In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1057; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

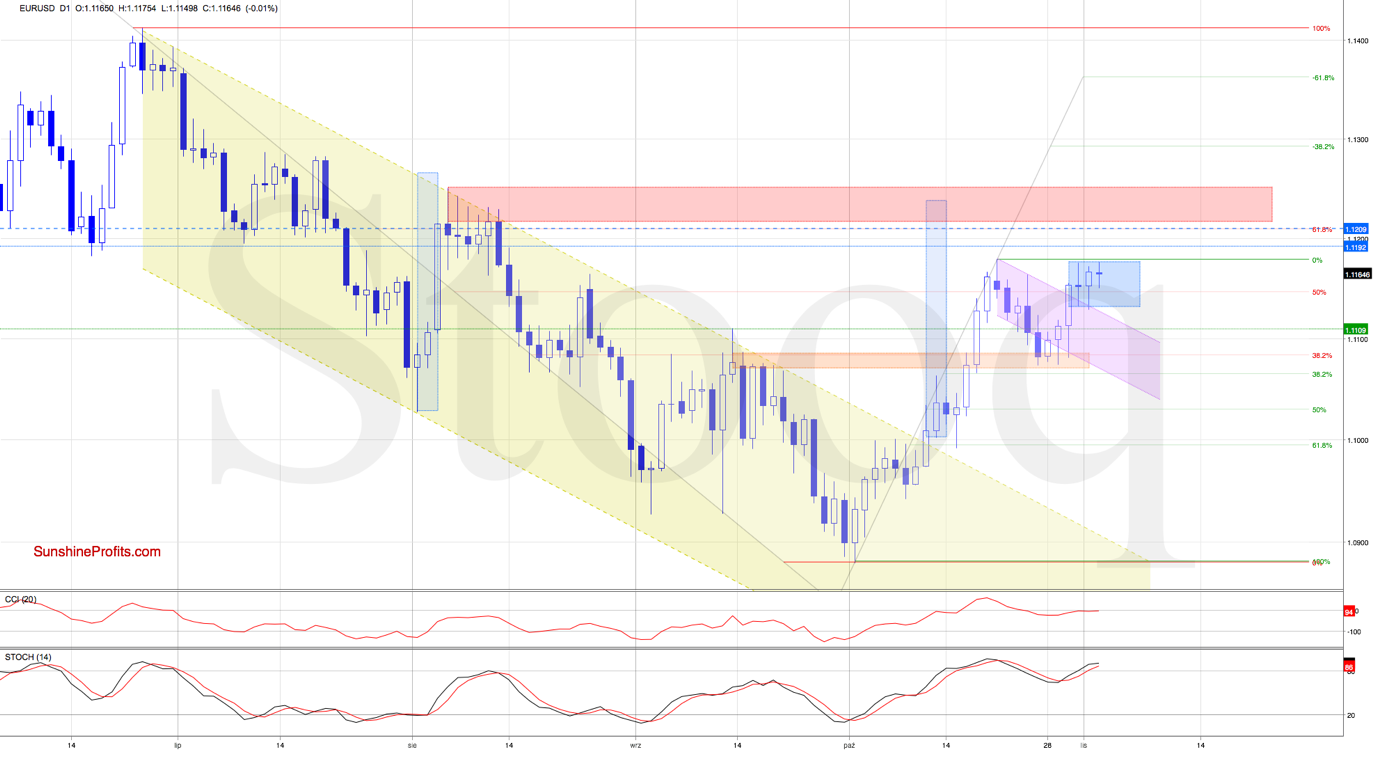

EUR/USD

Our Thursday's commentary notes the bulls' gains and the open path to the recent peaks. At the same time, we've raised the question how high can the pair go, providing several handy answers.

What happened in the market since our Forex Trading Alert was posted? Let's see the chart below to find out.

For now, EUR/USD remains stuck in the blue consolidation, which leaves the very short-term picture unchanged. Let's quote our Thursday's observations:

(...) considering the breakout above the upper border of the declining yellow trend channel, EUR/USD could hit a fresh monthly high in the following day(s).

How high could the pair go?

In our opinion, the first upside target could be the 61.8% Fibonacci retracement or even the red resistance area created by the August peaks. This is where the size of the upward move will correspond to the height of the mentioned yellow channel (as marked with blue rectangle).

Trading position (short-term; our opinion): Already profitable long positions with a stop-loss order at 1.1057 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

USD/CHF

The green support zone has held up the bears from further gains, and USD/CHF has again bounced off higher. A closer look at the daily indicators shows that they're still on their sell signals. That suggests another retest of the green support zone, or oven of the October low.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Let's recall our Tuesday's commentary:

(...) The bulls will likely test not only the previous peaks and the upper line of the formation, but also the mid-September highs or even the 38.2% Fibonacci retracement based on the entire 2019 decline in the very near future.

AUD/USD indeed broke above the upper border of the rising green trend channel later in the week. However, the combination of the Fibonacci retracements and the upper border of the declining grey trend channel stopped the buyers, leading to the current consolidation (marked with blue).

There have been unsuccessful attempts to move higher recently, and they suggest that a reversal may be just around the corner. Should we see buyers' weakness around the mentioned resistances, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist