This essay is based on the Premium Update posted January 15th, 2010. Visit our archives for more gold articles.

In the previous essay dedicated to gold and silver we have summarized that the very-long-term price projections are still in place and paint a bullish picture for long-term investors holding gold, silver, and corresponding equities. On the other hand, the short-term outlook remains bearish for the precious metals market.

This week, we would like to provide our thoughts on the precious metals stocks sector. After all, PMs usually move along with the corresponding equities, so analyzing PM stocks is useful even if you are interested in trading / investing in metals only.

Let's begin with the long-term chart of the HUI Index (charts courtesy of http://stockcharts.com.)

Generally, there are virtually no changes in the long-term picture of the HUI Index since we covered this situation previously, so we will just include the previous comments, as they are up-to-date also today:

Please take a look at the thin blue lines coming from the same price/time combination. Each of them was pierced, before the final bottom was put in, and this is what I expect to take place this time.

(...) taking the historical performance of the gold stock sector, it seems that PMs will need to move a little lower before putting in a bottom.

The HUI Index has just moved to the rising support line, so if it manages to break below it, this may mean that the final downleg for this correction has begun. Let's turn to the short-term chart for details.

The analysis of the short-term chart suggests that the PM sector might have already begun the second part of the decline.

First of all, please take a look at the volume, which failed to increase along with higher price on Monday, Jan 11th. The volume did in fact increase, but during the move lower on Tuesday, Jan 12th, which is a subtle clue that these declines are something more than just noise.

We have emphasized in the past that the corrections on the precious metals market often take form of a zigzag, which by itself suggests that another move lower is likely. Moreover, in case of PM stocks, the second part of decline tends to be similar to the first one. Therefore, we have extrapolated the previous move to the current one (assuming that the decline began on Monday), and the result for the GDX ETF is that the bottom is likely to be put in a few weeks at around the $42 level, which is slightly lower than the previous bottom.

Naturally, things may (and often do) change very fast on the market. One of the ways to detect which change may take place is to check what other market might influence prices of a given asset in the future, and then analyze it with appropriate (here: precious metals) perspective.

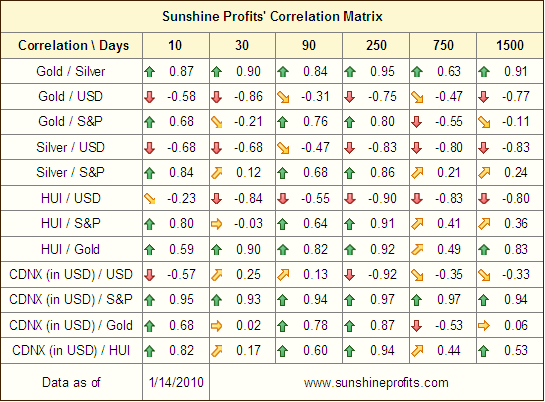

Our correlations table provides details as far as the strength of the influence from USD Index and the general stock market is concerned. These are the two main driving forces behind the short-term (!) price swings.

In the previous Premium Update we wrote the following:

(...) the fact that in the past 30 trading days PMs moved on average in the opposite direction to the general stock market (which is NOT in tune with the historical norms for PM stocks and silver) is very important. These numbers suggest that right now (!) we should not rely on the signals from the general stock market as far as timing PMs is concerned.

The correlation coefficient for silver and S&P 500 is now positive, but it's so low that it practically equals 0. This means that a breakdown in the general stock market does not need to have a direct influence on the precious metals market. Detailed analysis of the key drivers of PM prices is available to our Subscribers along with the rest of the full version of this essay (3x bigger than this version with many other relevant charts.)

Summing up, precious metals are not reaching new highs since several weeks, so it is understandable that Investors holding gold and silver are discouraged by their favorite asset class' performance, especially that there are signals that this is not the end of the corrective phase. On the other hand, the short-term weakness does not damage the long-term bullish picture for the sector.

To make sure that you get immediate access to my thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

P. Radomski

--

This week's Premium Update includes several factors that were not mentioned recently, and that are very important to investors holding junior mining companies.

Among other things, this week's Premium Update includes: analysis of gold (also the very-long-term chart), silver, and PM stocks from both long- and short-term point of view, cyclical tendencies on the silver market. Moreover, we analyze the key drivers of PM prices - USD Index and the main stock indices (also the NIKKEI 225 Index). Additionally, we comment on one of our unique indicators (dedicated to juniors) and on the current values in the precious metals correlation matrix. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.