In our opinion, the following forex trading positions are justified - summary:

EUR/USD

We wrote these words yesterday:

(...) the pair extended losses and reached our first downside target [the green horizontal support line based on the mid-September peak]. The sell signal generated by the Stochastic Oscillator remains on the cards, giving support to the bears.

Nevertheless, we think that as long as there is no daily close below the above-mentioned line, a reversal from here and a test of the 50% Fibonacci retracement or even the recent high can't be ruled out.

Looking at the daily chart, we see that the situation developed in tune with the above scenario. EUR/USD indeed reversed and rebounded during recent session. As a result, the pair came back above the 50% Fibonacci retracement, but the bulls didn't manage to get any higher. Such a show of weakness triggered a pullback, but just as we wrote in previous Alert, as long as the green horizontal line remains on the cards, the way to the south may not be open.

Additionally, when we take a look at the daily chart, we can see that even if the exchange rate moves lower from here, the bears will have to overcome two supports: the lower border of the potential purple trend channel that will in the upcoming days intersect the previously-broken orange area that serves as support now.

Connecting the dots, we will carefully observe the actions of both bulls and bears in the mentioned areas, waiting for more clear clues about future moves to emerge.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, we will carefully observe the actions of both, bulls and bears, in the areas discussed today, waiting for more clear clues as to the direction of the next bigger move.

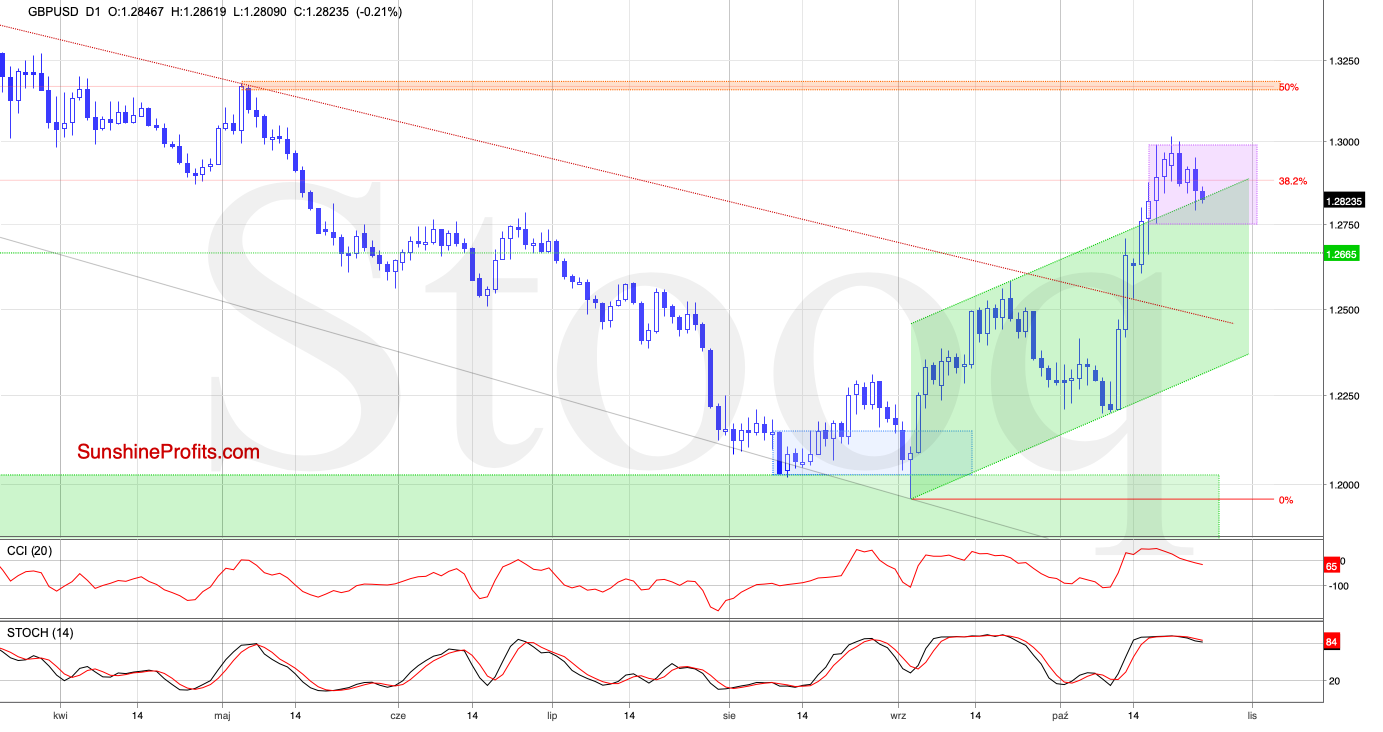

GBP/USD

In yesterday's alert we also discussed recent developments in this currency pair. We focused on the breakout above the upper border of the green rising trend channel and its implications, as well as the bulls' struggles with the psychological barrier of 1.300.

How did the buyers deal with this resistance? Let's take a look at the chart below.

We see that the bulls failed and didn't manage to break above the mentioned psychologically important level. This caused a downside move during recent sessions.

Thanks to yesterday's drop, the pair tested the previously-broken upper border of the rising green trend channel. The pair rebounded and closed the day still above the channel.

Despite this positive event, the bears moved once again earlier today, and GBP/USD slipped to the upper border of the channel for the second time in a row. Additionally, the CCI and the Stochastic Oscillator generated sell signals increasing the probability of further deterioration.

But will we see such price action? In our opinion, as long as there is no daily close back inside the channel (in other words, as long as the pair doesn't invalidate last week's breakout above the channel), another rebound from here can't be ruled out and opening short positions is not yet justified from the risk/reward point of view.

Should we see an invalidation of the breakout above this important support, we'll consider going short.

What could happen if the bulls do not manage to hold these levels? Comeback into the channel could translate into a drop to around 1.2500 or even lower, where the previously-broken red declining line currently is, serving as an additional support.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

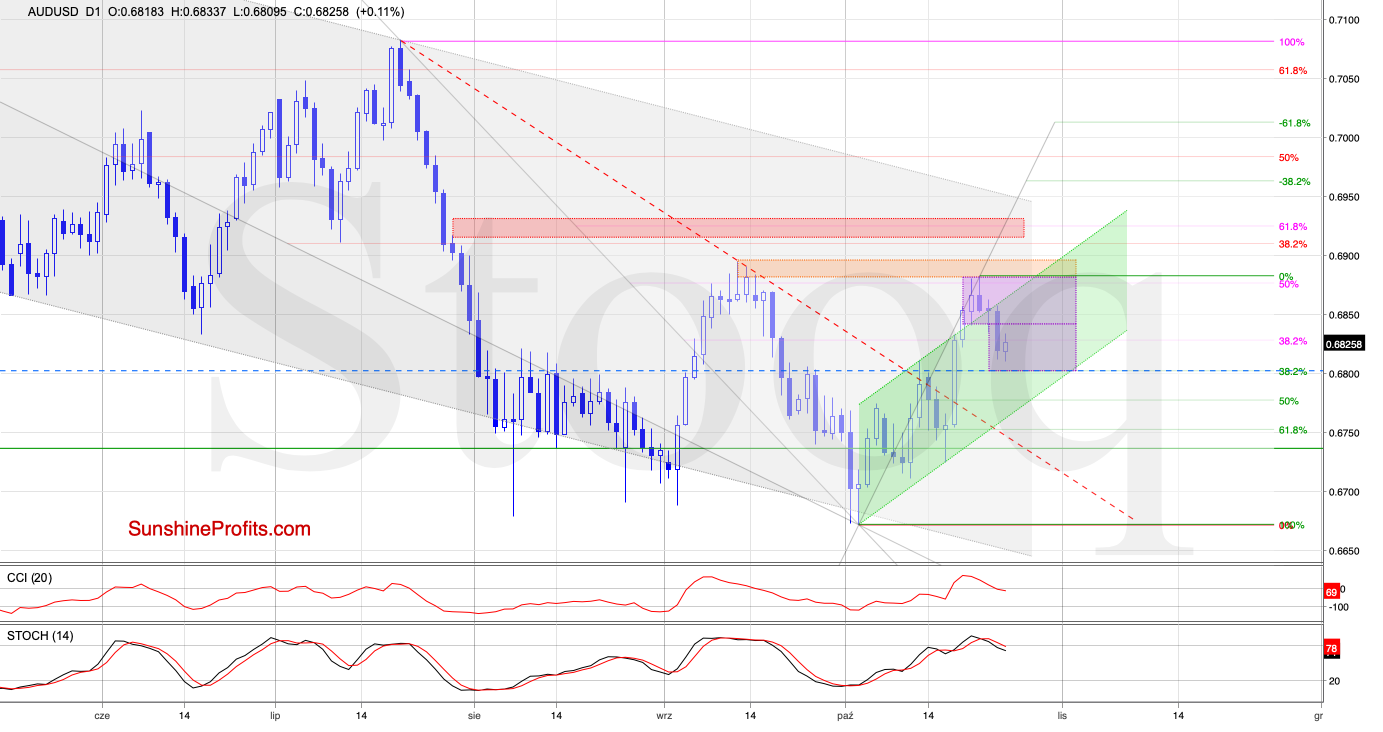

AUD/USD

We wrote these words on Tuesday:

(...) AUD/USD broke not only above the 38.2% Fibonacci retracement, but also climbed to the next retracement and the orange resistance zone at the beginning of this week.

What's next?

Taking into account:

- the proximity to the resistance zone

- the current position of the daily indicators (just like in the case of EUR/USD, GBP/USD and USD/JPY they moved to their overbought areas)

- the size of recent white candles (getting smaller from session to session),

we think that reversal and lower values of AUD/USD are just around the corner.

Looking at the daily chart, we see that the bears became active yesterday, and the pair broke down below the lower border of the purple consolation as a result.

Taking this fact into account, the exchange rate could move even lower from here, testing the lower border of the formation and the 38.2% Fibonacci retracement in the very near future - especially when we factor in the sell signals generated by the daily indicators.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist