Briefly: the medium-term outlook for the precious metals sector remains bearish.

There will be no regular Gold Investment Update posted tomorrow – it will be posted on Tuesday (Aug. 8), and for next Friday (Aug. 11), I’m preparing something special.

For now, I’m sharing today’s Gold Trading Alert as something “extra” for you. Also, please take a look at the 20% discount that’s available if one chooses to extend their subscription – that would also apply to you if you decide to upgrade your subscription for at least one year – times are likely to become more volatile, and getting more frequent updates might be worth it, especially when you can get it at preferred terms.

===

Surprised? No, you’re not. You read my analyses, and you knew that gold miners are going to magnify stocks decline when it happens.

In my analysis yesterday (written and posted before the markets opened in the U.S.), I wrote the following:

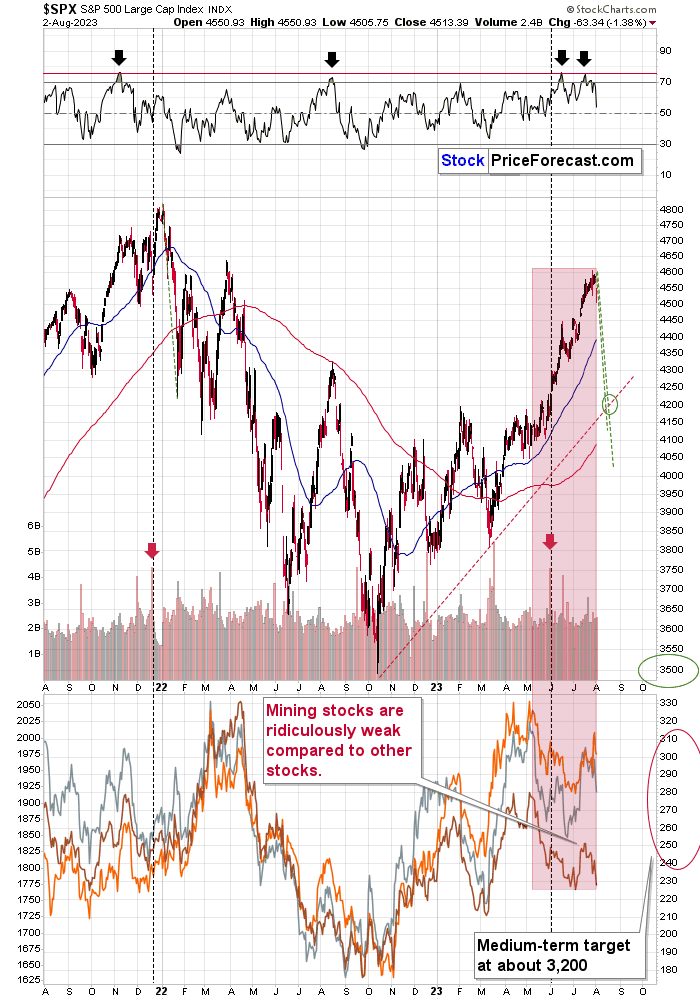

The S&P 500 futures formed a clear shooting star reversal in late July, and it can also be viewed as a failed attempt to move above the mid-July high. Stocks attempted to move above this level also in early August and they failed once again. Today’s early decline suggests that the rally might be over.

Why is this important for mining stocks?

Because they moved lower substantially yesterday, while stocks moved lower just a little. So, if stocks are going to move lower in a really significant manner (and it’s likely to happen either very soon, or soon, anyway), then miners are likely to truly plunge.

And here’s what happened:

Stocks declined by a lot… And by a little at the same time.

By a lot, because that was the first really notable decline in a relatively long time. The S&P 500 declined by almost 1.5% after all.

By a little, because when looking at the recent price moves from a broader perspective, it’s clear that so far the decline is barely visible.

Even if stocks are to decline just like they declined after previous highs that were preceded by extremely overbought RSI, they are likely to slide all the way down to their rising red support line, which is currently at about 4,200. But that would be a very bullish scenario in my view. Given the increases in interest rates, and by how much demand needs to be curbed for the inflation to really stabilize at lower levels, it makes sense to expect much (not a little) lower stock values.

That’s not even the most important point, though. The most important thing is how mining stocks reacted to S&P’s decline. I wrote that miners are likely to magnify those declines.

Here’s what happened:

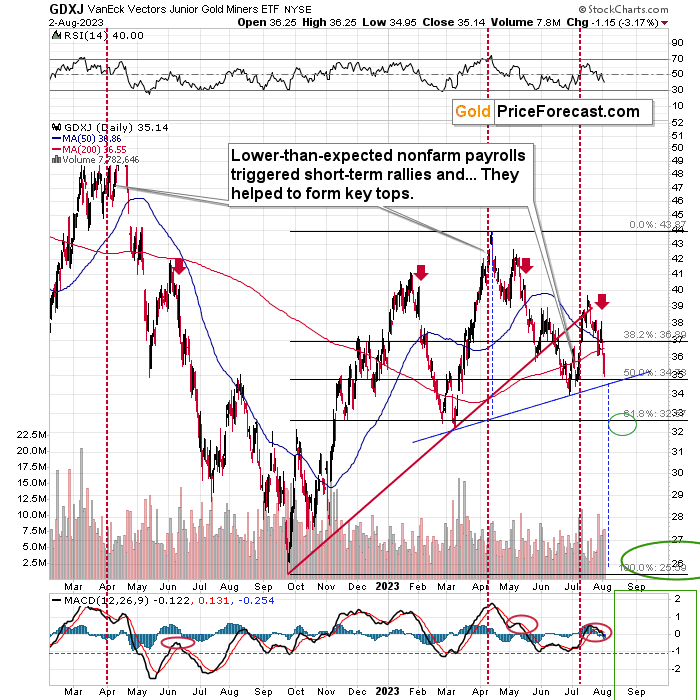

Junior miners plunged, declining over 3%. They are not very close to their June low, and they are not that far from their yearly low either.

The GDXJ is just about $2 away from its 2023 lows, and it’s about $9 away from its 2023 high. It’s also lower than it was when the year started.

At the same time the S&P 500 is very close to its yearly high and well above its yearly open.

Gold price is also closer to its yearly highs than yearly lows and well above its yearly open.

And yet, junior mining stocks are so damn weak!

How can it get any clearer that junior miners want to slide (and make a small fortune for those that are able to notice that and be positioned in advance)?

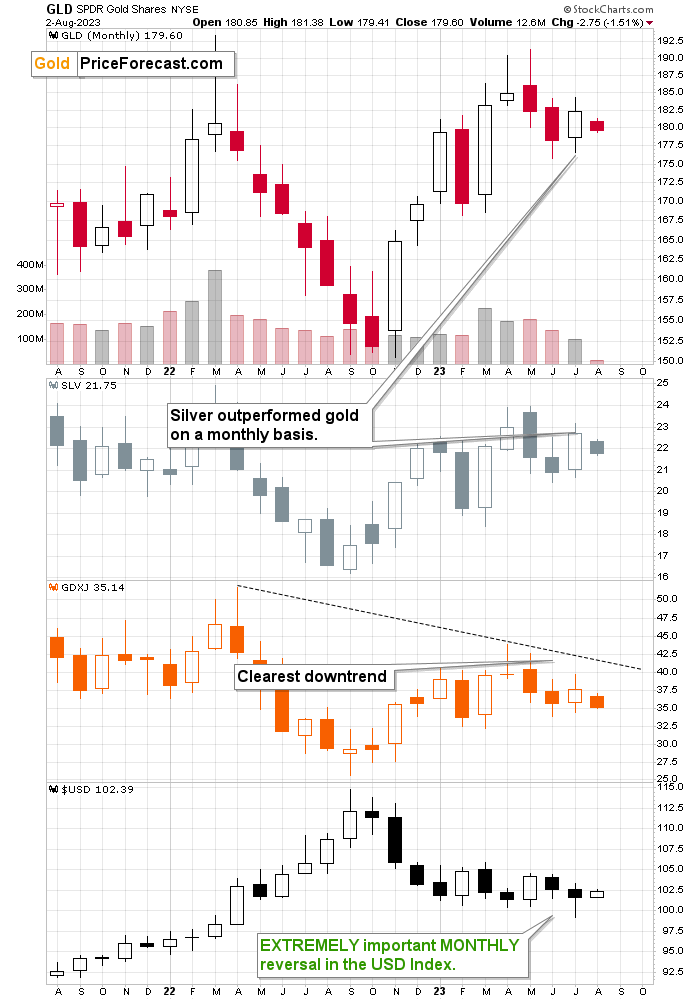

Let’s compare their performance to what happened in GLD and SLV.

The monthly perspective allows us to see the obvious even better.

Silver is above its June close. Gold is above its June close. But not the GDXJ.

The GDXJ is already below its June close – and this is the case even though the USD Index is not back above its June close.

That’s why we’re not shorting gold, nor are we shorting silver. But we are shorting junior mining stocks – no matter how you look, the bearish confirmations pop-up like mushrooms after heavy rain.

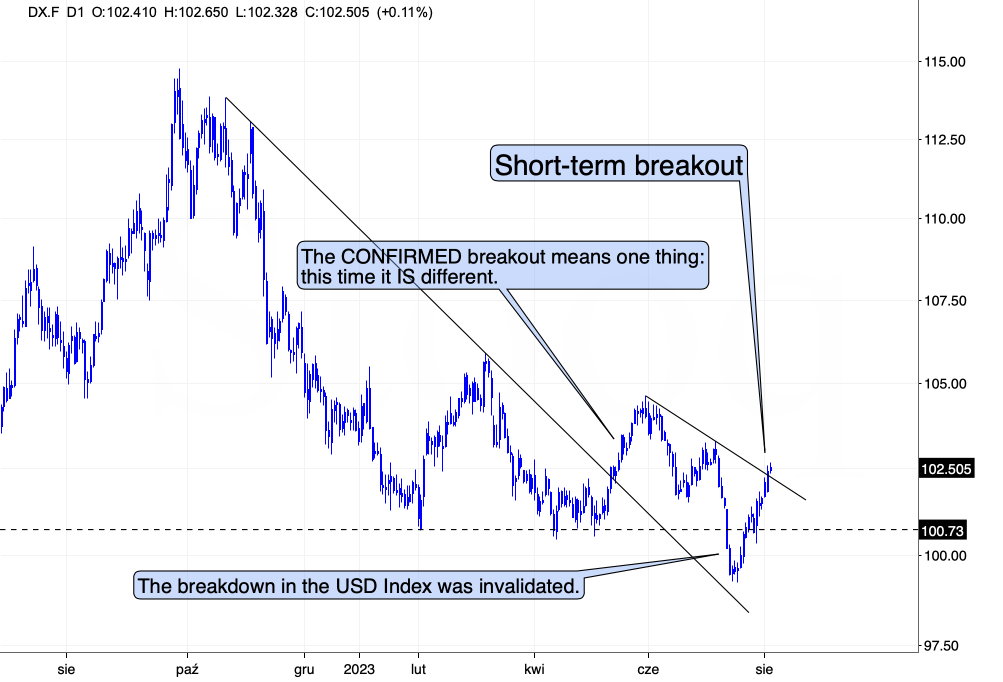

Oh, and speaking of confirmations, did you see what the USD Index just do?

It just jumped above its declining short-term resistance line. This means that we could get a tiny breather here, but it is a powerful bullish sign.

Even though the USDX is after a sizable short-term rally, it didn’t reverse when this line was reached. No. The USD Index moved through it like a hot knife through butter.

Implications? More rallies ahead for the U.S. currency.

And, yes, you guessed correctly, this implies lower precious metals prices. And yes, in particular junior mining stocks are likely to decline truly profoundly. In fact, if you look at the charts that I provided today prove that miners just can’t wait to slide even more.

This, in turn, means that the huge profits that we recently reaped in the FCX recently are likely to be joined by massive profits from the current short positions in the junior mining stocks and in the FCX. Stay tuned!

On an administrative note, the next big, flagship analysis is going to be posted on Tuesday and I’m planning something special for next Friday. As far as tomorrow (Friday, Aug. 4) is concerned, there will be no regular Gold Trading Alert (I’m traveling), but if something major happens, I’ll send out a quick intraday Gold Trading Alert (so, you’ll be informed).

Finally, since sliding GDXJ prices is such a great piece of news, here’s… Even more great news! We’re opening the possibility to extent your subscription for up to three years (at least by one year) with a 20% discount from the current prices.

Locking in those is a great idea not only because it’s perfect time to be ready for what’s next in the precious metals market, but also because the inflation might persist longer than expected and prices of everything (including our subscriptions) are going to go up in the future as well. Please reach out to our support – they will be happy to assist you and make sure that your subscription days are properly extended at those promotional terms. So, for how many years would you like to lock-in your subscription? Also, this might be a good time to also get interested in consultation or RMP profile – the 20% discount applies here as well.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

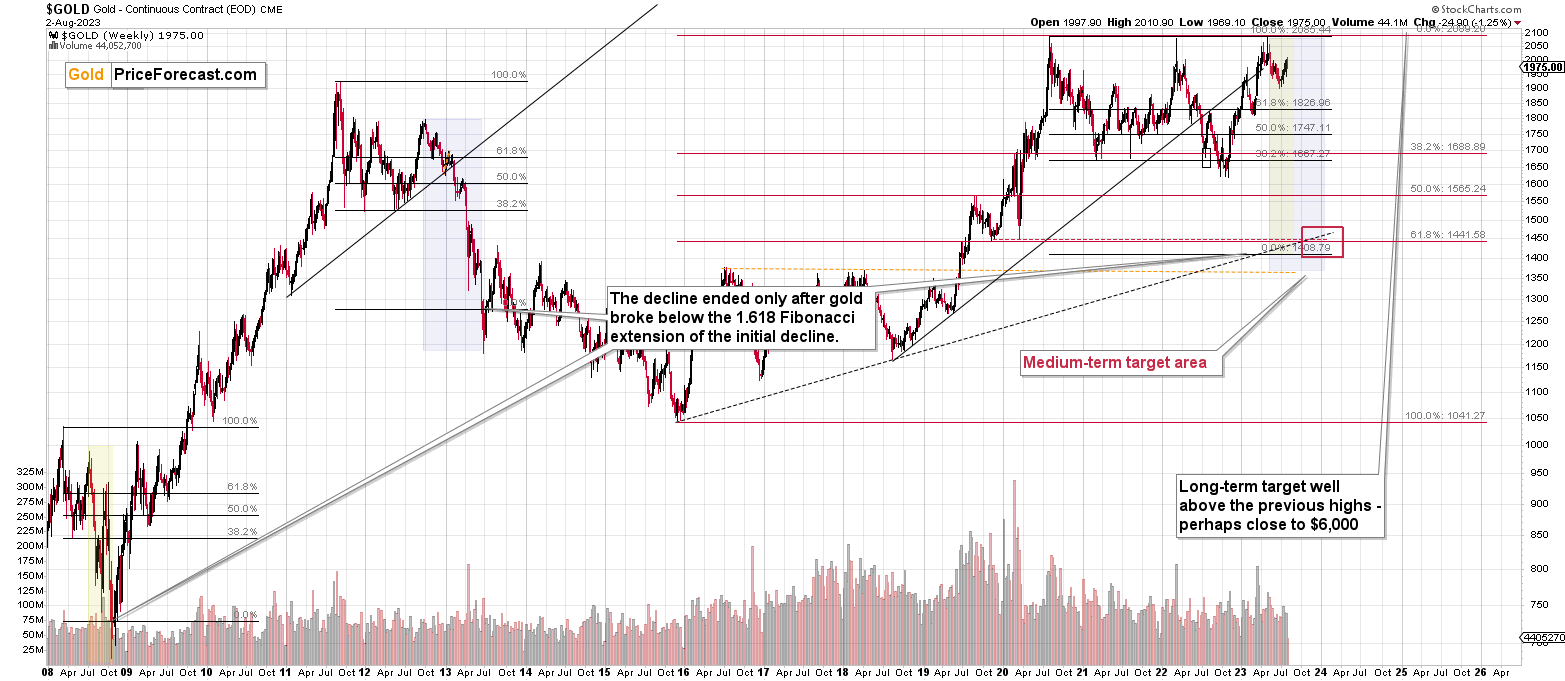

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term trend in the precious metals sector remains down, and it seems that the next short-term downswing is already underway. In mid-July, we saw major reversals and the following decline in precious metals and miners took place exactly as it was supposed to.

The Aug. 2 slide confirmed the bearish picture and it makes the following slides even more likely.

We might see an opportunity to take profits from the current short position in the GDXJ (and perhaps go long) if it moves below $33 after a quick downswing or at lower levels – but it’s too early to say for sure at this moment.

While I can’t promise any kind of return (nobody can), in my opinion, the recent profitable position in the FCX will soon be joined by even more profits from the current positions in GDXJ and FCX, and the winning streak of trades that started in early 2022 (so far 8 trades in a row), will continue.

If I didn’t have a short position in junior mining stocks, I would be entering it now.

As always, we'll keep you – our subscribers – informed.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief