Briefly: in our opinion, last week's Gold Investment outlook remains valid given that we've entered in a tight U.S elections race, Trump being COVID-19 positive, and that the pandemic is not over yet, with a long and bumpy path toward full economic recovery.

Welcome to this week's Gold Investment Update. Based on last week's price moves, our most recently featured outlook remains the same as the prices generally moved in tune with our expectations. On that account, there are parts of the previous analysis that didn't change at all in the earlier days, which will be written in italics.

Before discussing the technical point of view, we’d like to say a few words on the recent fundamental news and developments. At this point, we’ll focus on the upcoming US elections, Covid-19 situation, and the stimulus package related to the latter. Let’s start with the topic of the US elections.

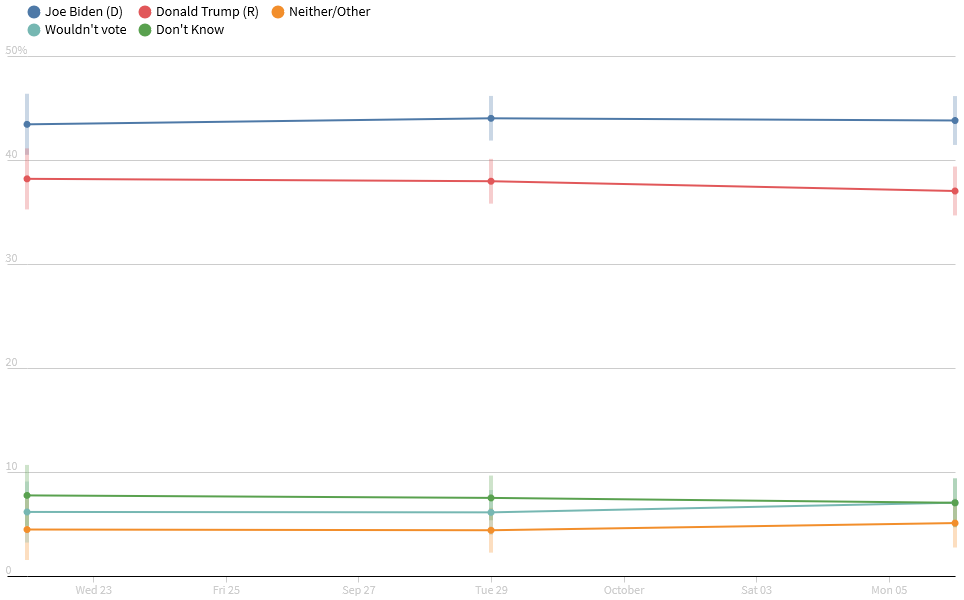

According to the most recent Reuters/Ipsos poll, Biden has increased his presidential race advantage. Now, as the chart below shows, he leads by 7 percent.

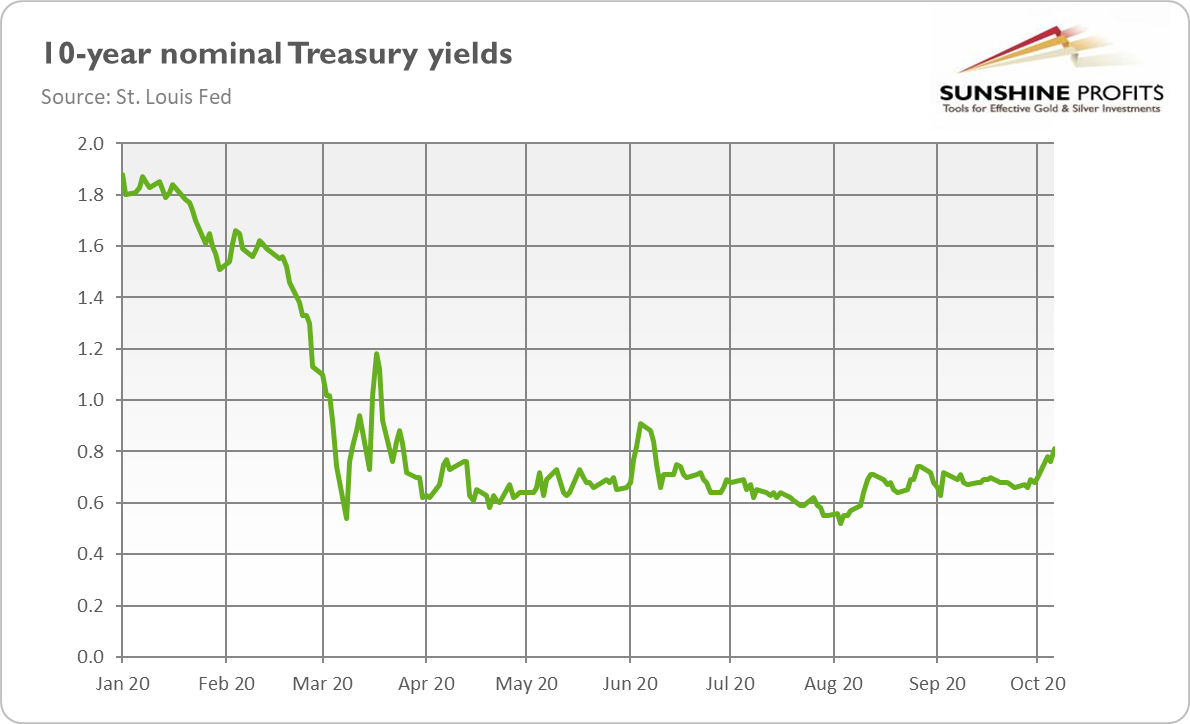

We don’t trust in opinion polls. And why is that you might wonder. It is because they measure the popular vote, which doesn’t exactly decide who wins the presidency. We all remember how the polls failed to predict Trump’s victory in 2016, and that is why we must take them with a grain of salt. However, investors have also increased their bets that the Democrat will have a clear-cut victory, as the green technology and trade-linked companies shares that would likely benefit from Democratic policies have climber recently. The rising possibility of Biden’s triumph and Democrats taking control of the Senate has also increased the Treasury yields in anticipations of higher stimulus packages, as shown in the chart below.

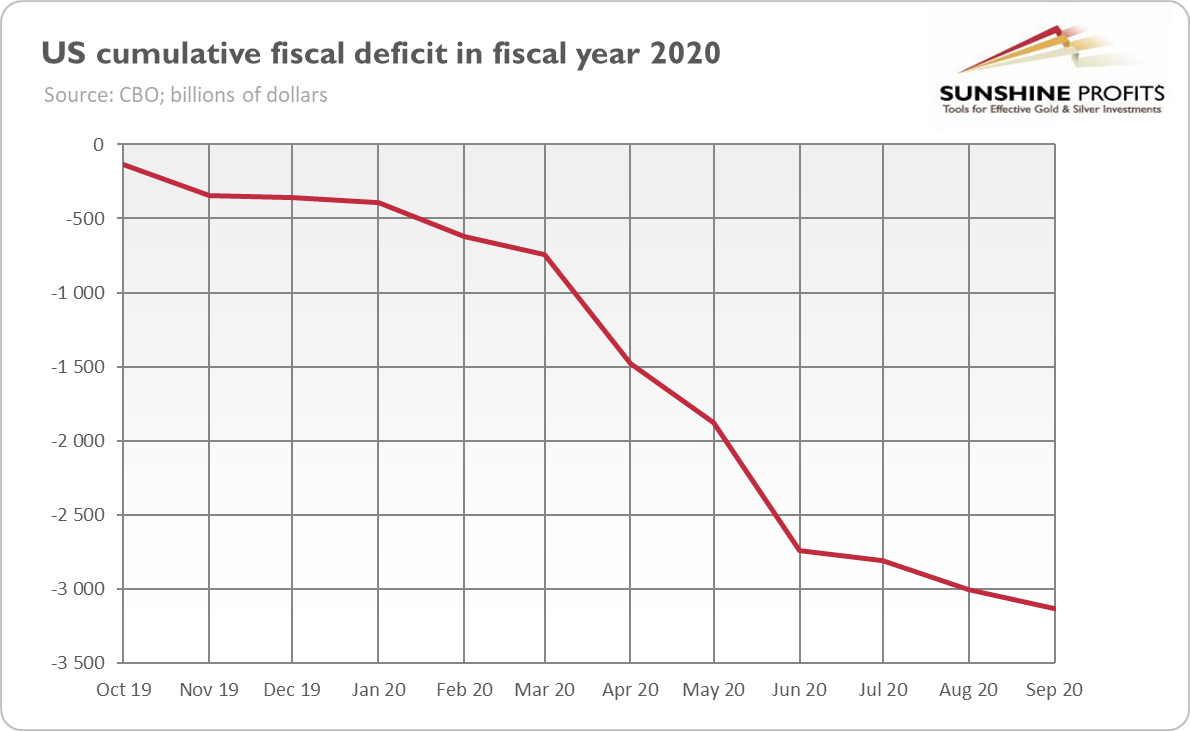

Theoretically, this is bad news for gold, which prefers declining bond yields. But still, gold could also rise amid strengthened expectations of a bigger stimulus package. After all, the federal debt has recently ballooned. Last week, the Congressional Budget Office projected that the U.S. fiscal deficit had hit a record of $3.1 trillion in the 2020 budget year.

Compared to the GDP, the budget deficit amounts to 15.2 percent, the highest one since 1945. Additionally, 2020 was the fifth year in a row in which the deficit increased as a share of the economy’s size. In a ballooning public debt environment, the U.S. dollar could find itself under downward pressure, which should support the gold prices as a result.

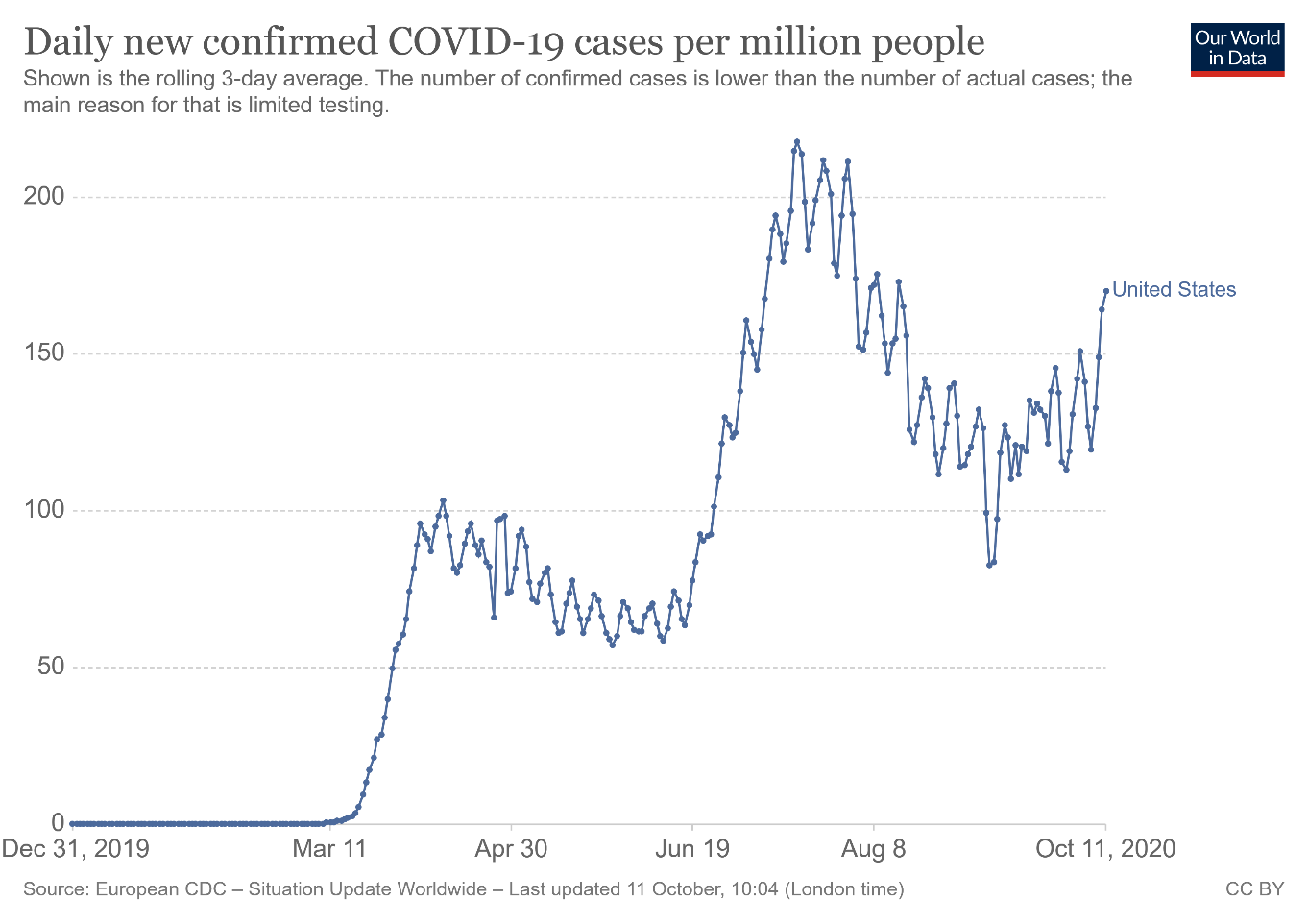

The specter of mammoth debt is the reason why Republicans prefer a smaller stimulus package. However, they are now under immense pressure, as almost all mainstream economists claim that the economic recovery pace will slow down without significant financial support. For example, Jerome Powell, the Fed Chair, in a speech to the National Association for Business Economics, last week reiterated that Congress should provide more fiscal help. “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” he said. More specifically, the support is more than necessary due to the ongoing coronavirus threat, which drags the economy down. Indeed, things are devastating. As the chart below indicates, the daily number of new Covid-19 cases has risen again to 50,000!

The economic data is not encouraging, as well. Although the unemployment rate decreased further, last month’s employment increase fell short of Wall Street’s estimate, while the initial jobless claims remain elevated. Even more importantly, the high-frequency indicators show little evidence of quick and smooth recovery. For example, Oxford Economic Recovery Index is around 20 percent below the pre-pandemic level.

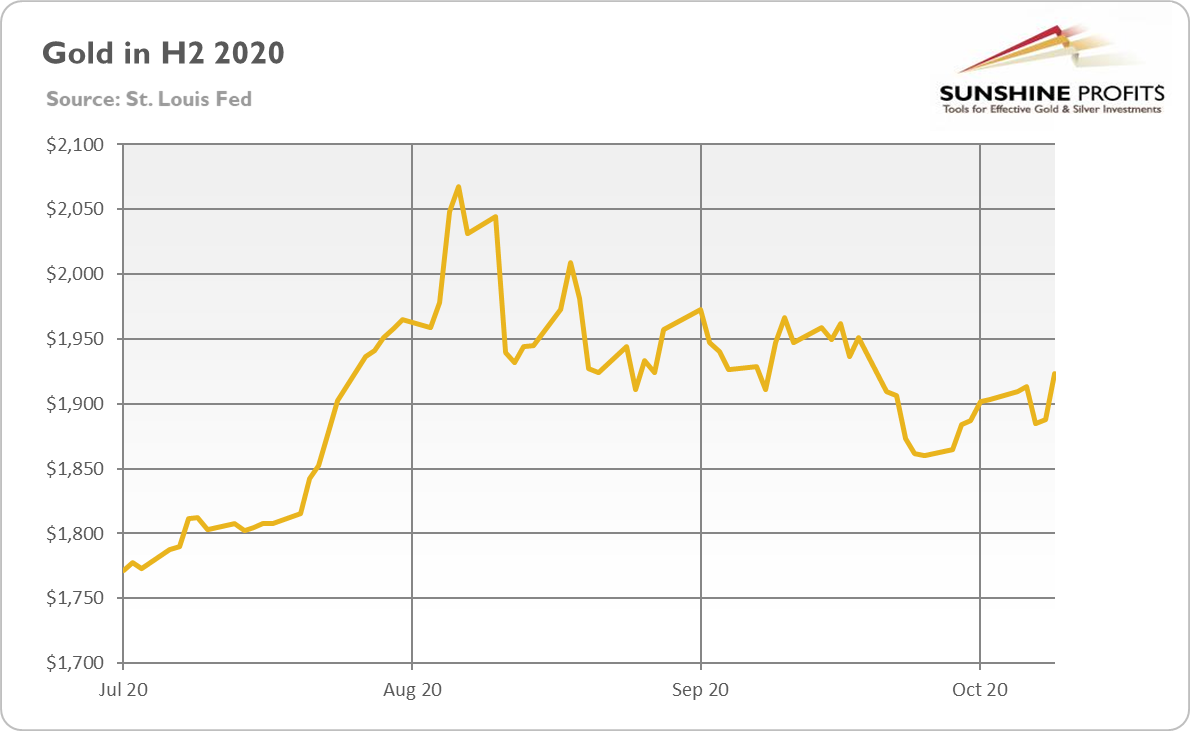

What does all of the above mean for the gold market? Well, as the chart below shows, gold jumped above $1,900 last week, partially due to the optimistic expectations of a new aid package, as Trump said on Thursday that talks with Congress have restarted over the fresh stimulus. And on Friday, the White House lifted its stimulus offer from $1.6 to $1.8 trillion. Two hundred billion one way or the other, what a difference!

