Finally! The core PCE Index hit the Fed’s 2-percent target for the first time in six years. Does this mean a revolution in American monetary policy? And what about the yellow metal?

Target Reached!

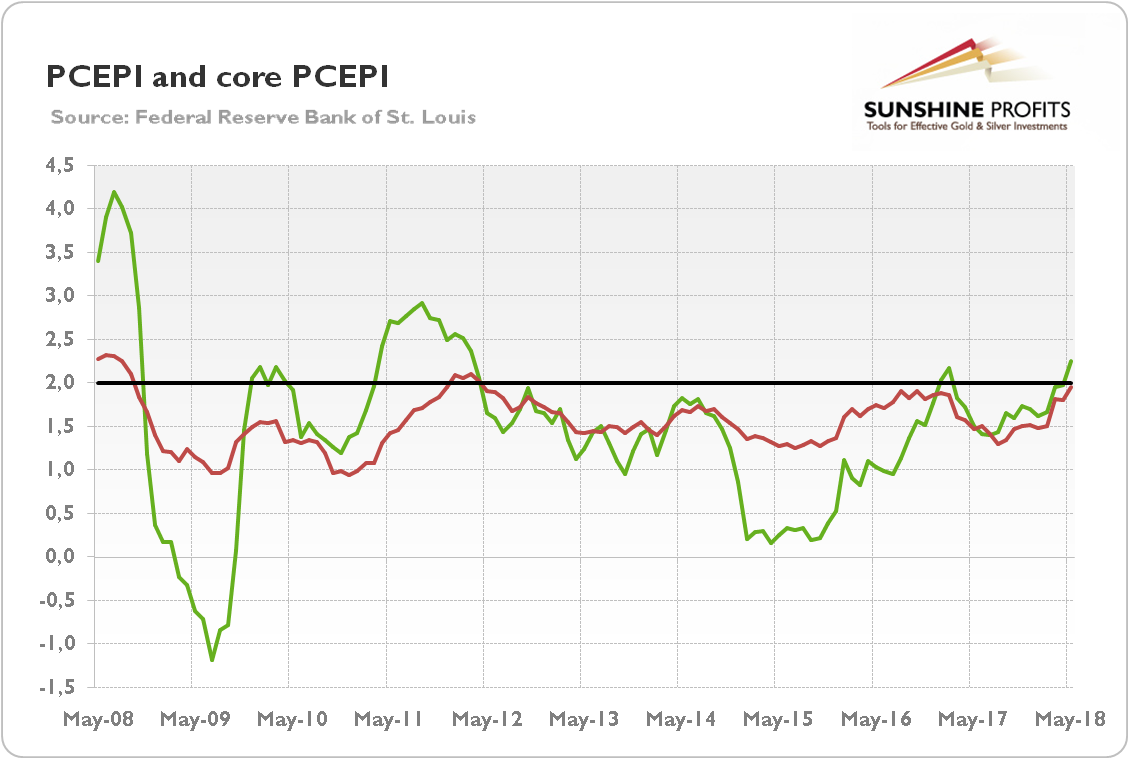

Last week, the Bureau of Economic Analysis released the May edition of the Personal Income and Outlays report. Both the overall and core versions of the PCE index rose 0.2 percent in May. On the annual basis, the headline rate rose 2.3 percent, while the core inflation hit 2 percent, the Fed’s target, for the first time since April 2012, as one can see in the chart below.

Chart 1: PCEPI (green line) and core PCEPI (red line) over the last ten years.

It means that after years of frustration over stubbornly low inflation, the Fed has accomplished its mission. We know, it’s just a one-month accomplishment, but there are actually some premises suggesting that the rate of inflation will stay around two percent. Remember that Powell has recently said that inflation may rise above the 2 percent target over the next few months due to the higher oil prices.

Will Inflation Make Fed Mad?

The U.S. central bank has already indicated that it plans to hike the federal funds rate twice this year. And Chair Powell has recently said that the Fed would cool things off if inflation were to persistently run above 2 percent. Is the U.S. central bank going to hike interest rates like mad? Well, if inflation goes well above the 2-percent target, the Fed would push interest rates even higher to curb rising prices.

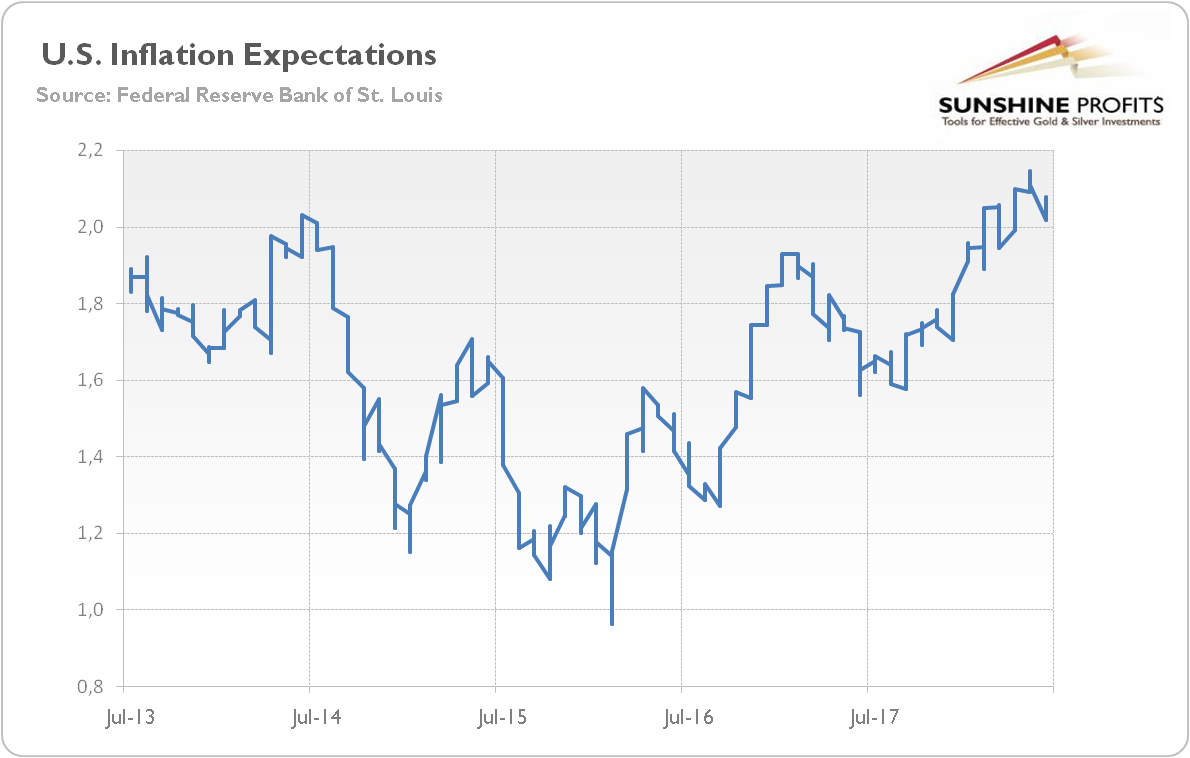

However, the FOMC should continue its strategy of gradually raising interest rates due to the lack of consensus, which reflects uncertainty about how high inflation will rise. The current uptick results largely from higher oil prices and was expected by the Fed. It’s no surprise that could change the minds of the FOMC members. Moreover, wages still lag, despite the very low unemployment rate. So, as Chairman Jerome Powell has recently said, the Fed is “not ready to declare victory until we sustain that over time, which we haven’t done yet.” And indeed the FOMC remains divided – as a reminder, the latest dot plot shows that only one member adopted a slightly higher interest-rate path. Neither investors expect that inflation will blast off into space, as the next chart shows. Hence, don’t expect a revolution – but you shouldn’t underestimate the hawkishness of the new FOMC either.

Chart 2: U.S. inflation expectations (5-year breakeven rate) over the last five years (weekly averages, in %).

Implications for Gold

And what about the yellow metal? Gold has not had a good time recently. But the rise in inflation should be positive for gold, right? Isn’t it an inflation hedge, after all? Well, it’s not so simple. Gold reacts strongly to high and accelerating inflation, like in the 1970s. However, the current inflation is completely different. It is hardly high and accelerating. The Fed has reached its target for the first time in six years, despite all the unconventional monetary policy, including quantitative easing.

It’s bad news for gold. The shiny metal likes high inflation – and not low inflation combined with rising interest rates. The implication is thus simple: the price of gold is not likely to rally significantly unless inflation really gets out of control or… eases, taking the pressure off central bank to hike rates. The Fed has to stop tightening, at least relatively to the BoJ or ECB to send gold prices significantly higher. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview