Tell me, just where is that? And what needs to happen to make us act? It's not true that nothing interesting happens when the markets are calmer than usually. Quite the opposite. Within the many false moves that try our patience and vigilance, the markets drop valuable clues for those willing to listen. For those willing to tilt the odds in their favor. For those willing to profit.

In our opinion, the following forex trading positions are justified - summary:

EUR/USD

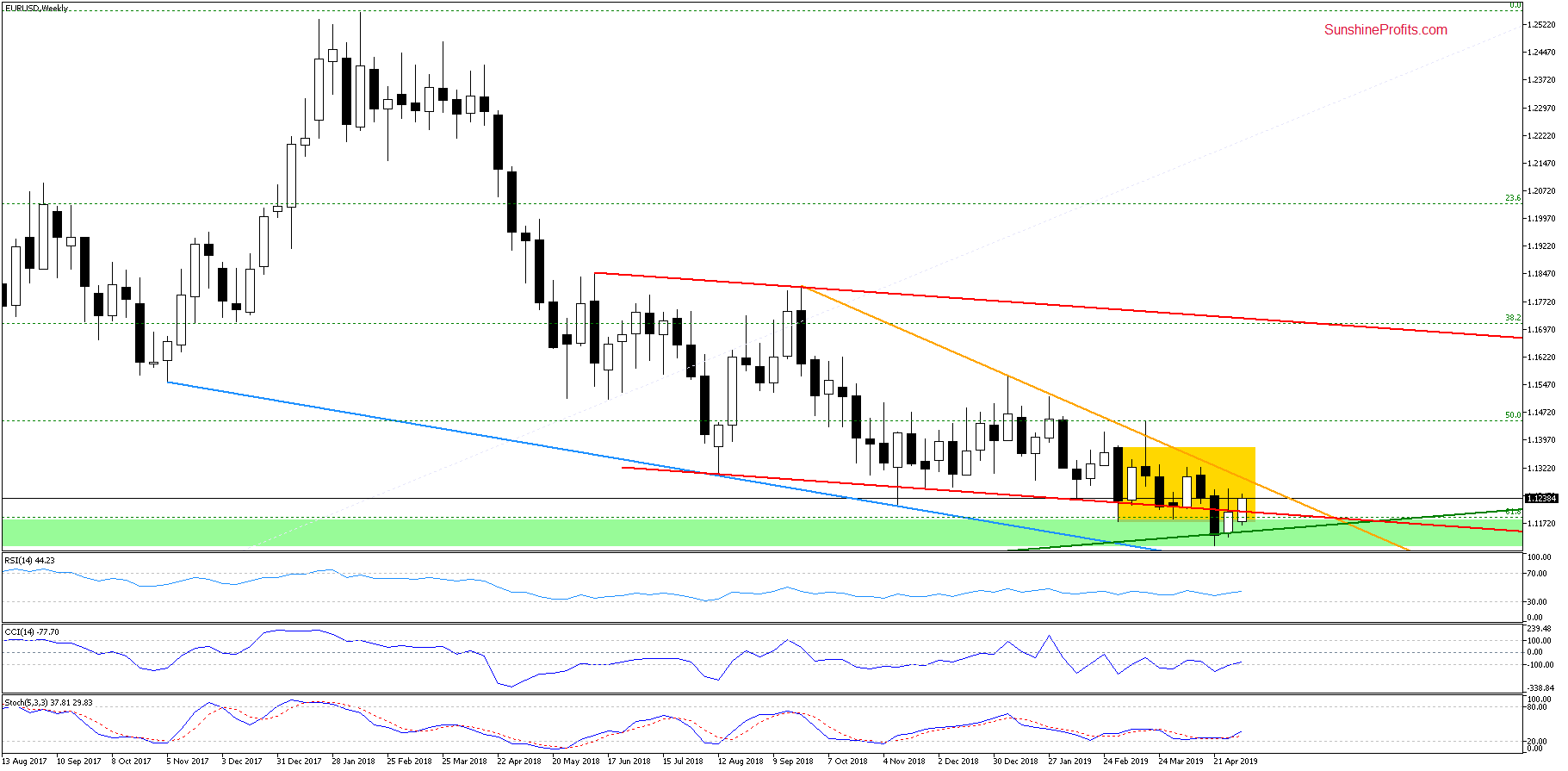

Let's start with the weekly chart. We see that EUR/USD has moved above the lower border of the declining red trend channel. While it may seem (and is) bullish, the bullish implications will kick in only if the pair closes today's session (which means the whole week) above this line.

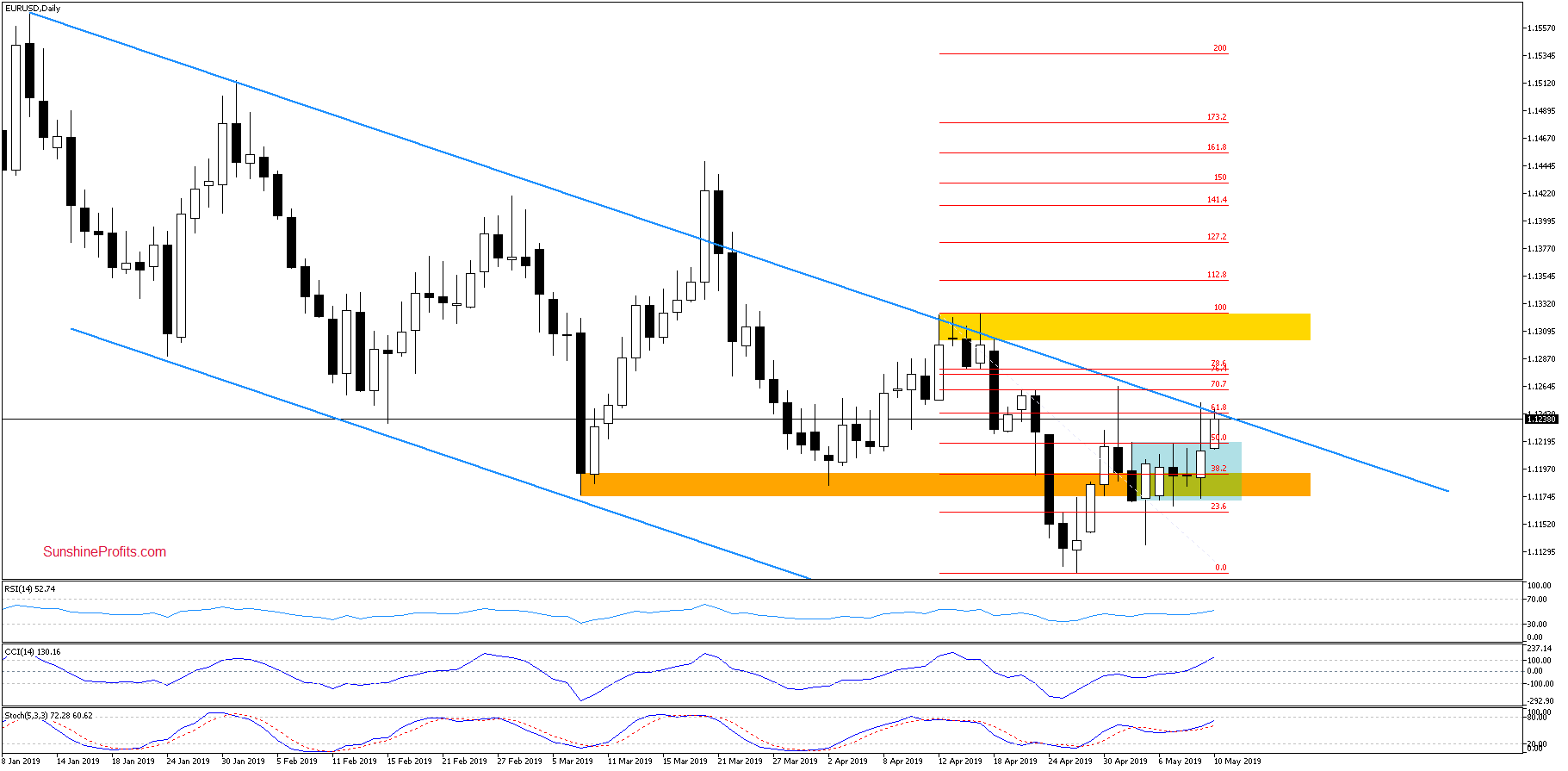

The daily perspective reveals that the pair broke the blue consolidation to the upside. This is a positive development for the bulls and a strong closing price would confirm that.

Speaking about closing prices, we have to point out yesterday's candle. The long upper knot serves as a sign of caution to the bulls. Especially so when we factor in the fact that the rate has reached the upper border of the declining blue trend channel. This resistance has stopped the buyers quite a few times in the past already. This warrants a cautious approach.

Therefore, a daily close above the consolidation is a mere starting point for the bulls, something that would support the case for further improvements.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

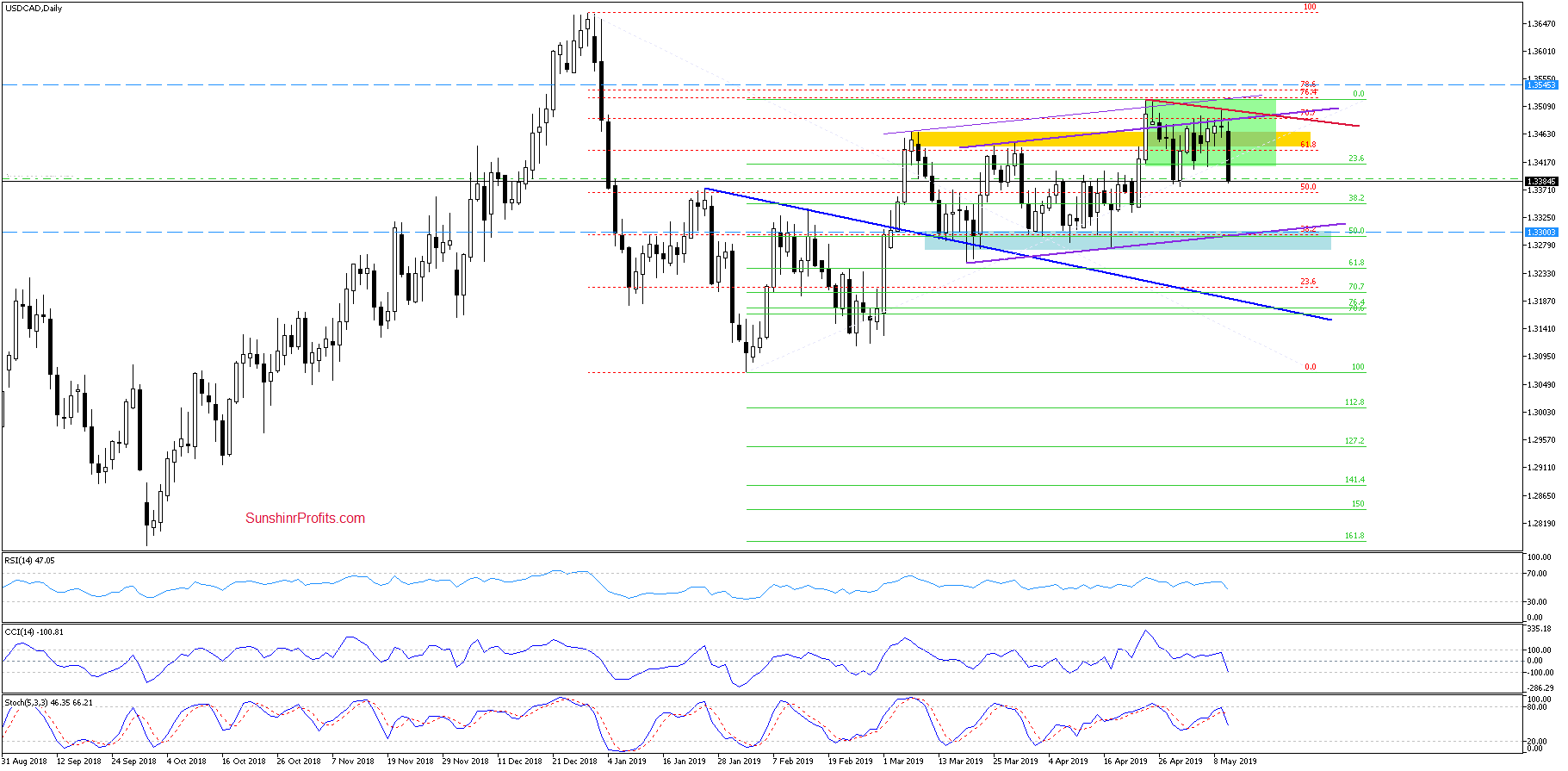

Again starting with the weekly chart, we see the upper border of the yellow consolidation encouraging the sellers to act. The following pullback means invalidation of the tiny breakout above the formation.

It's a positive development for the bears and suggests further deterioration in the coming week. The bears are further supported by the CCI and the Stochastic Oscillator having just generated their sell signals.

The daily chart reveals another unsuccessful attempt to break above the upper border of the purple rising trend channel. This has triggered a sharp move to the downside earlier today. It has been partially retraced and the pair changes hands at around 1.3415 currently.

That is right at the lower border of the green consolidation. Today's closing price will reveal more as to the balance of power between the bears and the bulls, yet a few factors increase the probability of declines in the coming days. It's the weekly picture and the daily indicators having generated their sell signals.

Bearish price action will be more likely and reliable only if we see a daily close below the green formation. Should we see such development, we'll consider going short.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

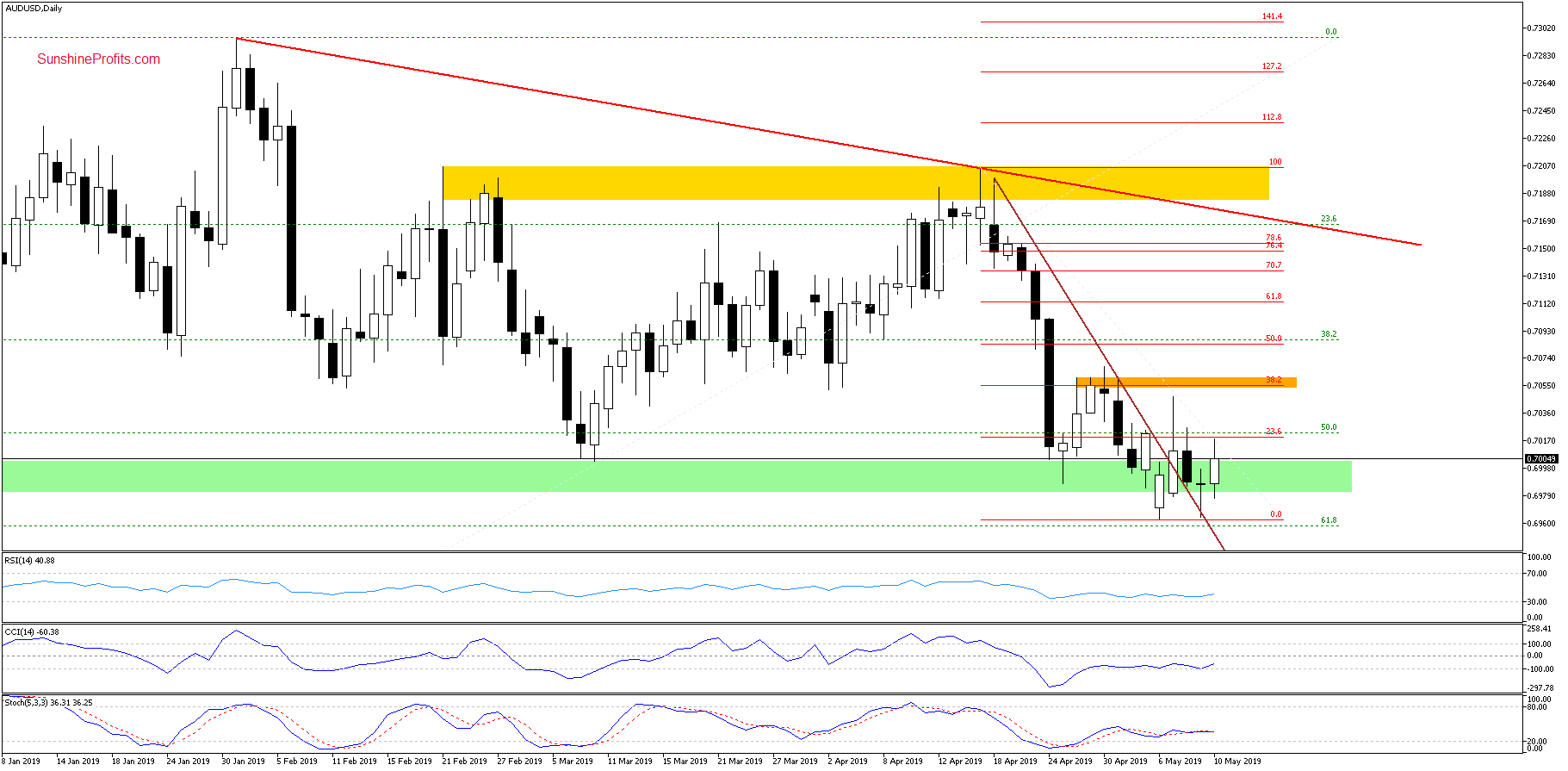

The daily AUD/USD picture reveals that the pair has attempted to move lower yesterday, yet was rebuffed. The previously-broken brown support line stopped the bears. Another attempt to go lower has failed earlier today and the bulls counterattacked. They moved the price to the 23.6% Fibonacci retracement but have given up much of their gains as the exchange rate trades currently at around 0.6995.

Another attempt to go higher is supported by the buy signals generated by the daily indicators. First however, the bulls would have to break above the 23.6% Fibonacci retracement and Tuesday's peak. Should they succeed, the way to the orange resistance zone would be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, should we see a strongly bearish close in USD/CAD beneath its recent consolidation, we'll consider going short. There're no other opportunities worth acting upon in the currencies. We remain keenly watching and as always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist