Today’s analysis is going to be different than the other ones. We usually discuss what happened on a given day, week, or month and we elaborate on what it changed and what it didn’t change in case of the outlook for gold, silver, and mining stocks. But not today. Today, we are going to focus on what didn’t happen. At the first sight it seems that this means that there was no new signal. That’s not the case. The three important “nothings” that we will discuss in today’s article have important implications for the following days. That is if one knows where to look.

Let’s start with the first chart (charts courtesy of http://stockcharts.com).

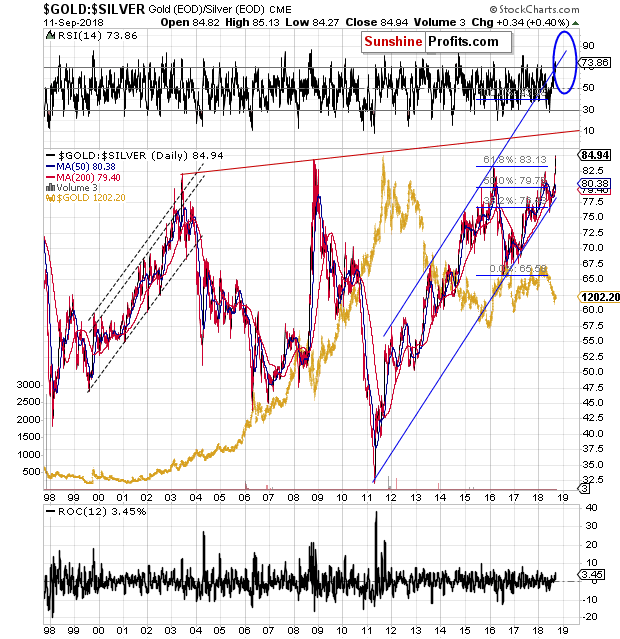

Nothing Changed in the Gold:Silver Ratio

The gold to silver ratio broke above the 2003, 2008, and 2016 highs and it didn’t move back below them. In this case, “nothing” means that the breakout is being verified and with each passing day when the ratio is above the previous highs, the continuation of the rally becomes more and more probable.

Moreover, since the rallies in the ratio tend to be sharp, it means that we can expect the continuation of the move that’s very visible. This most likely means a big decline in silver.

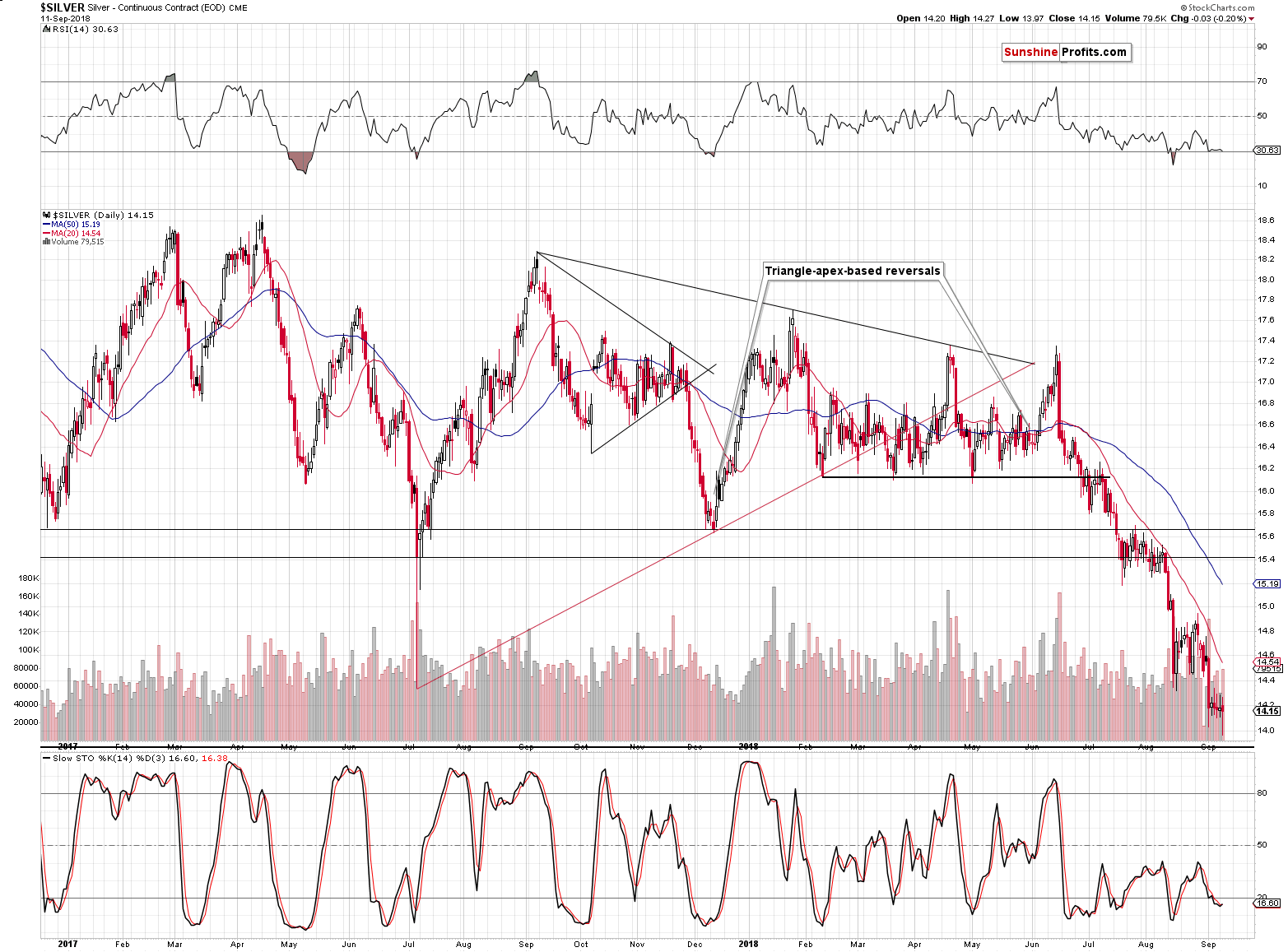

No Changes in Silver

And by saying “no changes”, we mean practically no changes in terms of the daily closing prices. Silver moves back and forth on an intraday basis, but ultimately it still ends the session at about $14.15 - $14.20. At least that’s what we saw in the last 5 sessions.

That’s interesting, because this decline (and many other declines) are characterized by periods of very high volatility that are followed by periods of very low volatility and then the cycle repeats, with no “average volatility” weeks. The pauses that we saw previously took place in early July, late July and early August and then in late August (ok, in case of the latter the volatility was higher than previously).

Taking the above 3 cases into account, we see a very specific pattern. The lower the volatility before the move, the bigger the volatility during the move i.e. the more profound the decline is.

The biggest decline took place just before the middle of August and the back and forth movement that preceded it was the calmest period in many weeks and months. The only case when silver was calmer is… right now. Consequently, we may be just before the biggest short-term decline of 2018. And perhaps of the decade.

Still, knowing how silver likes to provide fake signals just before big declines, we wouldn’t be surprised to see a one final upswing that will get people unnecessarily excited. So, even if we see a sudden $0.50 rally shortly, it will not be a bullish signal by itself. Conversely, if such a move was accompanied by weak mining stock performance, it would be a perfect bearish confirmation. Naturally, such a brief rally is not something that we expect to see, but if it happened, it would not be surprising – it would be within the definition of “normal” in case of silver and its declines.

Overall, the current silver price projection is very bearish.

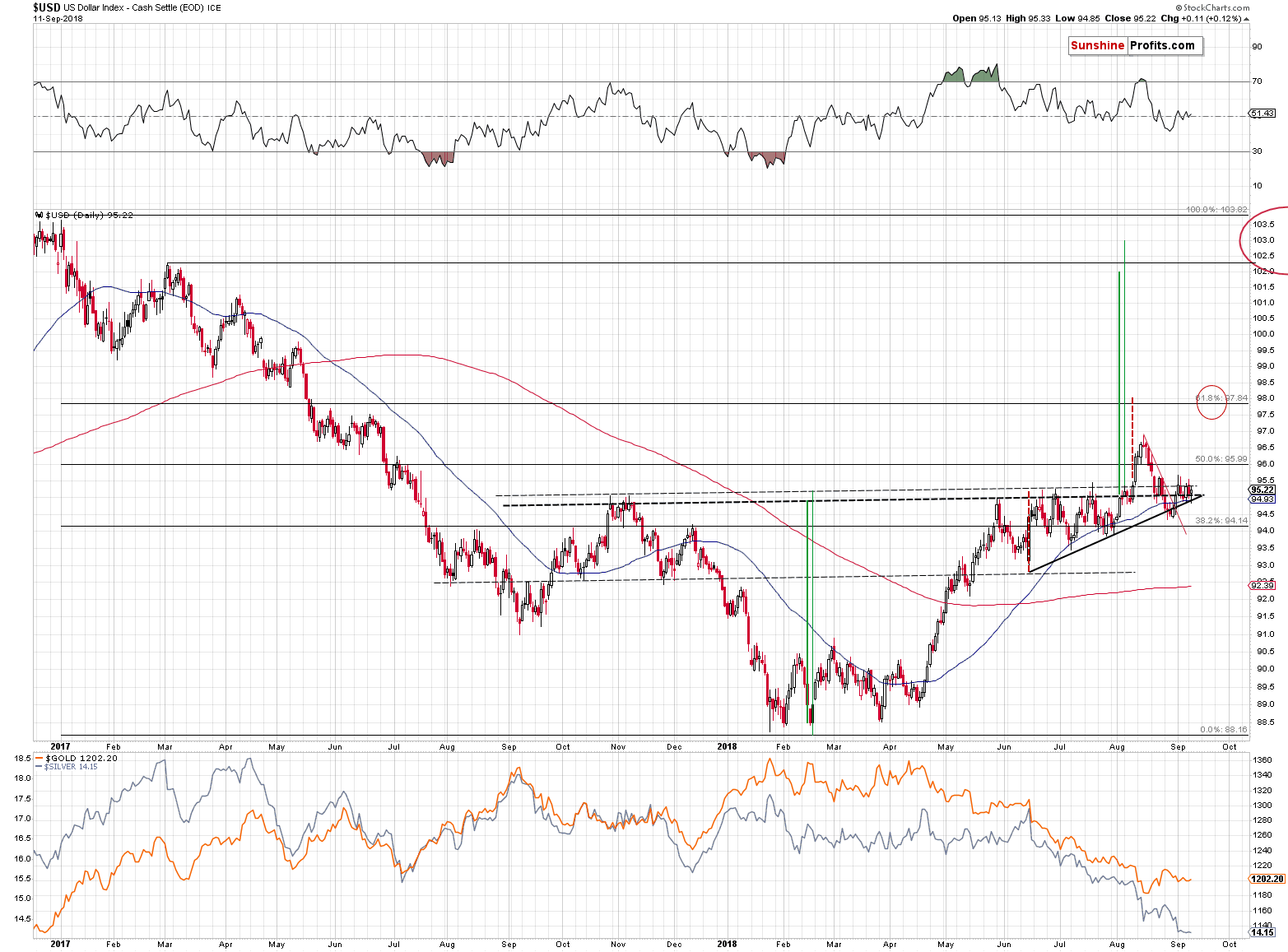

Still No Changes in the USD Index

Finally, we would like to emphasize that nothing really happened in case of the USD Index. It continues to trade back and forth above the neck level of the reverse head-and-shoulders formation. The formation is therefore active and has profoundly bullish implications. It indicates a move to 102 – 103, which will likely trigger a huge decline in the precious metals sector. As we discussed earlier this month, there are multiple other factors that point to the massive decline in the PMs and the situation in the USDX simply confirms them.

Summary

Summing up, it’s very likely that the pause in the precious metals market is over and the next big move down is already underway. We entitled our September the 4th, 2018 analysis Gold and Silver’s Stormy September. The current pause is most likely the naturally occurring calm before the storm. A profitable storm.

Details available to Subscribers only.

Details available to Subscribers only.

Click here to subscribe.

Please note that the above is based on the data that was available when this essay was published, and we might change our views on the market in the following weeks. If you’d like to stay updated on our thoughts on the precious metals market please join our subscribers today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts