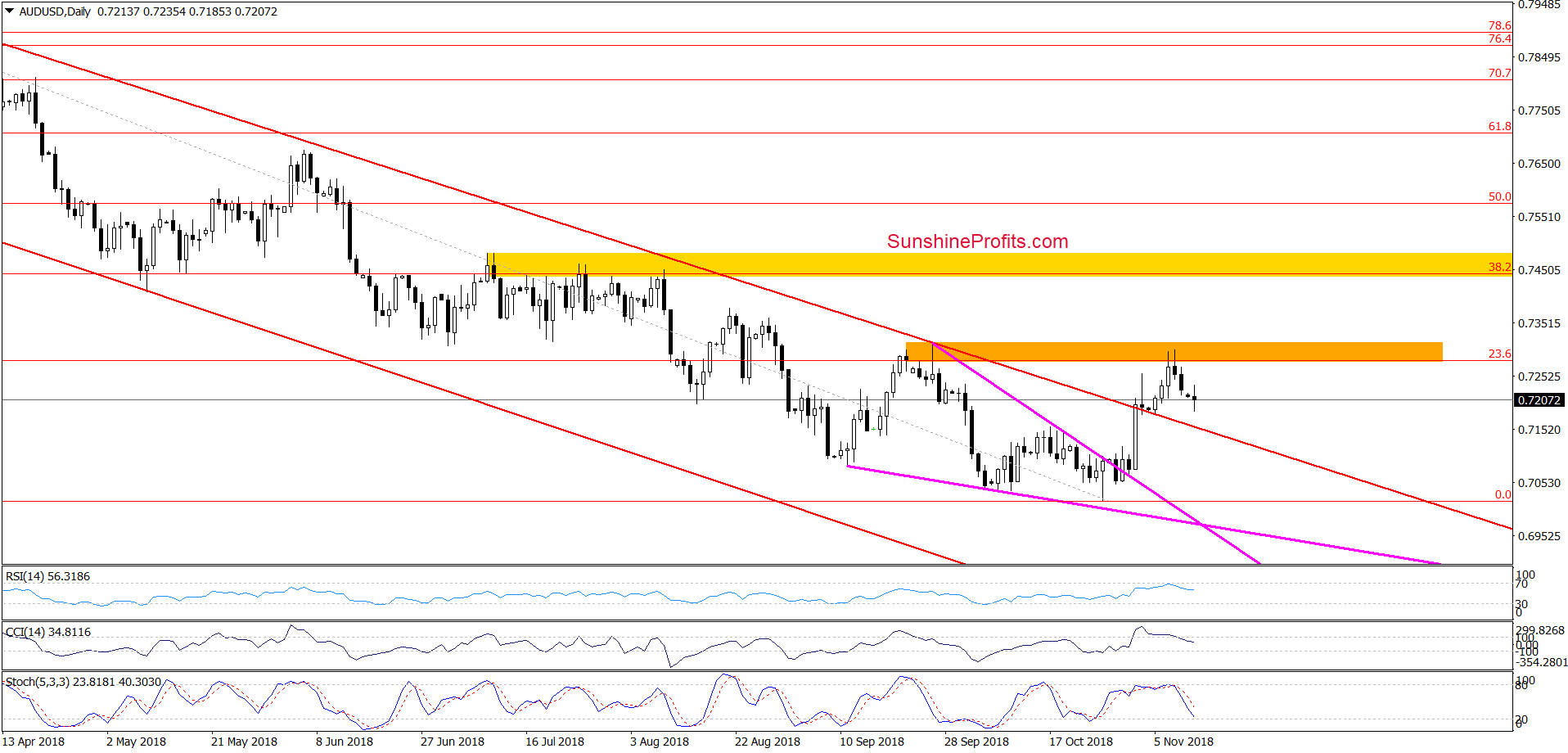

In the previous week, AUD/USD reached the first resistance zone, which encouraged currency bears to fight for lower values of the exchange rate. How low can they go in the coming week?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.62; the initial downside target at 111.84)

- USD/CAD: short (a stop-loss order at 1.3299; the initial downside target at 1.2934)

- USD/CHF: short (a stop loss order at 1.0128; the initial downside target at 0.9881)

- AUD/USD: none

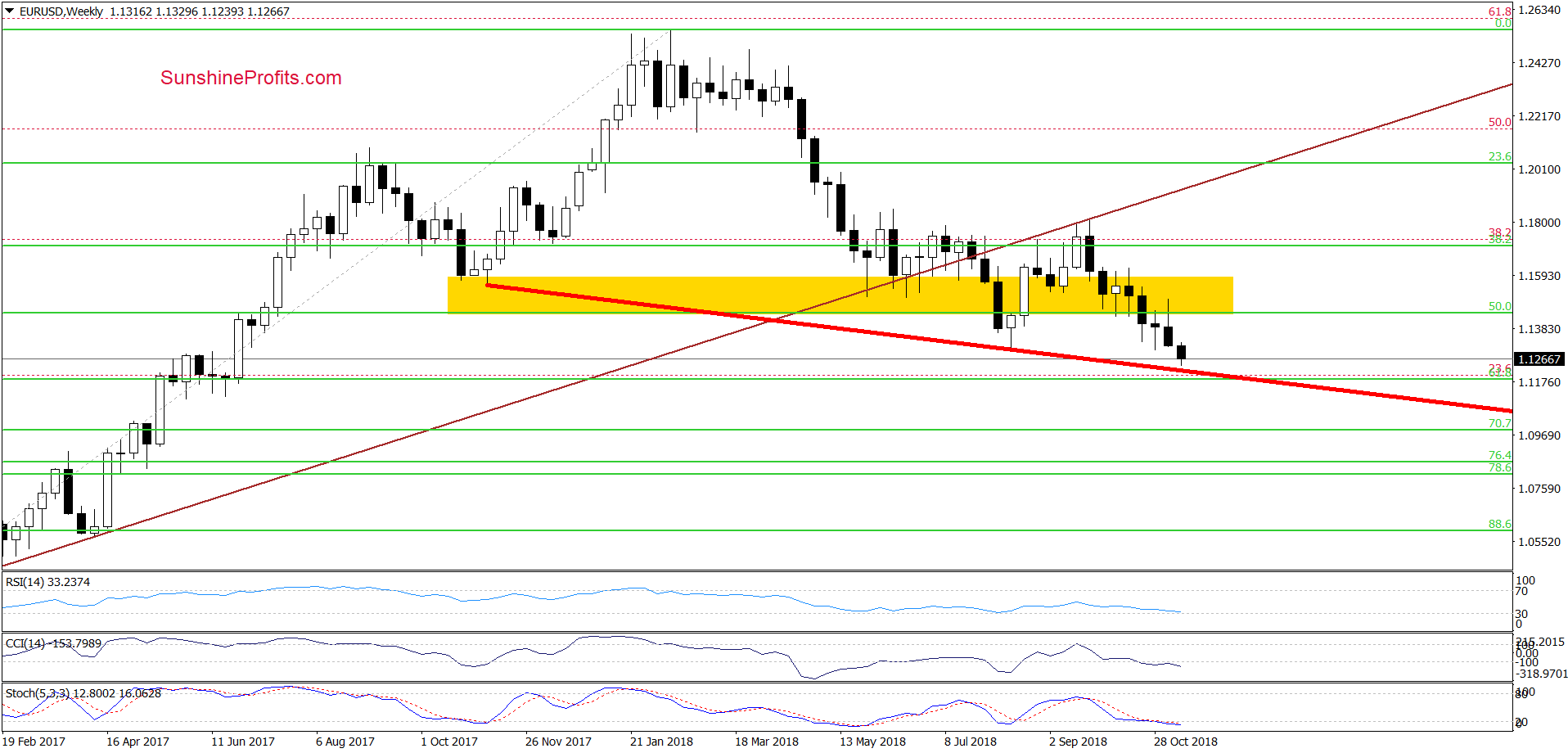

EUR/USD

Looking at the daily chart, we see that EUR/USD extended losses, which caused a drop to the lower border of the red declining trend channel. Although currency bears managed to push the pair slightly below it, the proximity to the 112.8% Fibonacci extension encouraged their opponents to fight in the following hours.

As a result, the exchange rate rebounded, but as long as there is no daily closure above this line further deterioration and lower values of EUR/USD are likely.

How low could the pair go? In our opinion, if the sellers trigger another downswing, the exchange rate will likely test the green support zone created by the 61.8% Fibonacci retracement (based on the entire January 2017-February 2018 upward move and seen more clearly on the weekly chart below) and the 127.2% Fibonacci extension (based on the mid-August – last-September increases).

What’s interesting, this support area is also reinforced by the red declining line based on November 2017 and mid-August 2018 lows, which could be the neck line of a potential head and shoulders top formation.

Connecting the dots, we think that as long as there is no breakdown below the above-mentioned support area, the space for declines is limited and reversal in the coming days is likely.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective after the stop-loss order closed our short positions.

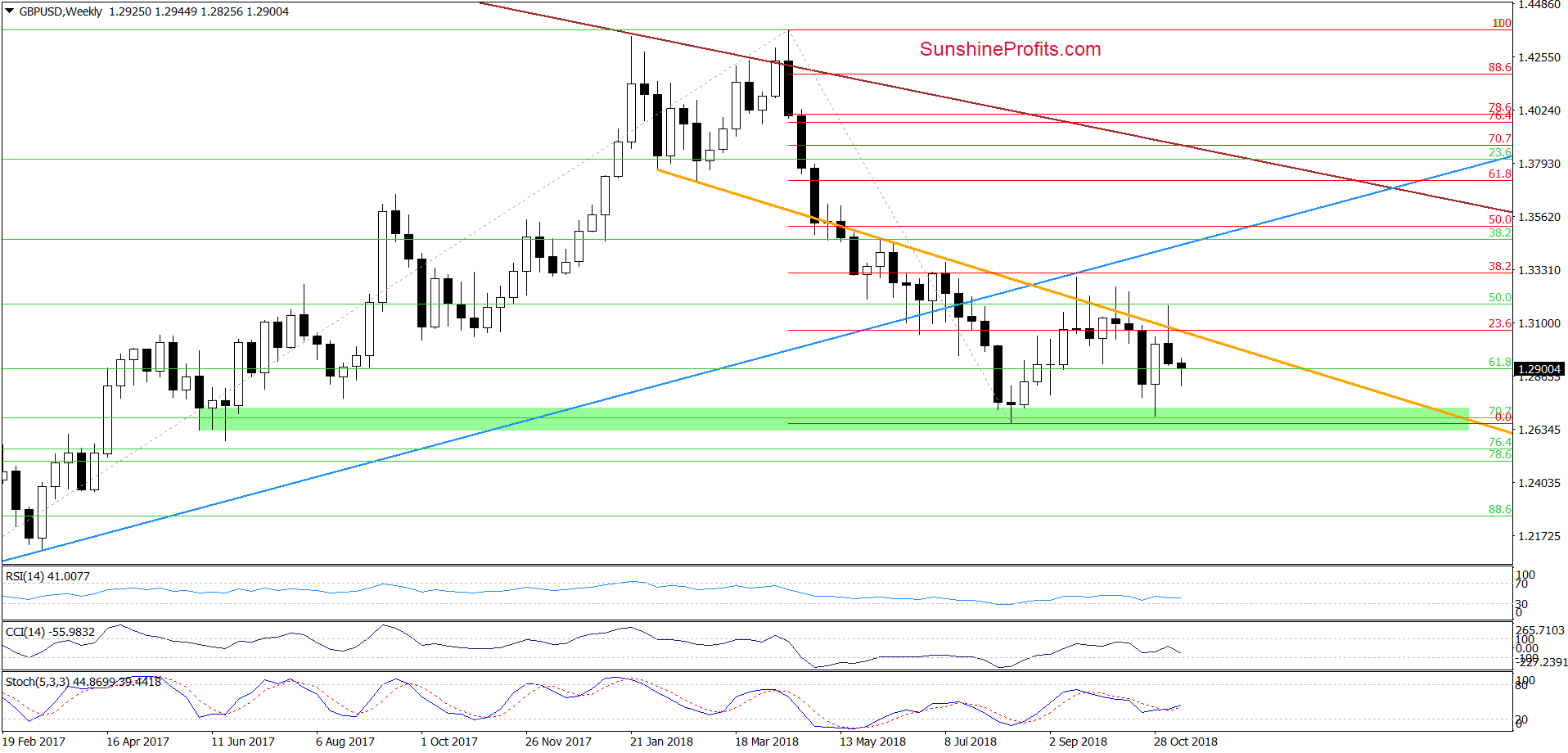

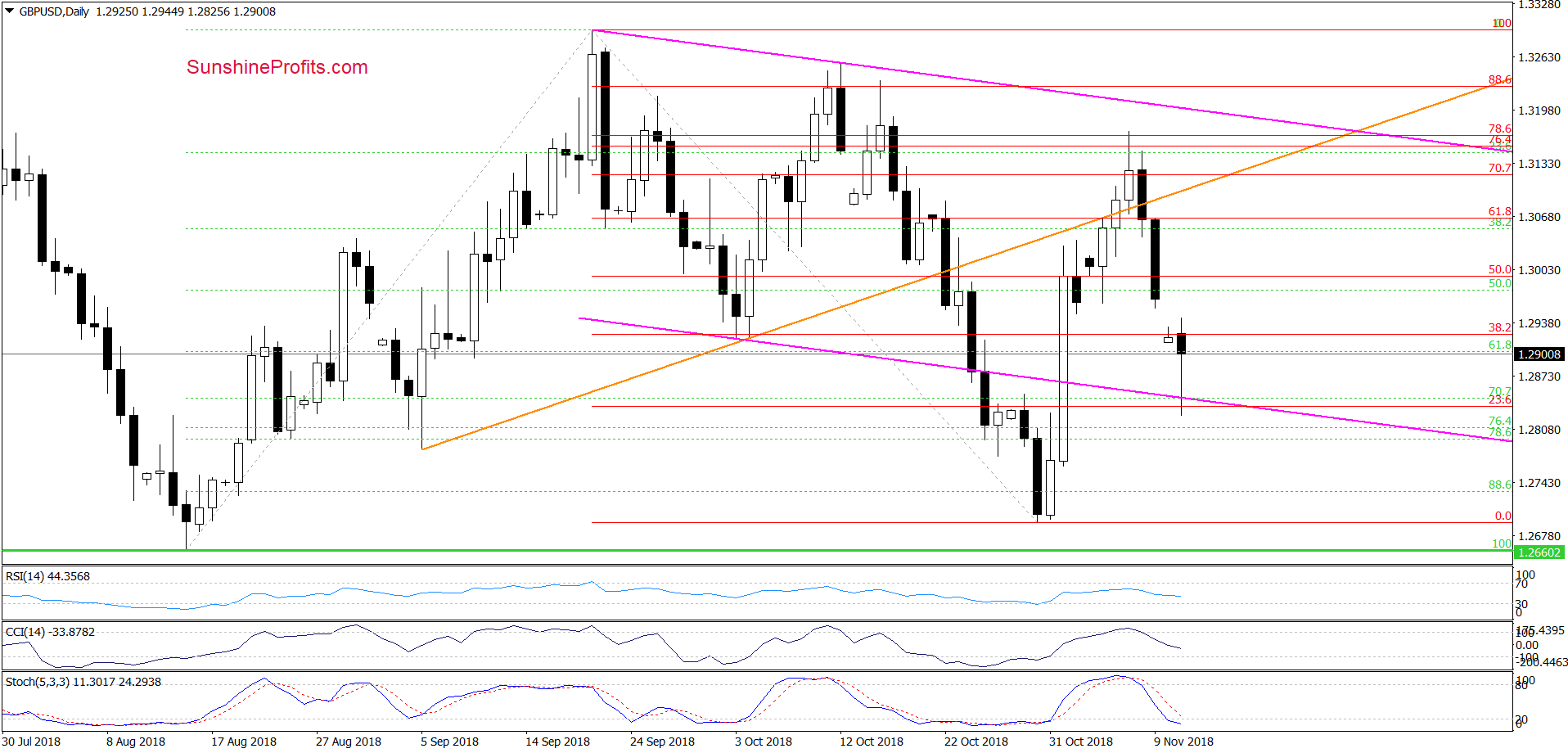

GBP/USD

On the weekly chart, we see that GBP/USD didn’t manage to climb above the orange resistance line once again, which resulted in another move to the downside. Thanks to the last week’s downswing the exchange rate invalidated the earlier tiny breakout above this line (similarly to what we saw many times in the past), which suggests further deterioration in the coming week.

How did this price action affect the very short-term picture of GBP/USD? Let’s examine the daily chart to find out.

From this perspective we see that the resistance area created by the 76.4% and the 78.6% Fibonacci retracements encouraged currency bears to act in the previous week. Thanks to their attack, the pair invalidated the earlier small breakout above the orange support line, which translated into a sharp decline in the following days.

Earlier today, GBP/USD tested the previously-broken lower border of the pink declining trend channel, but then rebounded, showing that this support line is quite important for the buyers.

Nevertheless, in our opinion, as long as the gap between the last week’s closure and this week’s open remains open another test of the pink support line should not surprise us. At this point, it is also worth keeping in mind that if this support is broken, the way to around 1.2770 will be open.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

AUD/USD

On the daily chart, we see that the orange resistance zone created by the September peaks and the 23.6% Fibonacci retracement (based on the entire 2018 downward move) activated the sellers, who triggered a reversal and decline during recent sessions.

Taking this fact into account and combining it with the sell signals generated by the indicators, we think that AUD/USD will extend losses and test the previously-broken upper border of the red declining trend channel in the coming days.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts