Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Introduction

More volatility confronted the PMs on Aug. 17, as gold declined by 0.68%, the GDX ETF by 0.79%, and the GDXJ ETF by 0.63%. In contrast, silver advanced by 0.80%, as the white metal was a relative outperformer.

But rates continued their bullish burst, and the USD Index followed suit. Consequently, the technicals and the fundamentals remain a powerful combination, and little has changed to alter our short and medium-term expectations.

Gold’s Pain Accelerates

It was another drawdown for the gold bulls on Aug. 17, as the rapid rise in interest rates continued. And with the GDXJ ETF closing at a new monthly low, our short position produced even more profits. Although, we’re approaching a point where flipping long offers an attractive risk-reward proposition. And while we’re not quite there, you’ll be the first to know when the decision has been made.

In the meantime, the technicals and fundamentals continue to perform as expected, and our out-of-consensus thesis is now popular among the crowd. To explain, we wrote on Sep. 15, 2022:

We’ve been warning since 2021 that investors materially underestimate the inflation fight that confronts the Fed. Moreover, while consensus expectations continue to move in a hawkish direction, the medium-term economic ramifications are far from priced in.

Please see below:

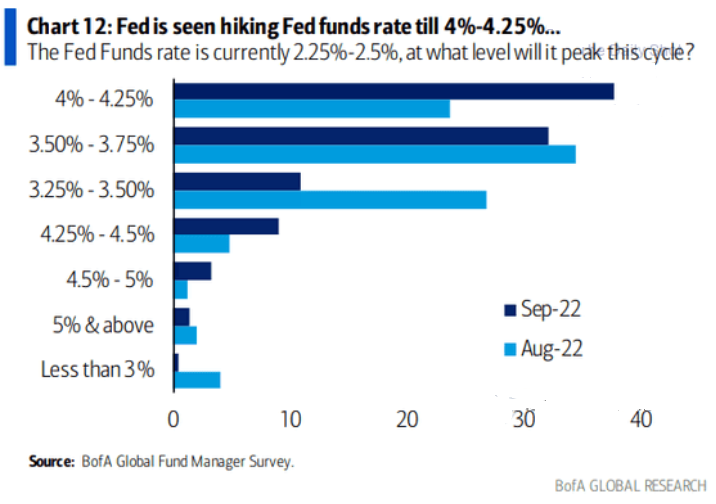

Bank of America’s latest Global Fund Manager Survey (FMS) shows that most respondents expected the U.S. federal funds rate (FFR) to peak between 3.25% and 3.75% in August (the light blue bars). Conversely, September’s results show that the top spot is now in the 4% to 4.25% range (the dark blue bar).

As a result, what a difference a month makes. Yet, while rate hike expectations have moved materially higher, notice how the 4.5% to 5% and the 5% & above rows are in the major minority? In reality, these are the most likely outcomes.

To that point, while the prediction proved prescient, fund managers are now worried about the dynamics we warned about ~12 months ago.

Please see below:

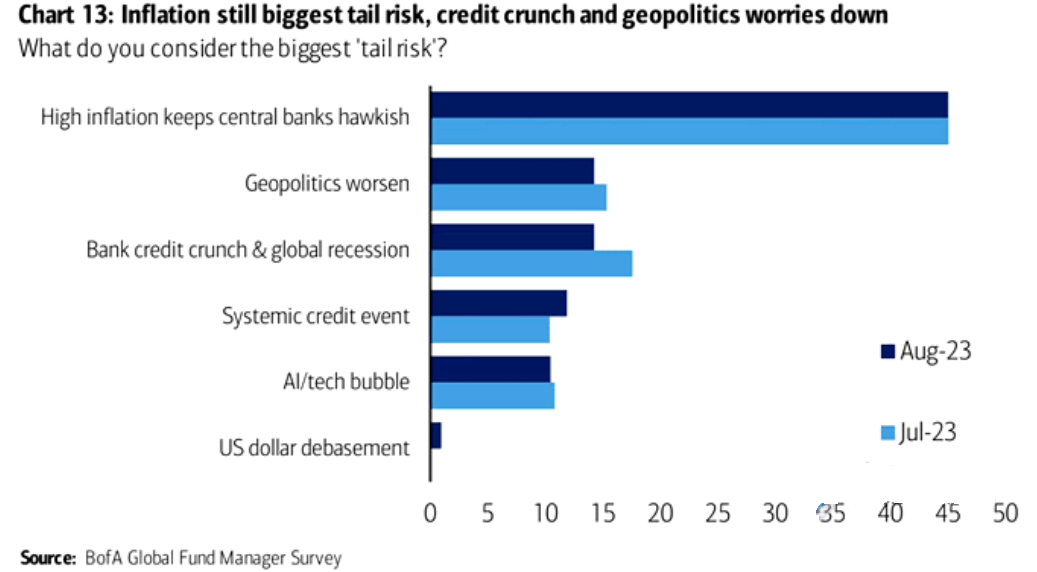

To explain, Bank of America’s latest FMS shows that money managers remain concerned that high inflation will keep central banks hawkish. And while this comes as little surprise to us, assets like mining stocks and silver should underperform in an environment where higher rates reign. Consequently, the recent re-pricings have validated our thesis, and we think a recession will be the final fundamental catalyst that ushers the PMs to their long-term lows.

Speaking of which, The Conference Board released its Leading Economic Index (LEI) on Aug. 17. And with the index declining for “the sixteenth consecutive month in July,” the underlying damage remains. As such, these issues should become material when Americans’ employment prospects and cash balances deteriorate.

Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators at The Conference Board, said:

“The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead. The Conference Board now forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan.”

Please see below:

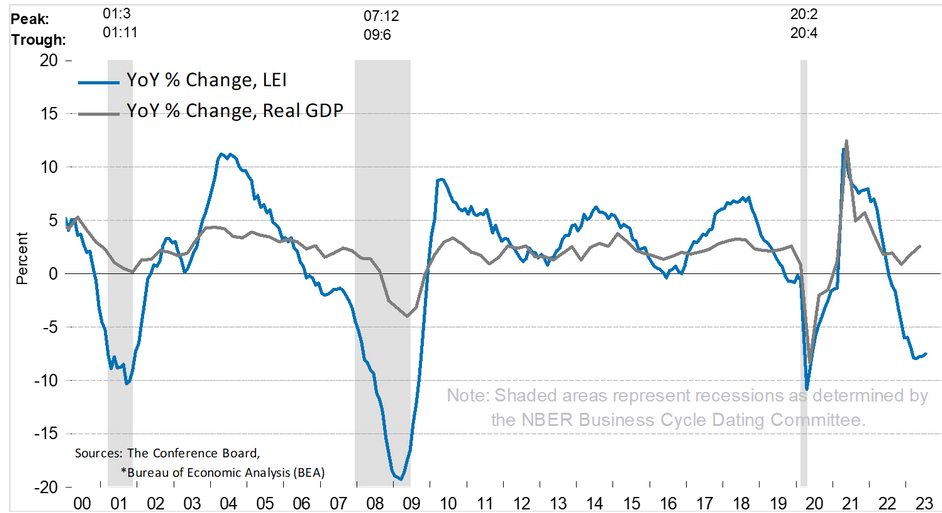

To explain, the gray line above tracks the year-over-year (YoY) percentage change in U.S. real GDP, while the blue line above tracks the YoY percentage change in The Conference Board’s LEI. If you analyze the right side of the chart, you can see that the blue line remains in recession territory, and this should have profound ramifications over the next six to 12 months.

Dollar Squeeze

The USD Index is back with a vengeance, and the dollar bears have suffered mightily over the last month. And with BofA’s FMS highlighting how bearish bets on the greenback remain, a short squeeze could provide further upside for the dollar basket.

Please see below:

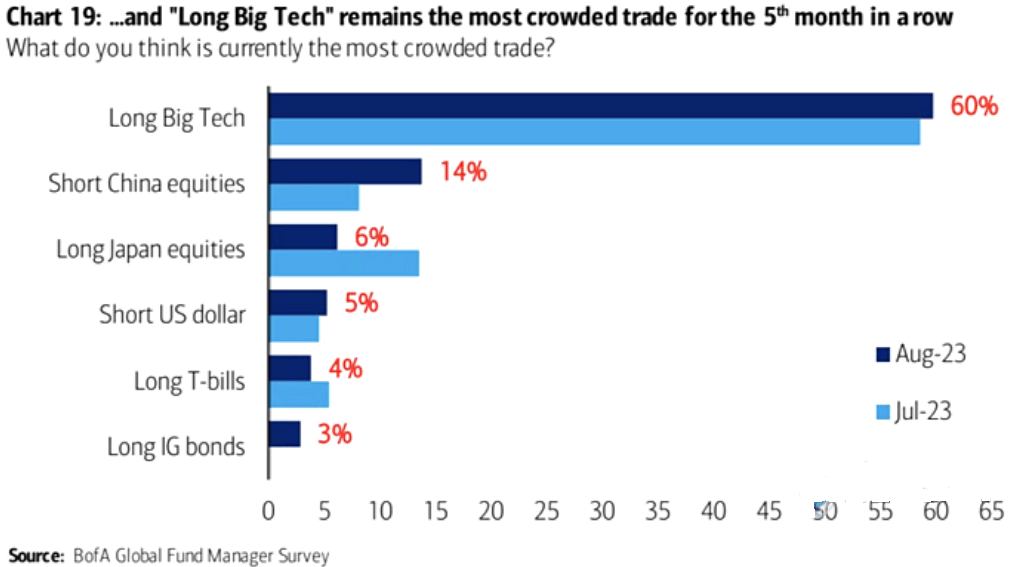

To explain, “short U.S. dollar” came in at fourth on the list of the most crowded trades. And while it’s still much lower than the top two, the dark blue bar shows that short enthusiasm increased from July to August. Therefore, if more of those bets unwind, it could provide more fuel for the USD Index to rally in the latter part of 2023.

Also, noteworthy, crude oil rose on Aug. 17 despite the selling that confronted other risk assets. Thus, even though higher rates and recession fears should hurt economically sensitive securities, oil’s strength makes the situation worse because it stokes further inflation.

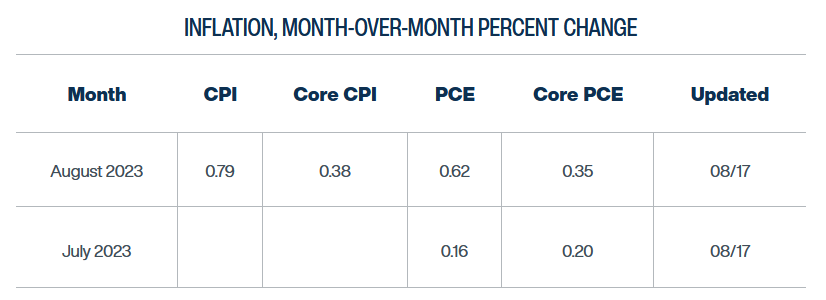

Please see below:

To explain, the Cleveland Fed expects the headline Consumer Price Index (CPI) to increase by 0.79% month-over-month (MoM) in August. For context, this annualizes to 9.90%. And while the figure is abnormally high, the important point is that MoM readings of this magnitude are not conducive to 2% annual inflation. Consequently, the strength is bullish for Fed policy, bullish for the USD Index, and bearish for the PMs.

Overall, the selling continued on Aug. 17, as the S&P 500 suffered another daily drawdown. Yet, the GDXJ ETF’s plight meant even higher returns for our short position. Moreover, while we expect the junior miners’ index to sink to much lower lows over the medium term, an opportunity to flip long is approaching. In other words, asset prices do not move in a straight line, and positioning for a bear market rally could prove immensely profitable in the days/weeks ahead.

Why were fund managers so wrong about inflation and the FFR?

Silver Showcases Relative Strength

Despite the ominous price action that plagued gold, silver ended the Aug. 17 session in the green. It was even more noteworthy since mining stocks were major casualties, which boosted the profits from our GDXJ ETF short position.

So, while we expect a short-term reversal to materialize soon (you will be notified if/when we flip long), it does not change our medium-term outlook. We still think the PMs will take out their 2022 lows, and the development should lead to long-term buying opportunities.

As evidence, we noted how this economic cycle should end with a recession. However, for it to occur, the U.S. labor market needs to weaken materially, and Americans need to spend their cash hoard. And as of right now, that has not happened.

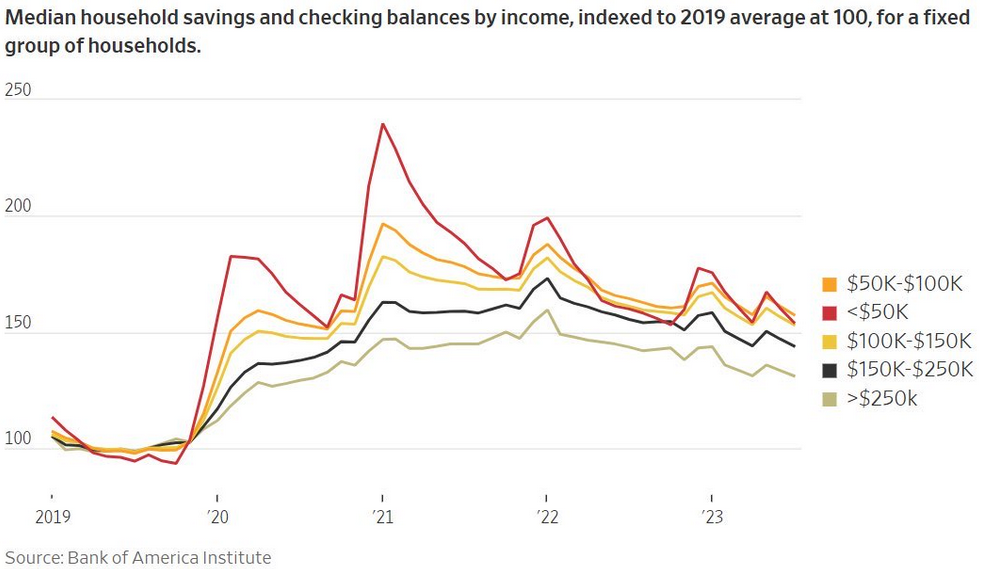

Please see below:

To explain, data from Bank of America shows that Americans’ savings and checking account balances remain above their pre-pandemic baseline. The various lines above organize the data by income, and the 100 level is the baseline for the 2019 average. If you analyze the right side of the chart, you can see that while balances have come down, all cohorts remain in relatively strong shape.

Thus, with Americans’ cash balances still too high to create an economic malaise, the higher rates/hawkish Fed/strong USD Index thesis is still the fundamental bear case for silver.

Manufacturing Musings

The Philadelphia Fed released its Manufacturing Business Outlook Survey on Aug. 17. The report stated:

“The prices paid diffusion index rose 11 points to 20.8. More than 27 percent of the firms reported increases in input prices, while 6 percent reported decreases; 66 percent reported no change. The current prices received index decreased 9 points to 14.1. More than 27 percent of the firms reported increases in the prices of their own goods, 13 percent reported decreases, and 59 percent reported no change.”

So, while the prices received index decreased, the prices paid index rose materially, which reflects the impact of higher oil prices. And while their expectations fell somewhat, Philadelphia manufacturing firms still see output prices moving well ahead of the Fed’s 2% goal.

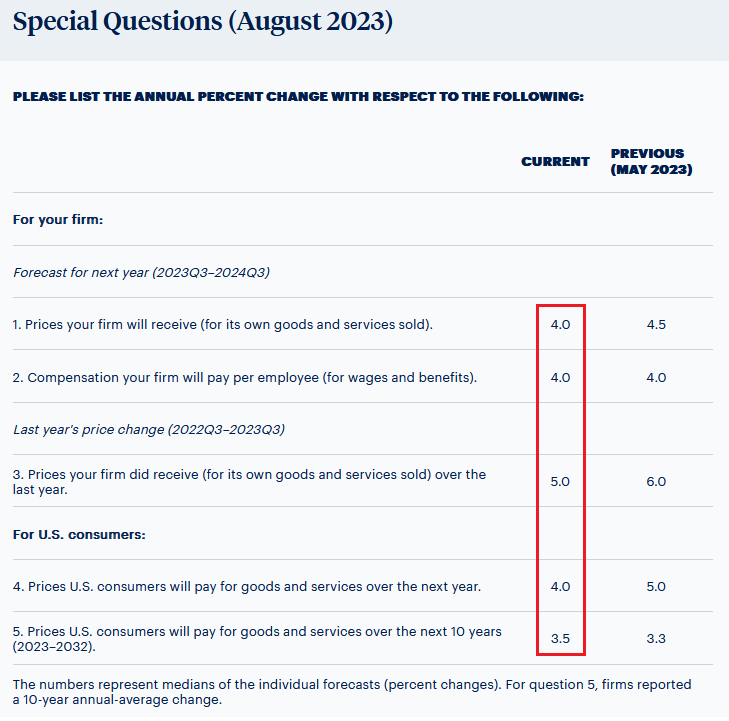

Please see below:

To explain, this month’s “special questions” showed that respondents expect wages and output prices to remain at 4% over the next 12 months. Even over the next 10 years, respondents said 3.5%. As a result, these figures highlight an inflationary psychology that necessities tighter financial conditions and a stronger USD Index.

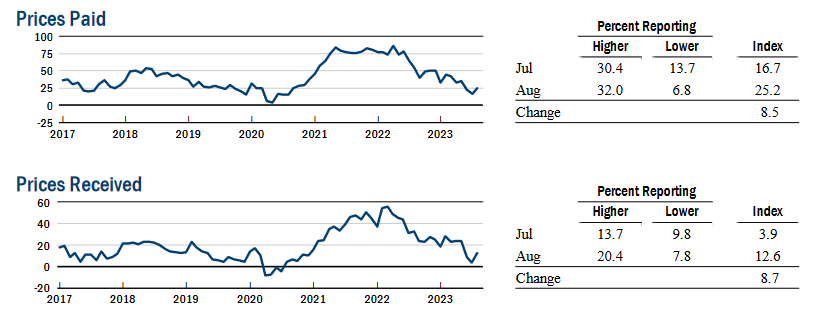

Similarly, the New York Fed released its Empire Manufacturing Survey on Aug. 16. An excerpt read:

“Both the input and selling price indexes moved up several points, but from relatively low levels, pointing to a modest pickup in the pace of price increases.”

Please see below:

To explain, both metrics are roughly in line with their pre-pandemic figures, so they are less problematic than other data. But, with the pair increasing at a time when CPI base effects have ended, the indicators signal that June should have been the bottom for inflation, and that higher oil prices are filtering through the real economy.

Overall, the GDXJ ETF has declined dramatically over the last month, and the S&P 500 has suffered too. Yet, we still expect more downside, as our take-profit level is steadily approaching. After that, we plan to flip long, as a bear market rally has the potential to generate even greater returns for our subscribers in the weeks ahead. Of course, we will keep you updated every step of the way to make sure everything is clear.

How high could the FFR go before the U.S. suffers a recession?

The Bottom Line

Financial markets remain unhinged, and we warned that bond volatility is bad for risk assets. When rates incur significant moves, it creates economic uncertainty and valuation imbalances across the stock and commodities markets. And with those imbalances leading to rotations, they spur further volatility. As such, the consequences are playing out in real-time. However, when these issues calm down (they always do), the relative peace should align with our technical timing for buying the GDXJ ETF.

In conclusion, the PMs were mixed on Aug. 17, as silver sidestepped the volatility. Conversely, it’s been a one-way street for the USD Index and the U.S. 10-Year Treasury yield, as their ascents continued. And with the U.S. 10-Year real yield hitting a new cycle high, our expectations have largely come to fruition.

The above ends today’s analysis, at least its part dedicated to markets. The following is – once again - info about the inaugural RISE session and the direction in which this is all going. If you have already read it, feel free to skip it – I simply want to make sure that everyone has a chance to read it, because the effects were so profound. (I’m going to keep quoting this text until the end of this week).

===

In short, the first Regain Inner Strength Experience session was a tremendous success. Before the key part of the session, I asked the participants about their overall wellbeing on a scale from 1 to 10, and the average was 6.1. I asked the same question after the key part of the session (about 30 minutes later), and it jumped to 8.1.

As far as I know, nobody’s financial status or anything else in their lives changed during those 40 minutes, and yet, due to the internal process that they went through, people were able to substantially increase their wellbeing. People moved from where they were, halfway to the max! In 40 minutes! If that’s not how a spectacular success looks like, I don’t know what it would be.

Before the session, I had my own expectations regarding the session; and I considered a move up by one point on that scale to be a success. We got twice as much.

And it actually gets even better!

I asked for more detailed feedback at the end of the session, and it turned out that there was only one person, whose wellbeing decreased from 10 to 8, but it came with an extra info: “the experience is still growing in me”, which is actually perfect. After some reflection, this person could move “beyond 10” thanks to insights that they will get. If we take the above into account, the real increase in wellbeing would be even greater! One final number – the record increase in wellbeing was from 4 to 9.

One of the questions in the survey was what people appreciated the most about the session, and here are some of the replies (I’m putting in bold the parts that I find key and that I particularly like):

- That it worked

- that it helps how to find more certainty and solution to my issues by myself

- I liked PR’s hands-on approach. No wasting time with anything. This tells me that I need more of these exercises, but rarely someone provides them, let alone for free. I imagine myself doing an exercise in the morning as well.

- informative

- Move forward. The experience is still growing in me

- Direct and insightful

- Your presentation is very honest and right from your heart.

- Practical meditation

You can watch the recording over here (in the description of the event), you can watch it also below (but please use the above link if for whatever reason the embed video function doesn’t work), and you can sign up for the RISE #2 session over here (Aug. 22 – 11 AM EST / 5 PM CET).

Now, while I’m experienced in working 1-on-1 during the Mastering Multidimensional Wealth | 1:1 Coaching Experience and Reiss Motivational Profile® sessions, facilitating an online session was something new for me, and I didn’t manage to do everything that I had planned even though I added extra 30 minutes to the hourly session.

Next time, I will plan it better, and I will introduce the key exercise in a separate video.

To make watching the recording easier and more pleasant for you here’s the breakdown:

- 0:00 – 17:15 – welcoming participants, and introducing myself

- 17:15 – 36:40 – theory behind the transformation exercise

- 36:40 – 59:21 – the transformation exercise along with the extra intro

- 59:21 – 1:20:35 – summarizing the exercise; survey

- 1:20:35 – 1:28:55 – final quick exercise regarding sharing positive wishes (plus a surprise in the second half of the exercise, which I don’t want to spoil; check it out) and the ending

Using the YT link might be most convenient as it then automatically takes you to the right part of the video (just click “more” on YT, to expand video’s description and then you’ll see the breakdown of chapters).

If you’re short on time and you trust the process (there’s a lot of science behind it and as you can see above, I talked about it for quite some time) you can skip the intros and move right to the transformation exercise.

===

One person in the feedback form wrote (in addition to writing that they found the session to be helpful) that they are wondering what the ultimate goal of these sessions is. In case you’re also wondering, here’s a (long, but probably worth reading) reply:

The increase in wellbeing that you saw in the session IS the ultimate goal of these sessions. This assists people in breaking out of the loss-stress cycle regardless of whose analyses their follow, because ultimately everyone will lose money at some point or will be holding on to a position that’s in the red for some time, before it becomes profitable. And that’s not pleasant. In the loss-stress cycle, the above causes stress (and all sorts of unpleasant emotions: fear, anxiety, shame, guilt, sadness, anger, frustration are the most common), which in turn makes it more difficult for one to remain objective about the situation, and they take worse investment decisions next time, perhaps making emotional decisions to increase their positions / leverage, or to drop those positions entirely. The irony here is that many tend to drop the positions right before the situation turns around and they become profitable, because it is at the price extremes that emotions are at their highest.

And as people make those less-objective decisions, the chances for more losses increase. Which increases stress, which decreases profits, which causes stress, and so on. Capital, health, and wellbeing in general all are negatively impacted.

What is the default way in which people can try to self-regulate? Some people will engage in sport activities, meditate, engage in their non-market hobbies etc., but some will want to vent their frustration publicly. While this is understandable, it’s also harmful for others, because some of those “other” might have been on the verge of panic, and they wouldn’t have panicked if left alone, but when they see someone else panicking or venting, they will probably be pushed to react in the same way, thus exacerbating the stress-loss cycle.

Now, I’m doing my best with my analytical part, but I can only do so much – I’m human after all, and neither I nor anyone else can be reasonably expected to pick all the tops and all the bottoms (I did pick the 2020 bottom, though). So, I’ve been thinking if there’s something else that I can do for you in the one-to-many arrangement, where I can assist multiple people at the same time. I’ve been thinking about it for a long time, and I finally realized that if I can make people break out of the stress-loss cycle (whether they are following my analyses or someone else’s analyses) then this will be the ultimate game-changer. The true success always comes within, anyway.

Also, I have a deep conviction that we’re living in times that are so difficult on many fronts, but in particular relating to mental health (and I don’t mean illnesses, but being on top of the mental game – happy, relaxed, and fulfilled) that the basics, or at least a large part of them should be available either for free or at a price that’s affordable for everyone. With 1-on-1 services it’s different, because it fully engages the provider and makes them unavailable to do anything else.

I’ve been collecting insights from various sources (believe me, what’s in RISE is the tip of the tip of the iceberg of what I learned and tested in the previous years) and in cooperation with the Stanford School of Medicine (and others), I came up with the idea to provide the Regain Inner Strength Experience sessions for free, and also to provide a course with key insights and exercises for next to nothing (probably $5 per month). This course, entitled “From Fear to Fortune” is currently in the making. This way, everyone will be able to enjoy their lives more, make more money on their trades, and make Golden Meadow a better, more supportive platform – everybody wins.

All this will also serve as an intro to many other courses (and then newsletters), some with basics of finance and investing, some aimed at more advanced areas in finance and wellbeing (you’d be surprised how much can be done with just breath – and yet very few people discuss that). We’ll greatly expand investment and financial scope of what’s available but also on the front where those “other” important things are – like communication, relationships, memory, preventing neurodegenerative diseases, increasing life quality in general, and many more.

Like I said, I experienced quite a lot (I’m working in the markets, I’m a CEO and I dedicate less than 1h total per week to workouts and yet when doctors look at my bloodwork, they ask if I’m a professional athlete – how? Research and efficiency in what I’m doing – it’s all connected), and it’s really surprising to me how underutilized the synergy between the finance, wellbeing and self-development has been up to this point.

So, the long answer to the question is that this is leading to increased wellbeing of everyone, who participates, increased profitability (of course, no guarantees, but you know very well how one thing leads to the other), and building a platform that will allow for enormous scaling of this effect. To make the world a better place and become happier and wealthier while doing so.

Also, while I’m at it, I’d like to mention two things:

- I re-introduced my 1-on-1 service, because it was previously described in a manner that didn’t really emphasize what it is that I can do. The new and up-to-date name of the service is Mastering Multidimensional Wealth | 1:1 Coaching Experience . I have only 4 seats available, because I assume that this will be an ongoing weekly experience for those who enter into this engagement. That’s where the biggest benefits can be reaped. However, it might be best to start with 30 minutes at first to just get to know me in this sort of work (it’s priced at a fraction of the regular session’s value), and we’ll both see if we’re a good match. If so, I’ll likely have some ideas for you even during those 30 minutes, and you’ll see if my approach makes sense for you, and whether you want to go into a longer engagement – where a true transformation can (and likely would) happen. If you feel that this is something that could be helpful to you at this stage of your life, you can book your seat here.

- The above has only 4 seats available even though there are 5 workdays in a week (I plan to have one of those sessions per day), because the fifth session will be reserved for someone who will have a priority due to the specific nature of the cooperation. Namely, I would like to enter into a partnership with someone (just one person) – a visionary investor who seeks to leave a profound mark on the world, and I plan to use all my insights to make sure that this person’s wellbeing will increase as much as possible thanks to our cooperation.

I can and will do all the above work related to Golden Meadow, anyway, but a partnership would speed things up substantially. I described what my plan and motivation are, and if you share my passion and are moved by the work that I’m undertaking, please consider this a call to action.

I’d like to welcome a strategic investment of $1M from a single individual who is not only driven by financial potential but also by the profound impact that can be achieved. It isn't just an investment in numbers, but an investment in a vision that encompasses collective well-being. By partnering with me, you'd not only be enriching your financial journey, but also contributing to the betterment of the world.

If you resonate with the deep resonance of this vision and want to explore the extraordinary potential that this investment partnership offers, please reach out today. Also, I’ll be in California in about a month, and I’ll be happy to meet to discuss the vision for the company with this person. This is your chance to ignite transformation not only within your wealth portfolio but on a global scale. Let’s start a conversation that has the power to shape not just your future, but the world's.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

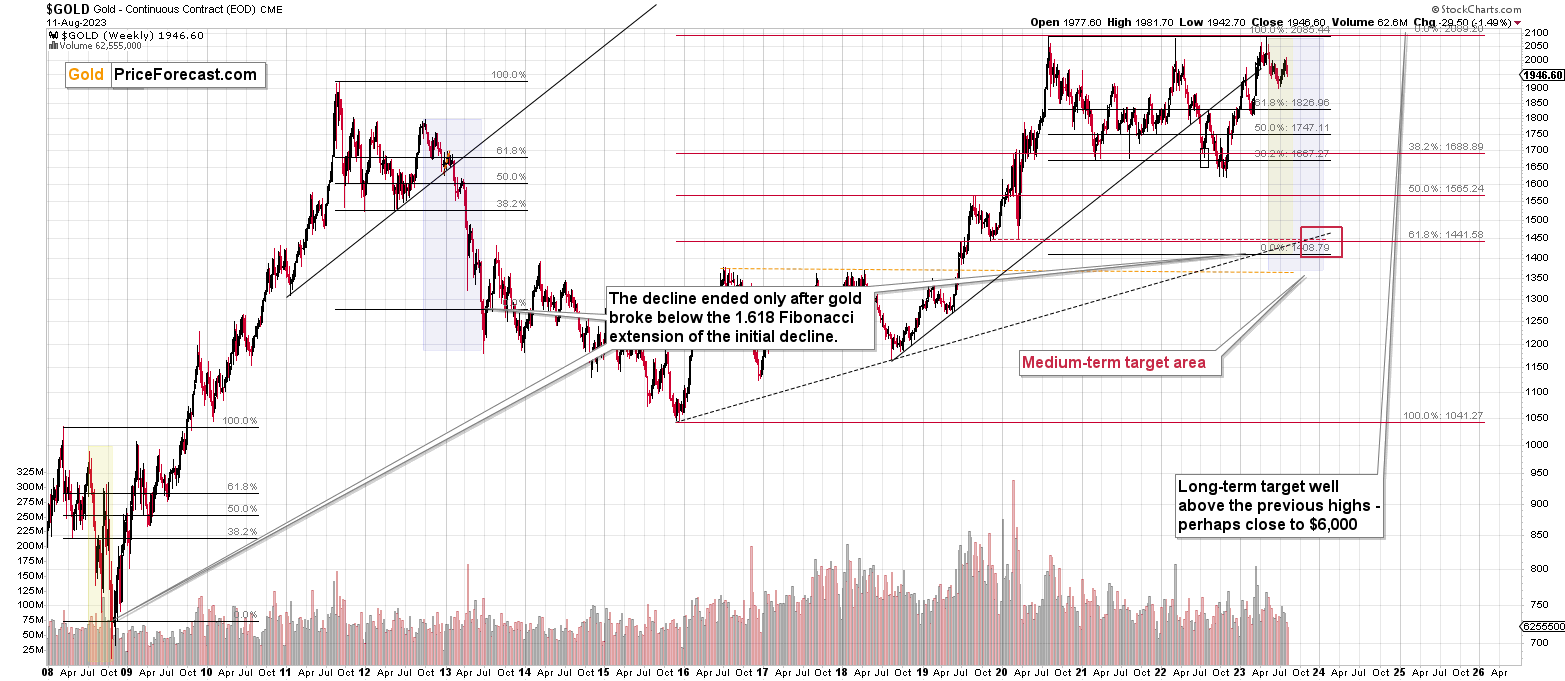

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term outlook for the precious metals sector (and for the FCX) remains to be extremely bearish and the profit potential for short positions in junior miners and FCX remains enormous.

While I can’t promise any kind of return (nobody can), in my opinion, the recent profitable position in the FCX will soon be joined by even more profits, and the winning streak of trades that started in early 2022, will continue.

If I didn’t have a short position in junior mining stocks, I would be entering it now.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief