Although currency bulls managed to trigger an upward move in the previous week, the combination of several resistances stopped them, giving their opponents the opportunity to fight for lower values of USD/JPY. What could happen if the sellers take control on the trading floor?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.68; the initial downside target at 111.84)

- USD/CAD: short (a stop-loss order at 1.3401; the initial downside target at 1.2934)

- USD/CHF: short (a stop loss order at 1.0192; the initial downside target at 0.9881)

- AUD/USD: long (a stop-loss order at 0.7190; the initial upside target at 0.7440)

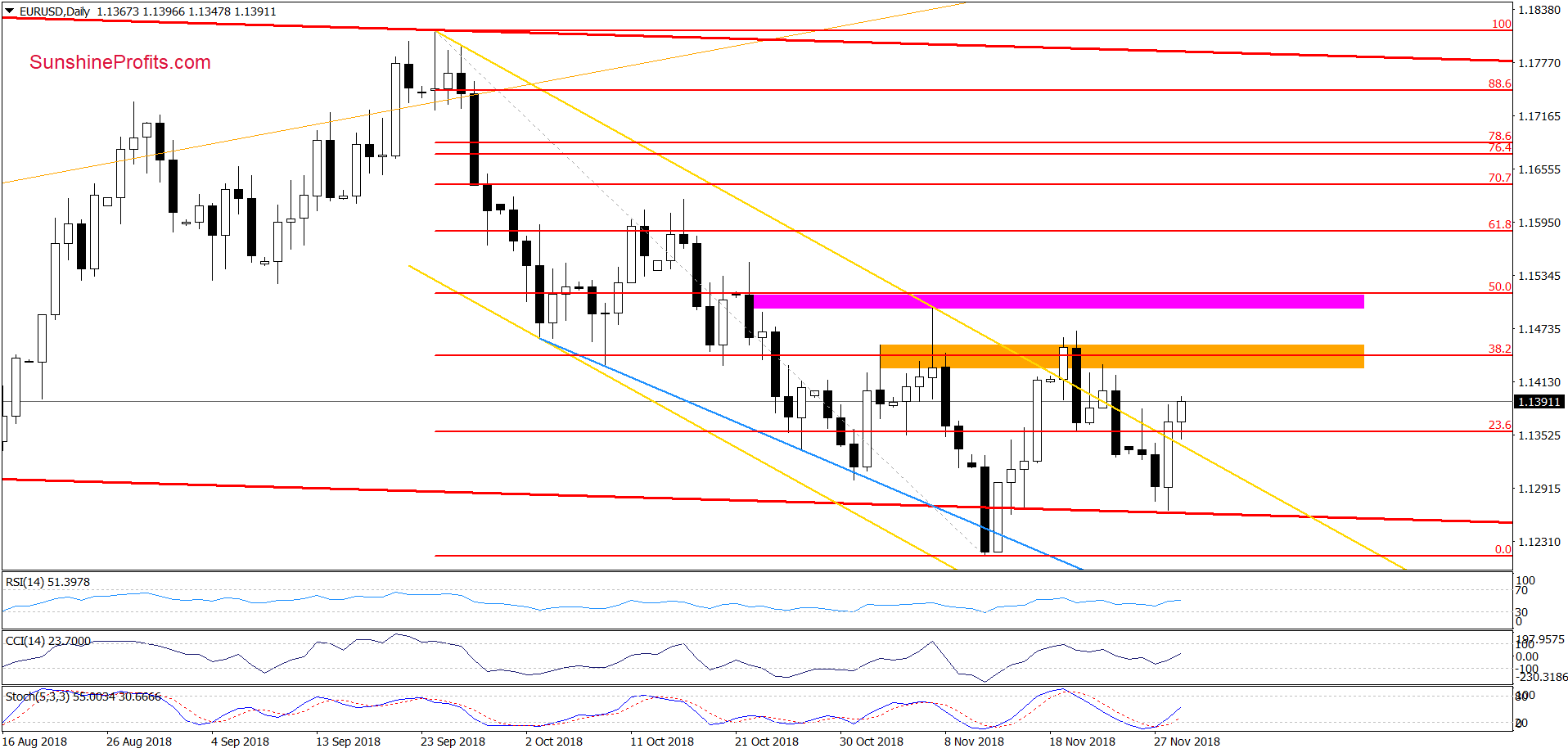

EUR/USD

Looking at the daily chart, we see that the lower border of the red trend channel triggered a quite big rebound during yesterday’s session, which resulted in a climb above the previously-broken yellow resistance line. In this way, the pair invalidated the earlier breakdown, which triggered further improvement earlier today.

Additionally, the CCI and the Stochastic Oscillator generated the buy signals, suggesting further improvement in the following days. If this is the case and EUR/USD extends gains from current levels, we’ll see at least a test of the orange resistance zone and the recent peaks in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment of writing this alert.

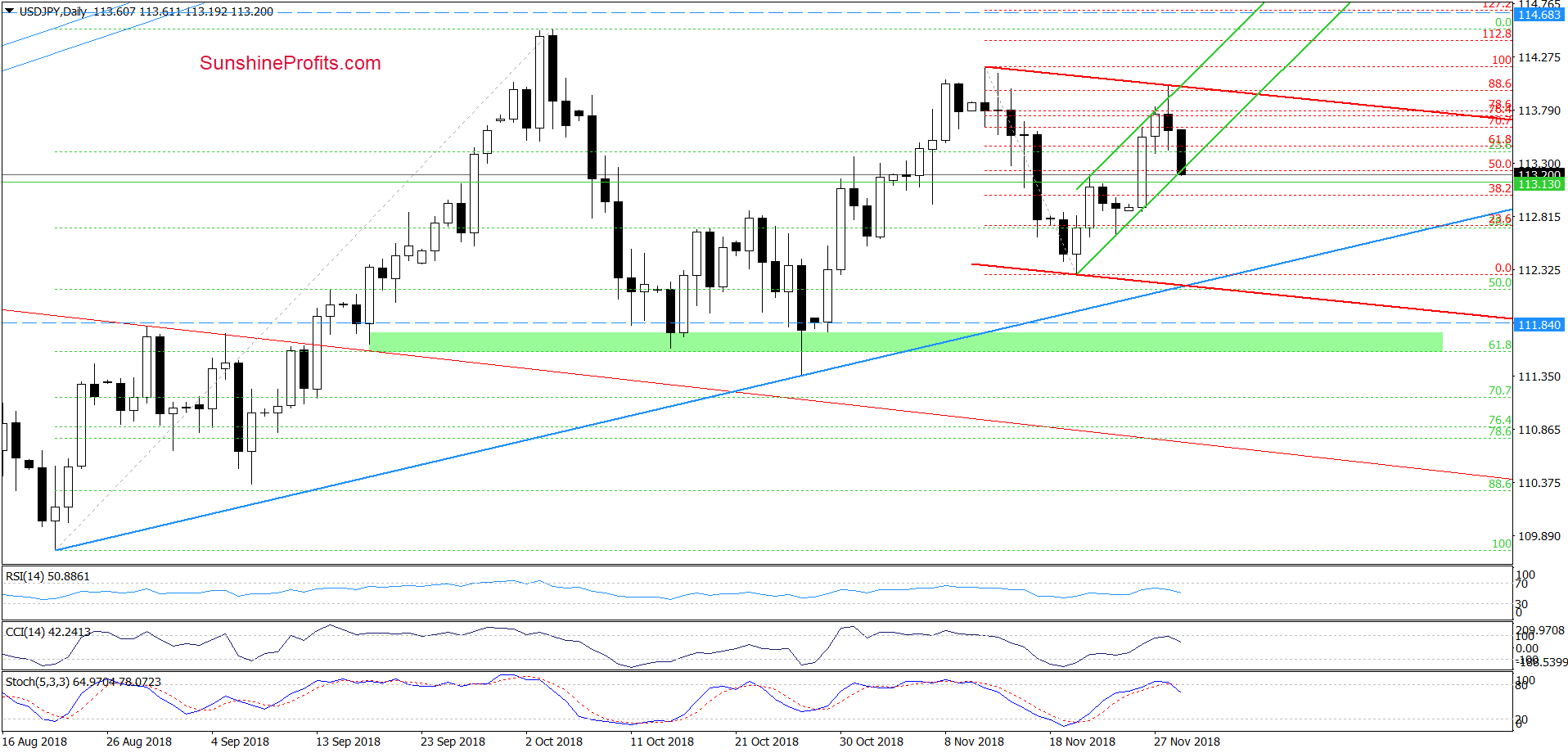

USD/JPY

In our last commentary on this currency pair, we wrote:

(…) USDJPY is trading (…) inside the very short-term rising trend channel based on recent lows and the last week’s high. Taking this fact into account and combining it with the current position of the daily indicators, we think that the space for gains is limited (not only by the upper border of the above-mentioned trend channel, but also by the resistance zone created by the 76.4% and 78.6% Fibonacci retracements and the major resistance zone marked on the weekly chart in our last week’s alerts) and lower values of the exchange rate are just around the corner.

From today’s point of view, we see that the situation developed in line with the above scenario and currency bears pushed the greenback lower against the yen. Thanks to today’s sellers’ attack, USD/JPY slipped to the lower border of the green rising trend channel, while the CCI and the Stochastic Oscillator generated the sell signals, increasing the likelihood of lower values of the exchange rate in the coming days.

What could happen if USD/JPY drops below the formation? In our opinion, the sellers will test (at least) the level of November 20 low, which is currently intersected by the medium-term blue support line based on the August and October lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 114.68 and the initial downside target at 111.84 are justified from the risk/reward perspective.

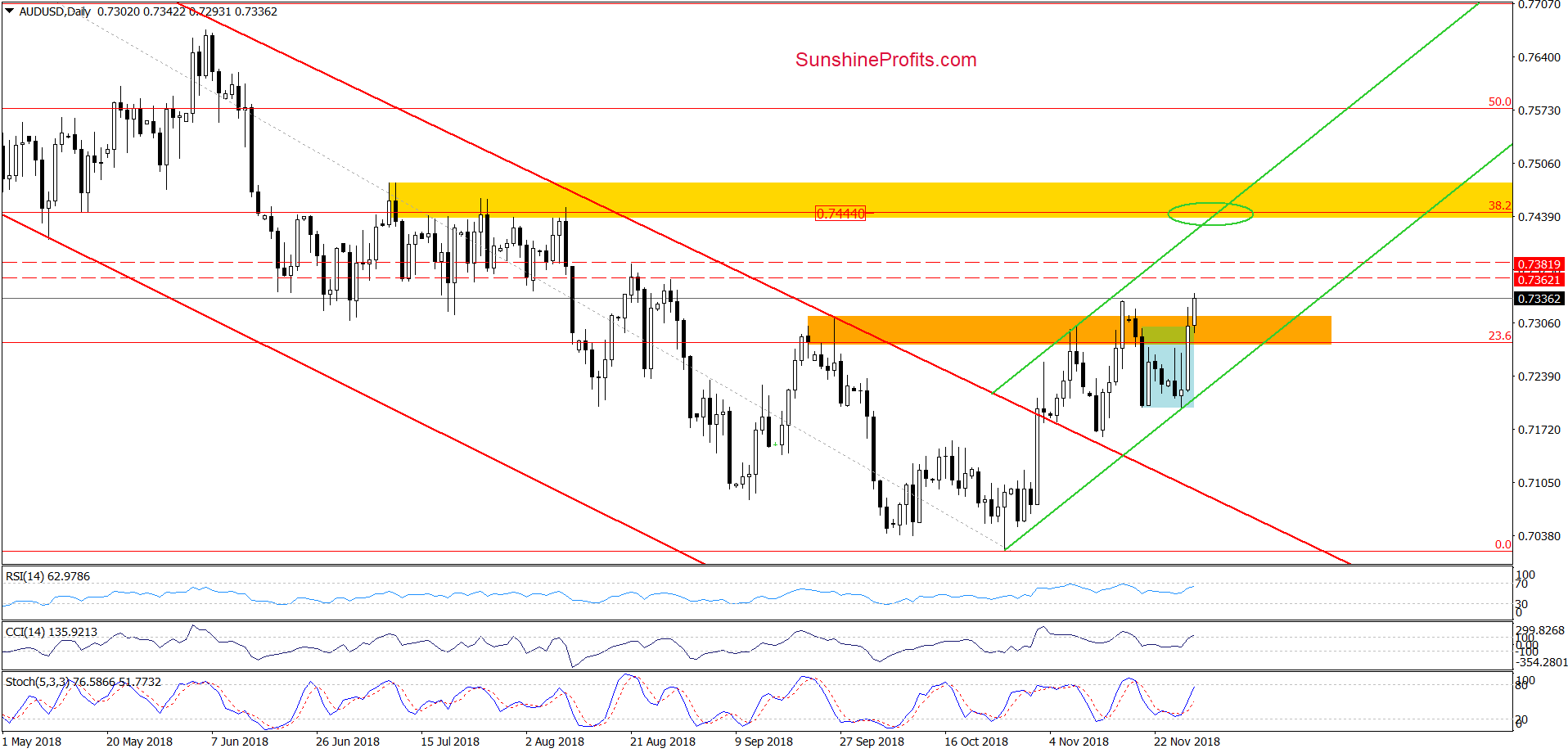

AUD/USD

The first thing that catches the eye on the daily chart is today’s breakout not only above the upper border of the blue consolidation, but also an increase above the orange resistance zone and the mid-November peak.

Yesterday’s sharp upswing, today’s move and the buy signals generated by the indicators suggest that we’ll see at least a test of the red horizontal resistance lines based on late-August highs. Nevertheless, if they are broken, currency bulls will likely test the 38.2% Fibonacci retracement (around 0.7444) and the yellow resistance zone in the following days.

Taking all the above into account, we think that opening long positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.7190 and the initial upside target at 0.7440 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts