In recent days, the U.S. dollar moved sharply lower against the Swiss franc, which suggests further deterioration. But do currency bears have enough arguments to do this in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8006; the initial downside target at 0.7730)

EUR/USD

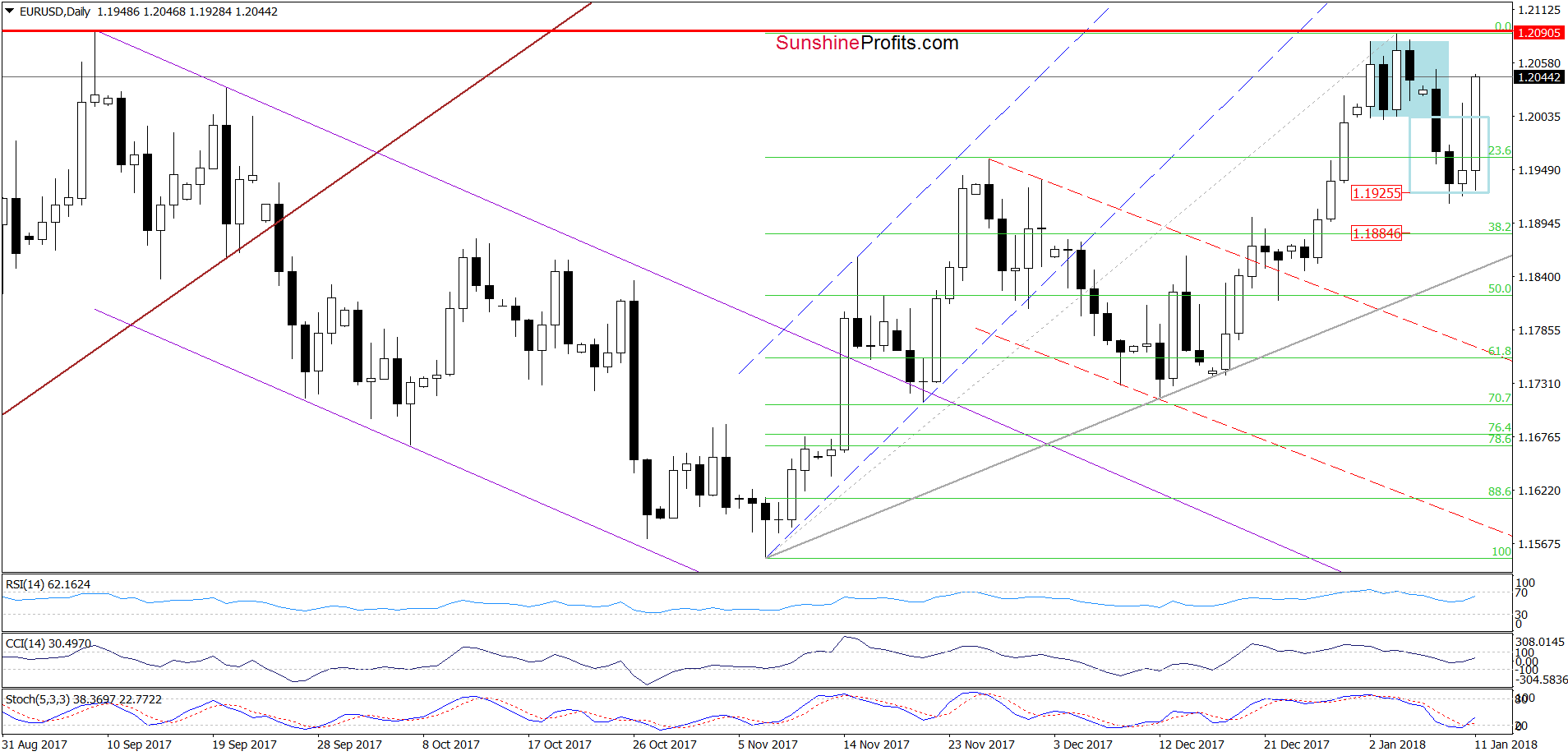

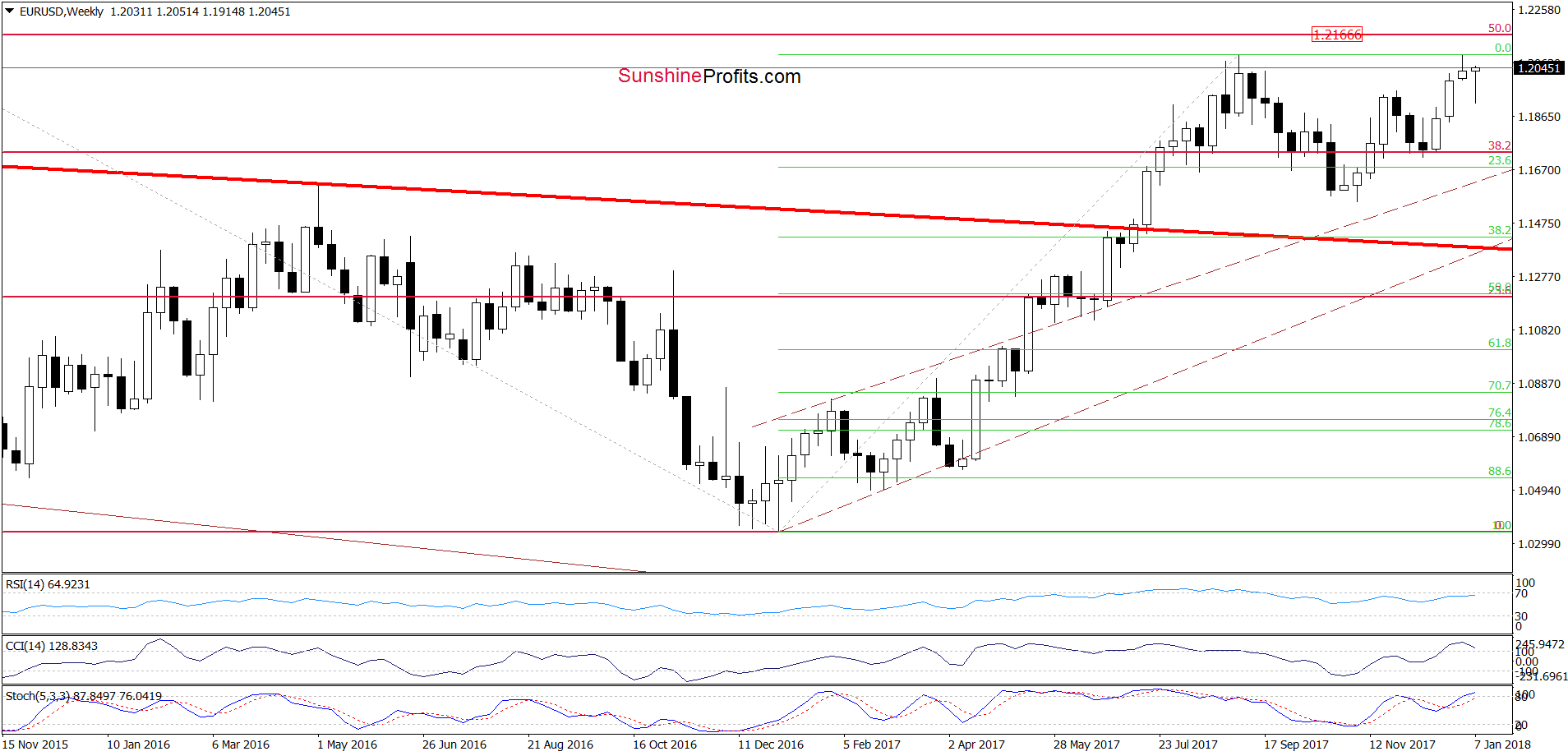

From today’s point of view, we see that EUR/USD rebounded sharply once again after a re-rest of the first downside target (set by the level at which the range of the decline corresponded to the height of blue consolidation). Thanks to this move the exchange rate erased most of the recent decline, which together with the buy signal generated by the Stochastic Oscillator suggests that we may see a test of the 2018 peak or even the 50% Fibonacci retracement (marked on the weekly chart below) in near future.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

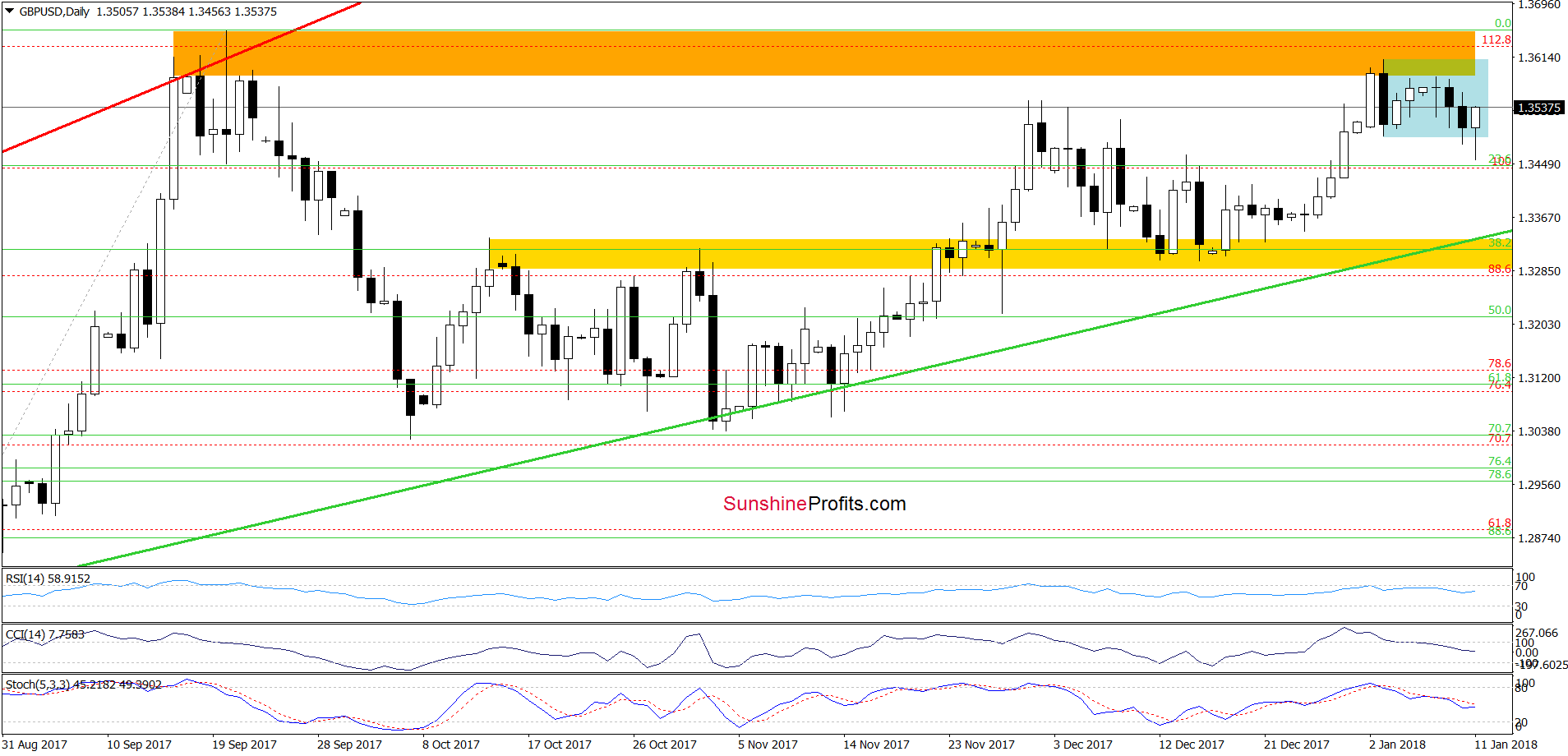

Looking at the daily chart, we see that although GBP/USD broke below the lower border of the blue consolidation earlier today, currency bulls stopped their opponents, which resulted in a rebound. Thanks to this move, the pair invalidated the earlier breakdown, which suggests that we may see a test of the orange resistance zone (created by the September highs) in the coming days.

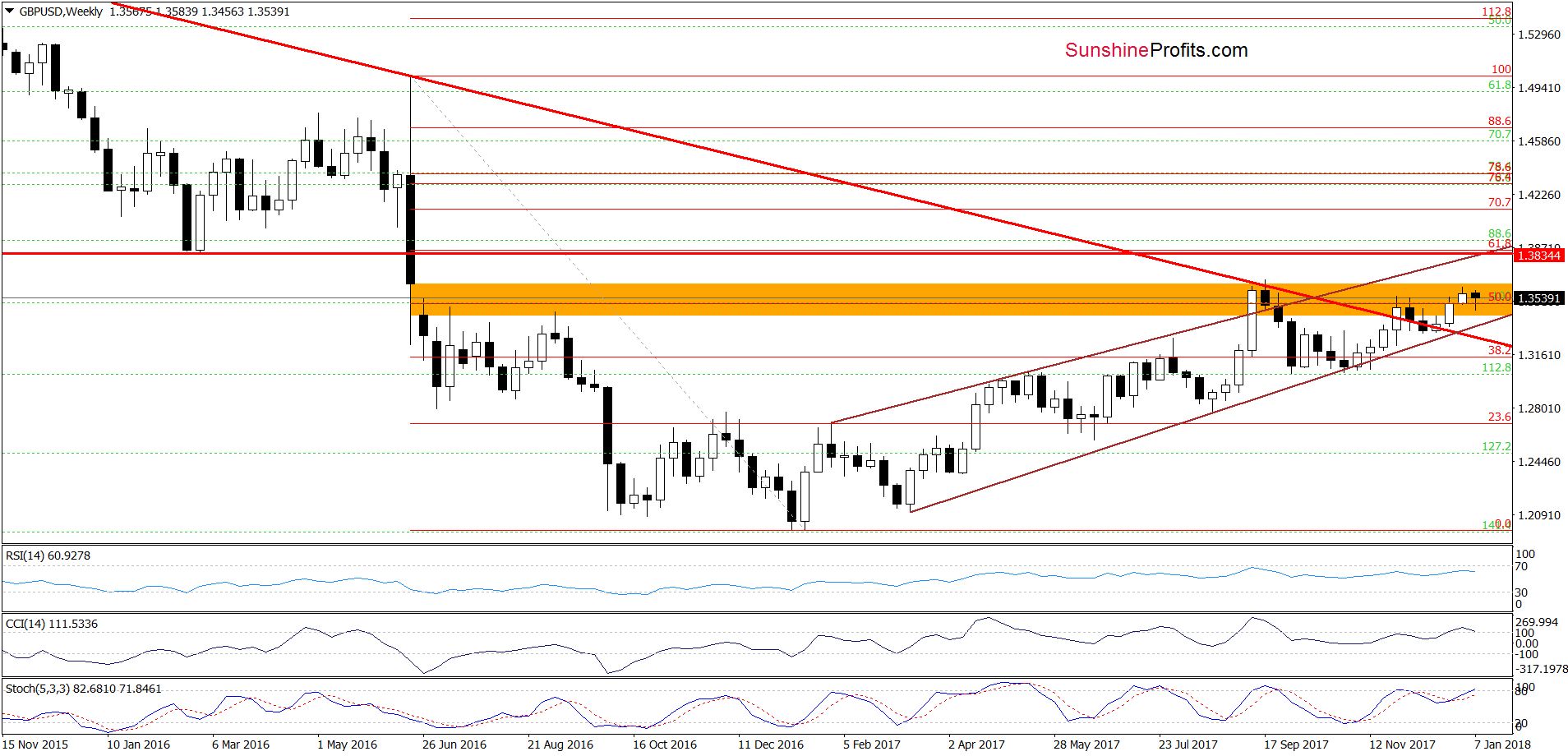

Nevertheless, in our opinion, further rally is questionable. Why? Let’s take a look a the weekly chart below.

From today’s point of view, we see that not far from current levels is the upper border of the orange gap created in June 2016, which serves as the nearest resistance. As you see on the above chart, currency bulls tried to break above it in September, but they failed, which resulted in a bigger correction. Taking this fact into account we think that another bigger move will be to the downside – especially when we factor in the current position of the daily and weekly indicators.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.3773 and the next downside target at 1.3000) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

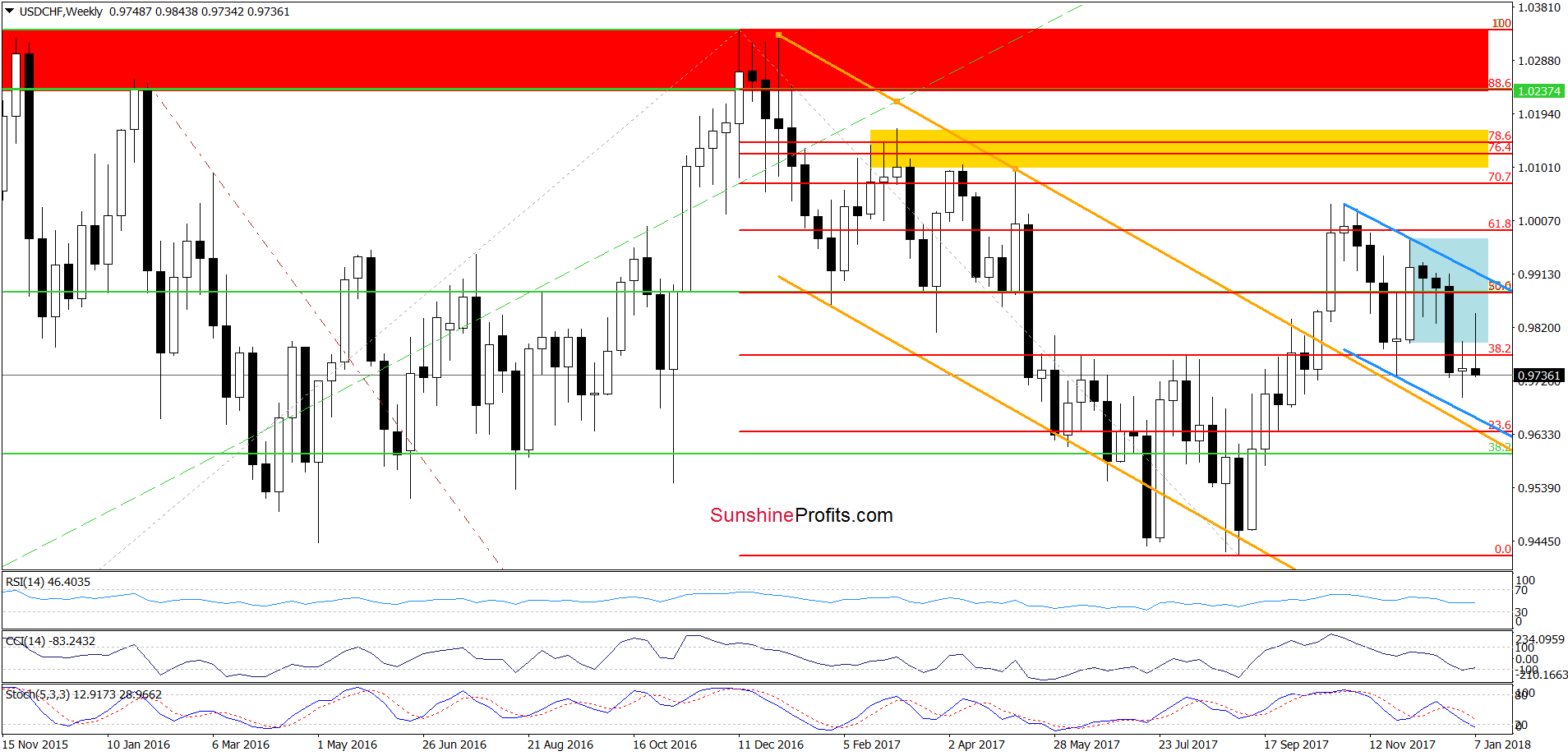

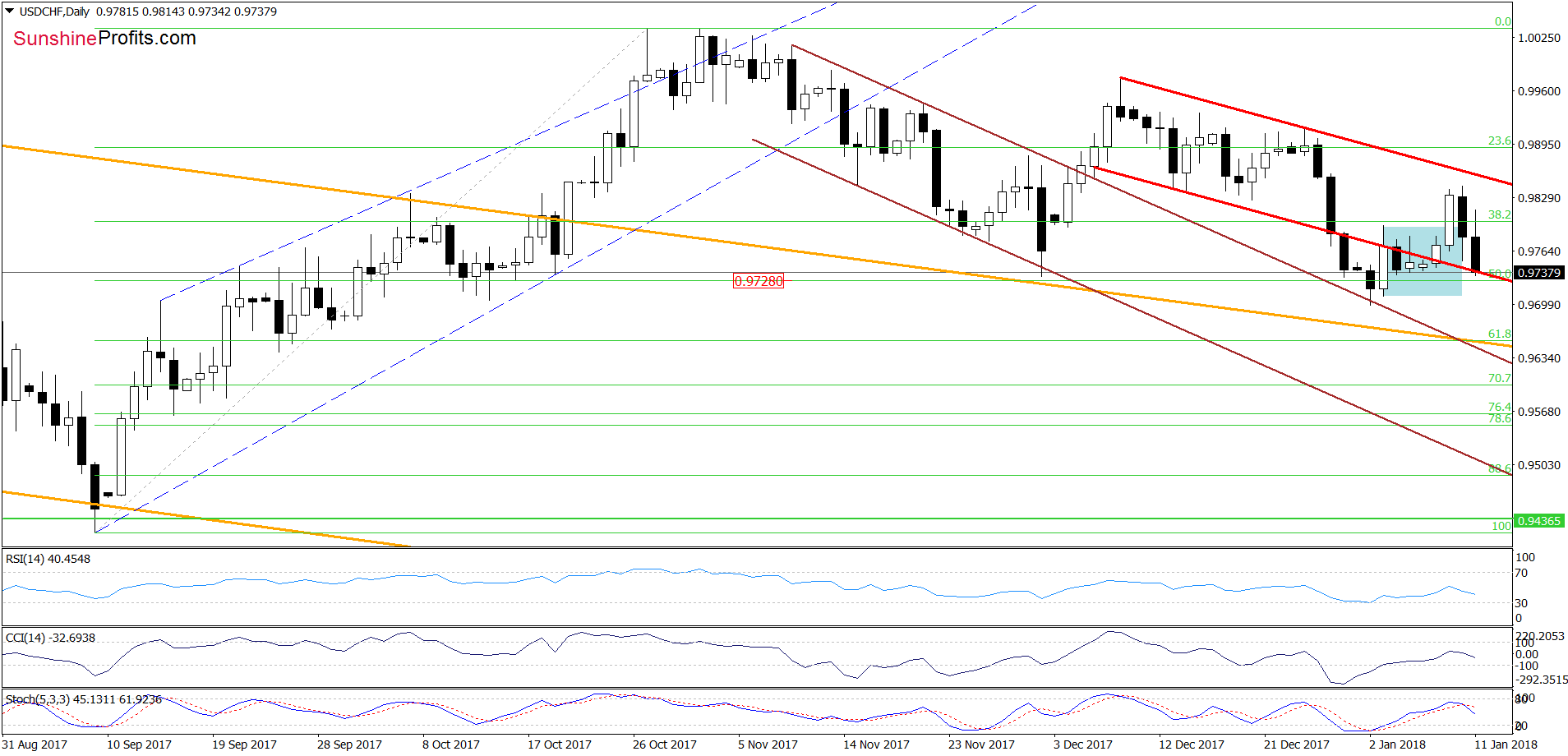

USD/CHF

Looking the daily chart, we see that USD/CHF reversed and declined sharply, reaching the previously-broken lower border of the red declining trend channel, which could pause currency bears. Nevertheless, when we take into account the fact that the Stochastic Oscillator generated the sell signal, it seems that the pair will extend declines and test the early January low or even the blue support line (the lower border of the blue declining trend channel seen on the weekly chart) in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts