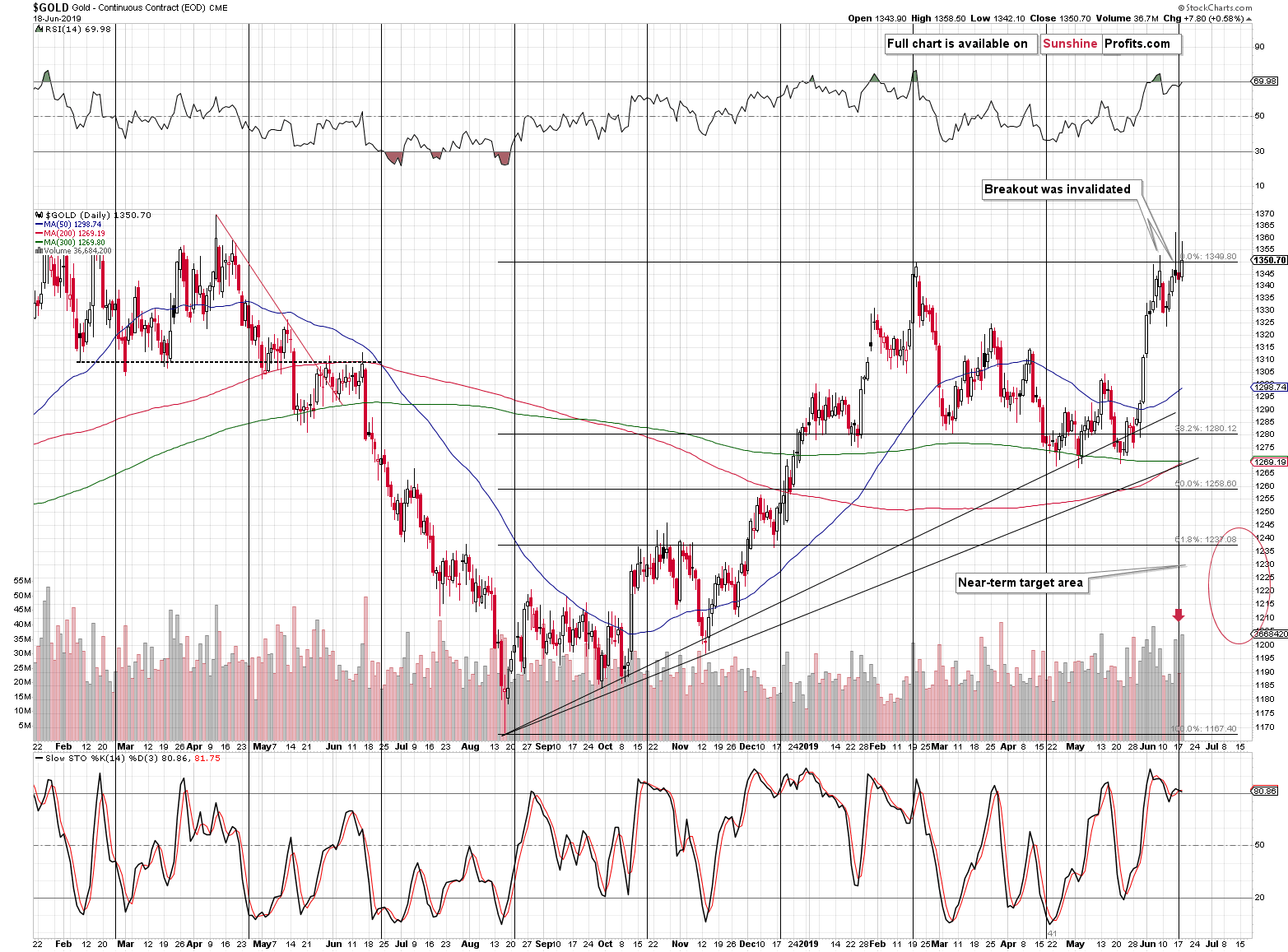

Gold and mining stocks just closed at a new yearly high. Silver is not even close to reaching such levels, and gold is already back below where it was trading 24 hours ago. Can these breakouts be trusted? Do they have a lasting power? To answer that, we better remember something important first. This changes the overall picture regarding gold and mining stocks entirely.

This key thing is the cyclical turning point. They often work even without additional factors strengthening them, but this time, we have the very rich week in terms of monetary announcements, which makes increased - and temporary - volatility even more likely.

Is Gold Seriously Pushing to New Highs?

While gold closed a bit higher than it did in February, it didn't make a new 2019 intraday high. In other words, gold attempted to move substantially higher, but it reversed before the end of the session. And it's already back below the February high at the moment of writing these words.

It was not only a tiny breakout that we saw - it was also yet another reversal. The implications of the former would be bullish (only once the breakout is confirmed, which it probably won't be), but the implications of the latter are clearly bearish.

Especially that we saw significant gold volume.

Also because it happened right after the cyclical turning point.

Bot factors confirm that the reversal interpretation of yesterday's price action in gold is the correct one.

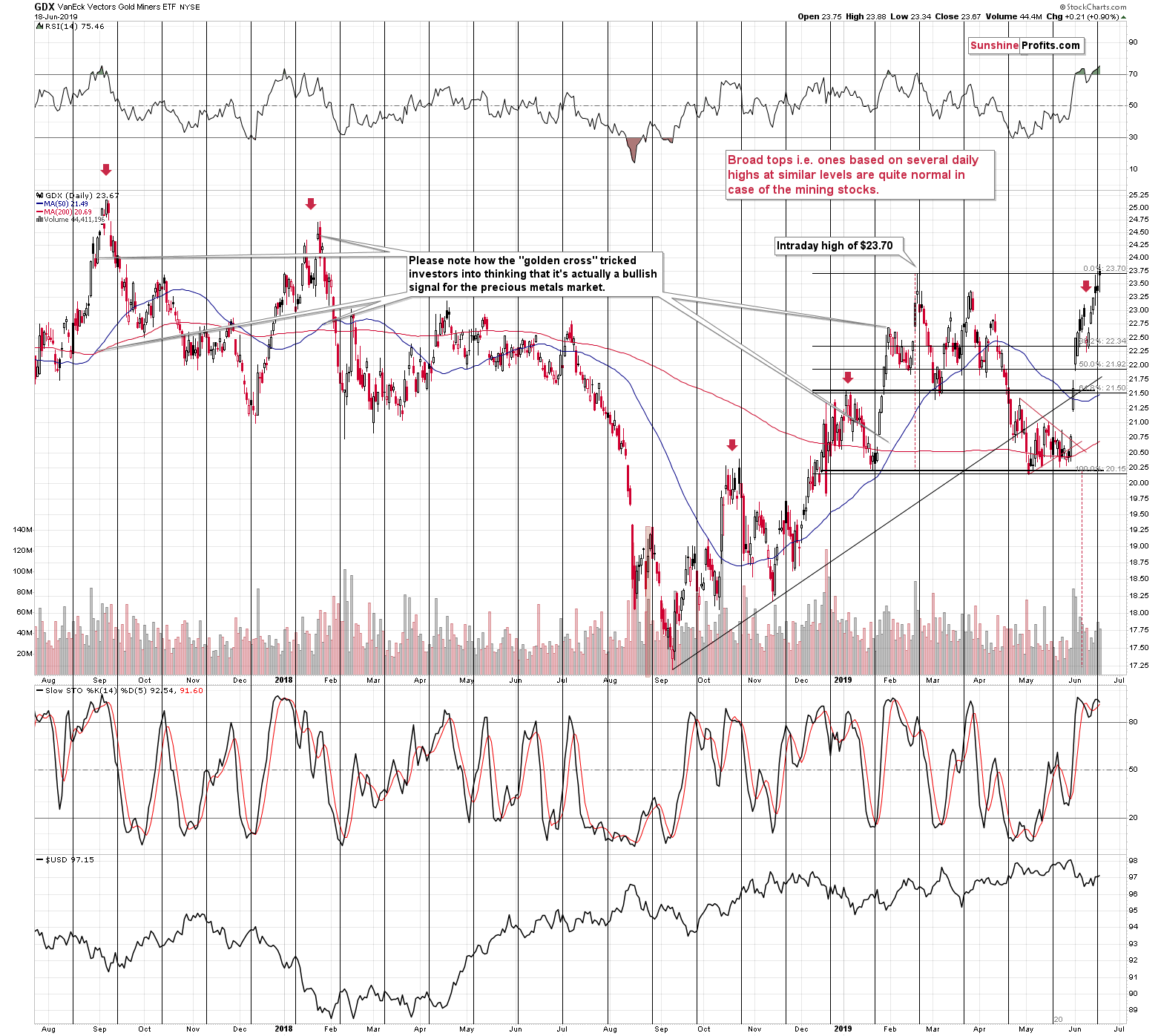

What about mining stocks?

The Same Question Goes for Miners Too

We see more or less the same thing. Mining stocks broke above the February high in an insignificant manner right after the cyclical turning point. The RSI above 70 shows that they are overbought. This along suggests that miners should take a breather and invalidate the breakout. Based on multiple other gold trading techniques (especially the long-term-oriented ones), it's likely that the decline will be much more than just a correction of the recent upswing.

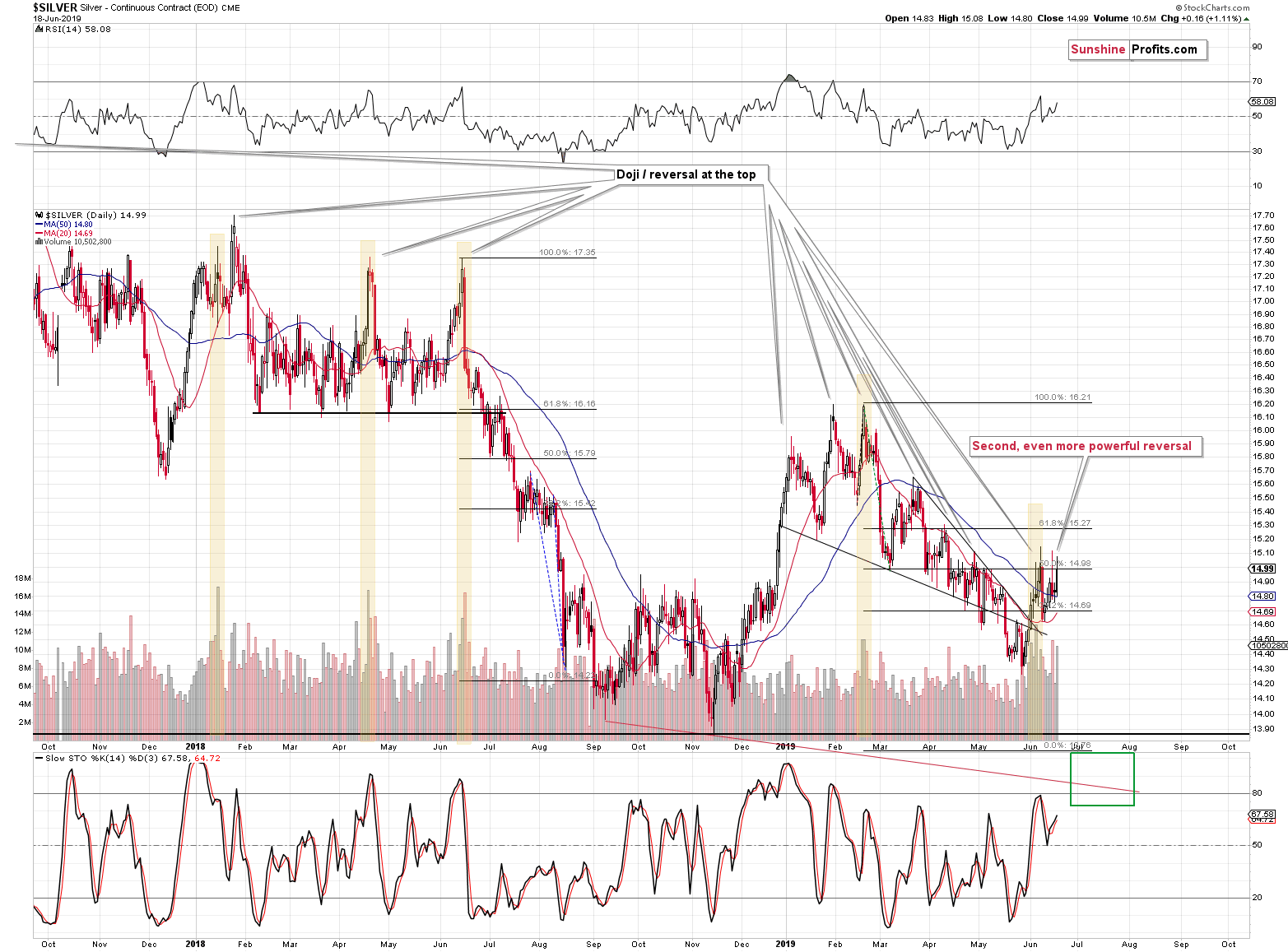

And silver?

No Breakout in Silver

Silver reversed for the third time, even though its rally in terms of the daily closing prices is more profound than the one of gold. Silver's outperformance at the tops is quite normal - it's definitely not a bullish sign.

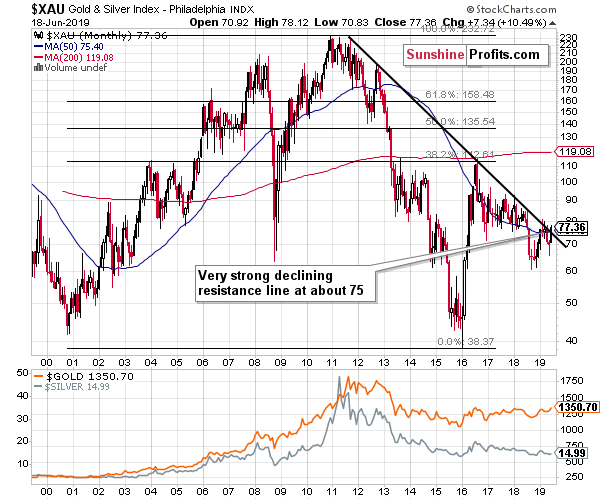

Let's turn our attention now to the big picture regarding the mining stocks and their under- and outperformance in the final parts of precious metals' rallies. It mightily helps in making sense of today's situation.

The Issue of Miners' True Strength

A move above this strong resistance line is possible, but it's highly unlikely that it would be significant or sustainable. Conversely, it's very likely that we will see a reversal and a big decline shortly after the small breakout is invalidated - in line with what we saw earlier this year.

As a reminder, the more important tops are used to create a given line, the more important it is from the technical point of view. Also, the more of the tops are used, the stronger the line becomes. The above-mentioned resistance line is based on five important tops and an additional confirmation of its strength in the form of XAU's inability to hold above it earlier this year. These five tops are:

- the late 2011 top

- the mid-2012 top

- the 2016 top

- the early 2018 top

- the mid-2018 top

All of them are very important and there's quite a few of them - usually the resistance lines are created based on just two extremes, and this time we have five of them. The implication is that this line is very unlikely to be broken, especially given the massive reversals in gold and silver that we saw recently.

So why did the miners move higher recently despite these reversals?

That's indeed the key question to ask. The reply may appear strange not only to those who have become interested in the precious metals market recently, but also to those, who have been in it for longer.

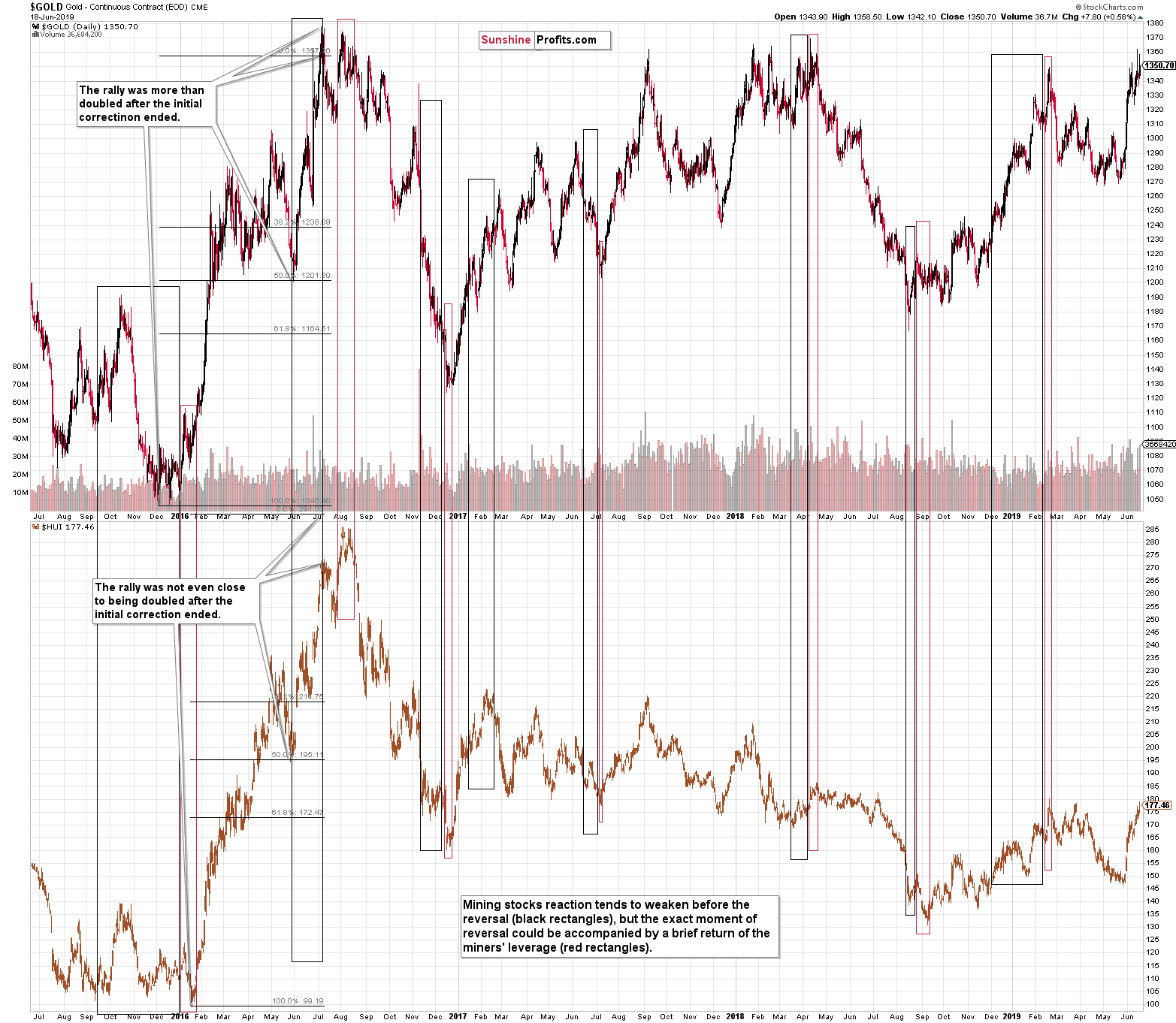

It is generally known that the mining stocks stop reacting to gold's movement before the move is reversed. Miners' usual outperformance wanes before tops, and the miners' dramatic decline becomes less dramatic or even stops altogether before gold bottoms.

However, what investors usually miss, is that in case of the really major turnarounds, there is also one additional stage of miners' relative performance. It's the part when miners fake the comeback of their regular strength. That's exactly how the early-2016 rally in the mining stocks started - with mining stocks' underperformance. Gold didn't make a new low in January 2016, but the HUI Index did. Of course, one swallow doesn't make a summer, and one exception from the rule is not enough to change the rule. The point is, however, that it was not the only exception - this phenomenon is actually quite common in case of major reversals. Please take a look at the chart below for details.

The early-2016 case is the most prominent one, but there were quite a few in the following months and years as well. Even the very end of the 2016 rally was accompanied by a small show of miners' strength.

The black rectangles mark the times when miners' reaction to gold's movement became weaker, and the red rectangles mark the cases when the strength was back right before the final reversal.

What does it mean? It means that if we are looking at a major top right now, this temporary strength in the mining stocks is very normal - it's not a game-changer, or a reason to ignore the huge reversals in gold and silver that we just saw.

Are we looking at a major top right now? Last week, gold reversed in a profound manner after reaching the resistance line based on the previous major tops and silver's intraday reversal was very volatile. Gold moved to a new high in terms of the daily closing prices yesterday but made no new intraday yearly high - and remains solidly below it in today's pre-market trading. Gold miners are at new yearly highs. That's exactly what a major top should look like.

Summary

Summing up, the combination of gold's reaching the very long-term resistance line, the immediate invalidation of the breakout to new 2019 highs, huge volume, proximity of the cyclical turning point, and RSI almost at the 70 level all suggest that the 2019 top for gold is in, and silver's price action clearly confirms it. Yesterday's strength in the mining stocks and today's monetary-news-based upswing in gold seem temporary and don't change the overall outlook, which remains down.

Today is exceptionally rich in monetary news, with the Fed playing the main role, so we might see more intraday volatility in the following hours. The turning points and the preceding rally, however, make it clear that ultimately - after today's volatile price action - gold is likely to decline.

We know the last few weeks, months, and years have been exhausting because not that much happened in the precious metals market - but it is exactly this kind of boring action that usually precedes the biggest price moves and biggest opportunities. This was even made into a trading technique. Bollinger bands become narrow when a given market is calm and seasoned traders know that when they are narrow, it's time to prepare for a huge move. Most people don't know that, and they get caught by surprise and only join the move once it's mostly over. It seems that we have this kind of situation in the precious metals right now. The patience will be well rewarded, especially that our medium-term downside target for gold remain intact.

Today's article is a small sample of what our subscribers enjoy regularly. To keep informed of both the market changes and our trading position changes exactly when they happen, we invite you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care