Foreigners. They are always plotting. This time, they hit Turkey. And gold at the same time. Will Erdogan save the country and support the yellow metal?

They May Have Their Dollars, but We Have Our People, Our God

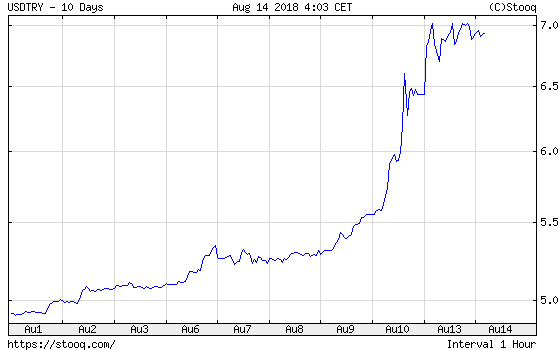

Following sharp losses last week, the Turkish lira plunged about 10% on Monday, as one can see in the chart below. The move came after President Erdogan reiterated his opposition to raising interest rates and said the lira’s recent free-fall was the result of a foreign plot. So, contrary to the market’s hopes for an interest rate hike, Turkey’s central bank announced a cut in reserve requirements ratios for banks.

Chart 1: USD/TRY exchange rate from August 1 to August 14, 2018.

Some analysts hope that Erdogan will change his stance. But why would he? After all, as he said last week, “they may have their dollars, but we have our people, our god.” He later said that Turkey faced an economic war and he blamed a foreign plot for the plunge in the domestic currency. Oh, yes, always these damned foreigners!

Gold Sinks below $1,200

Actually, gold dropped below $1,200 on Monday, as one can see in the chart below. Our Readers should not be surprised, as we have been warning for some time that the current macroeconomic environment is rather bearish for gold and that we, thus, see more downside than upside risks for the yellow metal.

Chart 2: Gold prices (London P.M. Fix) from August 10 to August 13, 2018.

The Fed tightens its monetary policy, while inflation remains under control. Real interest rates have been rising, creating downside risks. The traditional strong negative correlation between real rates and gold prices will come back one day, pushing the yellow metal down.

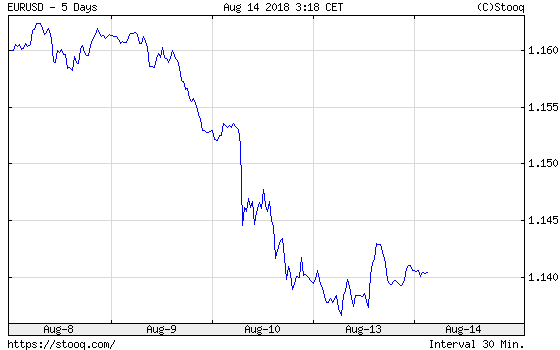

However, the blow did not come from the yields. This time the U.S. dollar has been the villain. As the chart below shows, the greenback has recently appreciated not only against the Turkish lira but also against the euro.

Chart 3: EUR/USD exchange rate from August 8 to August 14, 2018.

Again, our Readers should be hardly surprised. As we explained many times in the past, not all market perturbations or even crises are positive for gold. In the July edition of the Market Overview, we have already analyzed the turmoil in Turkey. We reminded that “the precious metals investors should remember that the emerging market crises do not necessarily boost the gold prices.” It turned out that we were right.

The yellow metal is a bet against the greenback. It competes with U.S. currency. It shines when the dollar suffers and struggles when the dollar prospers. Hence, emerging market crises, just like the one that is just unfolding in Turkey, are not able to support gold prices (unless there are strong concerns about contagion in the U.S.). Problems in Argentina or Turkey, although very harmful to the Argentineans and Turks, are not very important for the Americans. The reason is simple: they usually don’t threat the U.S. financial markets.

What’s more: crises in developing countries are usually positive for the greenback. The reason is simple: all the capital parked in these markets comes back to the U.S. In other words, although the dollar might look miserable compared to gold, it’s the real king in our contemporary monetary system based on fiat currencies. Hence, it also performs like a safe haven. Actually, it’s the default currency for most investors. They turn to gold only when their confidence in the Fed and the U.S. economy and its currency is shaken. Or yields for dollar-denominated assets are very low. But this is not the case today. The interest rates are rising, the economy is booming, and investors seem to like the Fed’s gradual and well-telegraphed approach.

Implications for Gold

The emerging market crises are seldom positive for gold in the medium term. Hence, investors should not expect that Turkey’s problem will support the yellow metal. Actually, lack of any safe-haven upward move (even temporary) amid the declines in the stock markets and worries about contagion in developed countries is really disturbing. The gold bulls must be frustrated. Indeed, what is important is not the news, but the reaction to it. Gold’s bearish move speaks for itself. But there is some hope for gold bulls: the net short positioning in managed money is historically high, which in the past preceded upward moves. When we reach the peak in negative sentiment, then gold will rise.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview