071.

Why are we discussing stocks in this precious-metals-oriented publication? Because in the past several weeks gold, silver, and mining stocks moved in great tune with the general stock market, driven by the same thing - fear-driven flight to cash.

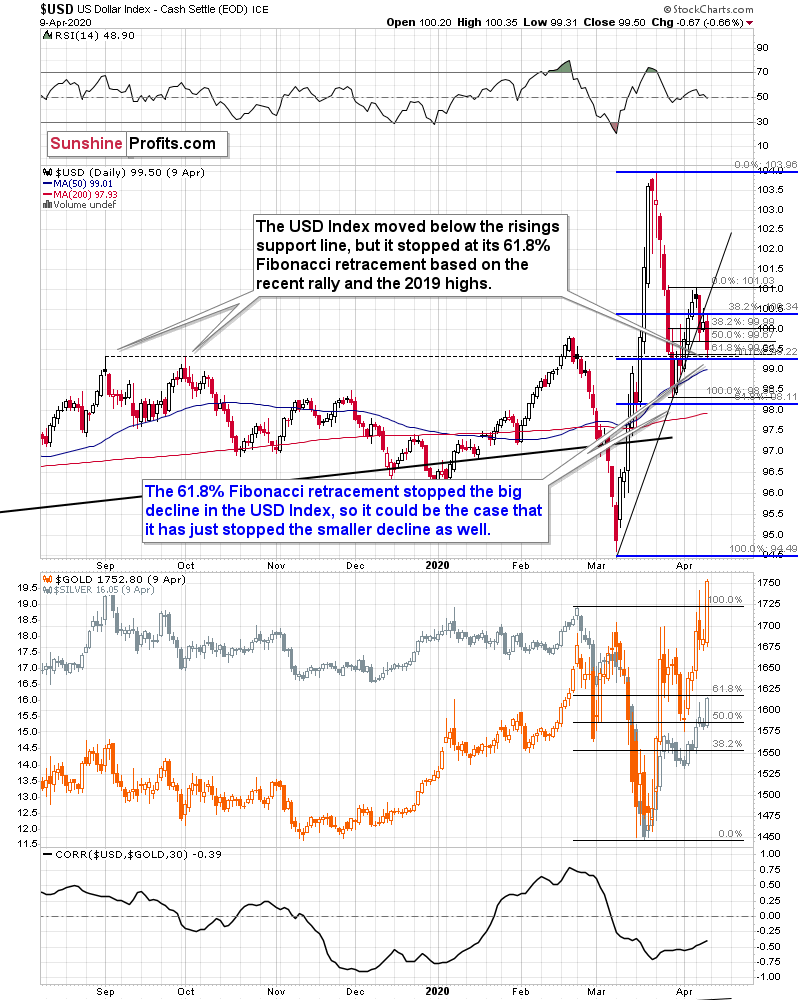

Speaking of cash, please note that the massive stimulus should have made the US dollar significantly less appealing. And what happened?

The USD Index declined by mere 0.66%. It declined to the 61.8% Fibonacci retracement based on the most recent rally and to the 2019 highs. Since the strong support was already reached, the decline might already be over.

Please note that silver corrected to approximately its 61.8% Fibonacci retracement based on the February - March decline as well, suggesting a good possibility of the top being in or at hand.

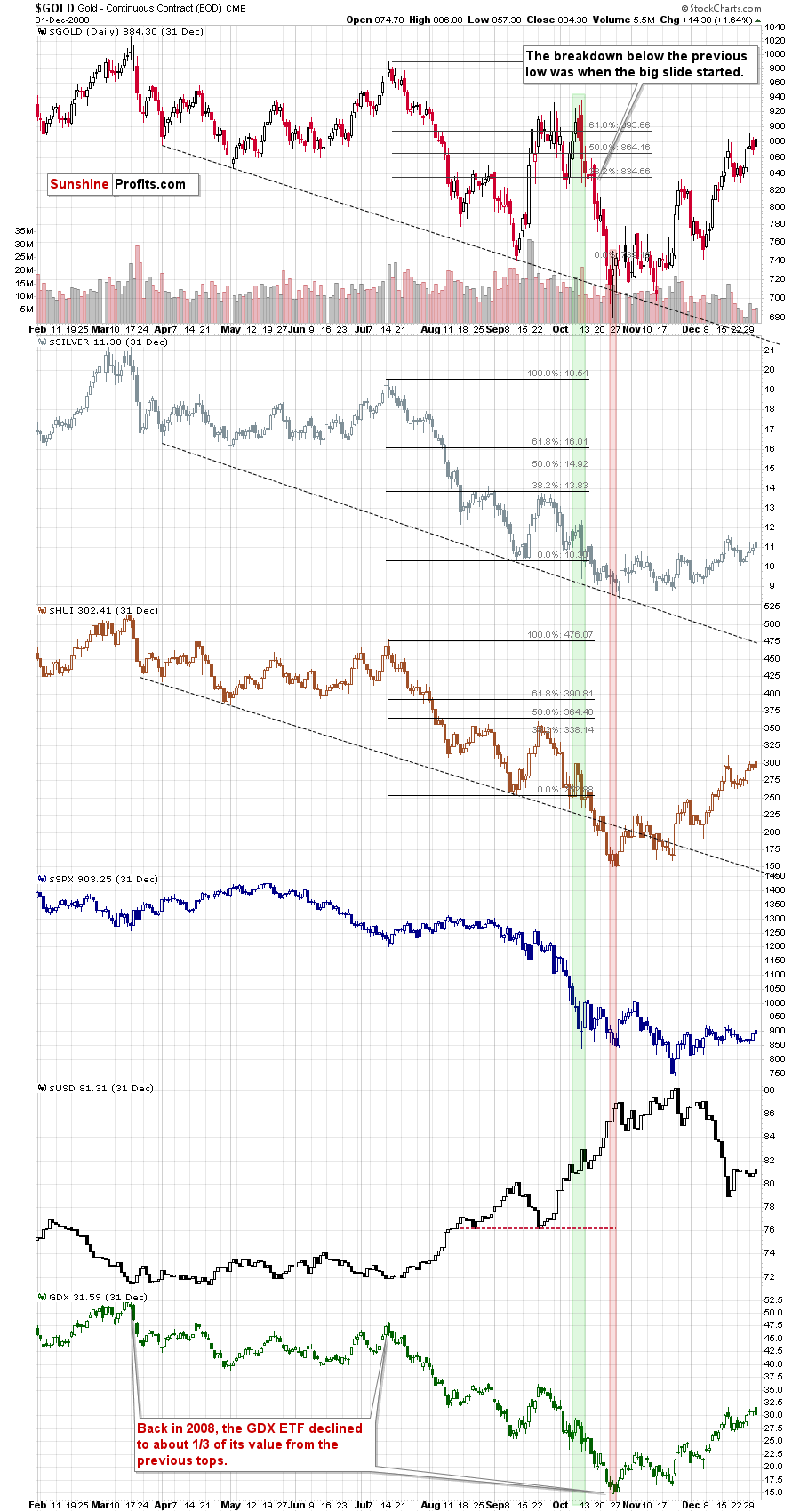

Gold's move above the previous intraday high as well as strong performance of mining stocks might have surprised some, but... It doesn't invalidate the link between 2020 and 2008.

Please note that right before the first huge slide of the final decline, gold moved to new highs, slightly above the most recent intraday high, and - on the very last day of the decline - miners moved considerably higher, but not even close to the previous highs. That's exactly what happened on Thursday.

This means that the rally in the precious metals market is likely to be reversed shortly - quite likely in the upcoming week.

The fundamentals for gold are excellent, but the fear-driven flight to cash doesn't seem to be over just yet.

Also, before the Fed surprised the market with another huge stimulus on Friday, the S&P was lower in the pre-market trading, while the USD Index was higher. These markets were practically forced to move in the opposite direction based on what the Fed did, but the sizes of these moves tell us that this is now where the markets really want to move, and we should expect moves in the opposite directions shortly.

We are not featuring more charts today, because most signals would need to be confirmed anyway and based on what happens during the day on Monday we might get completely different implications on the charts. Consequently, whatever we commented on the charts, might require an update on Tuesday or Wednesday, anyway. Consequently, we will provide you with a bigger analysis on Wednesday.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks, despite the upswing that we saw at the end of the week. The outlook might become bullish, if the strength in the PMs and miners persists and they prove to be able to rally despite falling stock prices, but it's much too early to say that this is already the case. We'll keep monitoring the market and we'll report to you - our subscribers - accordingly.

Thank you for reading today's special analysis. Hopefully knowing our detailed thoughts on the market and situation in general already today will lower the uncertainty before the next week, and thus help to make this Easter more peaceful...

This quarter was very volatile and even more profitable, but the most profitable part of the move seems to be still ahead. But the trading doesn't begin until after Easter, so for now...

We wish you healthy, peaceful and happy Easter, and/or a wonderful and safe weekend, if you're not celebrating the above. Thank you for staying with us and for staying up-to-date with the gold market.

With my very best wishes,

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager