On Monday, the euro declined to a fresh November low against the greenback and closed the day under the lower border of the trend channel. Despite this bearish development, the buyers managed to trigger a rebound in the following days, but can we trust them?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.62; the initial downside target at 111.84)

- USD/CAD: short (a stop-loss order at 1.3401; the initial downside target at 1.2934)

- USD/CHF: short (a stop loss order at 1.0192; the initial downside target at 0.9881)

- AUD/USD: none

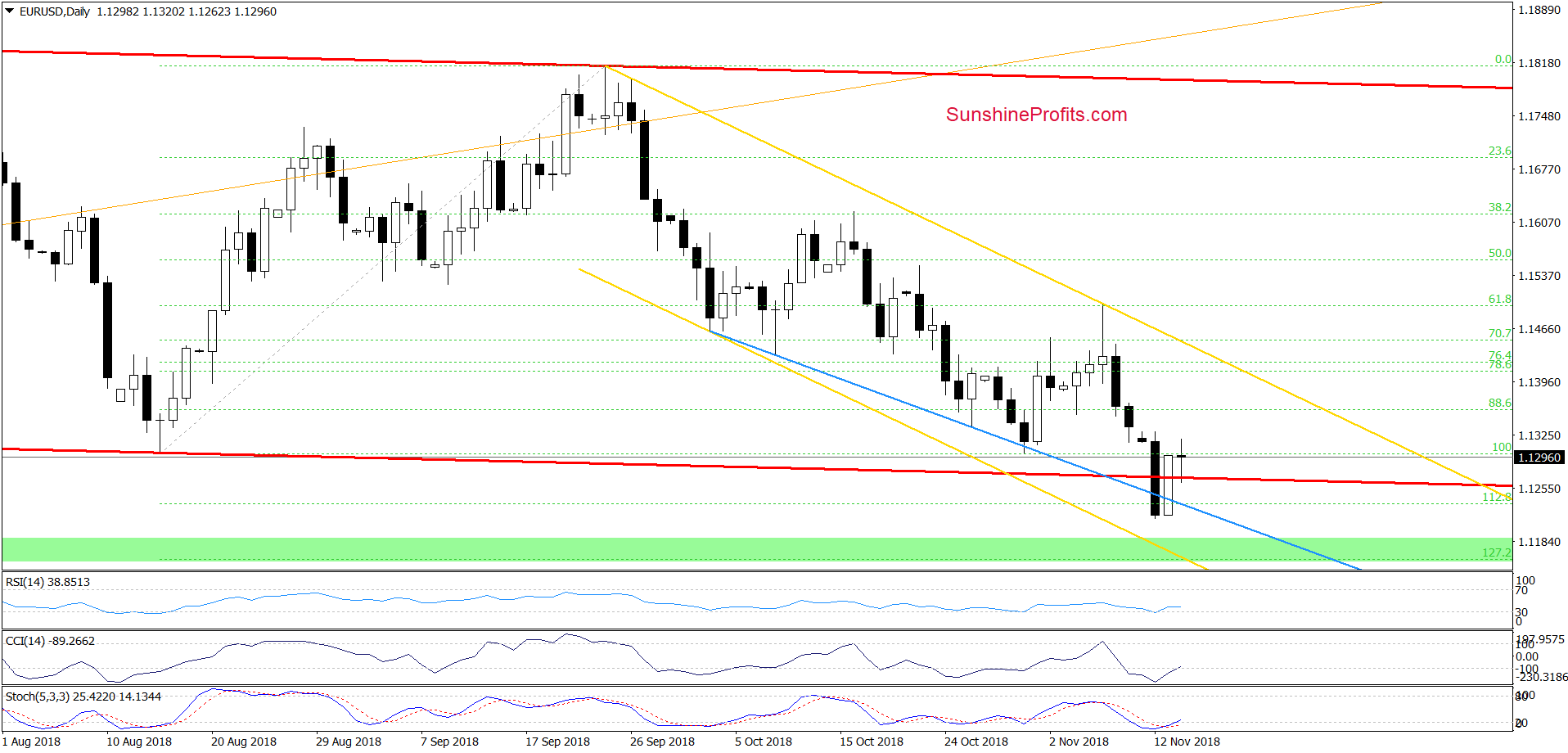

EUR/USD

Yesterday, currency bulls triggered a rebound, which took EUR/USD above the lower line of the red trend channel and resulted in an invalidation of the earlier breakdown.

Earlier today, the pair verified yesterday’s move, which in combination with the current position of the daily indicators suggests that another upswing may be just around the corner.

Taking all the above into account, we think that if the situation develops in line with this scenario, currency bulls will likely test the short-term yellow resistance line in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective after the stop-loss order closed our short positions.

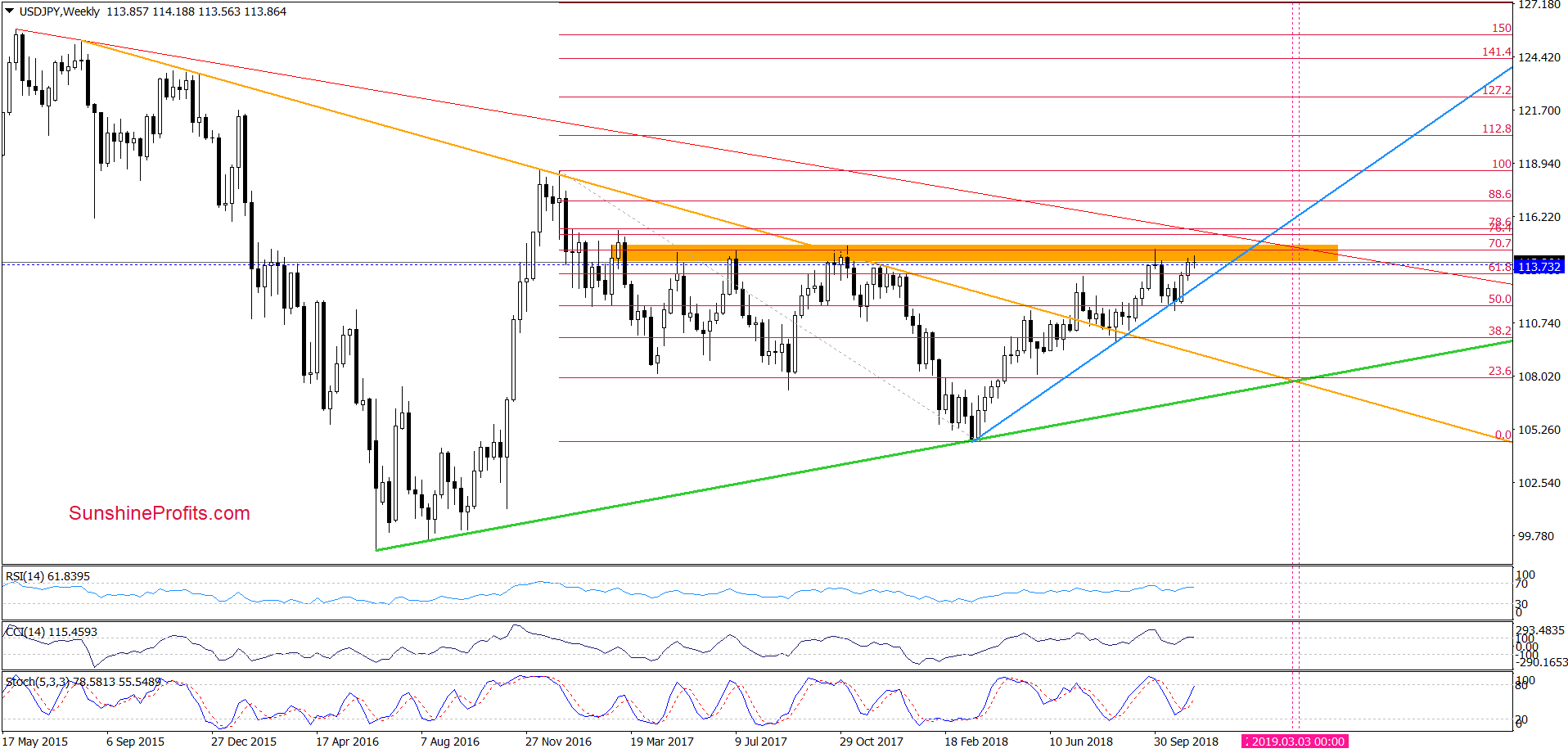

USD/JPY

From the medium-term perspective, we see that USD/JPY increased a bit recently, which caused a climb to the orange resistance, which serves as the major resistance since March 2017.

Therefore, in our opinion, as long as there is no successful breakout above it another reversal and lower values of the exchange rate are more likely than not. Will the very short-term chart confirm this assumption? Let’s check.

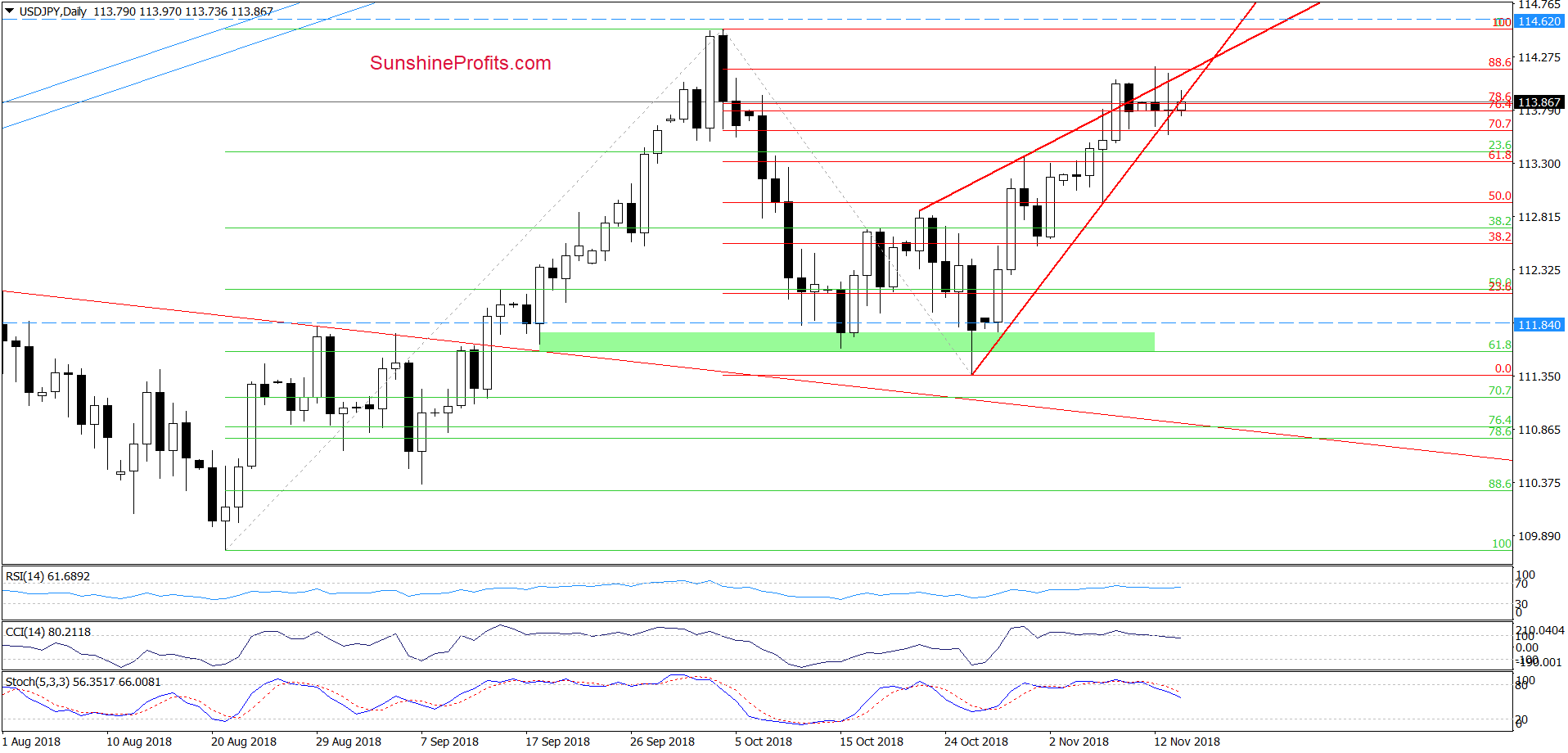

On the daily chart, we see that although currency bulls tried to go higher in recent days, the upper border of the red rising wedge stopped them, triggering pullbacks. Additionally, the sell signals generated by the indicators remain in the cards, suggesting that one more move to the downside is just around the corner.

If this is the case and USD/JY declines from current levels, we’ll likely see a drop to the November lows around 112.63 or even a downward move to the green support area created by the late-October lows and the 61.8% Fibonacci retracement.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 114.62 and the initial downside target at 111.84 are justified from the risk/reward perspective.

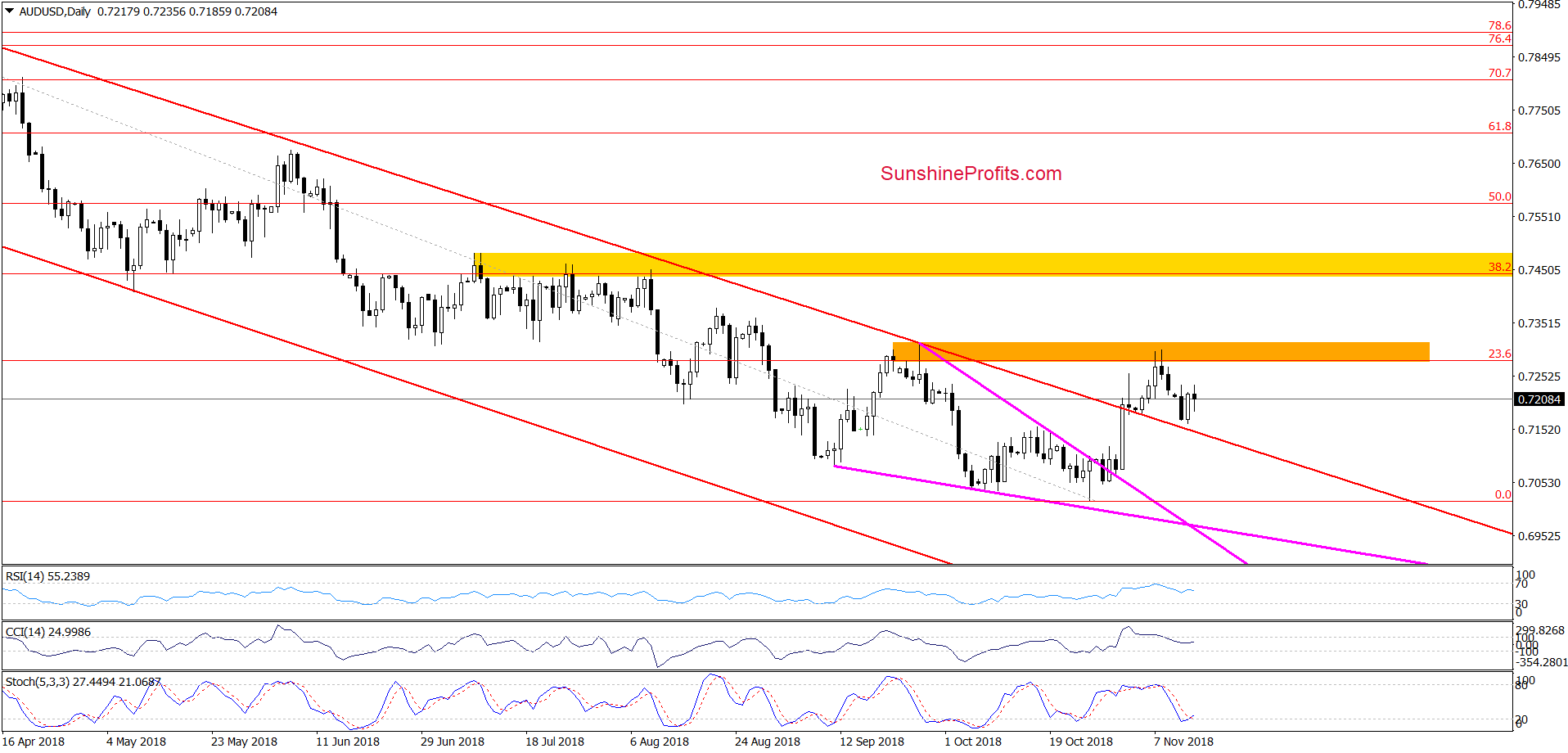

AUD/USD

On Monday, we wrote the following:

(…) the orange resistance zone created by the September peaks and the 23.6% Fibonacci retracement (based on the entire 2018 downward move) activated the sellers, who triggered a reversal and decline during recent sessions.

Taking this fact into account and combining it with the sell signals generated by the indicators, we think that AUD/USD will extend losses and test the previously-broken upper border of the red declining trend channel in the coming days.

From today’s point of view, we see that the sellers pushed AUD/USD lower, which approached the exchange rate to our downside target. As you see, the red support line triggered a rebound during yesterday’s session and the Stochastic Oscillator generated a buy signal, suggesting that another attempt to move higher may be just around the corner.

If this is the case and the pair increases from current levels, we’ll likely see a re-test of the strength of the orange resistance zone in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts