What a week! On Tuesday, gold prices hit a six-year peak of almost $1,440. But they declined since then to almost $1,400. What is happening? We got the Fed speaking... Let's dive in to the implications of what has been said.

Rally in Gold Ends

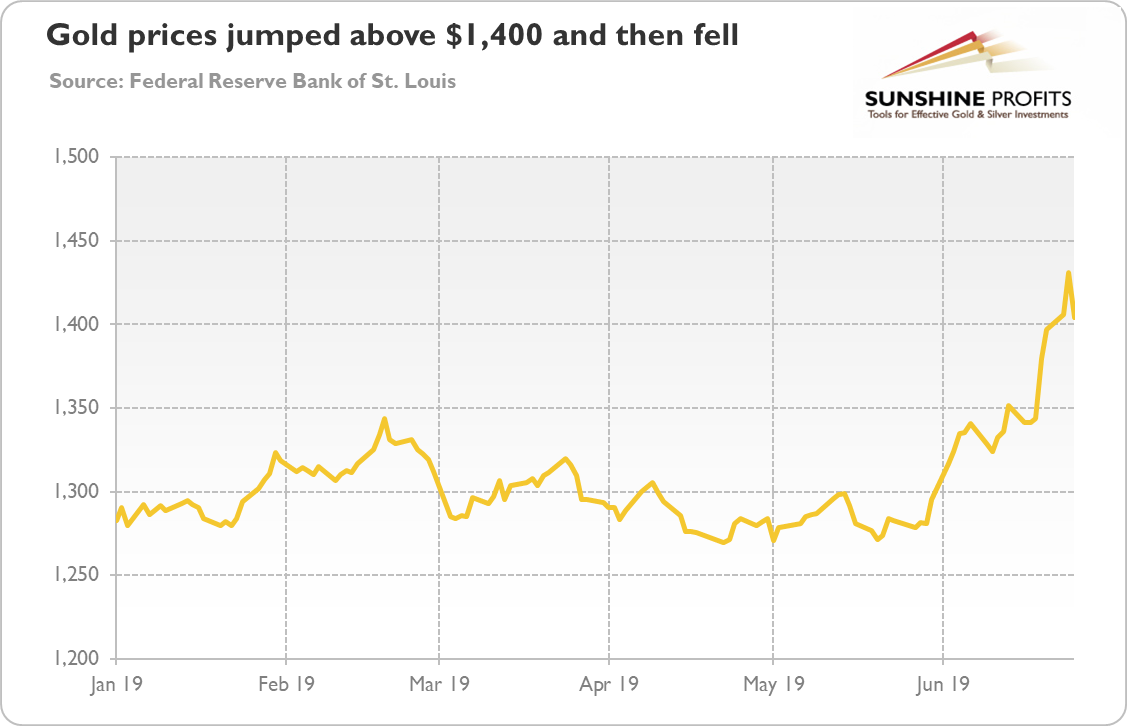

As we reported two days ago, the price of gold has jumped above $1,430 after the dovish FOMC meeting last week. However, the rally did not last long. Yesterday, the price of gold fell to a level slightly above $1,400, as the chart below shows. What happened?

Chart 1: Gold prices (London P.M. Fix, in $) from January to June 2019.

In a way, nothing special. Corrections are normal. What goes up must come down. However, gold reacted also to the comments from the Fed officials. In particular, St. Louis Fed President James Bullard argued in an interview with Bloomberg that a 50 basis points rate cut in July would be "overdone". Yup, it's the same man who favors two interest rate cuts this year to provide the economy with 'soft landing'. And it's the same person who dissented at June FOMC Meeting, wanting an immediate 25-basis points cut. So, if uber-dove does not want a half-point interest-rate cut in July - "I don't think we have to take huge action," he said - you can be sure that it means really something.

It implies that economy is still doing reasonably fine. Indeed, even Bullard himself admitted that he argued for an interest-rate cut as an 'insurance' move, to help insulate against a possible economic slowdown.

Insurance... interesting. It sounds convincing. After all, an ounce of prevention is worth a pound of cure, as all precious metals investors know (gold serves an a portfolio insurance). However, shouldn't the Fed be data-dependent?

Let's move to Powell. He talked at the Council on Foreign Relations in New York, pointing out again the greater uncertainty about trade and worries about the state of the global economy:

The question my colleagues and I are grappling with is whether these uncertainties will continue to weigh on the outlook and thus call for additional policy accommodation. Many FOMC participants judge that the case for somewhat more accommodative policy has strengthened. But we are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment. Doing so would risk adding even more uncertainty to the outlook. We will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.

Neither Powell's comments did sound as an affirmation of a 50-basis points, or even a 25-basis points cut as soon as in July. Therefore, both Bullard and Powell dampened investors' expectations of ultra-dovish Fed moves next month. Last week, the market odds of a 50-basis points cut were 38.5 percent. Now, they are at 22 percent. The revised forecasts of the interest rates path created downward pressure on the gold prices.

Implications for Gold

But what is really important here is that the markets still assign 22-percent probability of a 50-basis points cut and 78 percent probability of 25-basis points cut. The scenario of Fed keeping rates unchanged is not taken into account at all! Maybe we are a bit naïve, assuming that the policymakers are entirely rational, and their actions are data-based, but for us the market expectations are overly dovish. They are an important downward risk for gold. If those expectations get downgraded further, the price of gold may struggle.

And they may move lower if Trump and Xi reach a trade deal, or a trade truce at least. Anything can happen, but U.S. Treasury Secretary Steven Mnuchin said yesterday that the trade deal between the United States and China is "about 90%" complete. If the trade wars de-escalate, uncertainty about the trade policy will vanish, while positive sentiment will return to the financial markets. The Fed would lose then an excuse to cut interest rates. Keep that in mind, while investing in the precious metals market!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits' Gold News Monitor and Market Overview Editor