Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Gold & Silver Trading Alert: Gold’s Plunge, Dollar, and CCI

September 3, 2014, 12:41 PMThe precious metals sector moved sharply lower yesterday – in tune with its medium-term trend. The decline was to a large extent connected with the breakout in the USD Index. It seems that it is the U.S. dollar that will determine the short-term moves in PMs and miners in the coming days and in today’s alert we focus on this relationship. The CCI Index seems to be in a particularly interesting position as well and this is something that gold & silver traders should be aware of.

-

Oil Trading Alert: Stronger Greenback and Its Implications for Crude Oil

September 3, 2014, 12:38 PMOn Tuesday, crude oil lost 2.70% as the combination of disappointing Chinese data and stronger U.S. dollar weighed on the price. Because of these circumstances, the commodity bounced down the medium-term resistance zone and approached the recent lows. Will they withstand the selling pressure?

-

Forex Trading Alert: USD/JPY – Rally Is Gaining Steam

September 2, 2014, 12:50 PMEarlier today, the Institute for Supply Management reported that its manufacturing purchasing managers’ index increased to 59.0 in August, beating expectations of a drop to 56.8. As a result, U.S dollar climbed to an eight-month high against the yen. Will USD/JPY test the strength of Nov high?

-

Bitcoin Trading Alert: Bitcoin Might Move Shortly

September 2, 2014, 10:23 AM -

Oil Trading Alert: Crude Oil – Time For Rebound?

September 1, 2014, 2:19 PMOn Thursday, crude oil gained 0.97% as escalating tensions in eastern Ukraine and upbeat U.S. data weighed on the price. In this way, light crude broke above the upper line of the consolidation range. What’s next for the commodity?

-

Stock Trading Alert: Indexes Remain Close To Long-Term Highs – Which Direction Is Next?

September 1, 2014, 2:16 PMS&P 500 index is close to the level of 2,000 ahead of long holiday weekend. Will the uptrend extend?

-

Bitcoin Trading Alert: $500 as Current Downside Barrier

August 29, 2014, 12:35 PM -

Forex Trading Alert: AUD/USD – Currency Bulls In Charge

August 28, 2014, 12:38 PMEarlier today, Australia's second quarter private new capex (capital expenditure) data showed a gain of 1.1%, beating expectations for a 0.3% quarter-on-quarter fall. Thanks to these bullish numbers, AUD/USD extended gains and broke above the nearest resistance levels. How much more room to rally does the exchange rate have?

-

Stock Trading Alert: Negative Expectations Following Short-Term Consolidation

August 28, 2014, 12:35 PMS&P 500 remains relatively close to all-rime high, as investors’ sentiment slightly worsens. Will uptrend continue? Or is it due for a pull-back?

-

Oil Trading Alert: Crude Oil – Trading In Narrow Range – For Now

August 27, 2014, 2:44 PMOn Tuesday, the price of light crude climbed to an intraday high of $94.35 after better-than-expected U.S. economic data. Although the commodity gave us some gains in the following hours, crude oil gained 0.50%. Did this increase change anything in the very short-term picture?

-

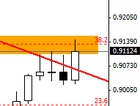

Forex Trading Alert: Will USD/CHF Rally Above 0.9200?

August 26, 2014, 2:39 PM

Earlier today, the U.S. Commerce Department showed that total durable goods orders (with transportation items) rose by 22.6% last month, well above expectations for an increase of 7.5%. Despite this bullish data, core durable goods orders (without volatile transportation items) declined by 0.8% in July, missing forecasts for a 0.5% gain. As a result, the U.S. dollar moved lower against major currency pairs. Did this drop change the USD/CHF outlook?

-

Bitcoin Trading Alert: Bitcoin Market Provides Clues for Investors

August 26, 2014, 11:50 AM -

Stock Trading Alert: Indexes May Open Higher As Investors’ Sentiment Improves

August 25, 2014, 8:05 AM -

Bitcoin Trading Alert: Continuation of a Move up

August 22, 2014, 12:57 PM -

Forex Trading Alert: USD/CHF – Time for Correction?

August 21, 2014, 4:49 PM

Earlier today, the U.S. dollar moved lower against the Swiss franc as investors jumped out to the sidelines and sold the greenback for profits waiting for the Federal Reserve Chair Janet Yellen's speech before the annual Jackson Hole economic symposium on Friday. As a result USD/CHF reversed and invalidated small breakouts above important levels. Does it mean that correction is just around the corner?

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts