Briefly: in our opinion, last week's Gold Investment outlook remains valid given that we've entered in a tight U.S elections race, Trump being COVID-19 positive, and that the pandemic is not over yet, with a long and bumpy path toward full economic recovery.

Welcome to this week's flagship Gold Investment Update. Based on last week's price moves, our most recently featured outlook remains the same as the prices generally moved in tune with our expectations. On that account, there are parts of the previous analysis that didn't change at all in the earlier days, which will be written in italics.

Before discussing the technical point of view, we'd like to say a few words on the recent fundamental developments. At this point, we'll focus on the severe economic slump that the U.S. GDP's decline demonstrated. But, before that, a few words on the very recent events.

The two crucial pieces of news from the past few days were the disappointing reading in the unemployment numbers, and of course, the news that the U.S. President - Donald Trump, and the First Lady - Melania Trump, had both tested positive for Covid-19. If the markets were waiting on any trigger that the situation is about to worsen - this might be it. Crude oil and stocks have recently declined as well, making the entire situation appear more and more like what we have witnessed back in March.

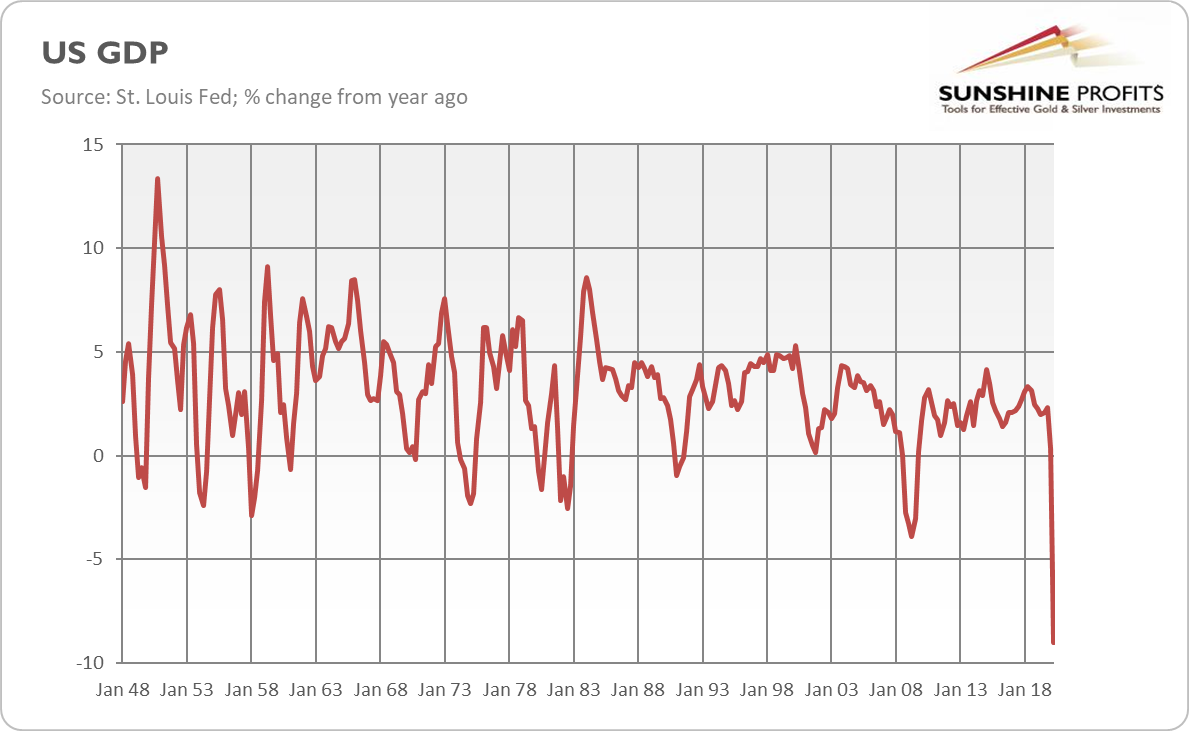

After taking the less recent - but not less critical events into account - we've learned that the real U.S. GDP plunged 31.4 percent at an annual rate in Q2 2020. We all knew that the second quarter was disastrous for the US economy. But now, it's official.

Last week, the Bureau of Economic Analysis published the third estimate of the real GDP in Q2. According to the report, the real GDP decreased at an annual rate of 31.4 percent (which is slightly better than the second estimate of 31.7-percent plunge), or 9 percent from the previous quarter, and also, 9 percent from the second quarter of 2019, as the chart below shows. This indicates that the US economy has suffered its sharpest contraction since the government started keeping records in 1947.

Although the report is terrible, nobody cares as it is also terribly old news, while market players are always future-oriented and are now focused on the prospects of a fast recovery. And indeed, some of the incoming data is encouraging. For example, the consumer Confidence Index has jumped from 86.3 in August to 101.8 in September, which is the highest level since the pandemic started.

Cleveland's Fed President Loretta Mester says that the economic recovery is now split into the tale of two cities: There's a big part of the economy now is where the activity is picking up, but you also have a significant part of the economy - travel, leisure, and hospitality - where we can't see a pickup.

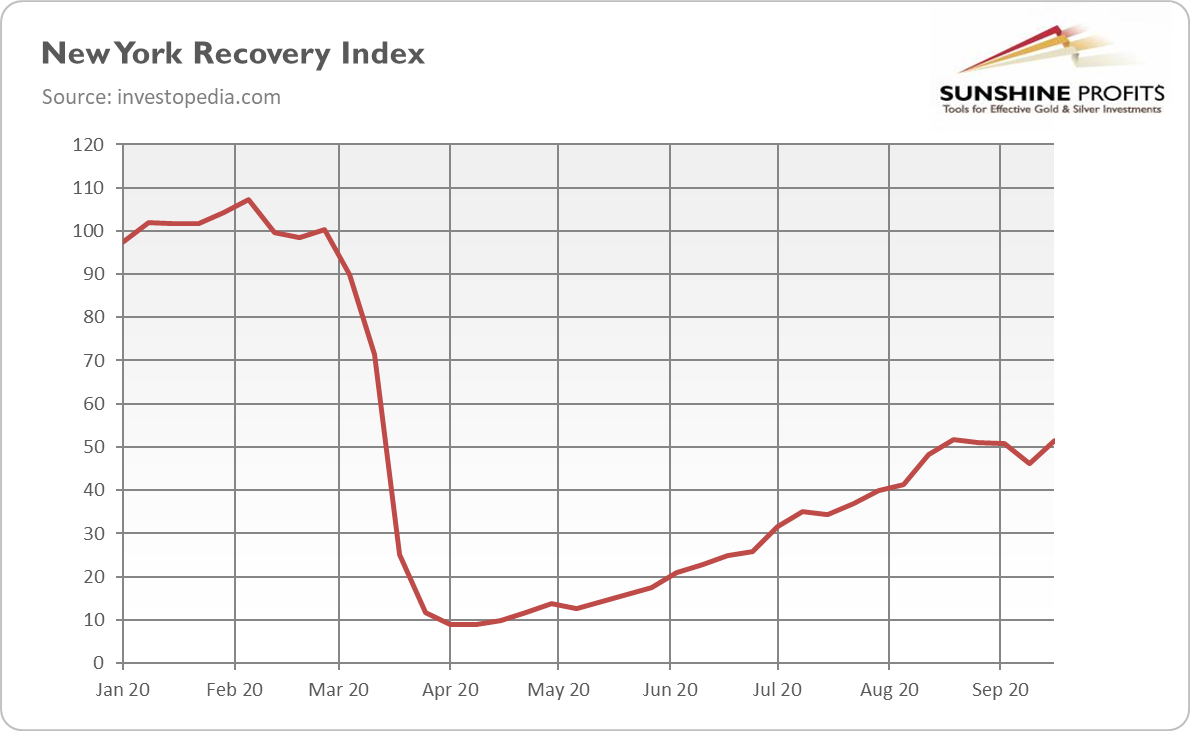

The data is somewhat discouraging. For example, the September nonfarm payrolls came below expectations, while the Chicago Fed's national activity index, which measures the overall U.S. economic activity, dropped from 2.54 in July to 0.79 in August. What this means is that the economy is stagnating or slowing down, instead of accelerating. Another important index is the New York Recovery Index, which is the combination of five sub-indices that aims to measure the pace of the recovery of New York. As the chart below shows, the index remains around 50, proving that the city is only halfway back to pre-pandemic levels.

The sad truth is that the American recovery pace depends on a significant extent of further stimulus packages. Therefore, all the Fed officials urge Congress to make a quick deal on the next aid bill. There will be a significant rebound in the third quarter, but if consider the entire year, the economy will most probably continue to decline. According to the Economist Intelligence Unit, the U.S. economy will drop 5.3 percent this year, and it likely won't return to the pre-pandemic level until 2020.

In other words, there will be a V-shaped recovery. But it will take place in China, not in the US. China's suppression of the coronavirus turned out to be draconian in the short-term, but as it seems, pretty effective in the long-run, as it allowed consumers to revert to their pre-epidemic behavior.

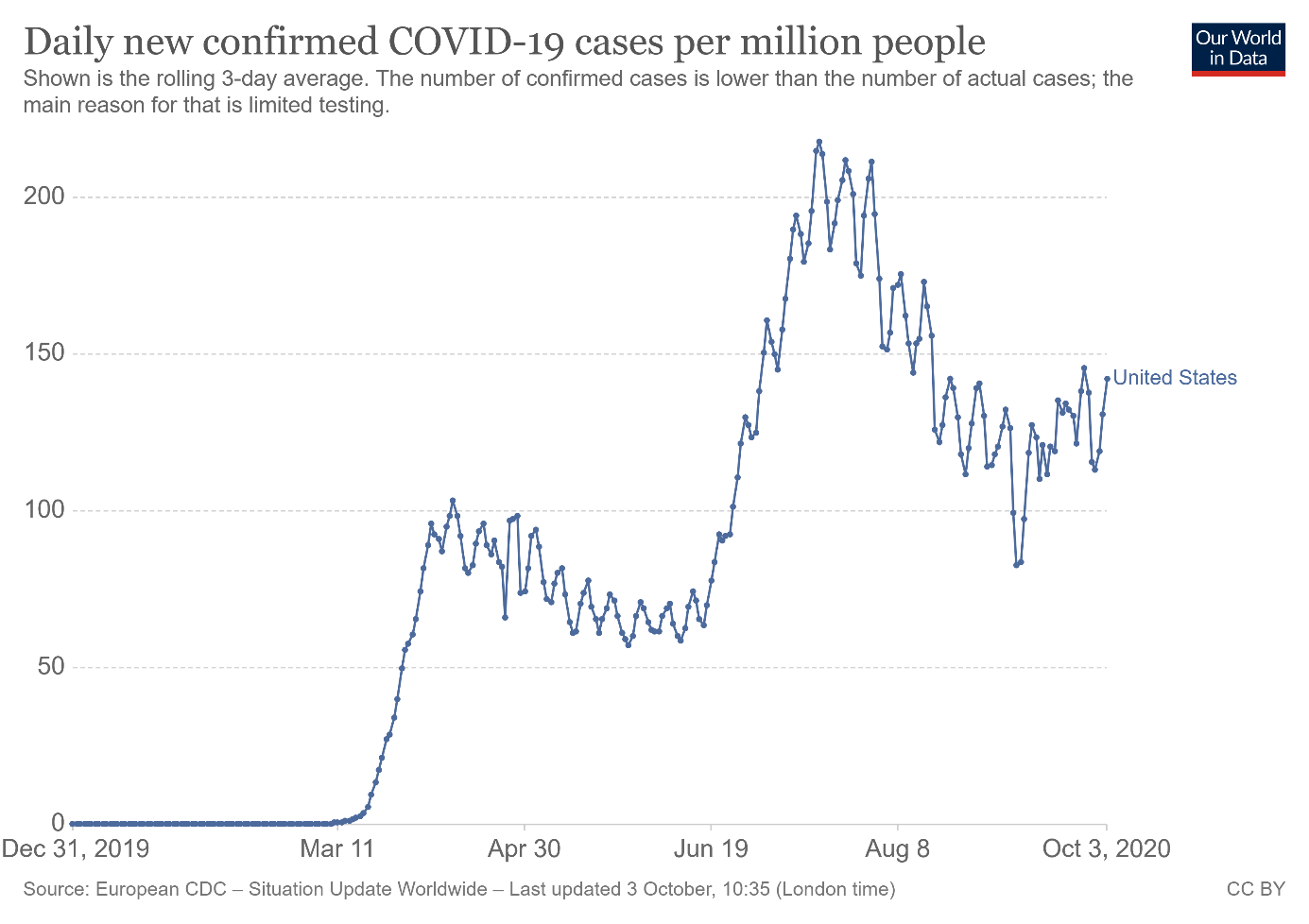

In contrast, the US never had any serious strategy to combat the coronavirus. Therefore, it comes as no surprise that the end of the pandemic is nowhere near in America. In fact, as the chart below shows, recently, the number of new cases is on the rise again. Even President Trump tested positive for the new virus. And keep in mind that we're only at the beginning of the fall season, with winter still ahead of us!

And no, waiting for a vaccine is not a strategy. Even if the vaccine gets invented this year, the economy may not be able to rebound quickly. You see, the vaccine must also be distributed and injected, which takes a long time. The authorities may try to speed up the whole process, but its rapid implementation may result in ineffectiveness or some additional serious side-effects. Let's not forget that a significant portion of the society may refuse to be vaccinated, given the high uncertainty related to the Covid-19 and the eventual vaccine implications.

So, what does all the above mean for the gold market? Just as the second quarter was disastrous for the American economy, it was also similarly excellent for the gold market. Furthermore, just as the third quarter was better for the partially rebounding economy, it was worse for the yellow metal, which retreated from above $2,000 to below $1,900, as the chart below shows.

However, given that the pandemic is not yet over and there will be a long and bumpy path toward full recovery, with further stimulus packages on the way, it seems that the recent correction was just, well, a short-term correction in a long-term bull market rather than a significant reversal. In any case, it doesn't mean that this correction has already ended.

Investors should not forget about the dovish change in the Fed's monetary regime. Although gold didn't rise or declined either, it does not matter in an immediate reaction to the Fed's strategy shift. You see, contrary to the widespread practice of market analysts, strategic movements should not be judged based on the current response of the financial markets. Strategic political decisions, such as the Fed's significant change in its monetary framework, are slow to act and bear fruit only over time. Given that the discussed shift implies lower real interest rates for longer and healthier tolerance to higher inflation, gold should benefit from it in the longer run.

All in all, there are multiple fundamental reasons due to which gold is likely to soar in the upcoming years, however, even the most profound bull markets can't move up in a straight line and some corrections will take place. After big rallies, we're likely to see big corrections, and one is long-overdue in case of the precious metals market.

Just as it was in March, it seems that the visible worsening in the economic situation might trigger a sell-off.

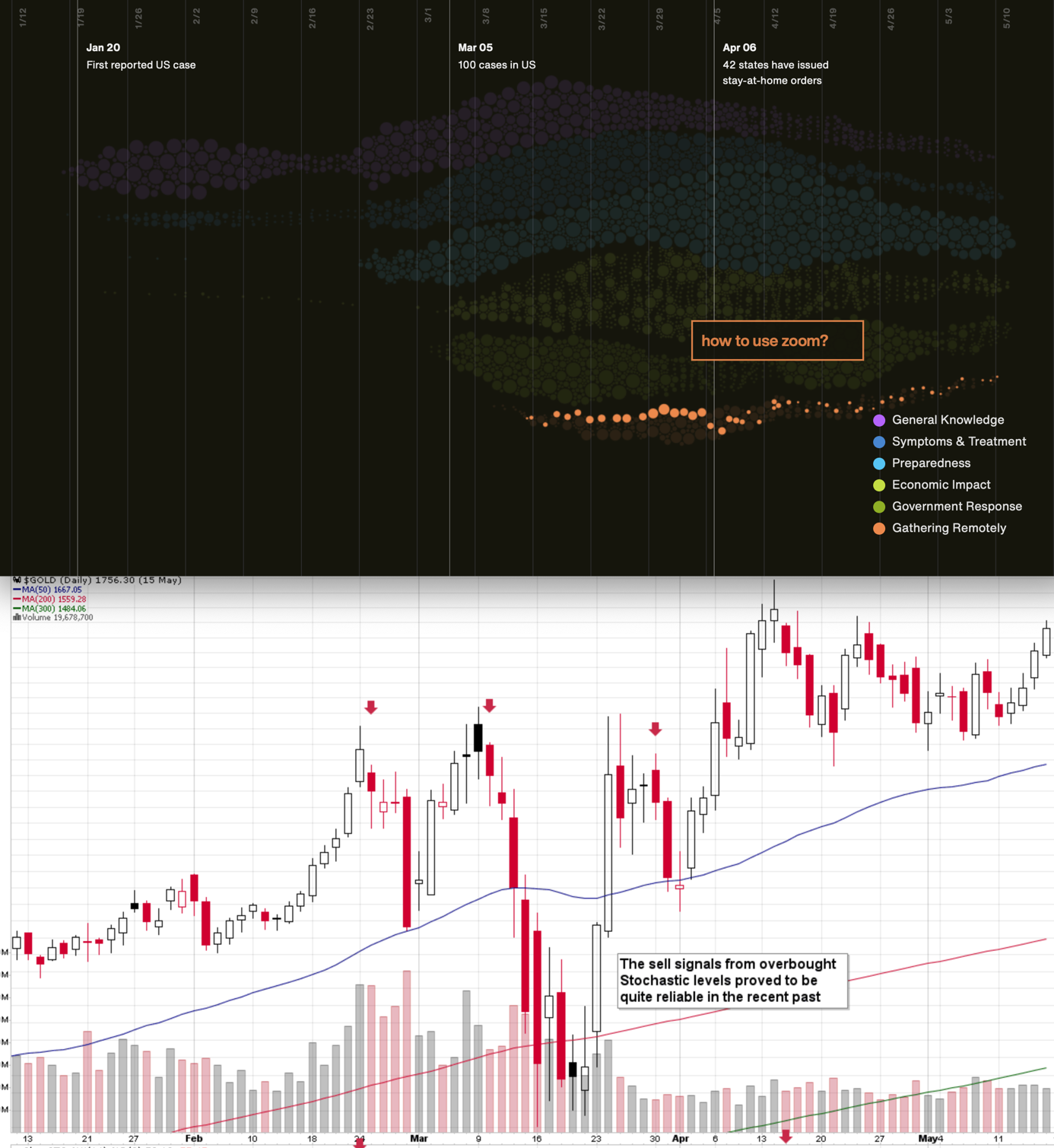

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it's vulnerable to a sizable decline, when the economic implications of the pandemic's continuation become obvious to investors.

Stocks and the Dollar Weigh In

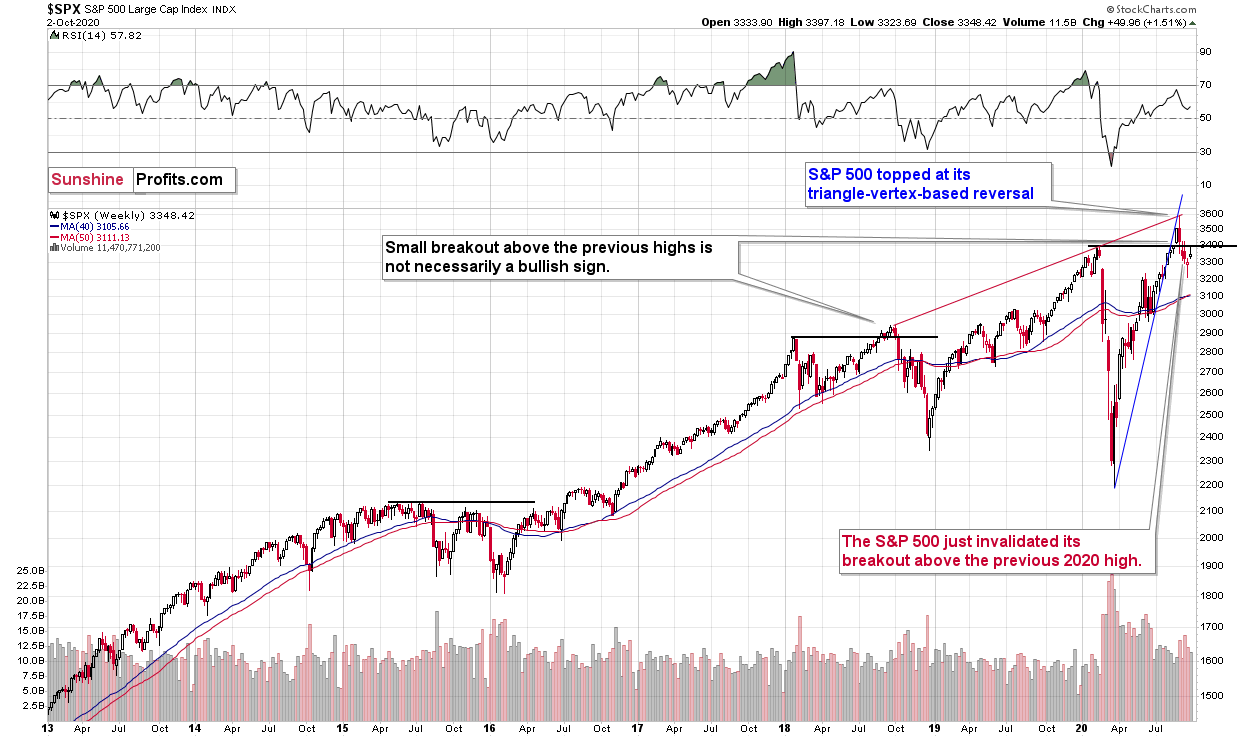

Recently, the S&P 500 has moved sharply above its previous 2020 high, however, it has declined sharply again - shortly thereafter. Once the S&P reached the rising red resistance line, it turned south.

I previously wrote that the invalidation of the breakout would be a clear bearish indication. And I believe that we'll see one soon - quite likely as the USD Index rallies further.

That's precisely what happened. The S&P 500 clearly invalidated its breakout.

Last week, stocks attempted to rally above the early-2020 highs once again, and they failed to do so. Instead, we saw a weekly reversal candlestick. That is a bearish sign for the stock market.

Do you remember what happened in February when the S&P 500 lost its upward momentum? Stocks plunged, and that was when tops in mining stocks and silver formed. Gold made another attempt to move higher but ultimately declined profoundly in the following days.

It appears that on one hand, everything that could have gone well for gold on the fundamental front, has already gone well, and it already rallied, and on the other hand, we have many signals pointing to the situation being excessive. This means that as some of the bullish factors ease (perhaps temporarily) and investors get scared about economy's ability to really recover, gold is likely to correct significantly, before continuing its upward march.

How far down can the general stock market go?

In my opinion, even a decline below the previous 2020 lows is not out of the question, but we wouldn't be the farm on this scenario. With so much liquidity injected into the system, regardless of the economic situation, people might still buy stocks. In short, it's a tough call to say whether stocks will move to or below the previous 2020 lows this year, but in my view a decline below 3000 is highly possible.

Speaking of indications pointing to the situation being excessive, let's take a look at the USD Index.

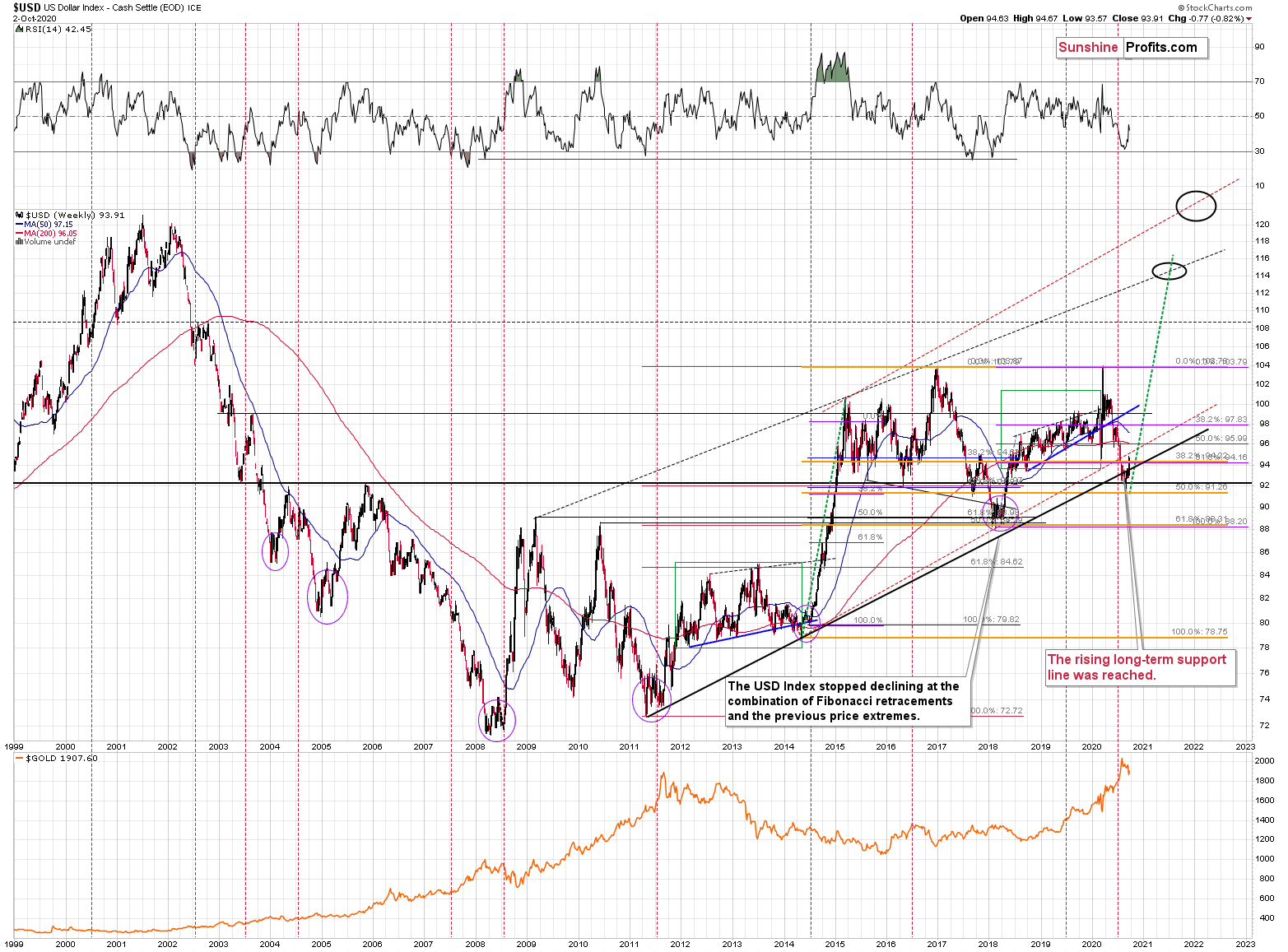

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone "knew" that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it's exactly the same right now.

The USD Index was at a powerful combination of support levels. One of them is the rising, long-term, black support line based on the 2011 and 2014 bottoms. The other major support level and a long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, broke slightly below them, and now it has clearly invalidated this breakdown. For many weeks, we've been warning about the likely USD Index rally, and we finally saw it.

Quoting my previous comments:

USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

Based on the most recent price moves, the USDX is once again below the above-mentioned strong rising support line, but we doubt that this breakdown would hold. We expect to see an invalidation thereof that is followed by a rally.

Before moving to the short-term chart, please note that the major bottoms in the USD Index that formed in the middle of the previous years often took form of broad bottoms. Consequently, the current back and forth trading is not that surprising. This includes the 2008, 2011, and 2018 bottoms.

A crucial aspect is that the rally that we've witnessed so far is just the tip of the bullish iceberg. The breakdown below the key support levels was invalidated, which is a strong bullish indicator. Since it happened on a long-term chart and the temporarily broken lines were critical, the implications are incredibly important as well- and they should be visible from the long-term perspective.

So, how high could the USD Index rally now? At least to the 100 level (approximately). This way, the upcoming rally would almost match the rally that started after the previous major invalidation - the 2018 one.

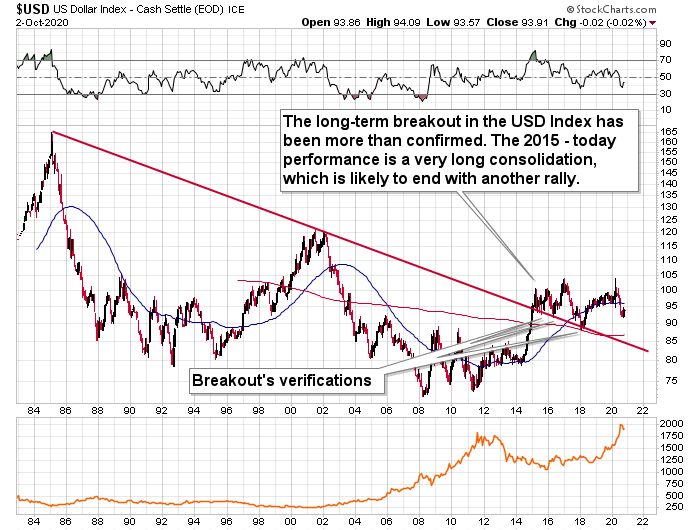

Still, we wouldn't rule out a scenario in which the USD Index rallies above its 2020 highs before another major top. After all, the USD Index is after a very long-term breakout that was already verified several times.

Taking into account USDX's lengthy breakout, its several breakout verifications, and the 5-year consolidation, it seems that the USD Index is ready to rally much higher - perhaps to approximately to the 120 level.

Please note that the consolidation that preceded the previous rally to 120 that took place between 1997 and 2000 happened when the USD index was trading at relatively similar price levels - approximately between 90 and 105.

The short or medium-term target for the USDX is relatively unclear right now, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when on many occasions, the USDX formed major bottoms. This makes a short-term rally here very likely.

The short-term USD Index chart is not as important as the long-term one, but let's take a look at it anyway.

USDX's breakout is more than confirmed. We saw a small corrective decline and prices stayed above the previously broken line for many days. We've also witnessed two weekly closes above it. Additionally, a monthly close as well. The breakout is as confirmed as it could get, and the implications are clearly bullish.

Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market. It's generally a good gold trading tip to monitor the USD Index's performance.

Please note that the USDX has also broken the very short-term declining resistance line, indicating that the small pullback might already be over, confirming the indications that we've previously based on gold's chart that featured the triangle-vertex-based reversal. The corrective rally seems to have ended approximately in tune with it, and the very short-term breakout in the USD Index serves as an excellent confirmation.

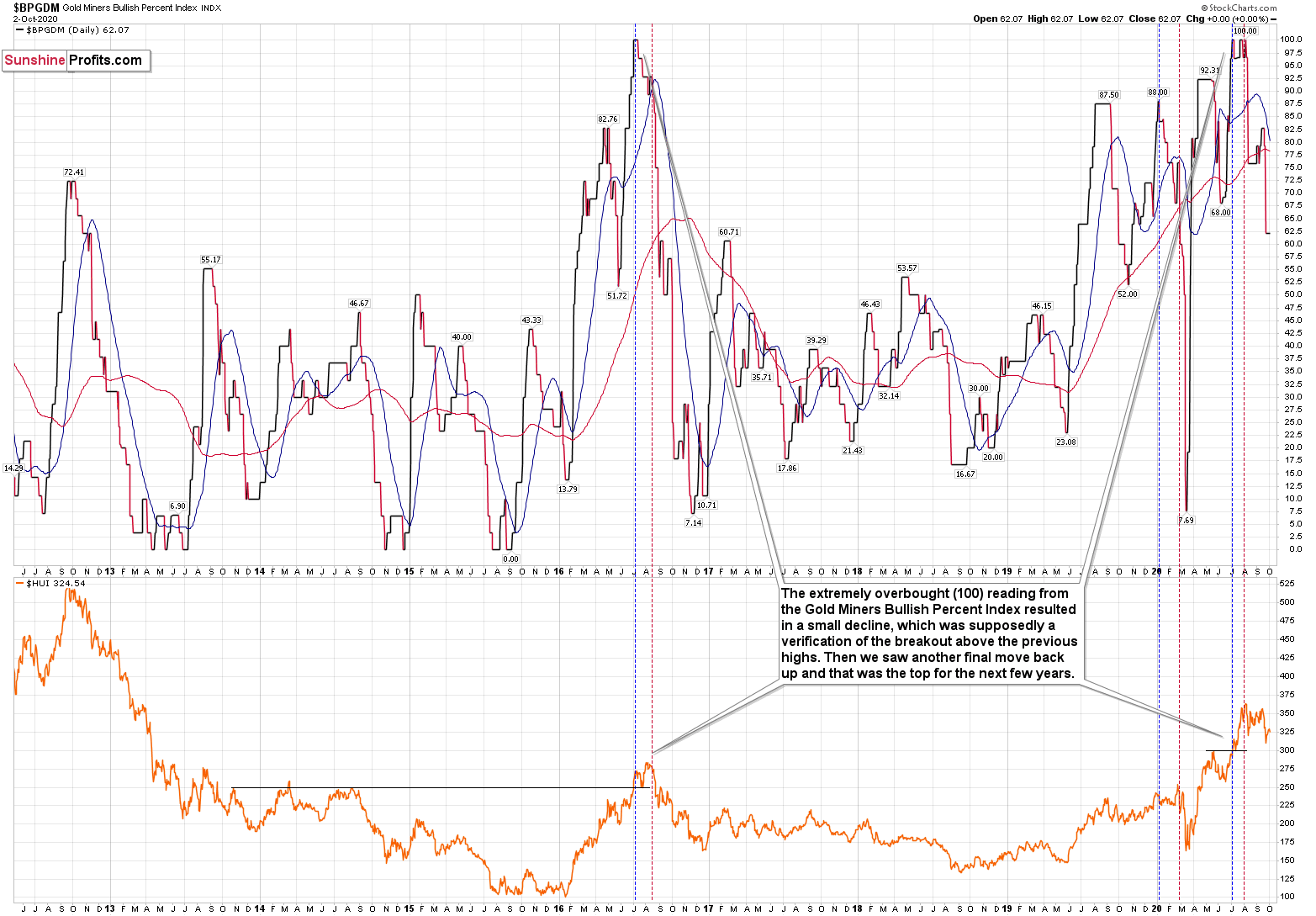

Consequently, based on this analogy, the implications for the near term are bearish for the PMs. Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn't cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing has caused the Gold Miners Bullish Percent Index to move up once again for a few days. It then declined once again. We saw something similar also this time. In this case, this move up took the index once again to the 100 level, while in 2016 this wasn't the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline. Given the situation in the USD Index, it seems that we're seeing the same thing also this time.

Please note that back in 2016, after the top, the buying opportunity didn't present itself until the Gold Miners Bullish Percent Index was below 10. Currently, it's above 60, so it seems that miners have a long way to go before they bottom (perhaps a few months - in analogy to how gold declined in 2016).

Six weeks ago, we've commented on the chart above in the following manner:

Now, since the general stock market moved above the previous highs and continues to rally, we might or might not see a sizable decline early this week. Back in March, the slide in miners corresponded to the decline in the general stock market, and this could be repeated, or we could see some sideways trading after the slide resumes, once stocks finally decline.

That's exactly what happened. The general stock market continued to move higher, and mining stocks have been trading sideways instead of declining - or rallying. Before miners' pause (and S&P's breakout) miners were repeating their late-February and early-March performance. The implications of the self-similar pattern were bearish, and they continue to be bearish, only the timing changed.

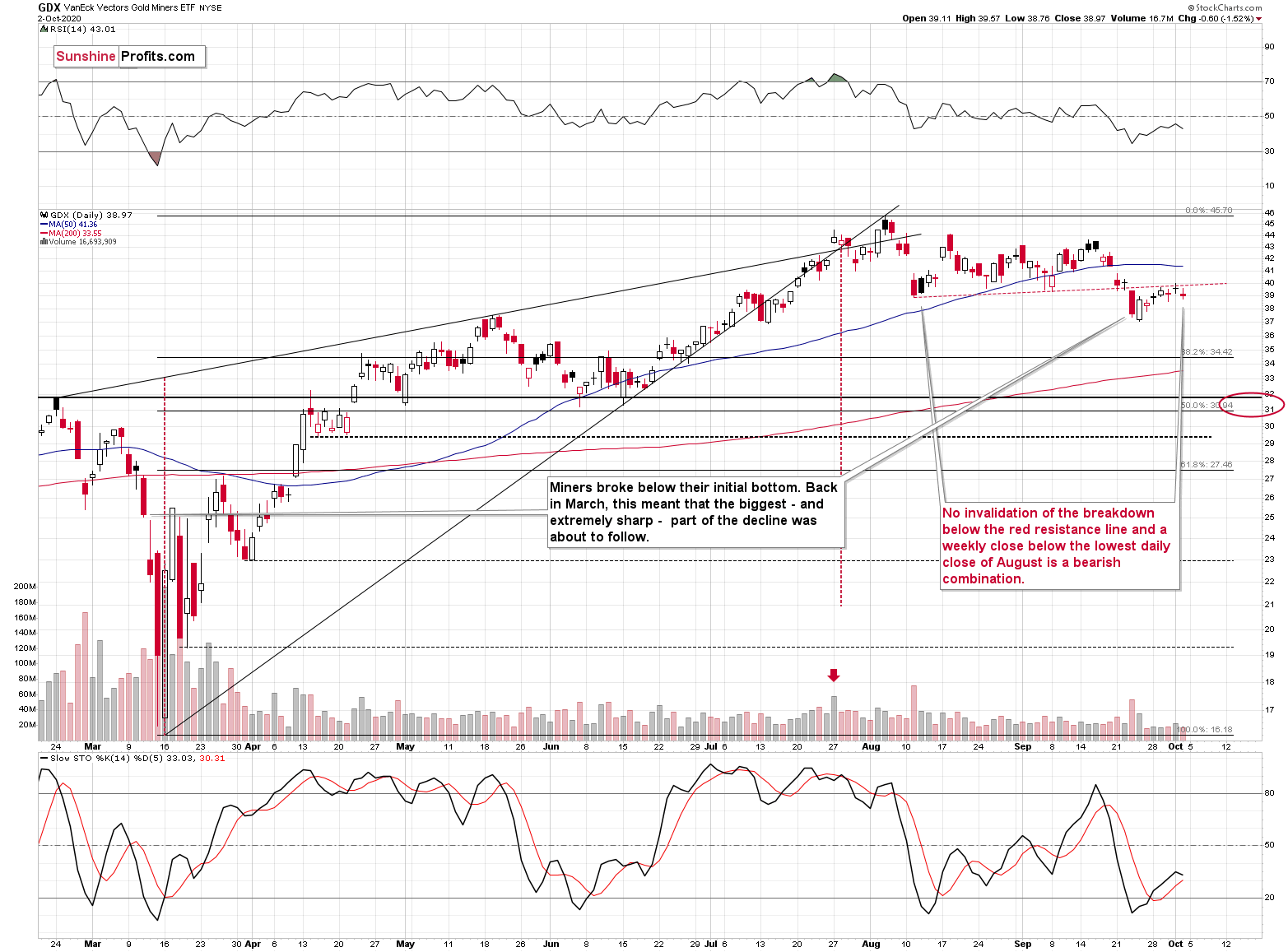

The GDX ETF didn't manage to break below the lower border of the triangle pattern yet, but given the situation in the USD Index and what we're about to show in you case of gold, it's likely that it will move lower shortly.

And it did.

After the top, the GDX declined below its August lows, and it then verified the breakdown by closing below these lows for three consecutive trading days. We also saw a weekly close below them. Last week, the GDX ETF closed below the August low once again.

Additionally, this mining stocks ETF moved back to the red resistance line, without breaking it, and on Friday, it declined once again. So, did the most recent upswing made the outlook bullish even for the short term? Not really.

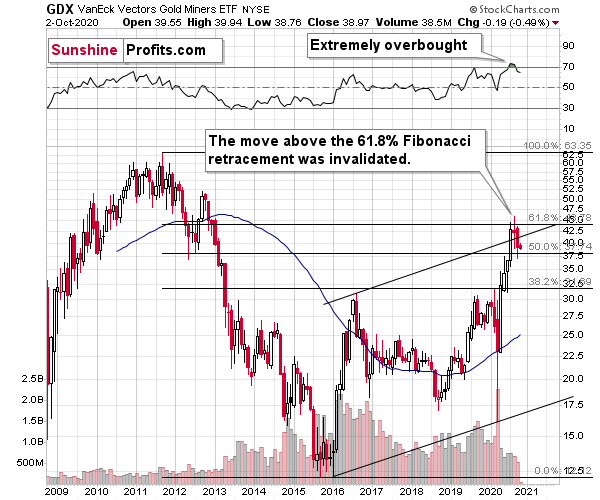

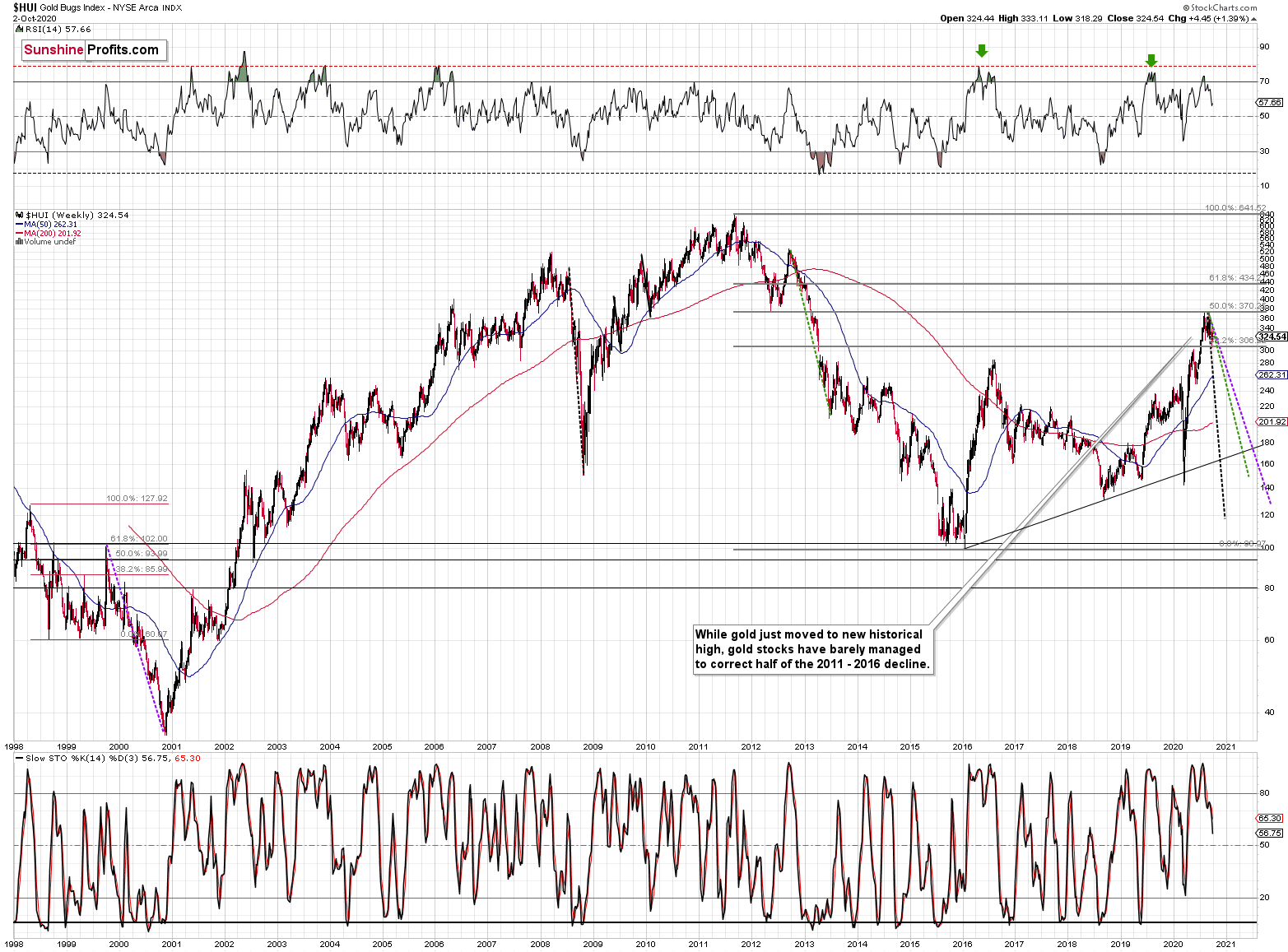

Also, let's not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 - 2016 decline.

When GDX approached its 38.2% Fibonacci retracement, it declined sharply - it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible - PMs are likely to decline after the sharp upswing, and since there are only several months left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners' inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners inability to stay above the rising support line - the line that's parallel to the line based on the 2016 and 2020 lows.

Let's proceed to metals themselves.

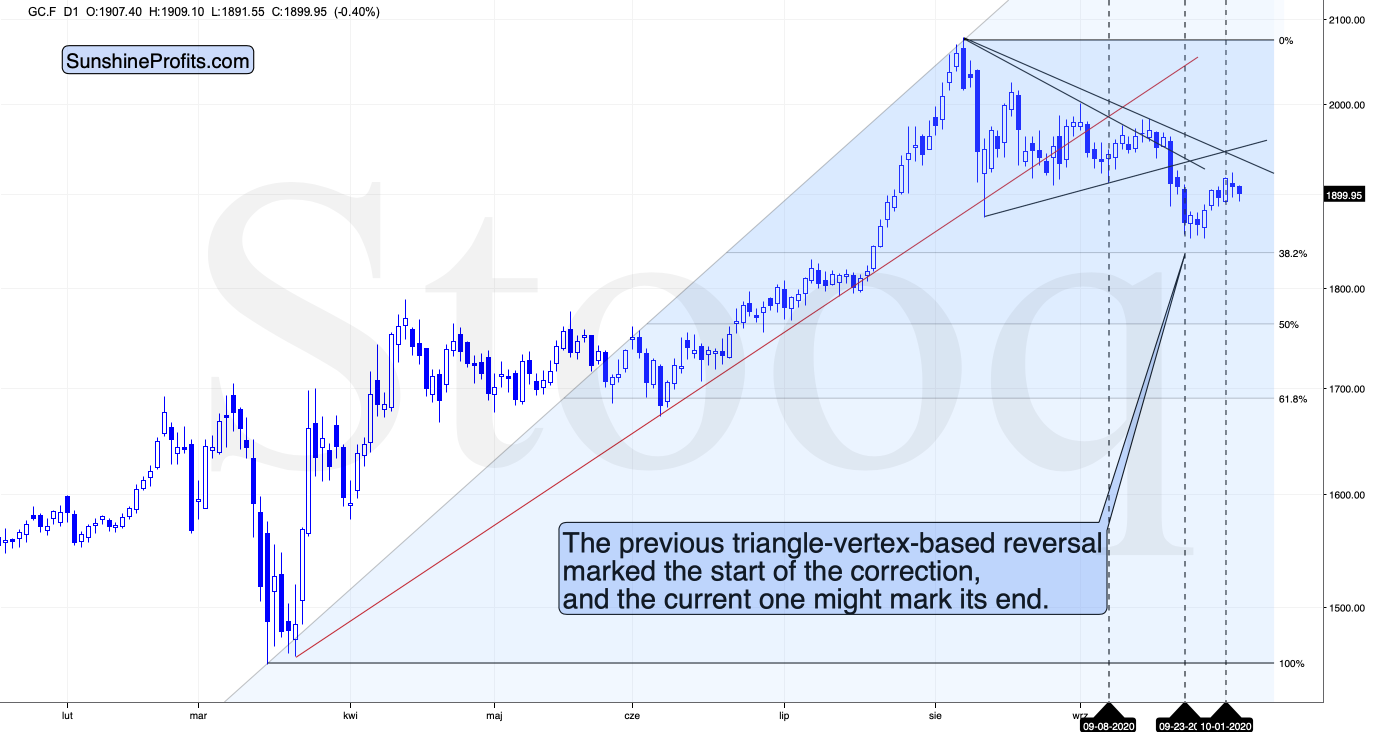

On Friday, we commented on the above gold chart in the following manner:

The short-term triangle-vertex-based reversals were quite useful in timing the final moments of the given short-term moves in the past few weeks. Please keep in mind that the early and late September lows developed when the support and resistance lines were crossed.

We can see the same thing happening once more. Based on the recent highs and lows, yesterday, the support and resistance lines both crossed again. And indeed, gold is trading below yesterday's closing price in today's pre-market trading.

Now, this technique might not work on a precise basis, but rather on a near-to basis, and given the highly political character of the current month (before the U.S. presidential elections), things might move in a somewhat chaotic manner... But still, this technique worked multiple times in the previous months and years, and it has worked recently as well. It seems quite likely that the days of this corrective upswing are numbered.

Indeed, gold moved lower in this week's pre-market trading. Therefore, what we've analyzed above remains valid, and the outlook continues to be bearish for the next several weeks - next few months.

Based on the chart above, the likely downside target for gold is at about $1,700, predicated on the previous lows and the 61.8% Fibonacci retracement, based on the recent 2020 rally.

As far as the white metal is concerned, previously, we've indicated the following:

Silver is also after a major breakdown and it just moved slightly below the recent intraday lows, which could serve as short-term support. This support is not significant enough to trigger any major rally, but it could be enough to trigger a dead-cat bounce, especially if gold does the same thing.

Once again, that's exactly what happened.

At this point one might ask how do we know if that really just a dead-cat bounce, and not a beginning of a new strong upleg in the precious metals sector. The reply would be that while nobody can say anything for sure in any market, the dead-cat-bounce scenario is very likely because of multiple factors, and the clearest of them are the confirmed breakdowns in gold and silver, and - most importantly - the confirmed breakout in the USD Index. The invalidation of the breakout above the previous 2020 highs in case of the general stock market is also a bearish factor, especially for mining stocks (and silver).

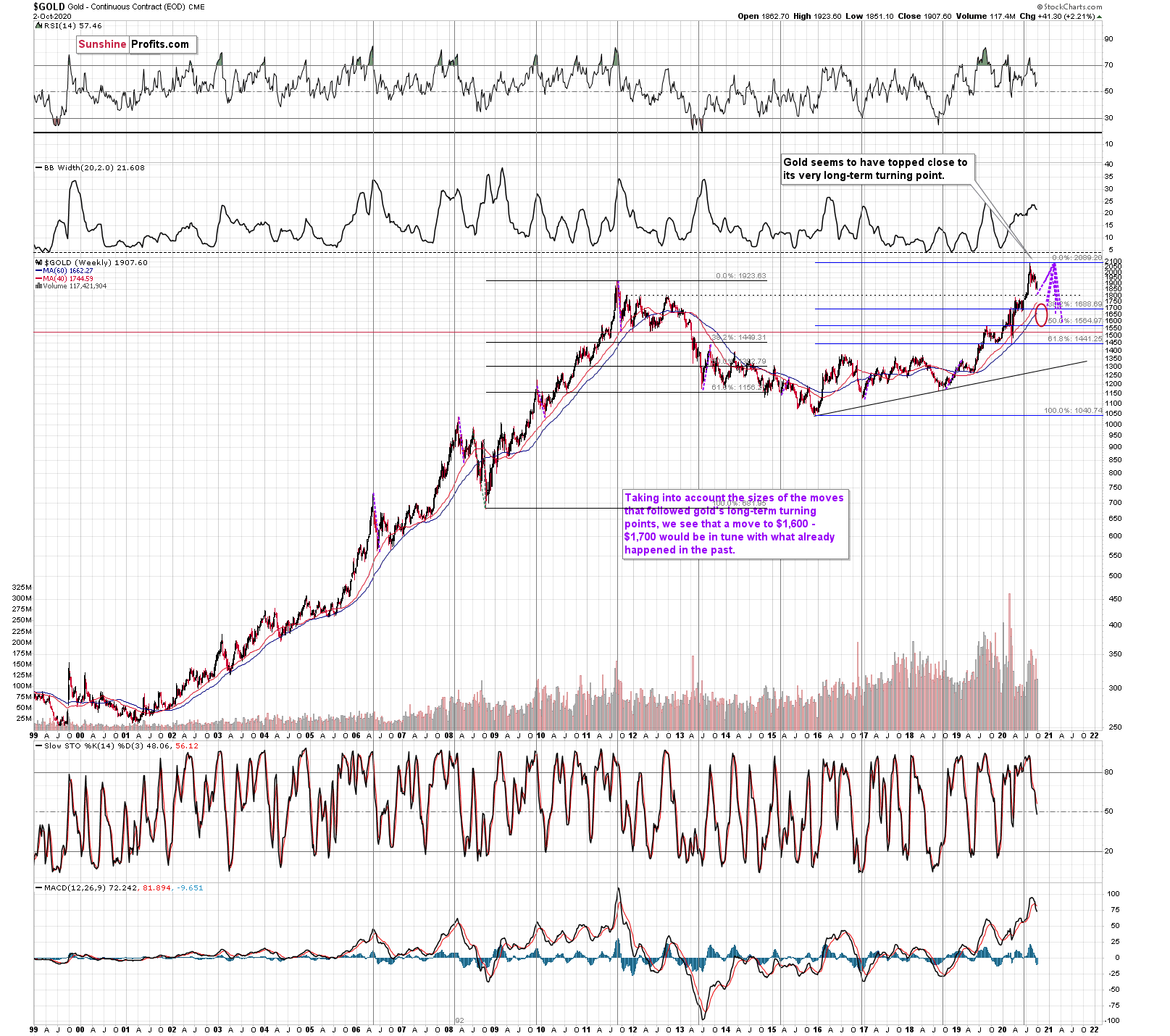

Let's get back to gold and zoom out.

The chart above shows exactly why the $1,700 level is even more likely to trigger a rebound in gold, at the very minimum.

The $1,700 level is additionally confirmed by the 38.2% Fibonacci retracement based on the entire 2015 - 2020 rally.

There's also possibility that gold would decline to the $1,500 - $1,600 area or so (50% Fibonacci retracement and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

Gold's very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold's big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom close to the $1,700 level. That's very much in tune with how much gold moved after the previous long-term turning points.

The analogy to the price moves after the previous turning points didn't change, but since the starting point is much higher, the downside target is also higher as well.

Speaking of upside targets, six weeks ago, we wrote:

Based on gold's Fibonacci extensions and the previous major highs and lows (the 2018 high and late-2019 low along with the 2020 low), we get a nearby upside target of $2085. At the moment of writing these words, gold is trading at $2044. Given this week's volatility, it could even be a matter of hours before gold reaches the above-mentioned target and reverses. Taking closing prices into account, gold is up by $35, so if it reverses significantly, we would be likely to see a powerful weekly reversal candlestick and one that causes gold to decline in the following weeks.

That's more or less what happened. Gold topped at $2,089.20. It then declined quite visibly and closed last week at about $1,950.

Do you get the feeling that you have already seen gold perform this way before? Because you did.

The history rhymes, but this time, the similarity is quite shocking.

We copied the short-term chart and pasted it on the long-term chart above and next to the 2011 top. We pasted it twice, so that you can easily compare gold's performance in both cases in terms of both: price and time.

They are very similar to say the least. Yes, these patterns happened over different periods, but this doesn't matter. Markets are self-similar, which is why you can see similar short-term trends and long-term trends (with regard to their shapes). Consequently, comparing patterns of similar shape makes sense even if they form over different timeframes.

After a sharp rally, gold declined quickly. Then we saw a rebound, and a move back to the previous low. Then, after a bit longer time, gold moved close to the most recent high and started its final decline. This decline was less volatile than the initial slide. That's what happened when gold topped in 2011 (and in the following years), and that's what happened also this year. Ok, after the initial decline from the 2011 top, we saw two initial reactive rallies and in 2020 there was just one, but it didn't change the similarity with regard to time.

The patterns of this level of similarity are rare, and when they do finally take place, they tend to be remarkably precise with regard to the follow-up action.

What is likely to follow based on this pattern, is that we're likely to see the end of the slower decline, which will be followed by a big and sharp decline - similarly to what we saw in 2013.

How low could gold slide based on this similarity? Back in 2013, gold declined approximately to the 61.8% Fibonacci retracement based on the preceding rally (the one that started in 2008), so that's the natural target also this time.

And we already wrote about this particular retracement - it's approximately at the $1,700 level. This has been our downside target for weeks, and it was just confirmed by this precise self-similar technique.

Another interesting point is that gold made an interim low close to the 50% retracement and the previous lows. Applying this to the current situation suggests that we could see a smaller rebound when gold moves to about $1,760 - $1,800.

This might be the moment to switch from short positions in the miners to short position in silver. It's too early to say for sure at this time, though.

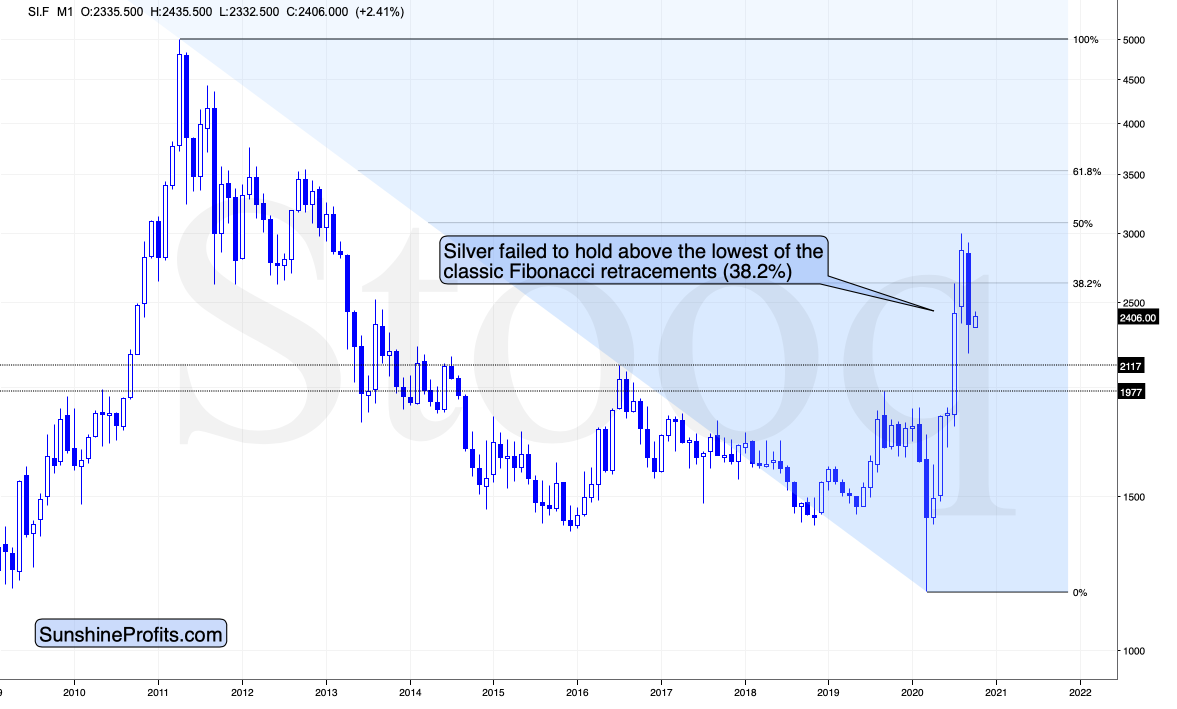

Speaking of silver, please note that from the long-term point of view, silver is not that strong.

While gold moved to new highs, silver - despite its powerful short-term upswing - didn't manage to correct more than half of its 2011 - 2020 decline.

In fact, silver has already invalidated its move above the lowest of the classic Fibonacci retracement levels (38.2%), which is not something that characterizes extraordinarily strong markets.

We see something similar in the HUI Index. The latter corrected half of its 2011 - 2016 decline and nothing more, while gold moved well above its 2011 high.

All in all, it's mostly gold that is making the major gains - not the entire precious metals sector.

So, how can one determine the end of the gold price decline? At $1,700, it seems that it can go either up or down. Where does gold need to go to complete the pattern?

In reality, gold could rebound from $1,700, but it could just as well slide further, perhaps once again to the previous 2020 lows, especially if the USDX rallies to its 2020 highs.

So, how do we determine whether we see the buying opportunity or not?

We will view the price target levels as guidelines, and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be something else. Something that we already saw in March when gold bottomed.

We will be on a special lookout for gold's strength against the ongoing USDX rally. At many vital bottoms in gold, that's exactly what happened, including what the March bottom.

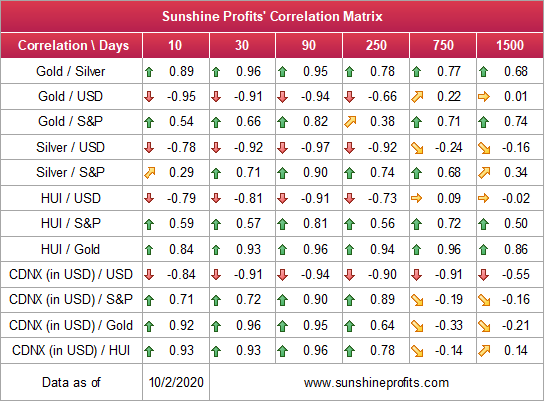

So far, the link between gold and the USD Index is strongly negative.

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the short (30-day column) and medium term (90-day column), it seems likely that will continue to be negatively affected by the USDX upswing.

...Until we see the day where gold reverses or soars despite the U.S. currency's rally.

If that happens with gold at about $1,700, we'll have a very good chance that this was the final bottom. If it doesn't happen at that time, or gold continues to slide despite USD's pause or decline, we'll know that gold has further to fall.

Naturally we'll keep you - our subscribers - informed.

To move forward, how does the GDX downside target compare to the gold's downside target? If, at the same time, gold moves to about $1,800 and miners are already after a ridiculously big drop (to $31-$32 in the GDX ETF, or lower), the binding profit-take exit price of your GDX ETF will become $32.02.

However, since gold is only at $1,800, with a GDX of $32, there's more decline to be expected. Perhaps that exiting GDX is only for changing to shorts in silver? Is that the only instance when that's the case, or could it also be with a GDX of $32 and a gold price of $1,700. What would be a GDX target for gold a gold price of $1700 be?

It's also not entirely clear whether you have up to six weeks until the lows arrive, instead of the end of the year.

Yes, we plan to exit the short positions in the mining stocks (GDX) and enter short position in silver. We don't have an exact price at which we'll do it (and it's unclear if we'll do it at all). We're just describing what we're going to do if a certain set of circumstances is met. If miners decline very profoundly, but silver declines only "normally", then it would create a specific opportunity for one to switch from miners (that would be after most of their decline) to silver (that would be not be after most of its decline). Our estimation is that it might happen with GDX at about $31 - $32, and/or with gold at about $1,800. However, it would be the specific relative performance of miners to silver that would determine if we would make the switch or not.

We expect the above - a local bottom with miners at about $31 - $32 - to form within the next 5 weeks. However, this will likely not be the final bottom, especially if gold doesn't slide to $1,700 at that time. We expect to see bigger declines to follow then, after a pause or a rebound. This means that miners could rally a bit from $31 - $32, and then decline below this area afterward.

At this time, the final GDX target (the one that would correspond to gold at $1,700 or lower) is still unclear. The $17 - $23 area seems probable, especially if the general stock market slides once again. It's too early to say with any significant level of certainty. Gold is providing us with a clearer final target, so that's what we'll focus on. And most importantly - we'll focus on gold's performance relative to the USD Index.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think it has already begun.

During the final part of the slide (which could end later than in 6 weeks, perhaps near the end of the year - just like it happened in 2015), we expect silver to decline more than miners. That would be aligned with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, but it doesn't make the short-term decline improbable. Markets can and will get ahead of themselves and then decline - sometimes very profoundly - before continuing their upward march.

The plan is to exit the current positions in miners after they decline far and fast, but at the same time, silver drops just "significantly" (we expect this to happen in 0 - 5 weeks). In other words, the decline in silver should be severe, but the decline in the miners should look "ridiculous". That's what we did in March when we bought practically right at the bottom. It is a very soft and broad instruction, so additional confirmations are necessary.

I expect this confirmation to come from gold, reaching about $1,800. If - at the same time - gold moves to about $1,800 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF - or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. It will be tempting to wait with opening the short position in silver until the entire sector rebounds, but such a rebound could last only a couple of hours, so it would be challenging to successfully execute such a strategy.

The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index. It could take the form of a gold's rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

Summing up, considering gold's breakout invalidation above the 2011 highs, it's clear that the rally (that ended $4 above our upside target) is entirely over. Given this invalidation and the confirmed USD Index breakout, gold will probably slide much lower over the next few weeks. There are indications that the corrective upswing in the precious metals market and the pullback in the USDX are over, so the decline could resume any day - or hour - now.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it wasn't already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager