Talk of a synchronized world - all three economic superpowers are in a recession! The U.S. suffers from industrial recession, Japan from export recession, while Germany may fall into a broad economic recession. Will the gold market warm up to these news?

Recent U.S. Data Shows Industrial Recession

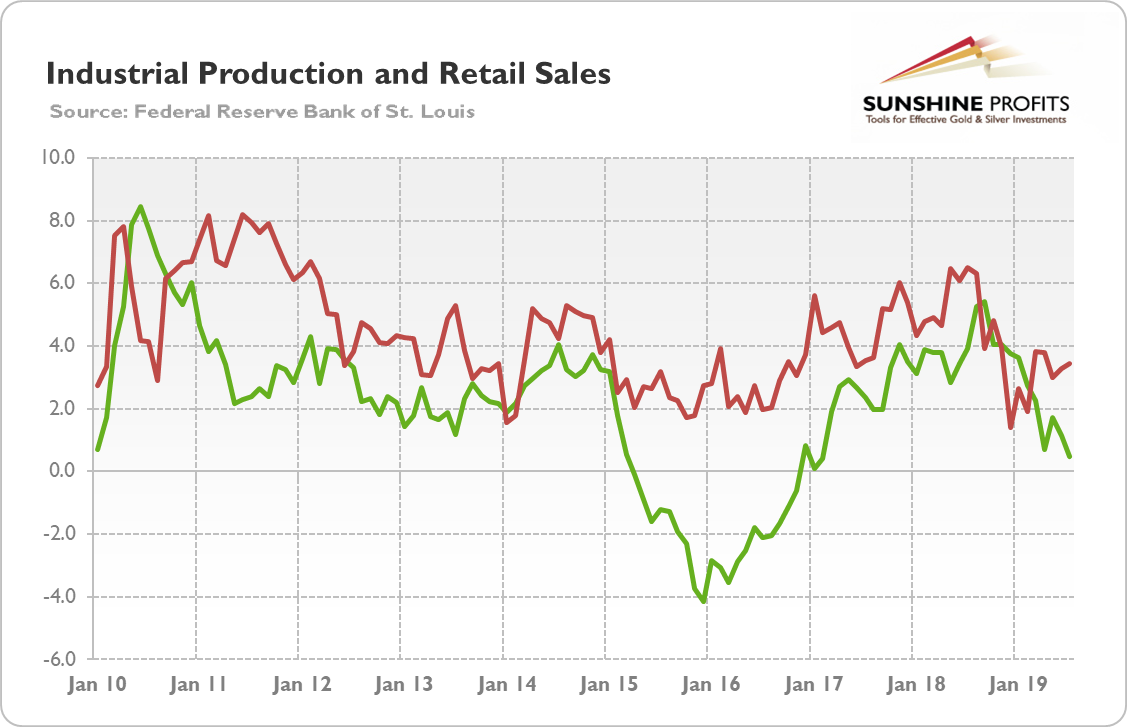

The recent inversion of the yield curve has sparked recessionary fears. Some of the newest pieces of the U.S. economic data confirm the gloomy outlook. For example, the industrial production fell 0.2 percent in July, the second drop in the past four months, according to the Federal Reserve, as one can see in the chart below. Although the scale of slump might be overstated due to the Hurricane Barry hitting oil production in the Gulf of Mexico, the industrial sector remains in a technical recession.

However, other recent economic reports have been more positive. The retail sales surged 0.7 percent in July, beating expectations. As the chart below shows, there is also an improvement on an annual basis. What is more, when omitting auto dealers and gasoline stations, retail sales scored an even stronger gain of 0.9 percent last month.

Chart 1: Annual percentage change in the US industrial production (green line) and the retail sales (red line) from January 2010 to July 2019.

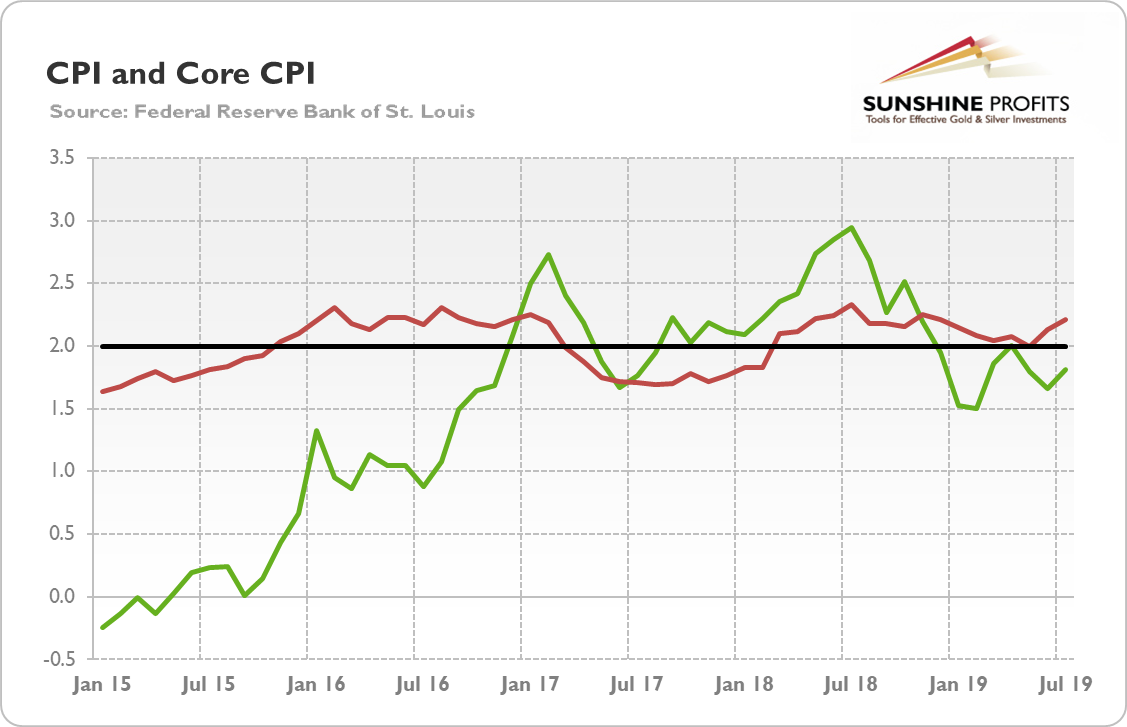

Moreover, the CPI increased 0.3 percent in July after rising 0.1 percent in June, according to the BLS. The core CPI also rose 0.3 percent, the same increase as in June. On an annual basis, the overall inflation rate jumped 1.8 percent, an acceleration from 1.6-percent change in June, while the core CPI rose 2.2 percent over the last 12 months, slightly more than the 2.1-percent increase for the period ending June, as the chart below shows.

Chart 2: Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to July 2019.

Although higher inflation is not good news for the consumers, it can soothe the nerves of doves among the FOMC and all those believing that subdued inflation is something bad for the economy. However, the markets still expect two more interest rate cuts this year - the modest acceleration in inflation notwithstanding. It's the best fundamental combo for gold: higher inflation but still dovish Fed.

Japanese and German Exports Suffers

Although the factory sector is in technical recession, the U.S. economy looks on a much more solid footing than Japan or the Eurozone does. In the Land of the Rising Sun, the exports fell 1.6% from a year earlier, marking eighth decline in a row. At the same time, manufacturers' confidence turned negative for the first time in over six years

When it comes to Germany, the Eurozone's economic powerhouse, it might be already in recession. The GDP fell 0.1 percent in the second quarter of 2019. To make matters worse, the Bundesbank said on Monday that the German economy could have continued to shrink over the summer. The downturn stems from the weak industrial production amid a dearth of orders. The trade wars finally hit both export-focused economies. Although the services sector should provide the support for Germany (and Japan), there are some signs that the industrial downturn will be felt in the labor market.

Given that slump and the fact that inflation in the Eurozone is now running at 1 percent, the European Central Bank could decide in September on further stimulus, perhaps even bigger than expected. It should weaken both the euro and gold against the U.S. dollar. However, it can also increase the safe-haven demand for gold, if the ECB's action scares European investors.

Implications for Gold

What does it all mean for the gold market? On the one hand, the U.S. remains in much better shape than Japan or the Eurozone. This should support the U.S. dollar, creating downward pressure on the gold prices. On the other hand, the global slowdown may eventually spread into the U.S. one day. When the recession arrives to the States - and the yield curve inversions suggests that it is only a matter of time - gold should shine.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits' Gold News Monitor and Gold Market Overview Editor