The additional fiscal help would not only further balloon the already mammoth public debt, but it will also force the Fed to at least partially monetize the government’s debt, which would only increase the central bank’s balance sheet. This is good news for the yellow metal.

Of course, there are also some headwinds ahead of gold. For example, the minutes from the ECB’s last monetary policy meeting indicate that the ECB could be more worried about the state of the eurozone’s economy than previously thought and that it is planning additional monetary stimulus, maybe even this year. Even though the gold bugs could welcome additional liquidity from the central banks, the ECB's new measurements could weaken both the euro and the yellow metal against the US dollar. Moreover, please note that the Covid-19 cases are currently rising much faster in the EU than in the US. The markets are not focusing on these statistics as much as they did in March, but we wouldn’t rule out quick moves – similar to the March ones – just yet.

Another risk is quicker than expected coronavirus vaccine distribution, which would increase the risk appetite among investors and slightly reduce the demand for gold as a safe-haven.

Nevertheless, the fundamental outlook remains positive for gold. An almost $2 trillion worth of stimulus is coming, which will balloon the public debt and weaken the U.S. dollar. The bond yields have recently increased, but the Fed’s purchases should prevent them from rising too much. All in all, gold should shine in such a macroeconomic environment.

All in all, there are multiple fundamental reasons due to which gold is likely to soar in the upcoming years, however, even the most profound bull markets can’t move up in a straight line and some corrections will take place. After big rallies, we’re likely to see big corrections, and one is long-overdue in case of the precious metals market.

Just as it was in March, it seems that the visible worsening in the economic situation might trigger a sell-off.

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

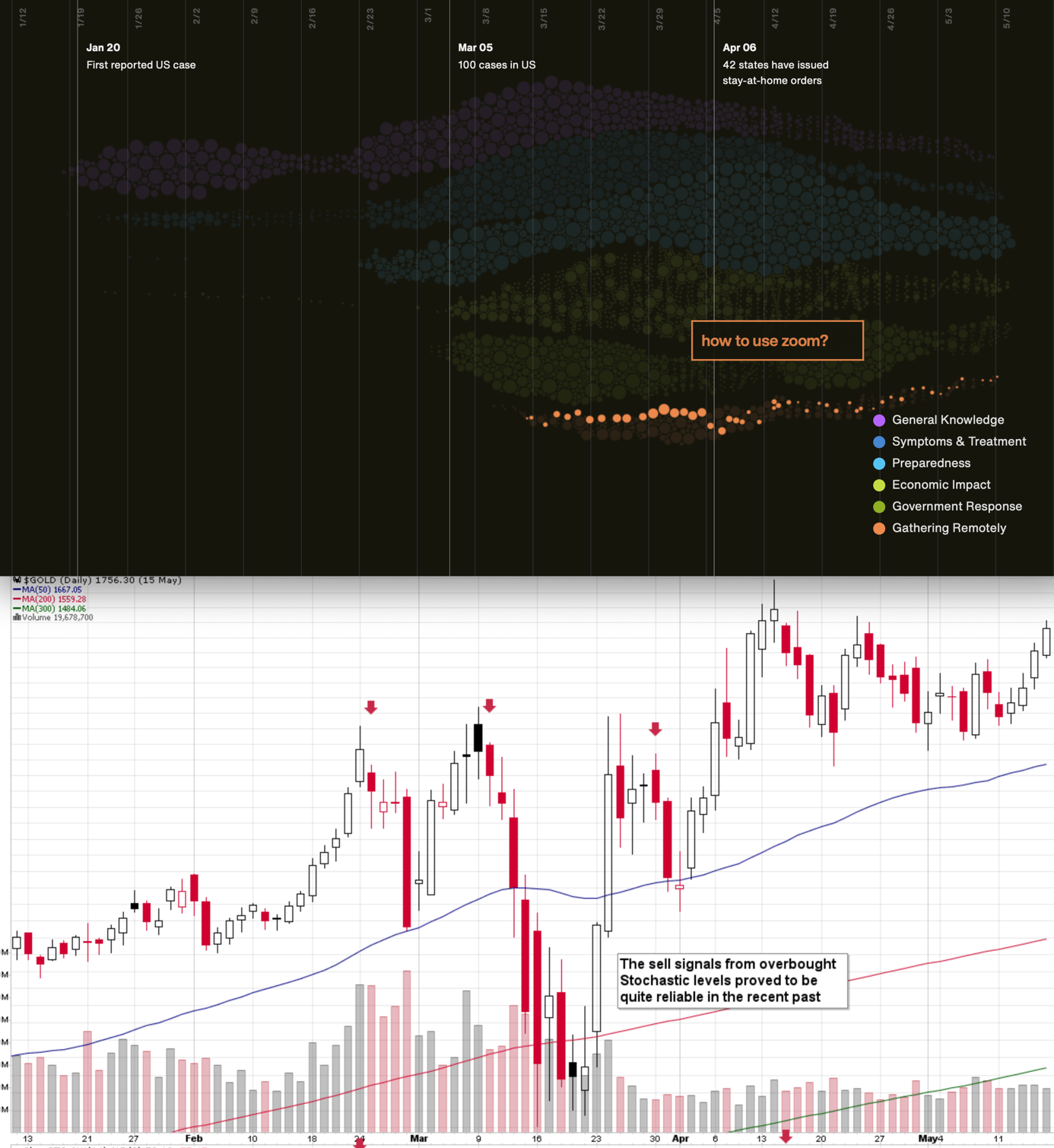

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it’s vulnerable to a sizable decline, when the economic implications of the pandemic’s continuation become obvious to investors.

Stocks and the Dollar Weigh In

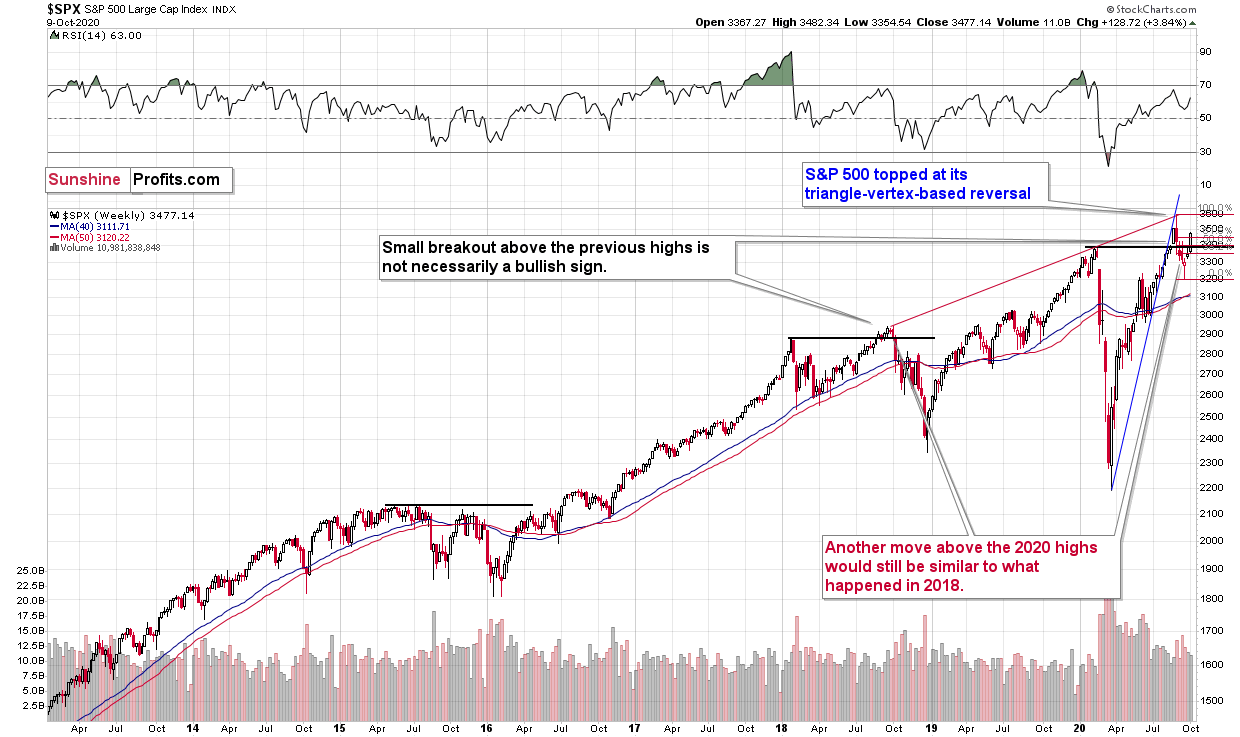

The big news of the previous week was that the general stock market managed to move higher, despite the invalidation of the early-2020 high. This is something unusual for any market, as commonly invalidations of breakouts or breakouts are strong indications that the market is going to move in the opposite way. The invalidation of the breakout was therefore a strongly bearish sign.

So, what happened? Well, it could have been the case that the nothing-bad-will-happen-before-the-elections rule applied, and the rally was more orchestrated than natural. By that we mean that some powerful investors bought enough to trigger the rebound. And let’s keep in mind that the Fed pledged to play an active role right now – even more so than it did in 2008.

What does it mean going forward? It means that the slide could be delayed, but I don’t expect it to be averted entirely. After all, no market can be “triggered artificially”, “supported”, “set”, or “manipulated” for longer periods (of course, except the interest rates), and despite the massive money printing, the economy is not doing great. And that’s an obvious understatement.

From the technical point of view, we would like to point out three things:

- Stocks have corrected more than 61.8% of the recent decline, so they could move higher in the short term. That’s not something certain, though.

- In 2018 we saw a tiny invalidation of the breakout, then another move higher (slightly above the previous highs), and stocks plunged shortly thereafter.

- In early 2020, the very initial decline was relatively small, and it was followed by another move higher (slightly above the previous high). Stocks plunged shortly thereafter.

Consequently, in analogy to two most similar situations to the current one from the recent past, it wouldn’t be surprising to see stocks move to or even slightly above the previous highs, before they turn south in a spectacular way.

This could mean a delay in precious metals’ and miners’ decline as well. Again, a decline, not its absence. Especially that the situation continues to be excessive on the forex market.

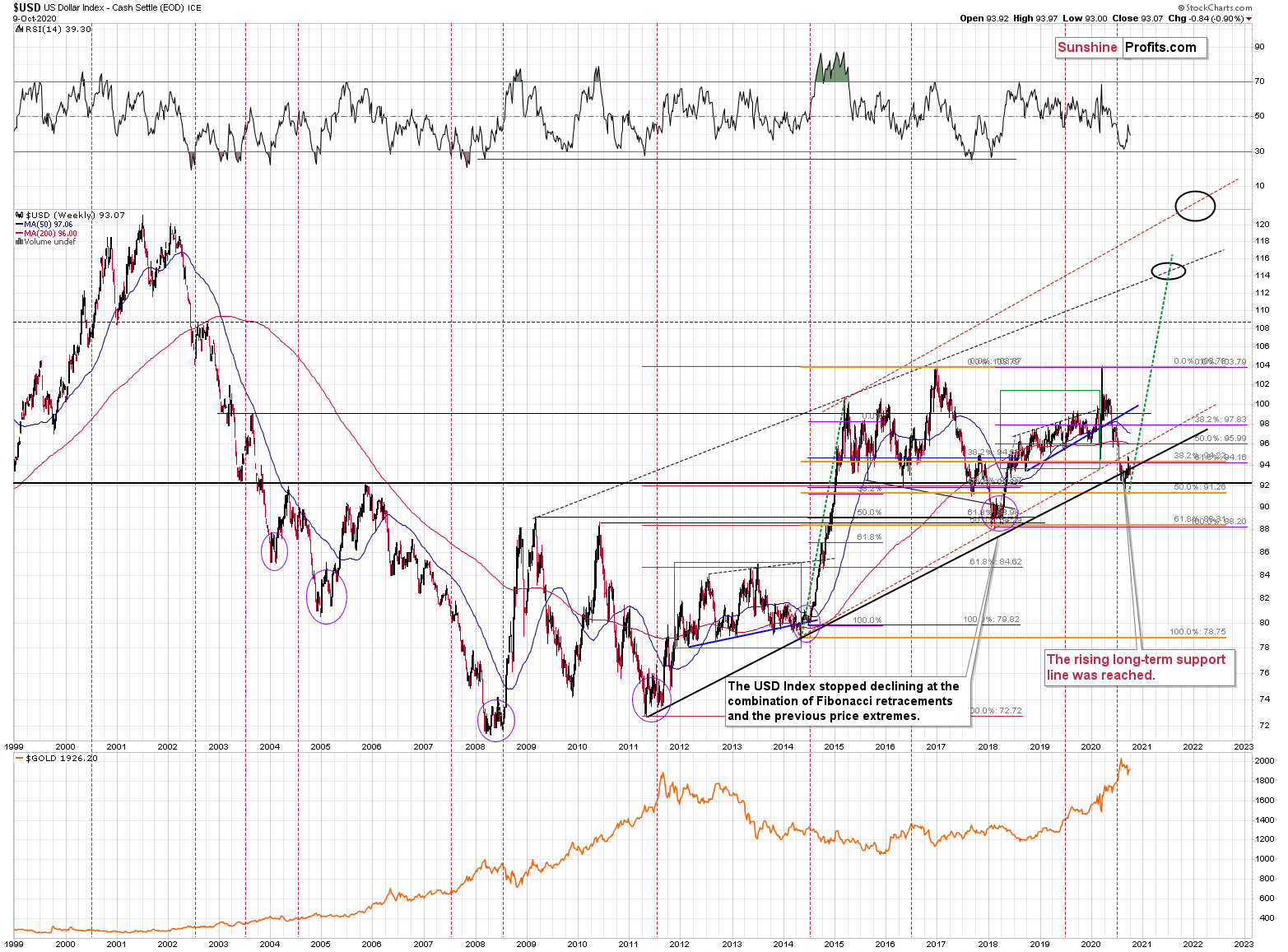

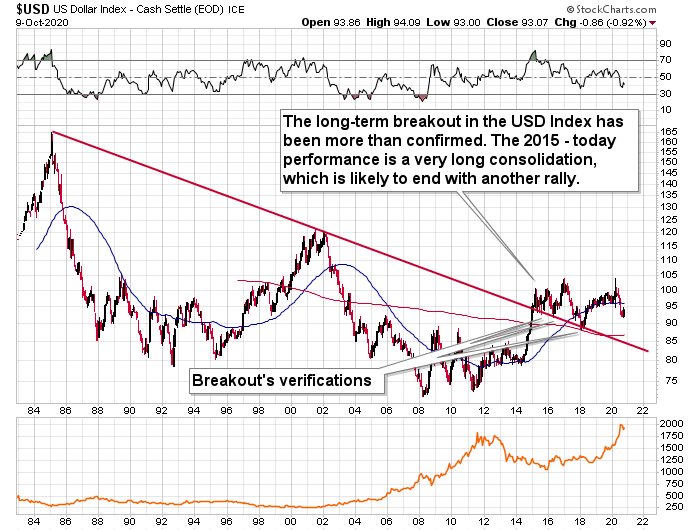

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone “knew” that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it’s exactly the same right now.

The USD Index was at a powerful combination of support levels. One of them is the rising, long-term, black support line based on the 2011 and 2014 bottoms. The other major support level and a long-term factor is the proximity to the 92 level – that’s when gold topped in 2004, 2005, and where it – approximately – bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, broke slightly below them, and now it has clearly invalidated this breakdown. For many weeks, we’ve been warning about the likely USD Index rally, and we finally saw it.

Quoting my previous comments:

USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

Based on the most recent price moves, the USDX is once again below the above-mentioned strong rising support line, but we doubt that this breakdown would hold. We expect to see an invalidation thereof that is followed by a rally.

Before moving to the short-term chart, please note that the major bottoms in the USD Index that formed in the middle of the previous years often took form of broad bottoms. Consequently, the current back and forth trading is not that surprising. This includes the 2008, 2011, and 2018 bottoms.

A crucial aspect is that the rally that we’ve witnessed so far is just the tip of the bullish iceberg. The breakdown below the key support levels was invalidated, which is a strong bullish indicator. Since it happened on a long-term chart and the temporarily broken lines were critical, the implications are incredibly important as well– and they should be visible from the long-term perspective.

So, how high could the USD Index rally now? At least to the 100 level (approximately). This way, the upcoming rally would almost match the rally that started after the previous major invalidation – the 2018 one.

Still, we wouldn’t rule out a scenario in which the USD Index rallies above its 2020 highs before another major top. After all, the USD Index is after a very long-term breakout that was already verified several times.

Taking into account USDX’s lengthy breakout, its several breakout verifications, and the 5-year consolidation, it seems that the USD Index is ready to rally much higher – perhaps to approximately to the 120 level.

Please note that the consolidation that preceded the previous rally to 120 that took place between 1997 and 2000 happened when the USD index was trading at relatively similar price levels – approximately between 90 and 105.

The short or medium-term target for the USDX is relatively unclear right now, and it’s very oversold on a short-term basis. It all happened in the middle of the year, which is when on many occasions, the USDX formed major bottoms. This makes a short-term rally here very likely.

The short-term USD Index chart is not as important as the long-term one, but let’s take a look at it anyway.

USDX’s breakout is more than confirmed. It was followed by zigzag-shaped decline, one of the common corrective patterns. Right now, the USD Index is trading just a bit above the levels from which it broke on September 21st. And where’s gold? More visibly below its September 21st high. Gold is not really showing strength here.

Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market. It’s generally a good gold trading tip to monitor the USD Index’s performance.

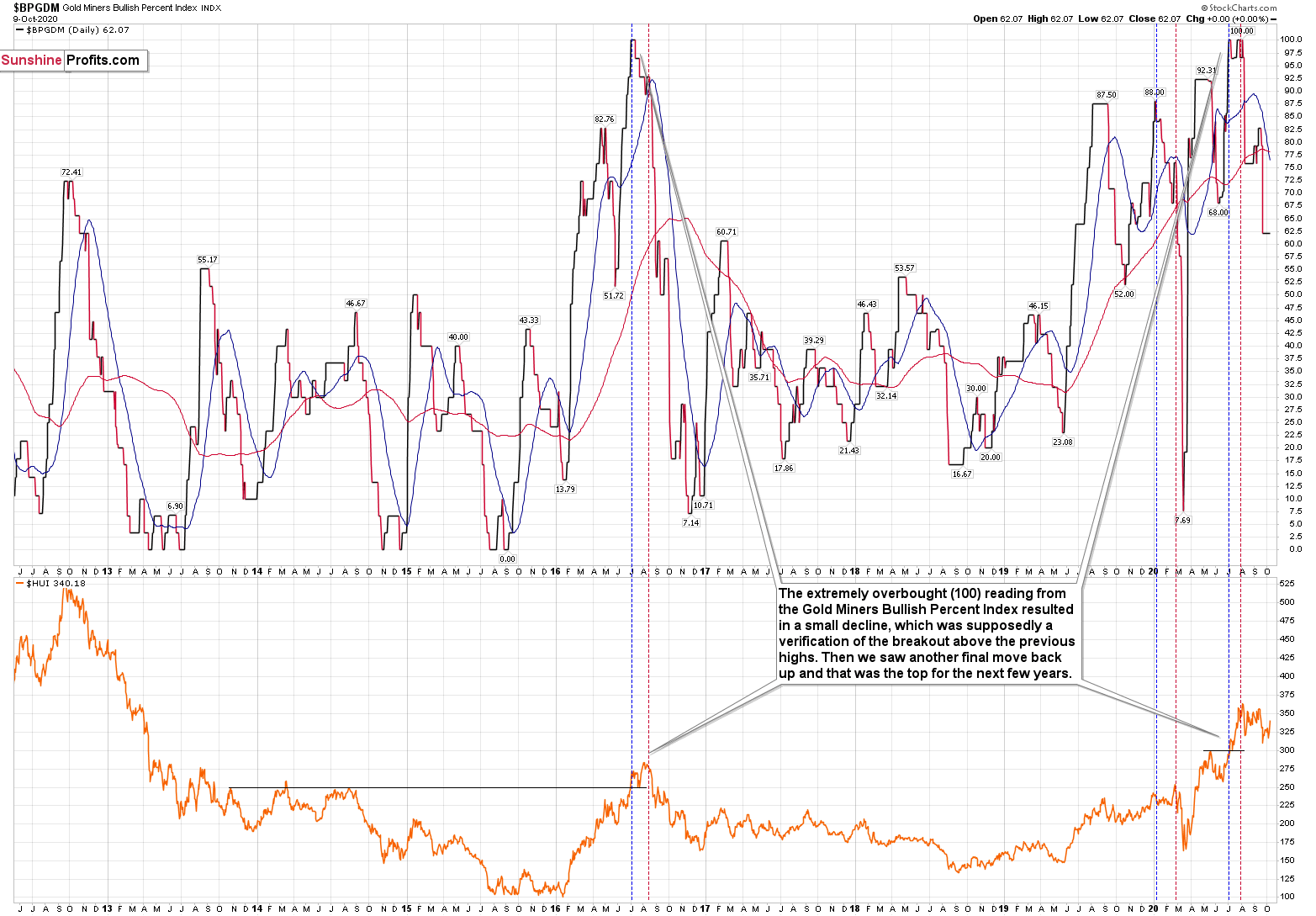

Consequently, based on this analogy, the implications for the near term are bearish for the PMs. Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing has caused the Gold Miners Bullish Percent Index to move up once again for a few days. It then declined once again. We saw something similar also this time. In this case, this move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline. Given the situation in the USD Index, it seems that we’re seeing the same thing also this time.

Please note that back in 2016, after the top, the buying opportunity didn’t present itself until the Gold Miners Bullish Percent Index was below 10. Currently, it’s above 60, so it seems that miners have a long way to go before they bottom (perhaps a few months – in analogy to how gold declined in 2016).

Seven weeks ago, we’ve commented on the chart above in the following manner:

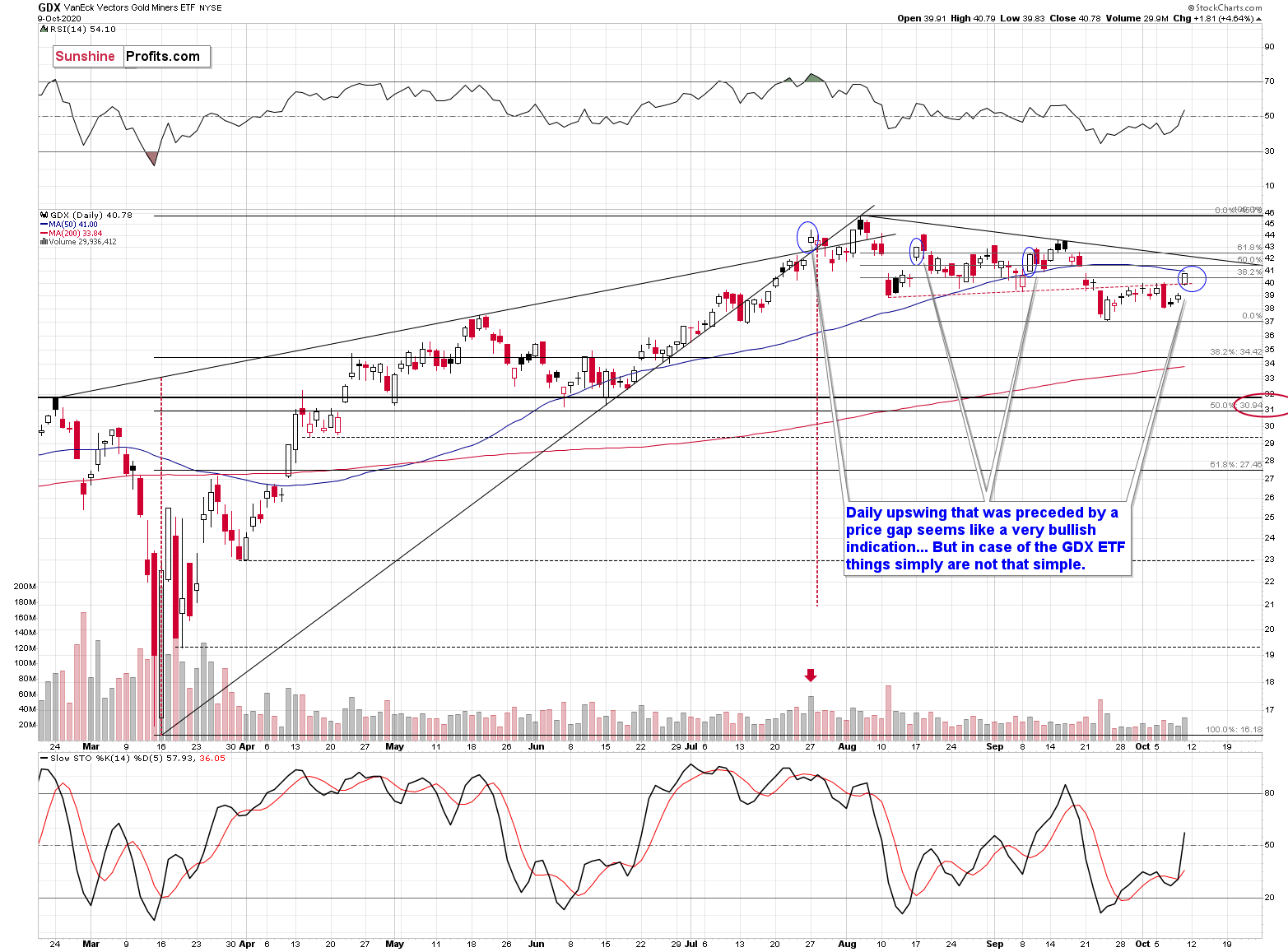

Now, since the general stock market moved above the previous highs and continues to rally, we might or might not see a sizable decline early this week. Back in March, the slide in miners corresponded to the decline in the general stock market, and this could be repeated, or we could see some sideways trading after the slide resumes, once stocks finally decline.

That’s exactly what happened. The general stock market continued to move higher, and mining stocks have been trading sideways instead of declining – or rallying. Before miners’ pause (and S&P’s breakout) miners were repeating their late-February and early-March performance. The implications of the self-similar pattern were bearish, and they continue to be bearish, only the timing changed.

The GDX moved higher on Friday, invalidating the breakdown below the red resistance line. Naturally, this is a bullish sign, but before saying that the situation become bullish, let’s consider what followed similar – seemingly very bullish – price moves that we saw recently (July 27, August 17, September 9). That was either the end of the rally or it meant that the vast majority of the rally was already over. Consequently, it was not the time to be going long, but rather to be going short. In fact, Friday’s closing price was below all above-mentioned sessions’ closing prices. Interestingly, each case had a lower daily close than the preceding case.

Moreover, please note that while stocks corrected more than 61.8% of their recent decline, the GDX ETF corrected only a bit more than 38.2% of the move. So, even if the general stock market moves to or slightly above its previous 2020 highs, it doesn’t mean that the same would be likely for gold miners. The decline of the latter would likely be delayed in this case, though. If the general stock market fails to rally, but the USD Index does, the miners would be likely to plunge.

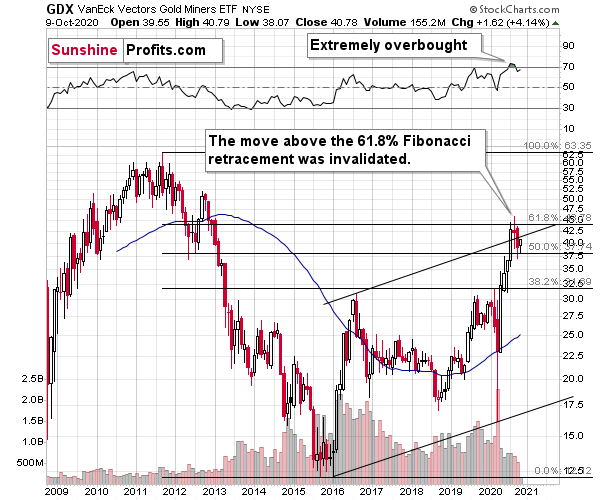

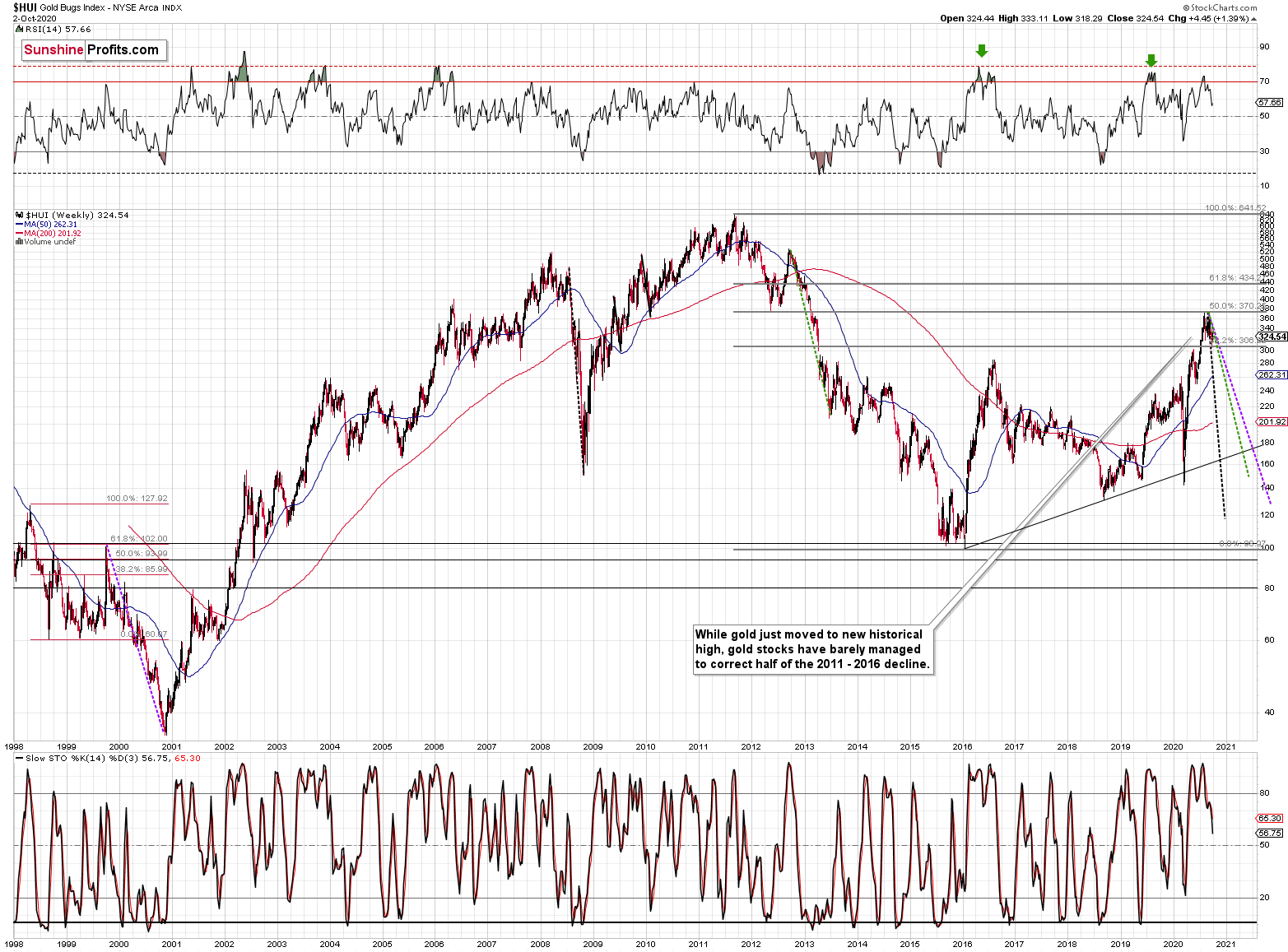

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there are only several months left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Let’s proceed to metals themselves.

Gold moved above the declining resistance line, but stopped at its 38.2% Fibonacci retracement. The move above the declining resistance line was not significant, so it would require a confirmation. Gold closed last week practically right at the resistance line, so it’s not that clear if the breakout is anything more than a blip on the radar screen. In today’s pre-market trading gold moved a bit lower, but not yet enough to invalidate the breakout.

Overall, gold is trading more or less, where it was trading at the beginning of the month, while the USD Index is trading visibly lower. Gold is not showing strength here, despite what one might think based on Friday’s upswing alone.

Gold is after a confirmed breakdown below the important red, medium-term support line, which means that it’s likely to slide in the upcoming weeks and/or months. Even if it doesn’t happen right away.

Based on the chart above, the likely downside target for gold is at about $1,700, predicated on the previous lows and the 61.8% Fibonacci retracement, based on the recent 2020 rally.

As far as the white metal is concerned, previously, we’ve indicated the following:

Silver is also after a major breakdown and it just moved slightly below the recent intraday lows, which could serve as short-term support. This support is not significant enough to trigger any major rally, but it could be enough to trigger a dead-cat bounce, especially if gold does the same thing.

Once again, that’s exactly what happened.

Is the counter-trend rally over? That’s quite possible, especially given today’s pre-market reversal, but given the possibility that the stock market moves higher, silver could move somewhat higher before it slides once again.

In early March, silver moved higher before truly plunging, so the current move up doesn’t invalidate this similarity, especially that the Covid-19 cases are rising in a quite similar way (this similarity is most visible in Europe).

Technically, silver moved as high as it did on July 28th, on an intraday basis. The corrective rally is not as bit as one might think, while focused on just the Friday’s upswing. But that’s not the key thing here. The key thing is that the breakdown below the rising support line was more than confirmed.

At this point one might ask how do we know if that really just a dead-cat bounce, and not a beginning of a new strong upleg in the precious metals sector. The reply would be that while nobody can say anything for sure in any market, the dead-cat-bounce scenario is very likely because of multiple factors, and the clearest of them are the confirmed breakdowns in gold and silver, and – most importantly – the confirmed breakout in the USD Index.

Let’s get back to gold and zoom out.

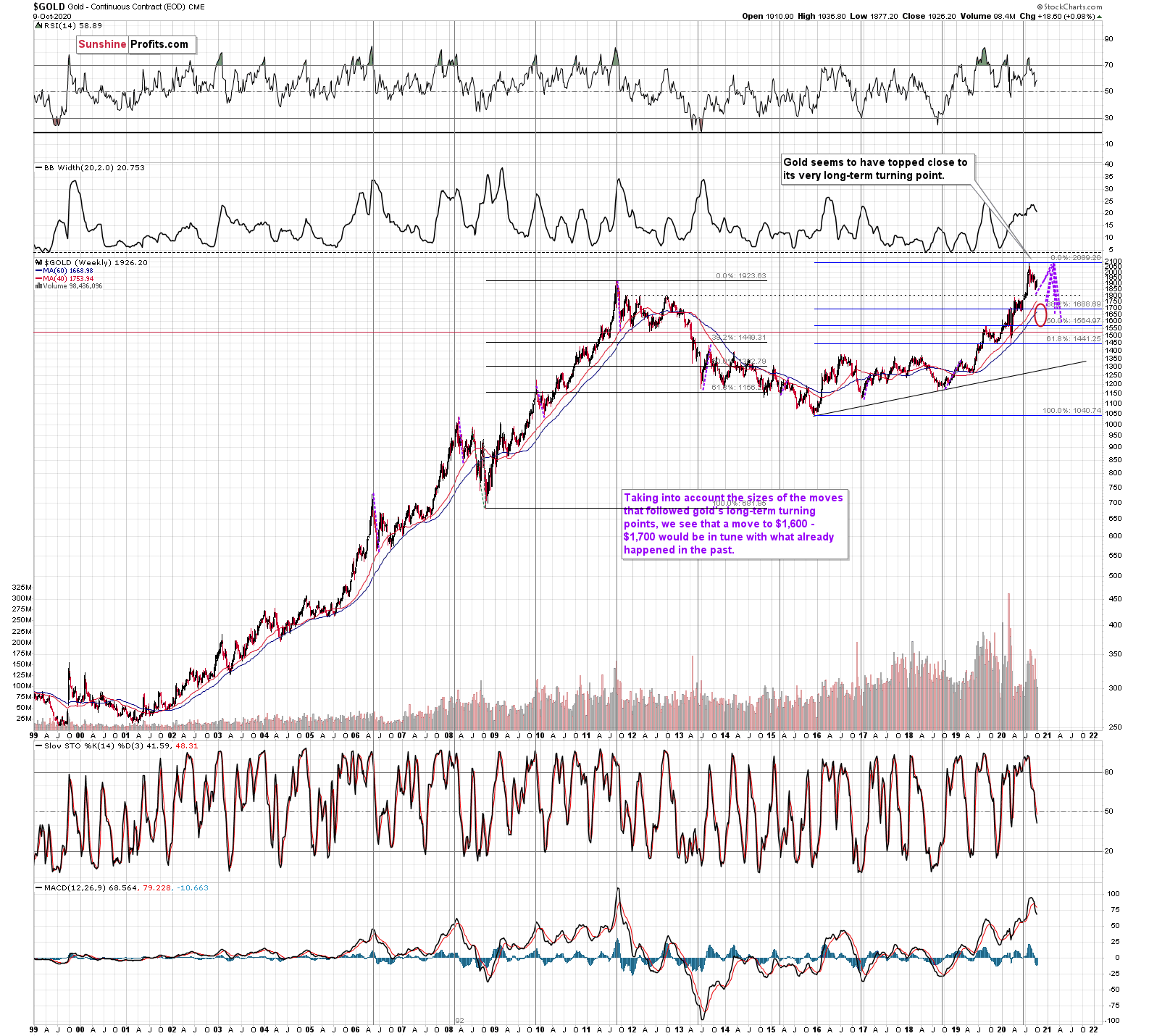

The chart above shows exactly why the $1,700 level is even more likely to trigger a rebound in gold, at the very minimum.

The $1,700 level is additionally confirmed by the 38.2% Fibonacci retracement based on the entire 2015 – 2020 rally.

There’s also possibility that gold would decline to the $1,500 - $1,600 area or so (50% Fibonacci retracement and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

Gold’s very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold’s big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom close to the $1,700 level. That’s very much in tune with how much gold moved after the previous long-term turning points.

The analogy to the price moves after the previous turning points didn’t change, but since the starting point is much higher, the downside target is also higher as well.

Speaking of upside targets, seven weeks ago, we wrote:

Based on gold's Fibonacci extensions and the previous major highs and lows (the 2018 high and late-2019 low along with the 2020 low), we get a nearby upside target of $2085. At the moment of writing these words, gold is trading at $2044. Given this week's volatility, it could even be a matter of hours before gold reaches the above-mentioned target and reverses. Taking closing prices into account, gold is up by $35, so if it reverses significantly, we would be likely to see a powerful weekly reversal candlestick and one that causes gold to decline in the following weeks.

That’s more or less what happened. Gold topped at $2,089.20. It then declined quite visibly and closed last week at about $1,950.

Do you get the feeling that you have already seen gold perform this way before? Because you did.

The history rhymes, but this time, the similarity is quite shocking.

We copied the short-term chart and pasted it on the long-term chart above and next to the 2011 top. We pasted it twice, so that you can easily compare gold’s performance in both cases in terms of both: price and time.

They are very similar to say the least. Yes, these patterns happened over different periods, but this doesn’t matter. Markets are self-similar, which is why you can see similar short-term trends and long-term trends (with regard to their shapes). Consequently, comparing patterns of similar shape makes sense even if they form over different timeframes.

After a sharp rally, gold declined quickly. Then we saw a rebound, and a move back to the previous low. Then, after a bit longer time, gold moved close to the most recent high and started its final decline. This decline was less volatile than the initial slide. That’s what happened when gold topped in 2011 (and in the following years), and that’s what happened also this year. Ok, after the initial decline from the 2011 top, we saw two initial reactive rallies and in 2020 there was just one, but it didn’t change the similarity with regard to time.

The patterns of this level of similarity are rare, and when they do finally take place, they tend to be remarkably precise with regard to the follow-up action.

What is likely to follow based on this pattern, is that we’re likely to see the end of the slower decline, which will be followed by a big and sharp decline – similarly to what we saw in 2013.

How low could gold slide based on this similarity? Back in 2013, gold declined approximately to the 61.8% Fibonacci retracement based on the preceding rally (the one that started in 2008), so that’s the natural target also this time.

And we already wrote about this particular retracement – it’s approximately at the $1,700 level. This has been our downside target for weeks, and it was just confirmed by this precise self-similar technique.

Another interesting point is that gold made an interim low close to the 50% retracement and the previous lows. Applying this to the current situation suggests that we could see a smaller rebound when gold moves to about $1,760 - $1,800.

This might be the moment to switch from short positions in the miners to short position in silver. It’s too early to say for sure at this time, though.

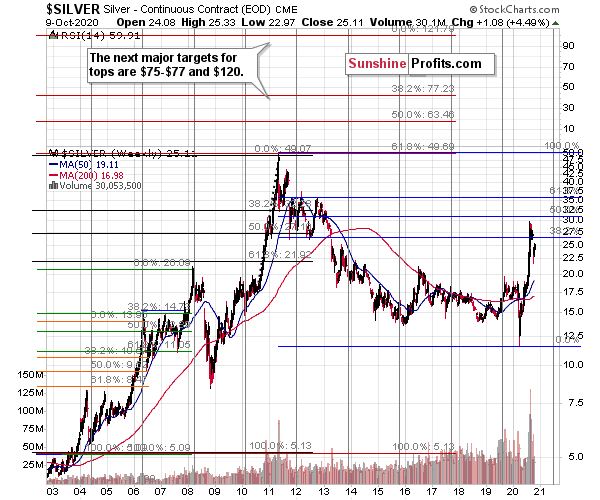

Speaking of silver, please note that from the long-term point of view, silver is not that strong.

While gold moved to new highs, silver – despite its powerful short-term upswing – didn’t manage to correct more than half of its 2011 – 2020 decline.

In fact, silver has already invalidated its move above the lowest of the classic Fibonacci retracement levels (38.2%), which is not something that characterizes extraordinarily strong markets.

Silver is likely to move well above its 2011 highs, but it’s unlikely to do it without another sizable downswing first.

We see something similar in the HUI Index. The latter corrected half of its 2011 – 2016 decline and nothing more, while gold moved well above its 2011 high.

All in all, it’s mostly gold that is making the major gains – not the entire precious metals sector.

So, how can one determine the end of the gold price decline? At $1,700, it seems that it can go either up or down. Where does gold need to go to complete the pattern?

In reality, gold could rebound from $1,700, but it could just as well slide further, perhaps once again to the previous 2020 lows, especially if the USDX rallies to its 2020 highs.

So, how do we determine whether we see the buying opportunity or not?

We will view the price target levels as guidelines, and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be something else. Something that we already saw in March when gold bottomed.

We will be on a special lookout for gold’s strength against the ongoing USDX rally. At many vital bottoms in gold, that’s exactly what happened, including what the March bottom.

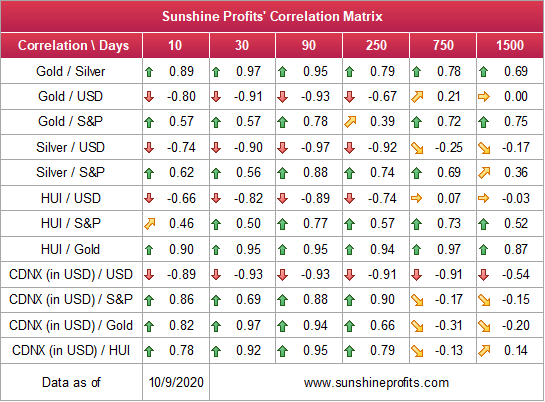

So far, the link between gold and the USD Index is strongly negative.

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the short (30-day column) and medium term (90-day column), it seems likely that will continue to be negatively affected by the USDX upswing.

…Until we see the day where gold reverses or soars despite the U.S. currency’s rally.

If that happens with gold at about $1,700, we’ll have a very good chance that this was the final bottom. If it doesn’t happen at that time, or gold continues to slide despite USD’s pause or decline, we’ll know that gold has further to fall.

Naturally we’ll keep you – our subscribers – informed.

To move forward, how does the GDX downside target compare to the gold’s downside target? If, at the same time, gold moves to about $1,800 and miners are already after a ridiculously big drop (to $31-$32 in the GDX ETF, or lower), the binding profit-take exit price of your GDX ETF will become $32.02.

However, since gold is only at $1,800, with a GDX of $32, there’s more decline to be expected. Perhaps that exiting GDX is only for changing to shorts in silver? Is that the only instance when that’s the case, or could it also be with a GDX of $32 and a gold price of $1,700. What would be a GDX target for gold a gold price of $1700 be?

It’s also not entirely clear whether you have up to six weeks until the lows arrive, instead of the end of the year.

Yes, we plan to exit the short positions in the mining stocks (GDX) and enter short position in silver. We don’t have an exact price at which we’ll do it (and it’s unclear if we’ll do it at all). We’re just describing what we’re going to do if a certain set of circumstances is met. If miners decline very profoundly, but silver declines only “normally”, then it would create a specific opportunity for one to switch from miners (that would be after most of their decline) to silver (that would be not be after most of its decline). Our estimation is that it might happen with GDX at about $31 - $32, and/or with gold at about $1,800. However, it would be the specific relative performance of miners to silver that would determine if we would make the switch or not.

We expect the above – a local bottom with miners at about $31 - $32 – to form within the next 5 weeks. However, this will likely not be the final bottom, especially if gold doesn’t slide to $1,700 at that time. We expect to see bigger declines to follow then, after a pause or a rebound. This means that miners could rally a bit from $31 - $32, and then decline below this area afterward.

At this time, the final GDX target (the one that would correspond to gold at $1,700 or lower) is still unclear. The $17 - $23 area seems probable, especially if the general stock market slides once again. It’s too early to say with any significant level of certainty. Gold is providing us with a clearer final target, so that’s what we’ll focus on. And most importantly – we’ll focus on gold’s performance relative to the USD Index.

Letters to the Editor

Q: At current situation of war in middle east , will they effect the gold price if other countries join it. Please talk about this issue in your emails.

A: Any substantial increases in the geopolitical risks are likely to trigger a rally in gold. However, such a price increase (or decrease if the geopolitical risks decline) would likely be a temporary phenomenon. We wrote about it in our “Dictionary” section, when defining geopolitical risks in general.

Another thing is that the way gold reacts depends on the emotional status of the market participants, which can be detected using sentiment analysis – and technical analysis, which some might define as one of the ways of analyzing the sentiment. If gold is ignoring other bullish information, it would be likely to ignore escalation of military conflicts, at least to a considerable extent. If gold is ready to rally, anyway, such escalation would be likely to trigger it.

In the current environment, I think that gold would not be likely to rally a lot based on news coming from the Middle East, unless they are really surprising. The decline in gold could be delayed, but I don’t think it will be averted.

Q: Your website has helped me transition from my own full time job to a full time futures trader. However, I noticed something lately that I don't understand and was wondering if you knew the answer.

This morning I noticed that the 10 year T-Bond futures /ZN was trading almost the mirror opposite of silver futures. Can you explain this phenomenon?

I know that gold and silver generally track the real interest rate, but how is it that nominal rates are trading at the opposite?

Thanks for your help.

A: Thank you, I’ve very happy that you’re getting a lot of value from our services.

As far as the link between 10-year T-bond futures (ZN) and silver is concerned, please note that it was something very brief, and this makes it relatively normal. Every now and then markets will move with each other for a short period and then move in tune with something else, or completely on their own. This is how things often work. The more short-term price movement one focuses on, the more of these irregularities one will detect. In the very short-term markets are primarily emotional. On the completely opposite end of the investment world, in case of the very long-term price moves (that last many years), we have logical aspects that determine where the price moves.

Moving back to the short run, please note that the markets might (and often do) change on what they focus. One month it could be Covid-19 cases, and price moves in the markets could be aligned with the Covid-19 chart, and in the other month, it could be Fed’s balance sheet dynamics. Then it could be real interest rates, then maybe nominal rates for a week, and then forex, and then something else entirely. For instance, the seasonal patterns.

The link between ZN and silver was quite likely accidental and has little meaning going forward.

There are some markets that are almost always important for a given market – like gold is practically always important for silver, but there might be things that have some impact only very temporarily. One of the ways to check one the markets is really moving together with the other one, is to check if this was the case for longer, not just temporarily. One might use the correlation coefficient for that – we are providing some of them in our Correlation Matrix (and we’re updating it after each trading day).

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think it has already begun.

During the final part of the slide (which could end later than in 6 weeks, perhaps near the end of the year – just like it happened in 2015), we expect silver to decline more than miners. That would be aligned with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, but it doesn’t make the short-term decline improbable. Markets can and will get ahead of themselves and then decline – sometimes very profoundly – before continuing their upward march.

The plan is to exit the current positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 0 – 5 weeks). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom. It is a very soft and broad instruction, so additional confirmations are necessary.

I expect this confirmation to come from gold, reaching about $1,800. If – at the same time – gold moves to about $1,800 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. It will be tempting to wait with opening the short position in silver until the entire sector rebounds, but such a rebound could last only a couple of hours, so it would be challenging to successfully execute such a strategy.

The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index. It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

Summing up, given the recent move higher in the general stock market, it could be the case that the decline is delayed, but there also signs pointing to the corrective upswing being already over (like today’s pre-market reversal in silver).

Considering gold's breakout invalidation above the 2011 highs, it's clear that the big rally (that ended $4 above our upside target) is entirely over. Given this invalidation and the confirmed USD Index breakout, gold will probably slide much lower over the next few weeks. There are indications that the corrective upswing in the precious metals market and the pullback in the USDX are close to being over, so the decline could resume any day – or hour – now.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it wasn't already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager