Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Introduction

Another day and another drawdown for the PMs. Gold retreated by 0.36%, silver by 0.53%, the GDX ETF by 1.35%, and the GDXJ ETF by 1.35%. And with the USD Index and the U.S. 10-Year Treasury yield continuing their ascents, the technicals and fundamentals remain aligned.

As such, our roadmap is intact, and we’re approaching the point where a long position could be justified from a risk-reward perspective.

Gold Yields to the Pressure

It’s been an unceremonious start to August for gold, as higher interest rates and a resurgent USD Index have put the yellow metal in a precarious position. Moreover, with the GDXJ ETF hitting another new monthly low, the profits from our short position remain abundant.

Please see below:

To explain, the gold line above tracks the GDXJ ETF, while the black line above tracks the iShares 20+ Year Treasury Bond (TLT) ETF. And while it may seem like a broken record, the pair continue to move in the same direction.

Furthermore, while we warned for many months that long-term interest rates were too low to elicit the demand destruction necessary to eradicate inflation, a new 2023 low for TLT on Aug. 16 validates our fundamental thesis.

Consequently, while silver is another casualty of the rate surge, we’re likely approaching a cooling-off period where a GDXJ ETF long position is warranted.

In the meantime, the FOMC released the minutes from its Jul. 25-26 monetary policy meeting on Aug. 16. An excerpt read:

“With inflation still well above the Committee's longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.

The report added:

“The staff continued to judge that the risks to the baseline projection for real activity were tilted to the downside. Risks to the staff's baseline inflation forecast were seen as skewed to the upside, given the possibility that inflation dynamics would prove to be more persistent than expected or that further adverse shocks to supply conditions might occur.”

Thus, while we warned on numerous occasions that higher interest rates are only the first part of our bearish fundamental thesis, the second act is also unfolding as expected. For example, with inflation risks “skewed to the upside,” Fed officials realize that more hawkish policy is needed to rebalance supply and demand.

Yet, this means working harder to slow the real economy, increasing the recession probability. In other words, while we’ve been consistent in our expectations throughout 2021 and 2022, we think there is roughly an 85% chance the U.S. will realize a recession before this cycle ends.

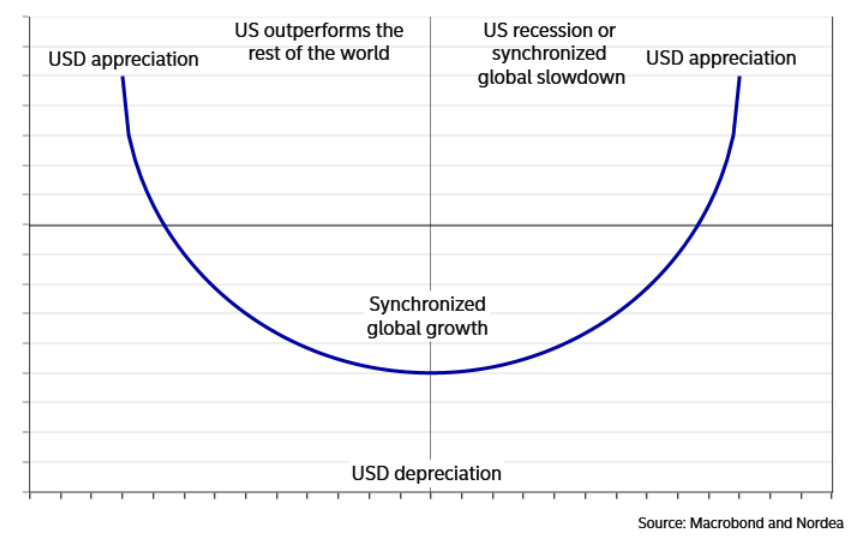

More importantly, the above cocktail is bullish for the USD Index. To explain, we wrote on Oct. 6, 2021:

The USD Index’s fundamental strength is underwritten by the ‘dollar smile.’ When the U.S. economy is trudging along, the U.S. dollar tends to underperform. However, when the U.S. economy craters and a safe-haven bid emerges, the U.S. dollar often outperforms. Conversely (and similarly), when the U.S. economy is booming and higher interest rates materialize, the U.S. dollar also outperforms.

Please see below:

Therefore, our bullish dollar thesis has been driven by the left side of the smile. With the U.S. economy outperforming the Eurozone and Japan (the largest weights in the USD Index), the stage was set for a hawkish Fed to boost the greenback.

But, if (when) a recession sparks a panic bid for the dollar, the right side of the smile should weigh heavily on the gold price in the months ahead.

Taking note, the crude oil price has pulled back in recent days as traders realize that higher long-term interest rates suppress, not enhance, economic activity. And as long-term rates weigh on the real economy, there is a greater chance of an ‘uh oh’ event occurring.

An Unhealthy Home

U.S. building permits and housing starts outperformed expectations (mostly) on Aug. 16.

Please see below:

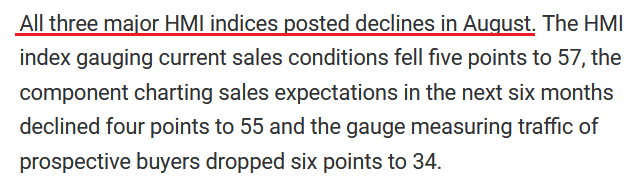

However, this data is from July and does not reflect the recent rate rise. A more accurate reflection was depicted by The National Association of Home Builders (NAHB) on Aug. 15. Its Housing Market Index (HMI) report stated:

“The August HMI survey also revealed that rising mortgage rates are causing more builders to use sales incentives to attract home buyers. After dropping steadily for four months (from 31% in March to 22% in July), the share of builders cutting prices to bolster sales rose again to 25% in August.

“The average decline for builders reducing prices remained at 6%. And the share of builders using incentives to bolster sales was 55% in August, higher than in July (52%) but still lower than in December 2022 (62%).”

As such, while it may not be noticeable on the surface, higher long-term interest rates are already making their presence felt in the real economy. And as this continues, volatility should rise, and that’s bullish for the U.S. dollar and bearish for the PMs.

Overall, the technicals and the fundamentals have proven their might once again, as our expectations for the PMs have come to fruition. And with more S&P 500 downside likely before our GDXJ target is reached, we foresee more profits on the short side before a bullish short-term trading opportunity presents itself. Consequently, we hope to generate even greater returns for our subscribers in the months ahead.

How high do you think the USD Index can rise if a recession hits?

Silver Swoons Yet Again

Silver suffered another daily drawdown on Aug. 16 as a sputtering gold price depresses sentiment across the precious metals sector. And with the GDXJ ETF one of the largest underperformers, our short position continues to produce healthy gains.

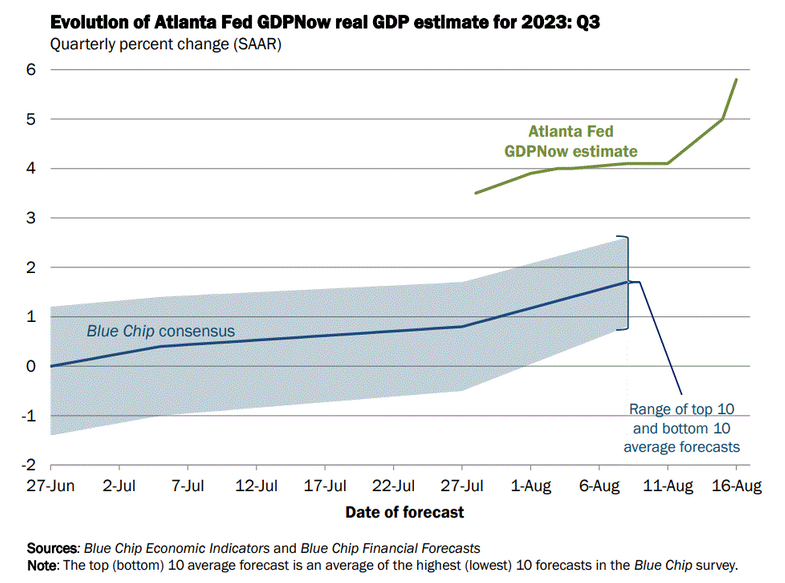

Furthermore, while we warned for many months that U.S. consumers were flush with cash and their ability to spend would keep the pressure on the Fed, economic resiliency means that we’re nowhere near rate cuts or QE.

Please see below:

To explain, the Atlanta Fed increased its Q3 GDPNow estimate (the green line) again on Aug. 16. The official release read:

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 5.8% on August 16, up from 5.0% on August 15.

“After this morning's housing starts report from the U.S Census Bureau and industrial production report from the Federal Reserve Board of Governors, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth increased from 4.4% and 8.8% respectively, to 4.8% and 11.4%.”

Thus, with more hot data putting upward pressure on interest rates, silver is caught in the bearish crossfire, and we warned these issues would persist. Similarly, please note that the S&P 500 and the silver futures price made their lows alongside one another in September/October 2022. As a result, if overvalued stocks suffer a material correction, the silver price should feel the pain.

S&P’s 500 Problems

The S&P 500 is approaching a 5% correction as higher rates reduce its attractiveness. Remember, when less risky assets like Treasury bonds offer higher interest rates, stock dividends lose their appeal, and valuation multiples become more securitized. In other words, why pay a premium for an asset with worse risk-adjusted prospects?

Well, this is the backdrop that confronts the S&P 500, and a sharp slide could be on the horizon.

Please see below:

To explain, the green line above tracks the S&P 500, while the red line above tracks the iShares iBoxx $ High Yield Corporate Bond (HYG) ETF. For context, high-yield bonds are very similar to stocks because they’re only one notch above them in the capital structure and rarely recoup any value during bankruptcies.

If you analyze the relationship, you can see that the pair largely moved in lockstep from the end of 2021 to the end of 2022. But, with a major divergence present on the right side of the chart, HYG’s underperformance highlights how high-yield bond investors do not share the same enthusiasm about corporations’ future earnings/solvency prospects. Therefore, the S&P 500 remains in la-la land, and a material sell-off would boost the outlook for the USD Index.

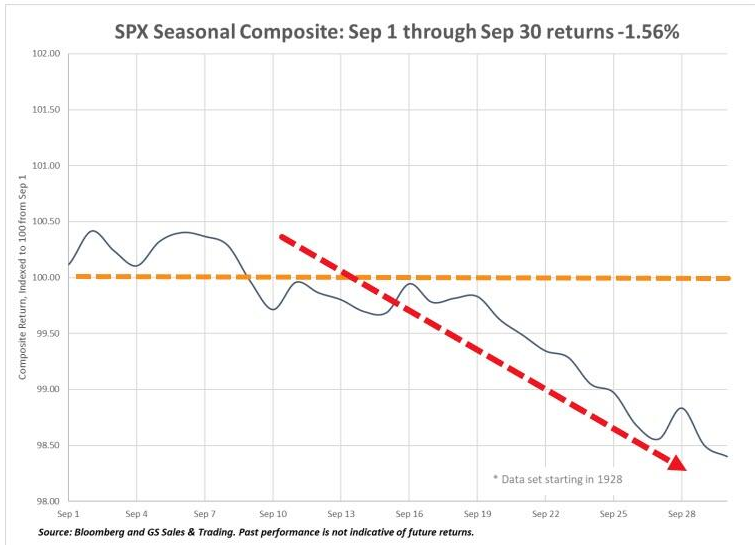

Speaking of which, seasonality has been an important factor driving S&P 500 returns. Yet, with September often a boon for the bears, the index’s median performance is the worst of any month dating back to 1928.

Please see below:

To explain, the blue line above shows the S&P 500 often makes lower lows throughout the month before bottoming at the end of September. So, if the seasonal data proves prescient, lower stock prices should help the GDXJ ETF reach our take-profit level on the short side.

Overall, oil prices have come down as thoughtful investors realize that higher long-term interest rates should darken the economic data in the months ahead. And with gold, silver and mining stocks partaking in the suffering, the profits from our short position have grown. Although, we plan to flip bullish in the not-so-distant future, as oversold conditions should give way to a tactical rally.

Where do you think silver will find a short-term bottom?

The Bottom Line

Hawkish data continues to elicit hawkish responses as the bond bulls run for cover. Moreover, we warned this would occur, as the recession crowd missed the forest through the trees. But, the more long-term interest rates rise, the greater the chance of an economic climax. And if you remember, back to 2020, TLT soared while the GDXJ ETF crashed. As a result, if (when) interest rates drop dramatically, the junior miners’ should have plenty of room to fall before they reach their long-term lows.

In conclusion, the PMs declined on Aug. 16, as Treasury yields and the USD Index battered the bulls once again. However, asset prices do not move in a straight line, and although we expect the GDXJ ETF to end this cycle at much lower levels, it may be wise to play for a bounce in the days/weeks ahead.

The above ends today’s analysis, at least its part dedicated to markets. The following is – once again - info about the inaugural RISE session and the direction in which this is all going. If you have already read it, feel free to skip it – I simply want to make sure that everyone has a chance to read it because the effects were so profound. (I’m going to keep quoting this text until the end of this week).

===

In short, the first Regain Inner Strength Experience session was a tremendous success. Before the key part of the session, I asked the participants about their overall wellbeing on a scale from 1 to 10 and the average was 6.1. I asked the same question after the key part of the session (about 30 minutes later), and it jumped to 8.1.

As far as I know, nobody’s financial status or anything else in their lives changed during those 40 minutes, and yet, due to the internal process that they went through, people were able to substantially increase their wellbeing. People moved from where they were halfway to the max! In 40 minutes! If that’s not how a spectacular success looks like, I don’t know what it would be.

Before the session, I had my own expectations regarding the session; and I considered a move up by one point on that scale to be a success. We got twice as much.

And it actually gets even better!

I asked for more detailed feedback at the end of the session, and it turned out that there was only one person, whose wellbeing decreased from 10 to 8, but it came with an extra info: “the experience is still growing in me”, which is actually perfect. After some reflection, this person could move “beyond 10” thanks to insights that they will get. If we take the above into account, the real increase in wellbeing would be even greater! One final number – the record increase in wellbeing was from 4 to 9.

One of the questions in the survey was what people appreciated the most about the session, and here are some of the replies (I’m putting in bold the parts that I find key and that I particularly like):

- That it worked

- that it helps how to find more certainty and solution to my issues by myself

- I liked PR’s hands-on approach. No wasting time with anything. This tells me that I need more of these exercises, but rarely someone provides them, let alone for free. I imagine myself doing an exercise in the morning as well.

- informative

- Move forward. The experience is still growing in me

- Direct and insightful

- Your presentation is very honest and right from your heart.

- Practical meditation

You can watch the recording over here (in the description of the event), you can watch it also below (but please use the above link if for whatever reason the embed video function doesn’t work), and you can sign up for the RISE #2 session over here (Aug. 22 – 11 AM EST / 5 PM CET).

Now, while I’m experienced in working 1-on-1 during the Mastering Multidimensional Wealth | 1:1 Coaching Experience and Reiss Motivational Profile® sessions, facilitating an online session was something new for me, and I didn’t manage to do everything that I had planned even though I added extra 30 minutes to the hourly session.

Next time, I will plan it better, and I will introduce the key exercise in a separate video.

To make watching the recording easier and more pleasant for you here’s the breakdown:

- 0:00 – 17:15 – welcoming participants, and introducing myself

- 17:15 – 36:40 – theory behind the transformation exercise

- 36:40 – 59:21 – the transformation exercise along with the extra intro

- 59:21 – 1:20:35 – summarizing the exercise; survey

- 1:20:35 – 1:28:55 – final quick exercise regarding sharing positive wishes (plus a surprise in the second half of the exercise, which I don’t want to spoil; check it out) and the ending

Using the YT link might be most convenient as it then automatically takes you to the right part of the video (just click “more” on YT, to expand video’s description and then you’ll see the breakdown of chapters).

If you’re short on time and you trust the process (there’s a lot of science behind it and as you can see above, I talked about it for quite some time) you can skip the intros and move right to the transformation exercise.

===

One person in the feedback form wrote (in addition to writing that they found the session to be helpful) that they are wondering what is the ultimate goal of these sessions. In case you’re also wondering, here’s a (long, but probably worth reading) reply:

The increase in wellbeing that you saw in the session IS the ultimate goal of these sessions. This assists people in breaking out of the loss-stress cycle regardless of whose analyses their follow, because ultimately everyone will lose money at some point or will be holding on to a position that’s in the red for some time, before it becomes profitable. And that’s not pleasant. In the loss-stress cycle, the above causes stress (and all sorts of unpleasant emotions: fear, anxiety, shame, guilt, sadness, anger, frustration are the most common), which in turn makes it more difficult for one to remain objective about the situation, and they take worse investment decisions next time, perhaps making emotional decisions to increase their positions / leverage, or to drop those positions entirely. The irony here is that many tend to drop the positions right before the situation turns around and they become profitable, because it is at the price extremes that emotions are at their highest.

And as people make those less-objective decisions, the chances for more losses increase. Which increases stress, which decreases profits, which causes stress, and so on. Capital, health, and wellbeing in general all are negatively impacted.

What is the default way in which people can try to self-regulate? Some people will engage in sport activities, meditate, engage in their non-market hobbies etc., but some will want to vent their frustration publicly. While this is understandable, it’s also harmful for others, because some of those “other” might have been on the verge of panic, and they wouldn’t have panicked if left alone, but when they see someone else panicking or venting, they will probably be pushed to react in the same way, thus exacerbating the stress-loss cycle.

Now, I’m doing my best with my analytical part, but I can only do so much – I’m human after all, and neither I nor anyone else can be reasonably expected to pick all the tops and all the bottoms (I did pick the 2020 bottom, though). So, I’ve been thinking if there’s something else that I can do for you in the one-to-many arrangement, where I can assist multiple people at the same time. I’ve been thinking about it for a long time, and I finally realized that if I can make people break out of the stress-loss cycle (whether they are following my analyses or someone else’s analyses) then this will be the ultimate game-changer. The true success always comes within, anyway.

Also, I have a deep conviction that we’re living in times that are so difficult on many fronts, but in particular relating to mental health (and I don’t mean illnesses, but being on top of the mental game – happy, relaxed, and fulfilled) that the basics, or at least a large part of them should be available either for free or at a price that’s affordable for everyone. With 1-on-1 services it’s different, because it fully engages the provider and makes them unavailable to do anything else.

I’ve been collecting insights from various sources (believe me, what’s in RISE is the tip of the tip of the iceberg of what I learned and tested in the previous years) and in cooperation with the Stanford School of Medicine (and others), I came up with the idea to provide the Regain Inner Strength Experience sessions for free, and also to provide a course with key insights and exercises for next to nothing (probably $5 per month). This course, entitled “From Fear to Fortune” is currently in the making. This way, everyone will be able to enjoy their lives more, make more money on their trades, and make Golden Meadow a better, more supportive platform – everybody wins.

All this will also serve as an intro to many other courses (and then newsletters), some with basics of finance and investing, some aimed at more advanced areas in finance and wellbeing (you’d be surprised how much can be done with just breath – and yet very few people discuss that). We’ll greatly expand investment and financial scope of what’s available but also on the front where those “other” important things are – like communication, relationships, memory, preventing neurodegenerative diseases, increasing life quality in general, and many more.

Like I said, I experienced quite a lot (I’m working in the markets, I’m a CEO and I dedicate less than 1h total per week to workouts and yet when doctors look at my bloodwork, they ask if I’m a professional athlete – how? Research and efficiency in what I’m doing – it’s all connected), and it’s really surprising to me how underutilized the synergy between the finance, wellbeing and self-development has been up to this point.

So, the long answer to the question is that this is leading to increased wellbeing of everyone, who participates, increased profitability (of course, no guarantees, but you know very well how one thing leads to the other), and building a platform that will allow for enormous scaling of this effect. To make the world a better place and become happier and wealthier while doing so.

Also, while I’m at it, I’d like to mention two things:

- I re-introduced my 1-on-1 service, because it was previously described in a manner that didn’t really emphasize what it is that I can do. The new and up-to-date name of the service is Mastering Multidimensional Wealth | 1:1 Coaching Experience . I have only 4 seats available, because I assume that this will be an ongoing weekly experience for those, who enter into this engagement. That’s where the biggest benefits can be reaped. However, it might be best to start with 30 minutes at first to just get to know me in this sort of work (it’s priced at a fraction of the regular session’s value), and we’ll both see if we’re a good match. If so, I’ll likely have some ideas for you even during those 30 minutes, and you’ll see if my approach makes sense for you, and whether you want to go into a longer engagement – where a true transformation can (and likely would) happen. If you feel that this is something that could be helpful to you at this stage of your life, you can book your seat here.

- The above has only 4 seats available even though there are 5 workdays in a week (I plan to have one of those sessions per day), because the fifth session will be reserved for someone, who will have a priority due to the specific nature of the cooperation. Namely, I would like to enter into a partnership with someone (just one person) – a visionary investor who seeks to leave a profound mark on the world, and I plan to use all my insights to make sure that this person’s wellbeing will increase as much as possible thanks to our cooperation.

I can and will do all the above work related to Golden Meadow, anyway, but a partnership would speed things up substantially. I described what my plan and motivation are, and if you share my passion and are moved by the work that I’m undertaking, please consider this a call to action.

I’d like to welcome a strategic investment of $1M from a single individual who is not only driven by financial potential but also by the profound impact that can be achieved. It isn't just an investment in numbers, but an investment in a vision that encompasses collective well-being. By partnering with me, you'd not only be enriching your financial journey, but also contributing to the betterment of the world.

If you resonate with the deep resonance of this vision and want to explore the extraordinary potential that this investment partnership offers, please reach out today. Also, I’ll be in California in about a month, and I’ll be happy to meet to discuss the vision for the company with this person. This is your chance to ignite transformation not only within your wealth portfolio but on a global scale. Let’s start a conversation that has the power to shape not just your future, but the world's.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

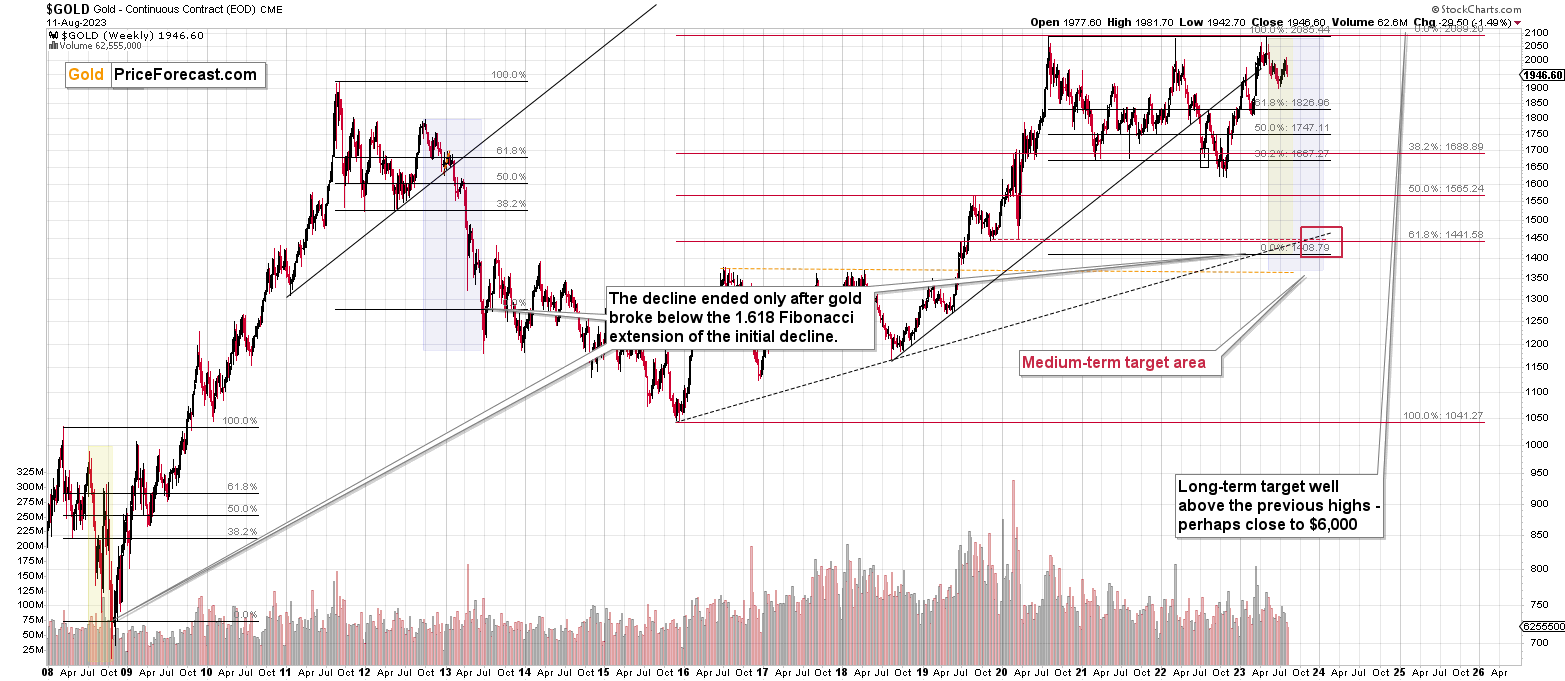

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term outlook for the precious metals sector (and for the FCX) remains to be extremely bearish and the profit potential for short positions in junior miners and FCX remains enormous.

While I can’t promise any kind of return (nobody can), in my opinion, the recent profitable position in the FCX will soon be joined by even more profits, and the winning streak of trades that started in early 2022, will continue.

If I didn’t have a short position in junior mining stocks, I would be entering it now.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief