Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week’s Gold Investment Update.

Gold is trying so hard to move above $2,000… The dramatic attempt gets many heads turning, but… It doesn’t look good.

It doesn’t look good because gold is pretty much the only part of the precious metals market that’s been moving much higher recently. $2,000 is slightly above gold’s 2011 high… In nominal terms. In real terms, gold is not even close to its 2011 high despite the wars in Europe and the Middle East.

Silver is not even half as expensive as it was at its 2011 top. And mining stocks? Ridiculously weak. They are not only below their 2011 and 2008 highs. They are below their… 2004 high! In nominal terms! That’s how weak they really are.

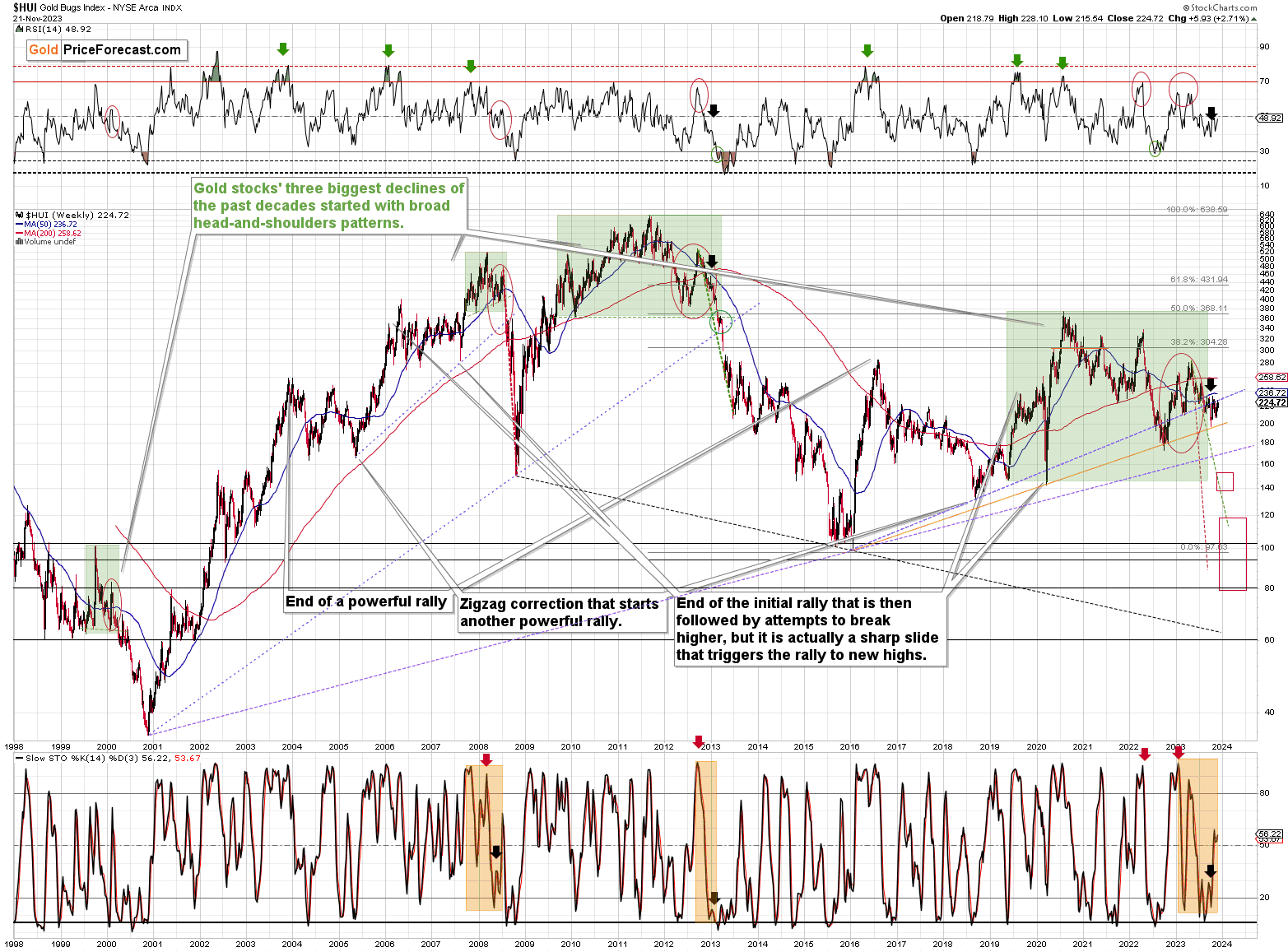

Does the above chart feature a huge rally? No, it looks like a huge correction after a huge decline.

The green area that ended the rally that started in 2008 is similar to the green area that we see now, that likely ends the rally that started in early 2016.

Back in 2013, gold stocks were similarly weak. And then they plunged in a spectacular manner – even without big help from stocks. When they did get that bearish push from stocks – in 2008 – their decline was truly gargantuan.

The above HUI Index (a proxy for gold stocks) chart can help to put the recent price moves into proper perspective.

And… What happened recently?

Pretty much nothing. The HUI Index is consolidating after the breakdown below the rising purple support line based on the 2016 and 2018 bottoms. This line stopped the 2020, 2022, and the previous 2023 declines. Given those invalidations, the lack of invalidation right now – given gold’s move above $2,000 can be viewed as a sign that this time is already different.

And you know what happened in 2008 and 2013 after analogous breakdowns? That’s right, gold stocks declined in a profound manner.

Of course, if one focuses on just the day-to-day price swings, it’s easy to forget about the really big picture that the above chart shows.

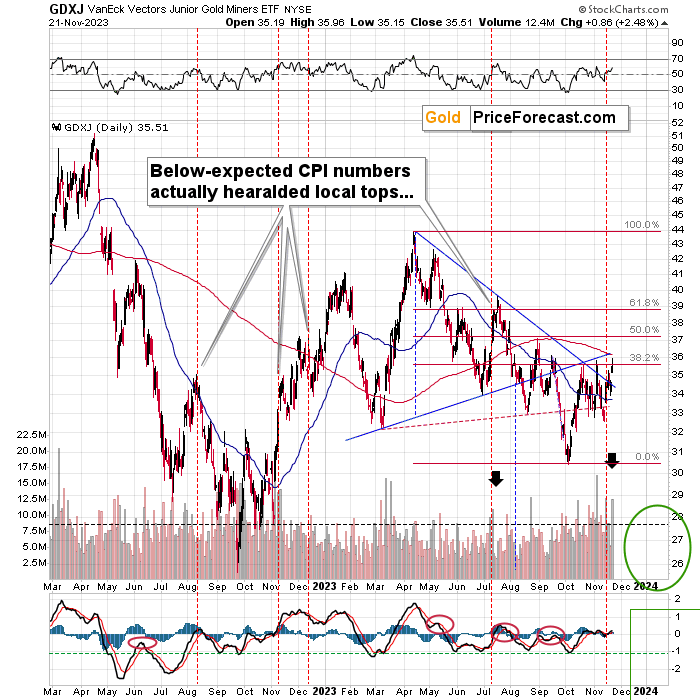

For example, yes, the GDXJ closed a little above the previous November high. What did it change? Once again – nothing. This small move above the previous high was not confirmed, and what didn’t happen is actually more important.

What didn’t happen was that the GDXJ didn’t move back above the rising blue resistance line. In other words, yesterday’s upswing was nothing more than yet another verification of the breakdown below this line!

So, it’s the case that yesterday’s rally was not only meaningless from the long-term point of view but also from the short-term point of view.

The next big move is very likely to be to the downside.

This is particularly the case since the USD Index and the S&P 500 Index continue to support this scenario.

I wrote about stocks yesterday, and everything that I wrote remains up-to-date:

Stocks soared recently. It is usually the case that people associate rallies with bullishness and declines with bearishness. Incorrectly so – bullish and bearish are terms that are about the future and forecasts, whereas a rally or a decline are terms that refer to the past – something that already happened.

Does the fact that a price moved higher make it likely to go higher in the future? No.

In fact, a price can’t form a top, without a prior rally.

What does matter is an entire set if indications and context in which a given rally or a decline took place.

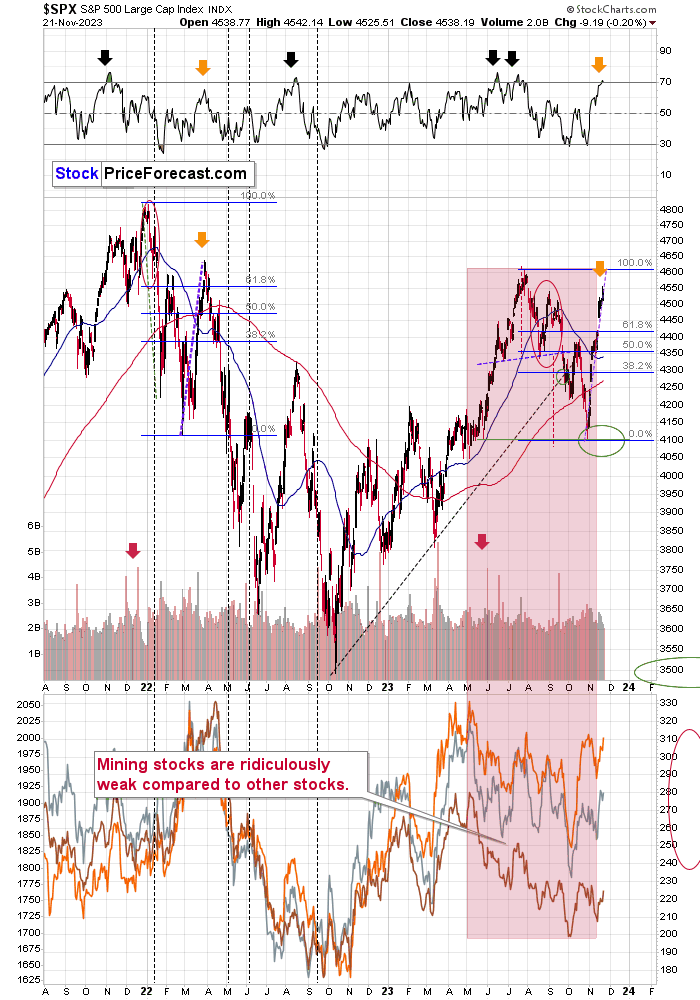

In the current situation, the rally in stocks is very much aligned with the same kind of action that we saw in early 2022, which also took place right after the concern about the military conflict peaked. Both rallies were sharp. In fact, they are almost identical in terms of sharpness. I marked the 2022 rally with a purple, dashed line, and I copied it into the current situation. It turns out that the moves are extremely similar.

In relative terms, the current move up is bigger, but in absolute terms, the current move is smaller. It’s a tough call to say which analogy is more important, so overall, we can say that it seems that stocks have either rallied as much (approximately) as they did in 2022, or they are about to top.

Interestingly, if the 2022 rally is repeated to the letter, the S&P 500 Index would be likely to top at its previous 2023 top. Either way, the top seems to be either in or at hand.

And you know what happened to the prices of mining stocks when stocks rallied back close to their yearly highs?

Almost nothing.

Mining stocks almost completely ignored stocks’ rally! This is particularly visible when you focus on the shaded area. At the same time stocks rallied substantially, while miners plunged.

This extreme weakness is a bearish sign for the miners on their own, but it’s also a sign that when stocks finally do decline (again, any day now), then miners are likely to magnify those declines and decline in a truly profound manner.

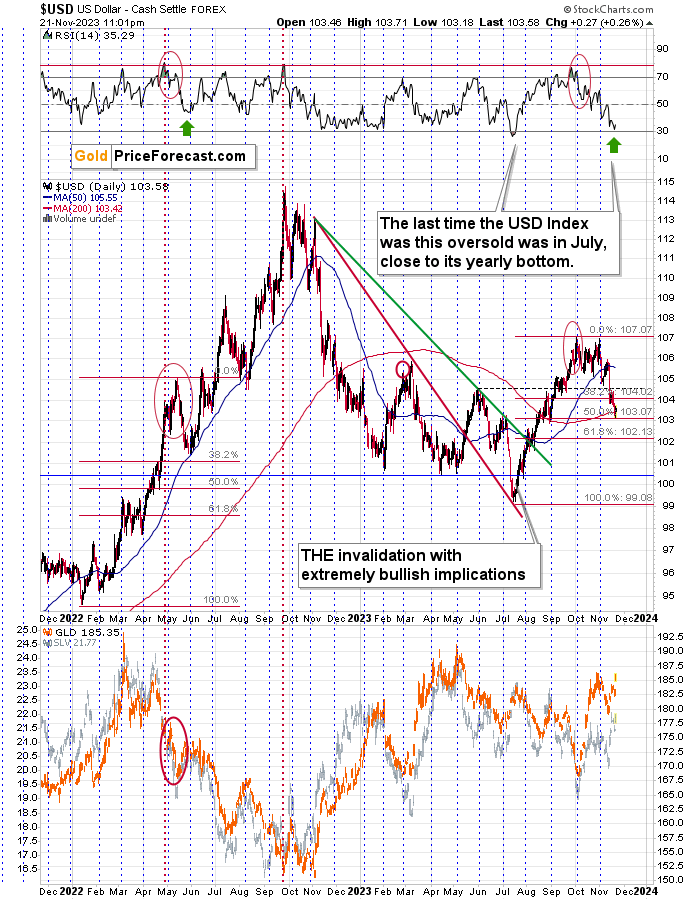

The situation in the USD Index is also just as I described previously:

The USD Index is currently almost as oversold as it was at its 2023 bottom, suggesting that a reversal is coming. Remember – when everyone gets to one side of the boat, its usually good to be on the other side.

The RSI indicator based on the USDX was just very close to 30, which can be viewed as a buy signal already, as those levels triggered rebounds in the past as well – the USDX didn’t have to move low enough for the RSI to move to 30 or below it. It was enough if it was near 30.

Plus, the fact that the USD Index bounced after moving to its 50% Fibonacci retracement level makes a rally from here even more likely.

Consequently, the pause in the mining stocks that we saw recently is likely to be over sooner rather than later, and the big, medium-term decline is likely to resume.

= = =

If you’d like to become a partner/investor in Golden Meadow, you’ll find more details in the above link.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

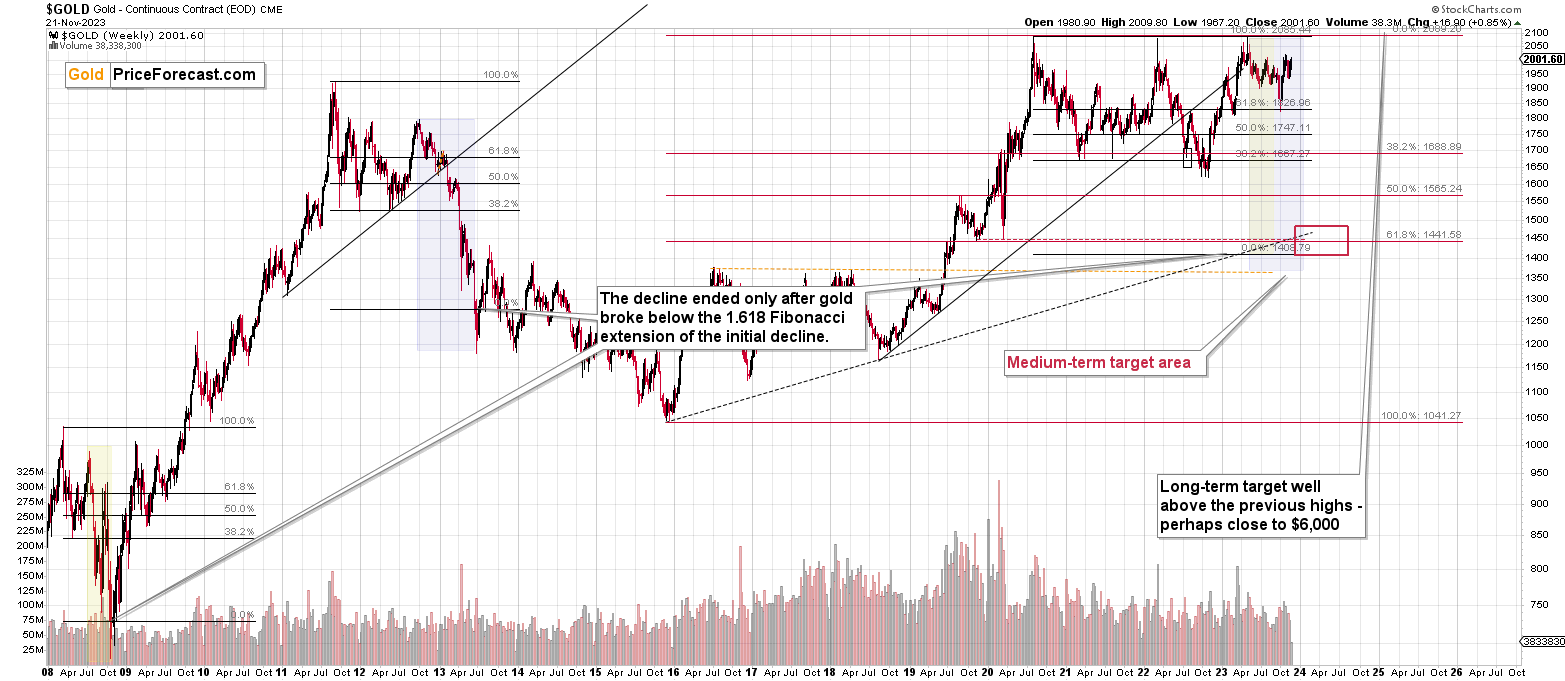

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community) so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term trend in the precious metals sector remains clearly down and given that the fear has most likely peaked, and the current technical indications point to lower precious metals prices, it seems that we won’t have to wait for much lower prices for long. The same goes for the FCX stock price.

===

On an administrative note, as the long Thanksgiving weekend begins tomorrow and the trading is going to be absent or limited, we’re going to post the next regular Gold Trading Alert on Monday, Nov. 27. In other words, there will be no regular Alerts on Thursday and on Friday. If, however, things get hot on the market or the outlook changes, I’ll send you a quick intraday Alert, anyway. In other words, you’ll stay up-to-date.

I wish you all happy Thanksgiving and may this break from markets serve as a great opportunity to connect with your loved ones and to focus on what you’ve been blessed with this month, this year, and in your entire life.

===

Please keep in mind that the possibility of extending your subscription for up to three years (at least by one year) with a 20% discount from the current prices is still open.

Locking in those is a great idea not only because it’s the perfect time to be ready for what’s next in the precious metals market but also because the inflation might persist longer than expected, and prices of everything (including our subscriptions) are going to go up in the future as well. Please reach out to our support – they will be happy to assist you and make sure that your subscription days are properly extended at those promotional terms. So, for how many years would you like to lock-in your subscription?

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief