Who wouldn't know the Spaghetti Western The Good, the Bad and the Ugly? In today's analysis, we have important pieces of economic data starring in the first two roles. Retail sales and industrial production rebounded in May, while the Empire State Index plummeted in June. How will these reports affect tomorrow's FOMC decision and the gold market?

The Good

Friday brought us some good economic news. First of all, the U.S. retail sales rose 0.5 percent in May, according to the government. It means an acceleration from 0.3-percent increase in April. Moreover, the latter change was revised up from -0.2 percent, which means that reports of the death of the American retail sales were greatly exaggerated. Moreover, the retail sales excluding the automotive sector rose also 0.5 percent, which indicates broad-based gains.

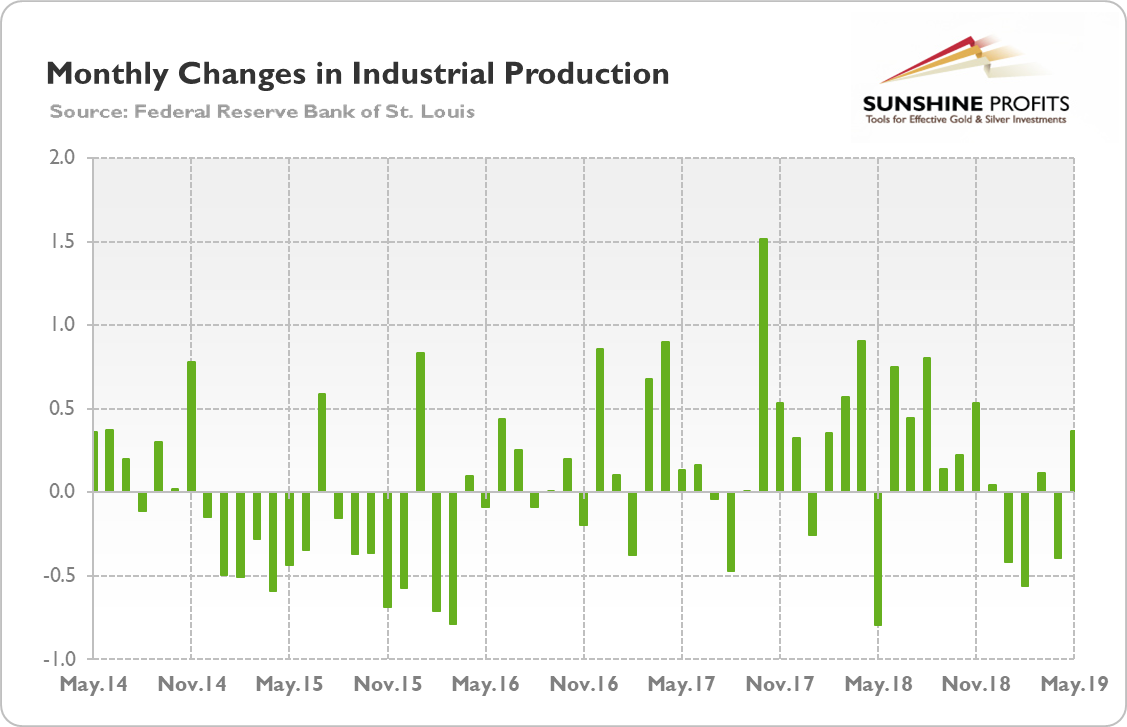

Second, industrial production rose 0.4 percent in May after declining -0.4 percent in April, according to the Fed. It was the strongest monthly increase since November 2018, as one can see in the chart below. Although the growth primarily reflected higher output of automotive products, it was generally well distributed among the many industrial production components.

Chart 1: Monthly changes in industrial production from May 2014 to May 2019.

The gain in industrial production, together with the rebound in retail sales, indicates an important economic improvement in May. It also shows that the worries about the health of the overall economy and the damage of the trade wars have been, at least so far, overstated. Both the consumer sector and industrial production rebounded after the softness in the first quarter. These reports will probably not change the U.S. central bank's overall assessment of the economy, but they should ease the pressure to act. Hence, the Fed is not likely to cut interest rates at the upcoming meeting. Instead, it should remain in a 'wait-and-see' mode.

The Bad

However, on Monday we have seen some negative data coming in. We mean here mainly the fact that the Empire State Manufacturing Index plummeted 26.4 points from 17.8 in May to negative 8.6 in June, according to the New York Fed. It was the first negative reading for the index in more than two years and the largest monthly decline on record. Importantly, the new-orders index sank 21.7 points to negative 12. The index for future business conditions also fell, declining five points to 25.7.

The sharp slide adds to the worries about the state of the US economy. However, the thinking is the decline might be just a temporary drop resulting from Trump's threat to impose tariffs on Mexico. But with the deal on immigration reached and tariffs suspended, the index may rebound in the near future.

Gold: The Ugly, Seriously?

What does it all mean for the gold? While the Empire State Index plunged, the overall picture of the U.S. economy has improved, as both the retail sales and the industrial production rebounded. Investors better remember that regional indices are based on businesses' surveys, and can be quite volatile.

Hence, it seems that the current market odds of the Fed's interest rate cut have swung a little too far. It might be the case that the Wall Street takes the Fed as a hostage, but the financial market is probably ahead of cuts. In the future markets, two rate cuts by the end of this year are already priced in. Not one, but two! It sounds as if we would be already in the recession! When we checked last time, it was not the case. This is why we believe that traders overestimate the dovishness of the Fed.

The same applies to the gold market. The yellow metal rallied at the turn of May and June - partially on dovish expectations about the future Fed's stance. But what will happen if the Fed fails to meet the market's expectations? The price of the gold may decline. Just sayin'. We will see soon - stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits' Gold News Monitor and Market Overview Editor