Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Bitcoin Trading Alert: New Rally Might Be Close

June 27, 2014, 2:12 PM -

Forex Trading Alert: USD/CAD – At Key Support Lines

June 26, 2014, 5:25 PM -

Oil Trading Alert: Crude Oil – Support vs. Resistance

June 25, 2014, 7:13 AM

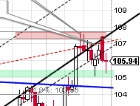

On Tuesday, crude oil moved higher as stronger than expected U.S. data boosted demand for the commodity. However, light crude reversed as investors sold it for profits for a second session in a row. Because of these circumstances, crude oil declined to its nearest support zone. Will oil bears be strong enough to push the price below it?

-

Forex Trading Alert: GBP/USD – Another Fakeout

June 24, 2014, 1:14 PM

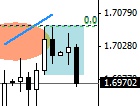

Earlier today, the British pound declined sharply against the greenback after Bank of England Governor Mark Carney testimony. Later in the day, sterling extended losses after data showed that Conference Board consumer confidence index jumped to 85.2 this month from 83.0 in May (it’s worth noting that this was the highest reading since January 2008), while the number of new home sales also rose to a six-year high, increasing 18.6% in May ( the highest level since May 2008 and the largest monthly increase since January 1992). These strong bullish numbers boosted the U.S. dollar and triggered a sharp decline in the GBP/USD pair. Where could the exchange rate drop after another fakeout?

-

Bitcoin Trading Alert: Bitcoin at Crossroads

June 24, 2014, 11:47 AM -

Oil Trading Alert: Crude Oil –Higher Short-Term, Lower Longer-Term?

June 23, 2014, 1:48 PM

On Friday, crude oil gained 0.54% as ongoing worries over the potential of supply disruptions from Iraq continued to weigh on the price. As a result, light crude climbed above the resistance line, invalidating earlier breakdown. Will this bullish factor trigger further improvement in the short term?

-

Stock Trading Alert: Another New All-Time High – Will Uptrend Accelerate?

June 23, 2014, 7:05 AM -

Bitcoin Trading Alert: Bitcoin Wavering around $600 – Which Way Will It Go?

June 20, 2014, 11:36 AM -

Oil Trading Alert: Crude Oil – Breakdown or Trap?

June 18, 2014, 1:32 PM

On Tuesday, the price of crude oil wobbled between gains and losses throughout the session as mixed data and profit taking weighed on investors’ sentiment. As a result, light crude reversed after an increase to the resistance zone and declined below an important medium-term support line. Will this event be strong enough to trigger a sizable correction?

-

Forex Trading Alert: AUD/USD - The News Is Negative

June 18, 2014, 9:14 AM

Earlier today, the Australian dollar declined against its U.S. counterpart after the Reserve Bank of Australia comments. Later in the day, we saw further deterioration as the Labor Department reported that the U.S. CPI rose 2.1% on year in May (and 0.4% from April). This the fastest increase in annual inflation since October 2008 sparked demand for the greenback and pushed AUD/USD below two important support lines. How low could the exchange rate drop from here?

-

Bitcoin Trading Alert: Tense Days Ahead for Bitcoin

June 17, 2014, 12:31 PM -

Stock Trading Alert: Short-Term Uncertainty As Stocks Fluctuate, Is Correction Over?

June 16, 2014, 8:14 AM -

Bitcoin Trading Alert: Depreciation, Reversal – Which Will Prevail for Bitcoin?

June 13, 2014, 11:31 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts