The ECB dropped its easing bias on Thursday. Monetary hawks are pleased. But doves are holding tight. And what does gold do?

Hawks Awaken in Frankfurt…

A major change at the European Central Bank! On Thursday, it removed its long-standing pledge to increase bond buys if needed. In January we could read that statement:

(…) if the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, we stand ready to increase the asset purchase programme (APP) in terms of size and/or duration.

Now, it’s gone! What does it mean? The removal of that part of the monetary statement means that the ECB drops the explicit reference to the likelihood of an increase in the pace of purchases in the near future. In other words, the ECB abandoned its commitment to increase the size of quantitative easing, if necessary. It implies that the bank has taken another step away from its ultra-accommodative policy. It’s a hawkish change that should strengthen the euro further. The upward trend in the EUR/USD would support gold prices.

…but Doves Don’t Intend to Move Anywhere

Draghi pleased the hawks among the Governing Council by dropping the ECB’s intention to increase bond purchases when the outlook worsens. However, the stimulus won’t end overnight. The ECB will remain accommodative for a while. It moves at a very slow and gradual pace, in line with its doctrine of patience. Draghi will continue its quantitative easing at least until September. And even then, interest rates will remain very low for at least six months after that. Indeed, the ECB executive board member Benoit Coeure clearly told the French radio station BFM Business on Monday that “it is very clear to us that short term interest rates, the ones that are controlled by the central bank, will remain at very low levels, far beyond the horizon of our asset purchases.” It means that the ECB will remain less hawkish than the Fed. This should support the U.S. dollar, which would be bad for the gold market.

So, Who’s Right?

The ECB took hawkish action, but remains ultra-dovish. What is more important for the EUR/USD exchange rate and gold? Change, of course. Investors think at the margin. States don’t count, only changes matter – unless they don’t, since they are too small to make a difference, or are smaller than expected.

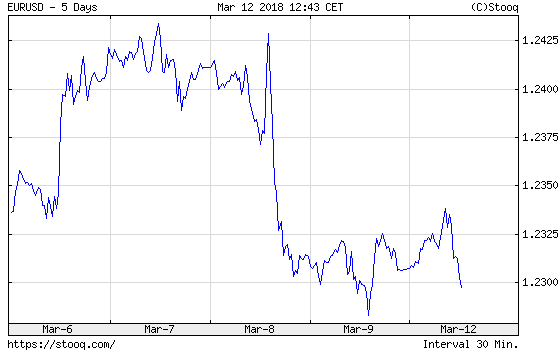

Let’s look at the chart below. As one can see, the euro initially strengthened against the U.S. dollar in response to Draghi’s comments.

Chart 1: EUR/USD exchange rate over the last few days.

So at the beginning, investors interpreted Thursday’s move as a signal that the ECB is more certain about the economic outlook for the Eurozone (the outlook for real GDP growth has been revised up for 2019) and, thus, it’s (slowly) preparing the exit from its quantitative easing program. However, after a while, the euro dropped like a stone.

What happened? Well, it seems that investors had expected that Draghi would be even more hawkish (after all, the interest rates will remain low). And on Thursday Trump signed an order to impose tariffs on steel and aluminum imports, which could affect the markets. The U.S. dollar could strengthen as part of a “sell the rumor, buy the fact” strategy.

Implications for Gold

The ECB’s removal of its easing bias is an important step towards the end of its crisis-era support. Surely, it’s a snail’s pace – but normalization is on track. Surely, it’s not revolution, but evolution. But markets are forward-looking, so the ECB’s hawkish signals, if strong enough, should be fundamentally supportive for the gold market.

However, the ECB’s doesn’t act in a vacuum. Many other factors simultaneously affect gold prices. Like Trump’s tariffs. Or the expectations of a Fed hike. The U.S. economy added 313,000 new jobs in February, well above forecasts. As a result, the market odds of a March hike increased even further and the price of gold fell. It suggests that gold may struggle in the short term, in line with the pattern of selling off ahead of the FOMC announcements and rallying after them. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview