Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Dear subscribers,

Friday’s Gold Investment Update got stuck in the pipes and we did not upload it properly. We also failed to double check, making it a double oversight on our part. Therefore, you and the rest of our cherished readers were not able to access this important publication. It’s a rare occurrence, but that’s not an excuse. On behalf of the editorial team, I offer you my sincere apologies for this mishap. You deserve better, and we’ll work on making sure that every publication is delivered on time and on schedule.

As a thank you for your understanding, we’re also including the full daily Gold and Silver Investment Update in your mailbox for the rest of the week.

Again,

our kindest apologies.

Best regards,

Dominik

Starosz

Managing Editor

Introduction

Welcome to the Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

As gold tried to rally to new all-time highs, I sent you an intraday Gold & Silver Trading Alert, and in it, I emphasized the likely temporary nature of this move. I wrote the following:

Yes, the situation in Ukraine is critical.

However, the two key drivers of gold price continue to point to lower gold prices, and at the same time we know that geopolitical-event-based rallies don’t last and very likely to be reversed.

These two key drivers are:

- Real interest rates

- USD Index

The USD Index is already soaring, and real interest rates are likely to increase as the nominal interest rates are about to increase – and given the recent rally in prices they might increase more than most investors expect them to.

Consequently, while – given today’s rally – it might seem like there’s no stopping gold, silver, and mining stocks, please keep the above in mind. This rally is likely to be reversed, and when it reverses, junior gold miners are likely to decline in an epic manner. And lead to epic profits in case of those, who were able not to follow the mania during the parabolic upswing.

Let’s continue this topic by focusing on how tight the financial conditions are becoming and what that means.

The Best of All Worlds

Another day, another headline uplifting the PMs. This time it was the White House banning Russian oil imports. As a result, WTI rallied, the S&P GSCI rallied, and the PMs joined in the fun.

However, while picture-perfect scenarios have confronted the PMs in recent weeks, the optimistic headlines are likely near their peak. With U.S. economic sanctions already priced in and only Europe left to consider a Russian import ban, we'd need WW3 to create more headline risk.

Moreover, while the PMs' war premiums have been material, the medium-term fundamentals signal that their bliss should unravel in the coming months. To explain, I wrote on Feb.2:

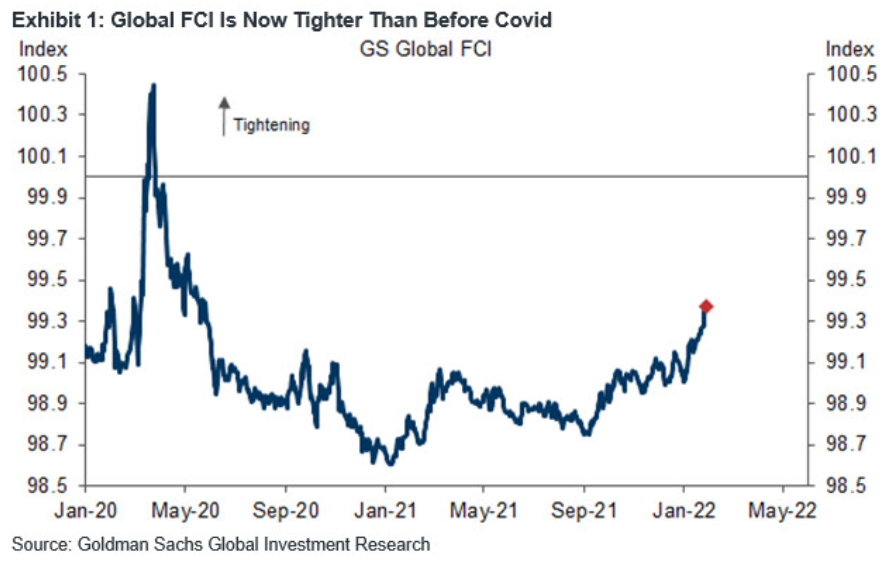

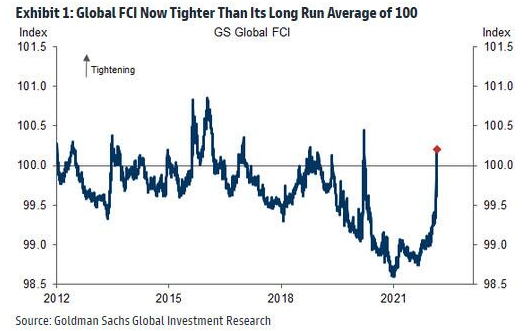

The blue line above tracks Goldman Sachs' Financial Conditions Index (FCI). For context, the index is calculated as a "weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP." In a nutshell: when interest rates increase alongside credit spreads, it's more expensive to borrow money and financial conditions tighten.

To that point, if you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it's no coincidence that the PMs have suffered mightily since January 2021. Likewise, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs' relief rallies should fall flat like in 2021.

In addition, while the USD Index has come down from its recent high, it's no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

Furthermore, while the two rights haven't been beneficial in recent weeks, the unfortunate events surrounding the Russia-Ukraine conflict have distracted the PMs from a sharp rise in the FCI and the USD Index.

Please see below:

As a result, while war premiums have outweighed the negative consequences of financial tightening, prior increases in the FCI have coincided with weak performances by the PMs.

Remember what gold did in late-2015 when the Global FCI peaked? That was when gold bottomed, meaning that it declined strongly when the FCI was rallying.

Thus, geopolitical risks remain the primary driver of the PMs’ rallies, and once that settles, gold, silver, and mining stocks will likely face harsh medium-term realities.

To that point, while investors fret that the U.S. confronts an unavoidable recession, I’ve noted for months that the U.S. economy remains on solid footing; and while the S&P 500 has been under pressure in 2022, U.S. economic data has largely outperformed.

Please see below:

To explain, the blue line above tracks the S&P 500, while the orange line above tracks Citigroup’s Economic Surprise Index. For context, a surprise occurs when an economic data point outperforms economists’ consensus estimate.

If you analyze the right side of the chart, you can see that the orange line bottomed in January and has been moving higher ever since. As a result, the U.S. economy remains in a healthy position, and as long as this is the case, it keeps the pressure on the Fed to raise interest rates at its next several monetary policy meetings.

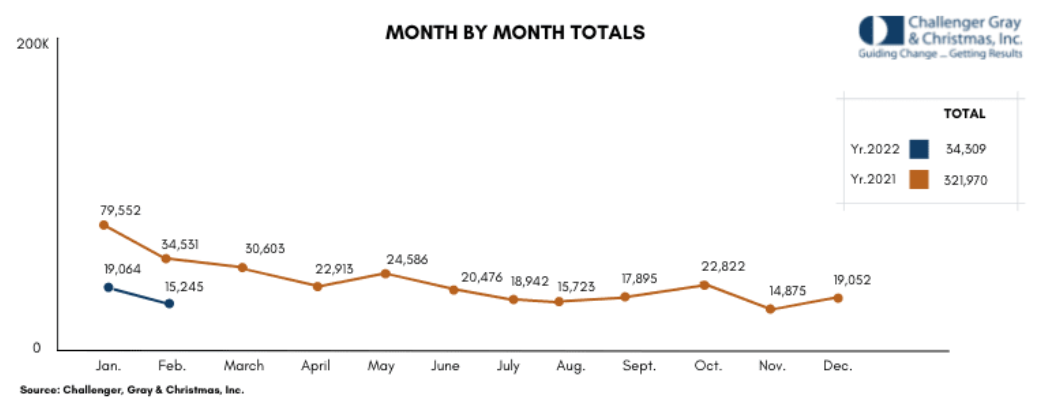

As further evidence, Challenger, Gray & Christmas released its Challenger Job Cuts report on Mar. 3. For context, job cuts occur when companies reduce their workforce. The report revealed: “U.S.-based employers announced 15,245 cuts in February, a 20% drop from the 19,064 cuts announced in January.”

“While job cuts remain at record lows, employers in the United States announced 215,127 hiring plans, the highest monthly total since September 2021, when seasonal hiring pushed hiring plans to 939,790. It is the highest February total since Challenger began tracking monthly hiring figures in 2002.”

Please see below:

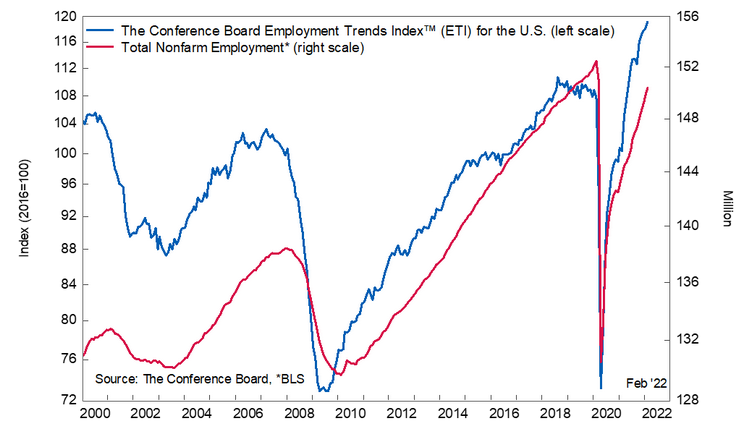

Likewise, The Confidence Board released its Employment Trends Index (ETI) on Mar. 7. With the index increasing from 118.15 in January 2022 (an upward revision) to 119.18 in February, Frank Steemers, Senior Economist at The Conference Board, said that “the Employment Trends Index increased again in February, suggesting that robust job growth lies ahead.”

He added: “So far in 2022, more than 1 million jobs have been gained. However, some moderation in job growth is likely in the months ahead – we are now further into the recovery and economic growth rates are projected to decelerate compared to an especially strong 2021. Still, with the labor market being short 2.1 million jobs, returning to pre-pandemic employment levels is likely in 2022.”

Please see below:

On top of that, the NFIB released its Small Business Optimism Index on Mar. 8, and while the headline index decreased from 97.1 in January to 95. 7 in February, the report revealed:

“Forty-eight percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up 1 point from January. The number of unfilled job openings remains far above the 48-year historical average of 23 percent.”

Furthermore, the report highlighted the effect that surging inflation is having on small businesses across America.

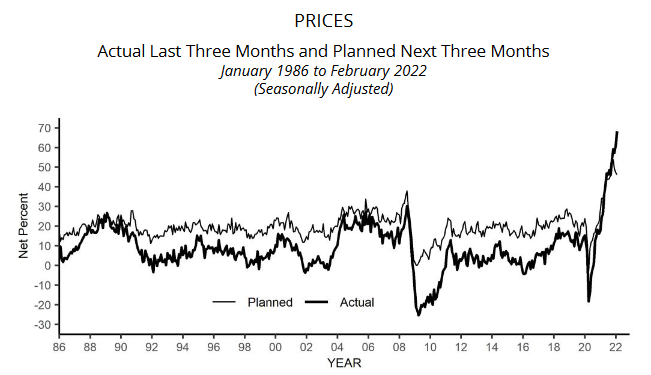

Please see below:

To that point, the report revealed:

“The net percent of owners raising average selling prices increased 7 points to a net 68 percent seasonally adjusted, the highest reading recorded in the series.”

Please see below:

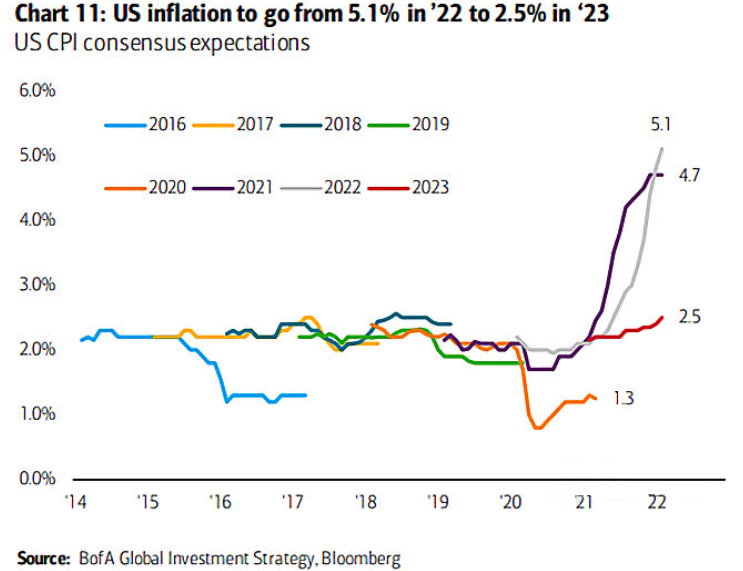

If that wasn’t enough, with the Russia-Ukraine conflict resulting in meme-stock-like performance for commodity indexes, the consensus expectation for inflation in 2022 has ratcheted higher.

Please see below:

To explain, the various lines above track economists’ consensus estimates for the headline Consumer Price Index (CPI). If you analyze the gray line on the right side of the chart, you can see that the consensus expects 5.1% annual inflation in 2022. For context, the Fed’s mandate is 2%.

Moreover, with the next CPI release scheduled for Mar. 10, another sizzling print will likely materialize. Furthermore, with commodities on a tear in recent weeks, the increases should intensify the inflationary pressures in the coming months. As a result, the Fed needs to raise interest rates before it falls further behind the inflation curve. With the Fed’s tightening cycles often extremely unkind to the PMs, their short-term excitement will likely morph into medium-term dejection.

The bottom line? While the PMs seem invincible at the moment, sentiment will likely shift over the next few months. Remember, the S&P 500 was at an all-time high roughly two months ago, and look where we are now. As such, while the Russia-Ukraine conflict has put the PMs in pole position, the narrative can shift rather quickly.

In addition, while the U.S. 10-Year Treasury yield made a lower intraday low, it didn’t make a lower closing low; and after ending the Mar. 8 session at 1.86%, the bond market isn’t buying gold’s fear.

In conclusion, the PMs rallied on Mar. 8, as the U.S. ban on Russian oil imports provided another upside catalyst. However, with severe sanctions already in place, the PMs will likely need worsening headlines to maintain their momentum. If history is any indication, investors’ attention spans tend to wane over time. As a result, profound drawdowns should materialize once the conflict settles down.

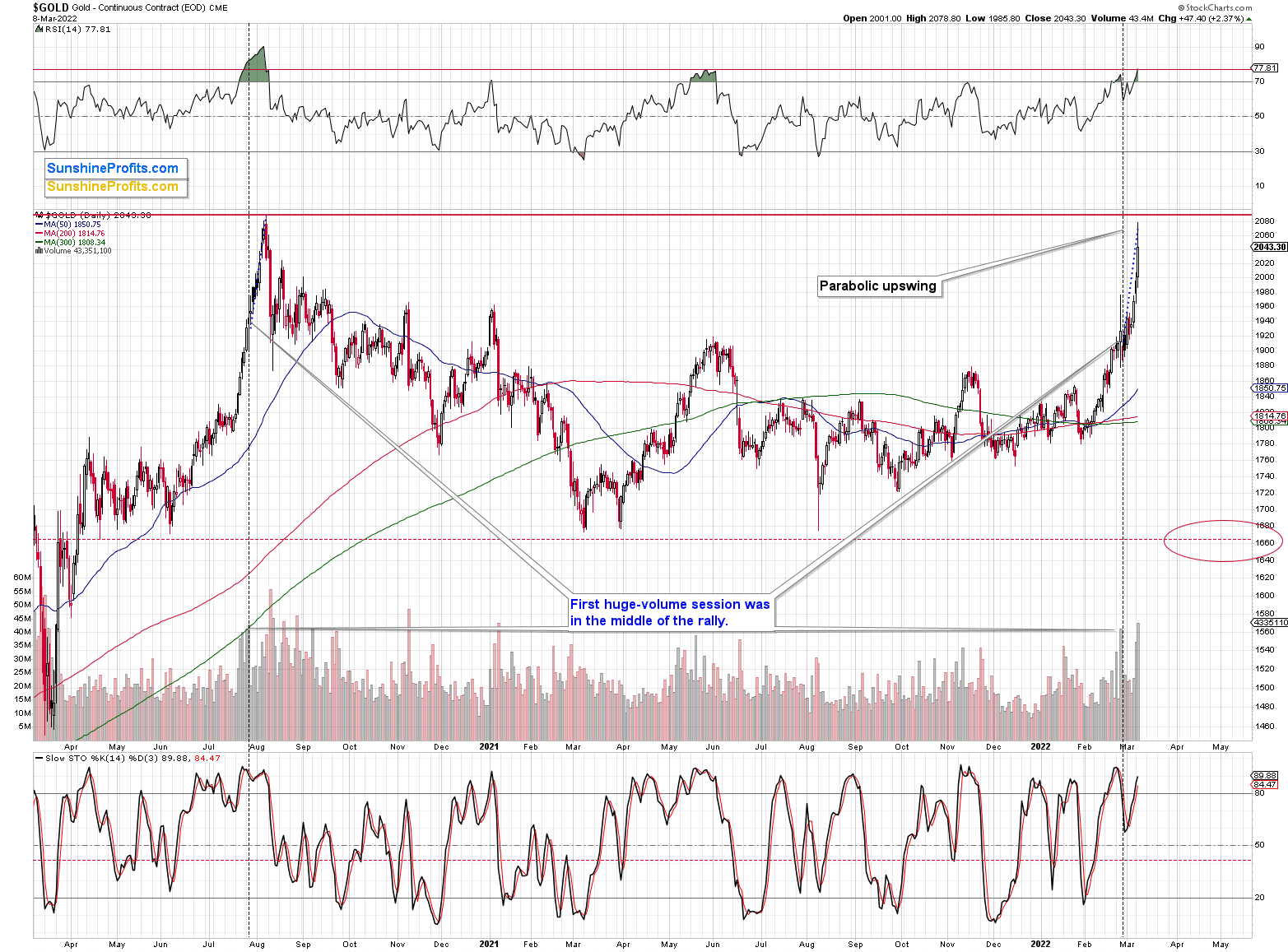

On the technical level, we see that gold not only attempted to break above $2,000, but it also challenged its all-time highs! As I wrote above and previously, the rally is not likely to last for long.

At the moment of writing these words, gold is trading at about $2,020, and given the last few days’ volatility, it could be below $2,000 in a few hours. Taking a step back, please note that the previous breakouts above $2,000 were all invalidated sooner rather than later.

Gold tried to break above $2,000 several times:

- twice in August 2020;

- twice in September 2020 (once moving above it, once moving just near this level);

- once in November 2020 (moving near this level);

- once in January 2021 (moving near this level);

- once in February 2022 (moving near this level).

These attempts failed in each of the 7 cases mentioned above. This is the eight attempt. Will this very strong resistance break this time? It seems more likely that this breakout will be invalidated shortly and that the decline will start without an additional delay.

Gold topped at a similar price to its 2020 top, while the sharpest part of the rally started at about $1,800 (just like in 2020), and the entire rally started in the middle of the year at about $1,670.

In fact, even the moment where gold traded on huge volume for the first time during those rallies is similar. I marked that with blue dotted lines. We saw huge volume more or less in the middle of the final (sharpest) part of the upswing. History tends to rhyme, and since it seems that the tensions have finally peaked (as I wrote in the opening part of today’s analysis), the same is quite likely for the gold price.

Gold actually reversed yesterday, giving away a large part of its gains, and it happened on huge volume. That’s a very bearish sign, as volume confirms the validity of the reversal candlesticks.

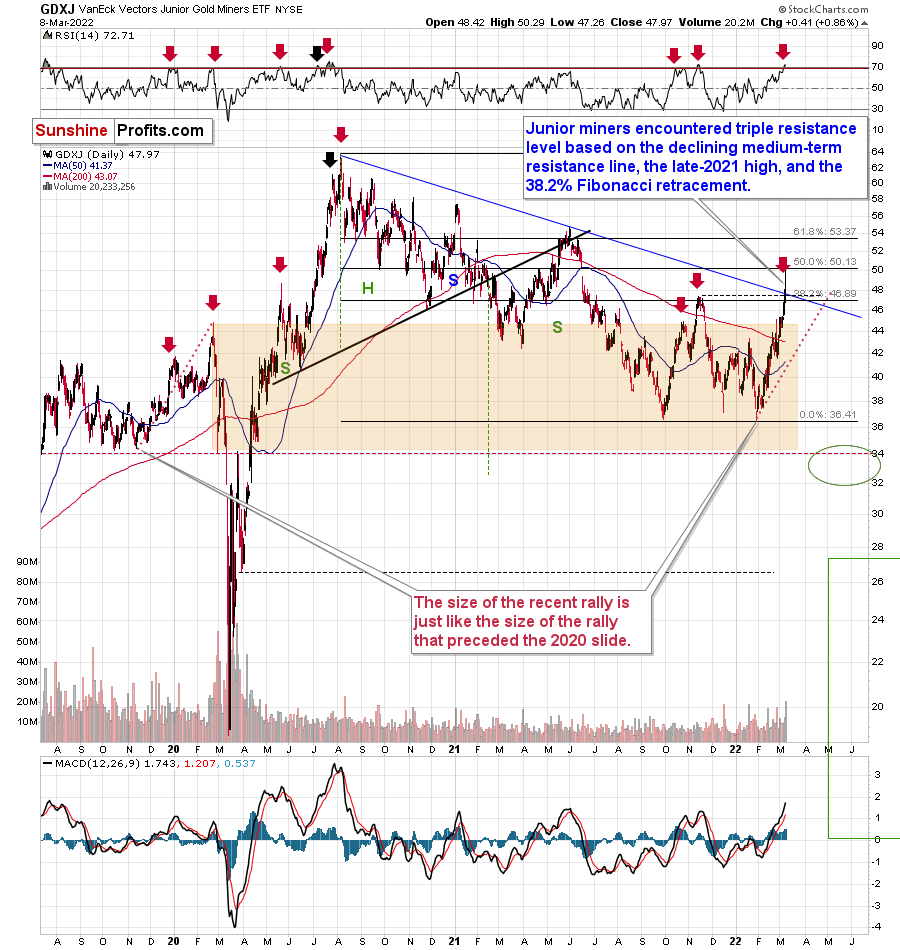

The dramatic sell signal was even clearer in the case of mining stocks.

While the junior miners (GDXJ ETF) closed higher yesterday, they were up only slightly. At one point in the session, the GDXJ was up from its previous close by 5.74%. However, it ended up only 0.86% higher. Therefore, almost the entire daily rally of junior miners was invalidated.

Yesterday’s session was therefore a profound daily reversal – in candlestick pattern terms, it was a “shooting star reversal.” These patterns should be confirmed by high volume, and yesterday’s volume in the GDXJ was the highest volume not only this year, but it was actually the highest volume that we’ve seen in this ETF since mid-2020. The top is most likely in.

If I didn’t have my short position in the GDXJ ETF that’s already significant (and in tune with how significant I want it to be), I would have entered or added to this position now.

(Of course, the above is not investment advice, nor am I saying that you should increase your position, but that’s exactly what my opinion is at the moment based on what we just saw.)

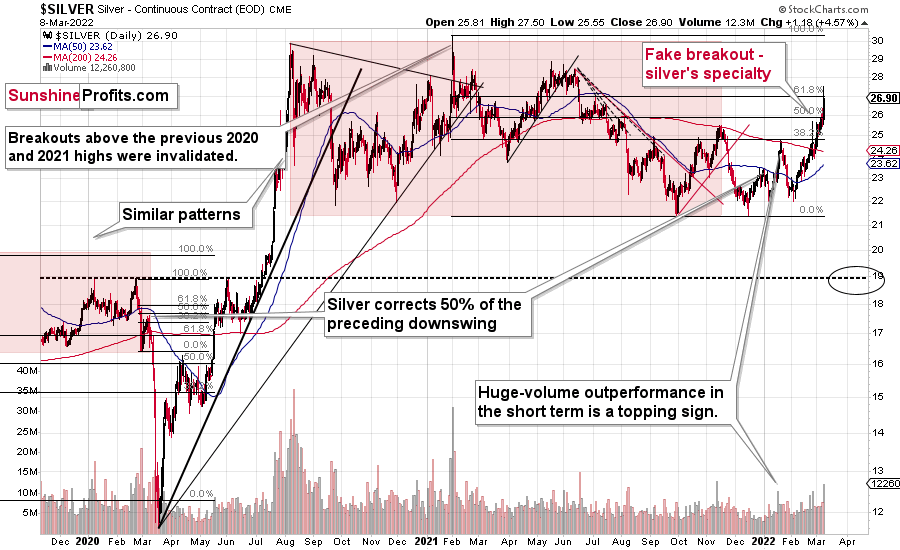

While mining stocks underperformed gold in a rather extreme manner, silver outperformed it.

The GDXJ ETF was up by less than 1%, gold was up by 2.37%, and silver was up by 4.57%. Silver’s outperformance and miners’ underperformance is what we tend to see right at the tops.

As far as silver’s technical picture is concerned, it just tried to rally above its 61.8% Fibonacci retracement level and failed to close above it. So, it’s weak relative to gold on a medium-term basis, but we saw short-term outperformance. In short, that’s bearish.

How high could silver go before declining? Well, it seems to me that silver will decline right away, without moving above yesterday’s (Mar. 8) high. Even if it didn’t, I don’t think it would manage to move above $30.

Again, based on gold reaching its all-time high yesterday and declining shortly thereafter (also in today’s pre-market trading), it seems that the top is in. The 61.8% Fibonacci retracement in silver and GDX is what appeared to be analogous to the above-mentioned resistance in gold. In GDXJ’s case, it was the 50% retracement (which is another confirmation that junior miners are the weakest part of the entire precious metals sector).

All in all, it seems that due to the technical resistance in gold and mining stocks, the sizable – but likely temporary (like other geopolitical-event-based ones) – rally is likely to be reversed shortly. Then, as the situation in the general stock market deteriorates, junior miners would be likely to plunge in a spectacular manner.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

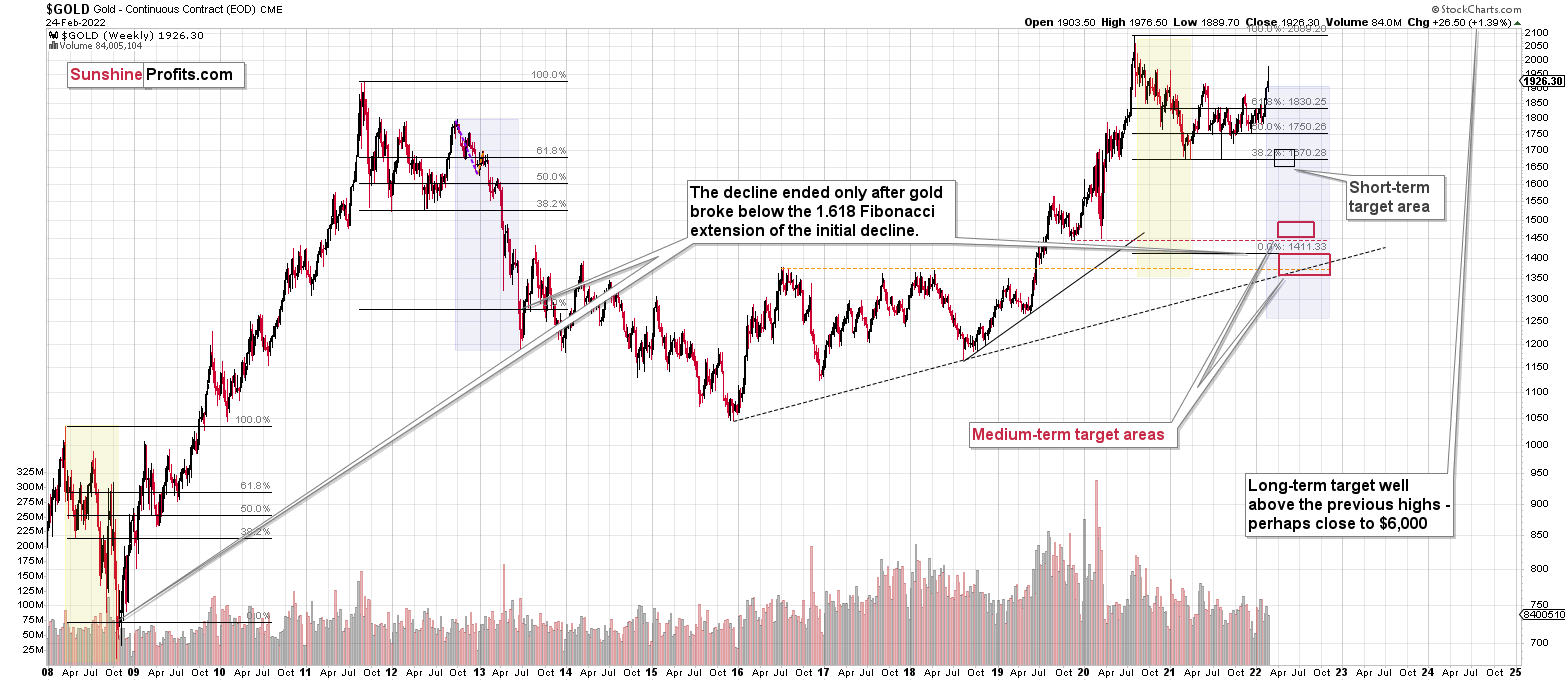

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Many thanks for your great service. Here are a couple of points I would like to offer to you for your thoughts:

1. There is talk of the US government (and this would lead other governments to follow) moving to a Central Bank Digital Currency (CBDC). This would potentially be the end of cryptos in the private sector. Crypto would be transferable at a given price and time for the CBDC. Like what FDR did with gold in 1933. After the conversion, cryptos would be banned. Would this occurrence or the rumor/threat of this action occurring push people back into the precious metals? How do you see this scenario playing out?

2. How do you think the precious metals will react to a long-drawn-out war in Ukraine/Europe (which could potentially morph into WW3 post-2026)?

3. How do you see the move of both Russia and China away from the SWIFT system affecting the precious metals? (China and Russia are accelerating their efforts to move to a new system in light of the recent Russian bans.)

A: Thank you. Here’s my take:

1. Well, as much as I don’t like to write it, I view the above scenario as likely. Cryptocurrencies pose a direct threat to the monetary system and the power that it grants to those that control it. Why wasn’t it banned, then? Because while it’s popular, it could get widespread adoption and then the monetary authorities could move to government cryptos that only they control.

Theoretically, there are many positives to a system where money is “intelligent” and “customizable”. For example, money that is provided as social support might be used for most products, but not for alcohol or other similar substances. Supporting a specific area could be made easy. Simply put, money spent there would be worth 30% more than elsewhere, so people would rush in to take advantage of the opportunity, thus supporting the area that they were supposed to support. For example, in the case of natural disasters, it would help the area recover.

However, there are also myriads of things that can go wrong in this system. You didn’t like my party’s narrative before the elections? Swooosh!, goes the magical monetary wand – and your money is now worth only 70% of what it was worth previously. “Hey, my company’s money should be worth more, because we’re so cool, and besides, look, here’s a bribe.”

Would you rather own this smart money or dumb old gold and silver that nobody can change? I’d personally go with both, but it would be more important to me than previously to have a bigger portion of my assets in physical gold and silver than before. Just in case someone with monetary power doesn’t like what I do, write, or think. Remember that those in power can change, so even by being a completely law-abiding citizen, who knows what the next government would think of that…

So, I think that ultimately it will make prices of precious metals move higher, but, of course, this is something that I see happening in the coming years, not in the next few weeks.

Who knows, maybe the global rise in interest rates (which is just starting) is supposed to make people dislike the current monetary system so that they not only are OK with the new crypto system, but they request it. Remember people shouting “Lock us down! Lock us down!” at the beginning of the pandemic?

2. Moving into a WW3 would like make the precious metals sector (especially gold) soar. However, I think that a stock-market-slide-led decline awaits us first – in the following weeks/months.

3. My reply here is exactly the same as when I replied to the question about Russia’s ban from the SWIFT system yesterday. Namely: This could work as you wrote above, but… history tells us that this would likely not be the case initially. Remember 2008? We had an international banking crisis (this doesn’t fully express what it was, but serves as a good summary), so the contagion effect was in full force, and what did gold do? It first declined significantly, along with the general stock market, and then came back up with a vengeance. While gold was declining, silver and mining stocks were also declining, particularly significantly. That’s in perfect tune with what I’m expecting to see in the future of the precious metals market.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Crude oil’s extreme outperformance, the stock market’s weakness, and critical medium-term resistance levels reached by gold (all-time high!) and junior mining stocks all indicate that the tops are at hand or have just formed. The huge-volume reversals in gold and (especially) mining stocks, along with silver’s short-term outperformance, all point to lower precious metals prices in the following days/weeks. It seems that the top is in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact”. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

Consequently, I’m keeping my short position in the GDXJ intact. In fact, as it declined in value due to recent movement, and the outlook didn’t change (in fact, the downside potential is even bigger), I just added to my short position in the junior miners. Please note that it doesn’t mean the increase of the desired position size – it means making sure that the desired size of the position remains as I want it to be. If that’s not a clear confirmation of putting one’s money where one’s mouth is, then I don’t know what would be one.

Moreover, let’s keep in mind that there are triangle-vertex-based reversals in mid- and late-February, so even if we see more back-and-forth trading soon, it’s likely that the decline resumes later this month.

I continue to think that junior mining stocks are currently likely to decline the most out of all the parts of the precious metals sector.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief