SPX continued losses. CPI slowed down. IMF cut its projection of global growth. What does it all imply for the gold market?

Stock Market Turmoil Continues

Let’s start from the US stock market. In the last edition of the Gold News Monitor, we discussed the Wednesday’s stock market turmoil. But the bear market continued later. On Thursday, the SPX extended its losses, declining about 2 percent. It means that traders continued their liquidation sale of risky assets and moved into safe havens, such as gold. The yellow metal jumped above $1,220 on Thursday, as one can see in the chart below.

Chart 1: Gold prices from October 10 to October 12, 2018.

In our Stock Trading Alerts you can read about the current correction from trading perspective. Fundamentally, we do not see reasons to panic. At least not yet. Of course, the financial system is nowadays quite fragile as it used to live on a drip from the Fed. The tightening of monetary policy ends the year of ultra low interest rates and easy money, so certain corrections are inevitable. However, the bond yields are still historically very low, so the elevated stocks valuations might be actually justified. Hence, gains in gold might be temporary, unless the correction transforms into a genuine bear market, or the Fed becomes more dovish.

Inflation Slows Down

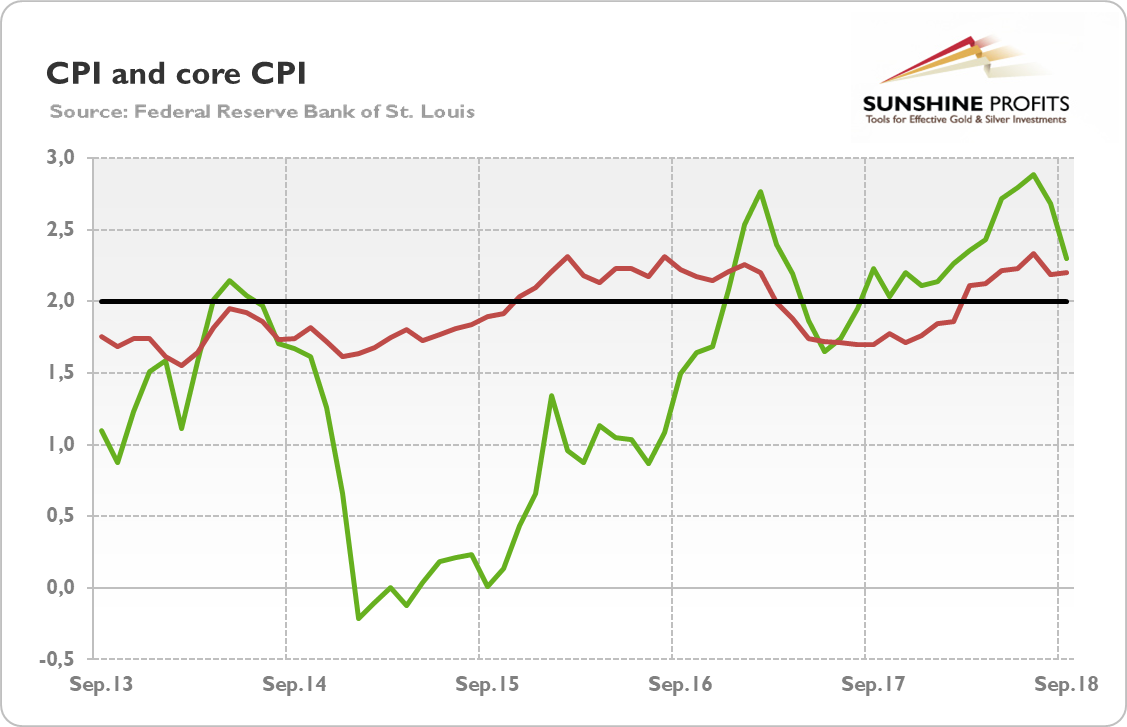

Or we will see the acceleration in inflation. But now we’re seeing the opposite. The CPI rose 0.1 percent in September, following an increase of 0.2 percent in August. The core CPI also moved up 0.1 percent, the same change as in the previous month. Over the last 12 months, the consumer prices jumped 2.3 percent, compared to 2.7 percent increase in August. The slowdown was mainly caused by a notably smaller increase in energy prices. The index for all items less food and energy climbed 2.2 percent, the same as last month, as the next chart shows.

Chart 2: CPI (green line, annual change in %) and core CPI (red line, annual change in %) over the last five years.

Hence, the inflationary pressure eased somewhat in September. However, inflation is still slightly above the Fed’s target. So we don’t expect any changes in the Fed’s policy of gradual hiking the federal funds rate. Surely, trade disruptions and rising shelter prices may actually support inflation in the near future, but there will be no price revolution. And we bet that the new FOMC with Powell as a chair will not allow for a sudden surge in inflation. Precious metals investors should remember about that.

IMF More Pessimistic about Global Economy

Gold should also shine if the global economy significantly slows down or enters the recession. The gold bulls should welcome the new edition of the World Economic Outlook, as the IMF cut its projection of global growth in 2018-2019 by 0.2 percentage point from 3.9 to 3.7 percent. Importantly, the organization also downgraded its forecast for the US economic growth from 2.7 to 2.5 percent in 2019 to reflect the impact of protectionist trade measures. And the balance of risks deteriorated, as “downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.” The trade barriers and political uncertainty rose, while the fiscal stimulus is likely to soften next year. Moreover, the Global Financial Stability Report, also written by the IMF, finds that “global near-term risks to financial stability have increased somewhat, reflecting mounting pressures in emerging market economies and escalating trade tensions.”

However, the global economic expansion continues and most of the risks mentioned by the IMF concern the emerging countries which are sensitive to a strong greenback and rising dollar-denominated rates. The bottom line is thus that some caution is warranted, but it isn’t quite time to panic.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview