Although the greenback extended gains against the yen in the previous week, currency bulls didn’t manage to hold gained levels, which resulted in a reversal. How low could USD/JPY go in the coming days?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.2717; the take profits level at 1.2510)

- USD/CHF: none

- AUD/USD: none

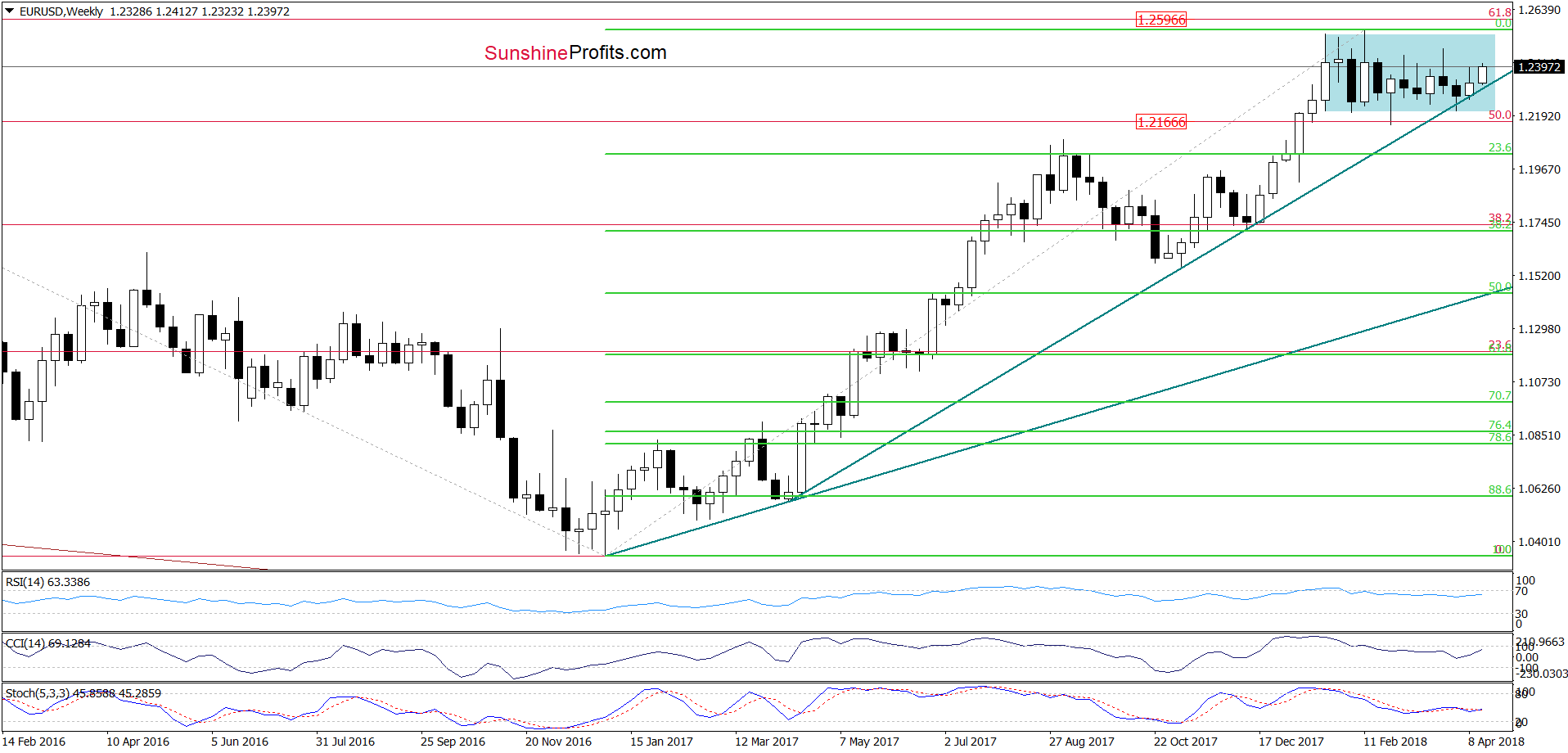

EUR/USD

Looking at the medium-term chart, we see that the long-term green line (which intersects the blue consolidation) continues to keep declines in check since the beginning of the month.

Additionally, this support encouraged currency bulls to act earlier this week, which could result in further improvement in the coming days.

Are there any negative technical factors that could thwart pro-growth plans? Let’s take a look at the daily chart below to find out.

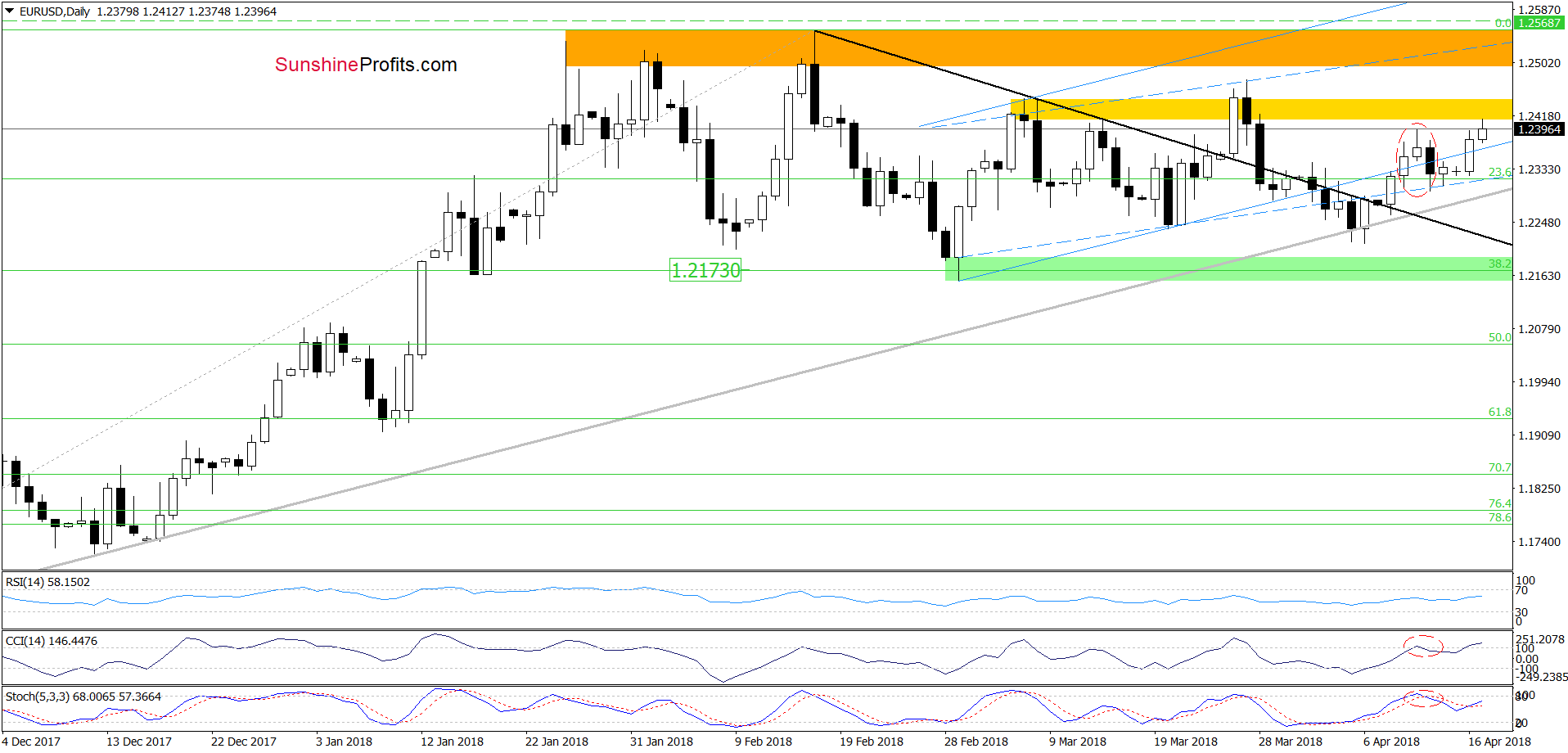

From this perspective, we see that EUR/USD broke above the last week’s high earlier today, which together with the current position of the indicators suggests that we may see a test of the late March peak. Additionally, thanks to today’s price action, the exchange rate invalidated the pro-bearish evening star (candlestick pattern marked with the red dashed ellipse), increasing the probability of another upswing.

Nevertheless, this improvement will be more likely and reliable if currency bulls manage to close the day above the yellow resistance zone. But if they show weakness in this area, a reversal and a test of the grey medium-term chart should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

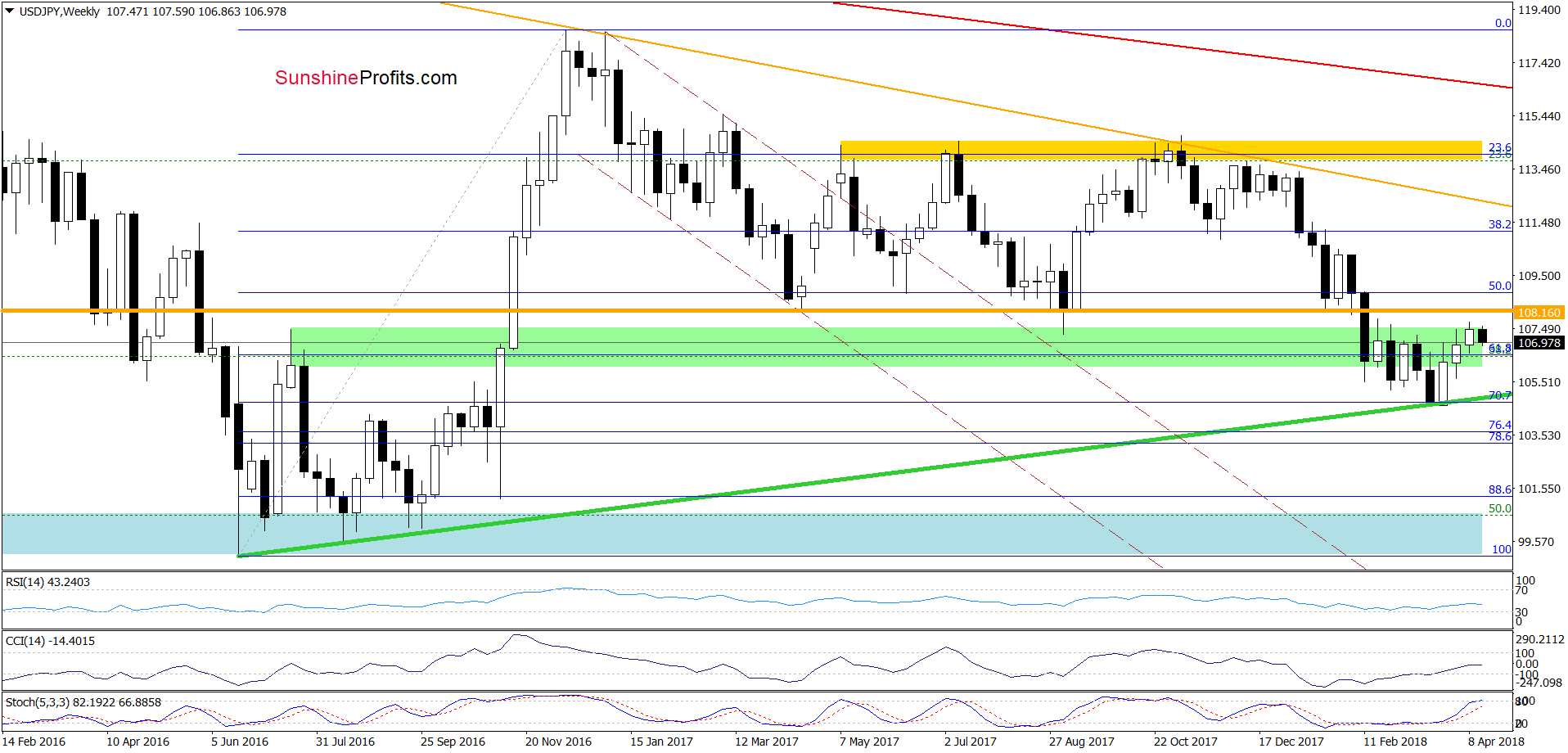

USD/JPY

On the medium-term chart, we see that the exchange rate reversed and declined earlier this week, erasing over 70% of the last week’s increase.

How did this price action affect the very short-term picture?

Before we answer this question, let’s recall the quote from our last commentary on this currency pair:

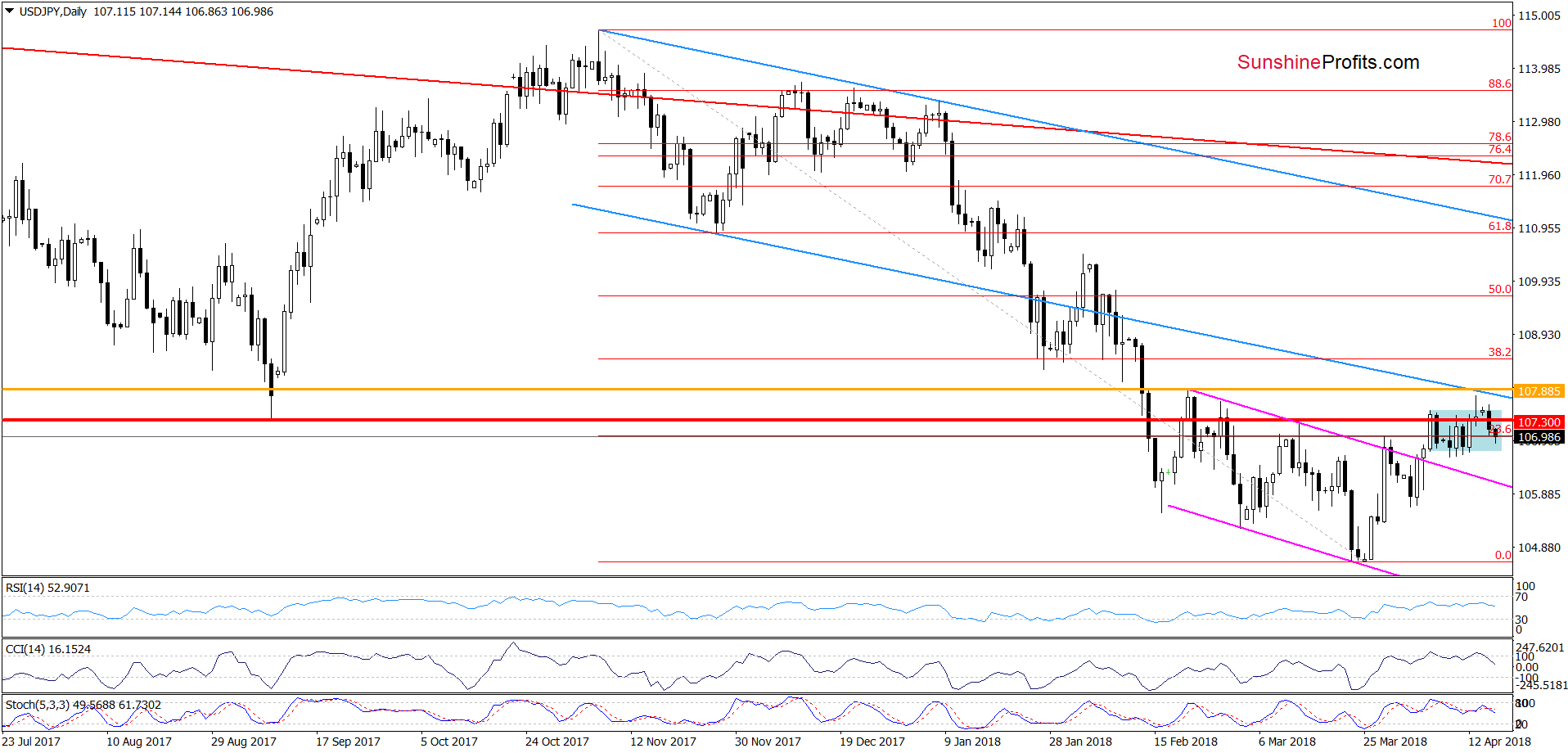

The first thing that catches the eye on the daily chart is breakout above the upper border of the blue consolidation. Although this is a bullish development, we can’t forget that the exchange rate remains under the resistance area created by the orange resistance line based on the late February peak and the previously-broken lower border of the blue declining trend channel.

This suggests that as long as there is no successful breakout above these lines further improvement is questionable and one more reversal can’t be ruled out.

From today’s point of view, we see that the situation developed in line with the above scenario and currency bears pushed USD/JPY lower. Taking into account an invalidation of the breakout above the upper line of the above-mentioned formation and the sell signals generated by the indicators, we think that the exchange rate will not only test the lower border of the blue consolidation, but also the previously-broken upper line of the pink declining trend channel in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

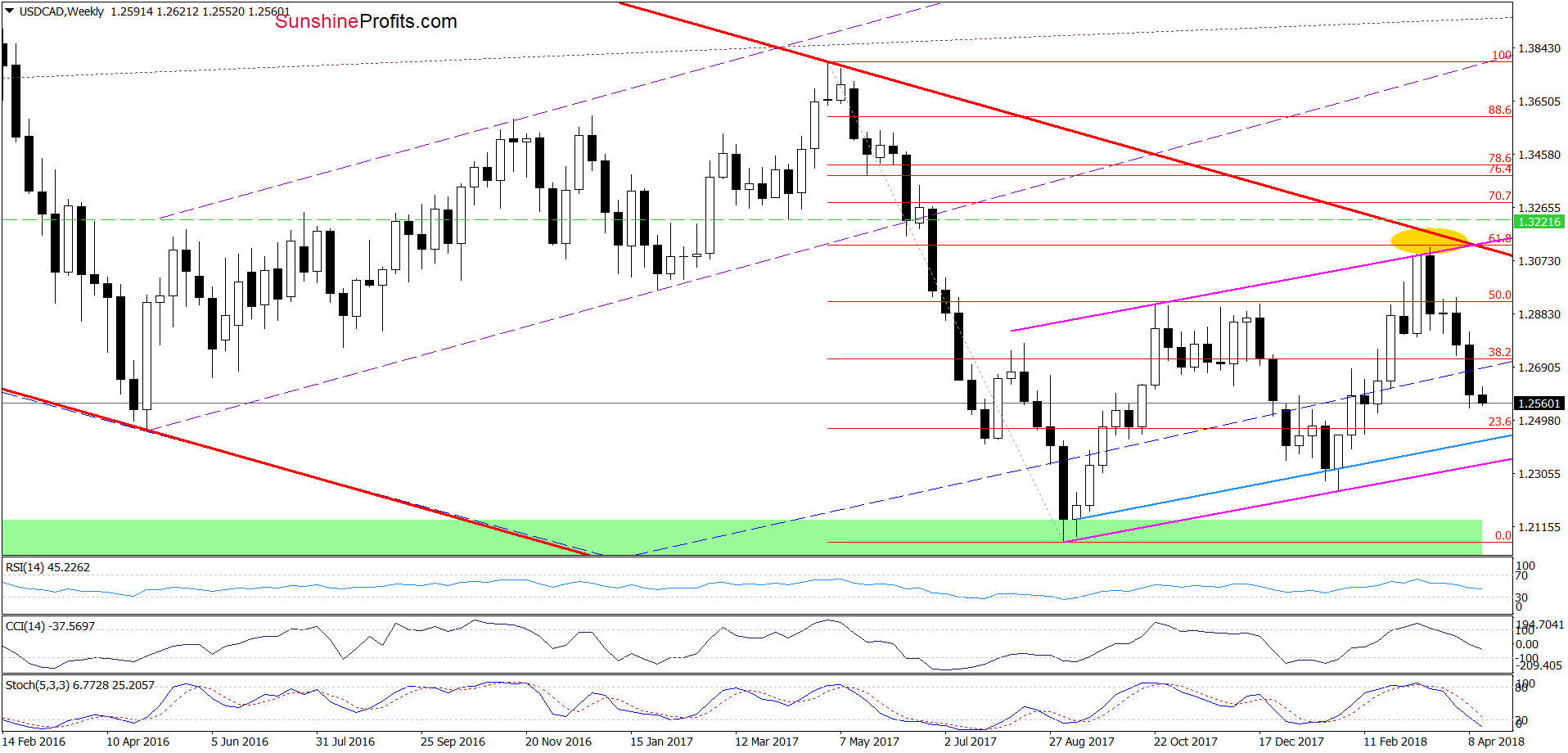

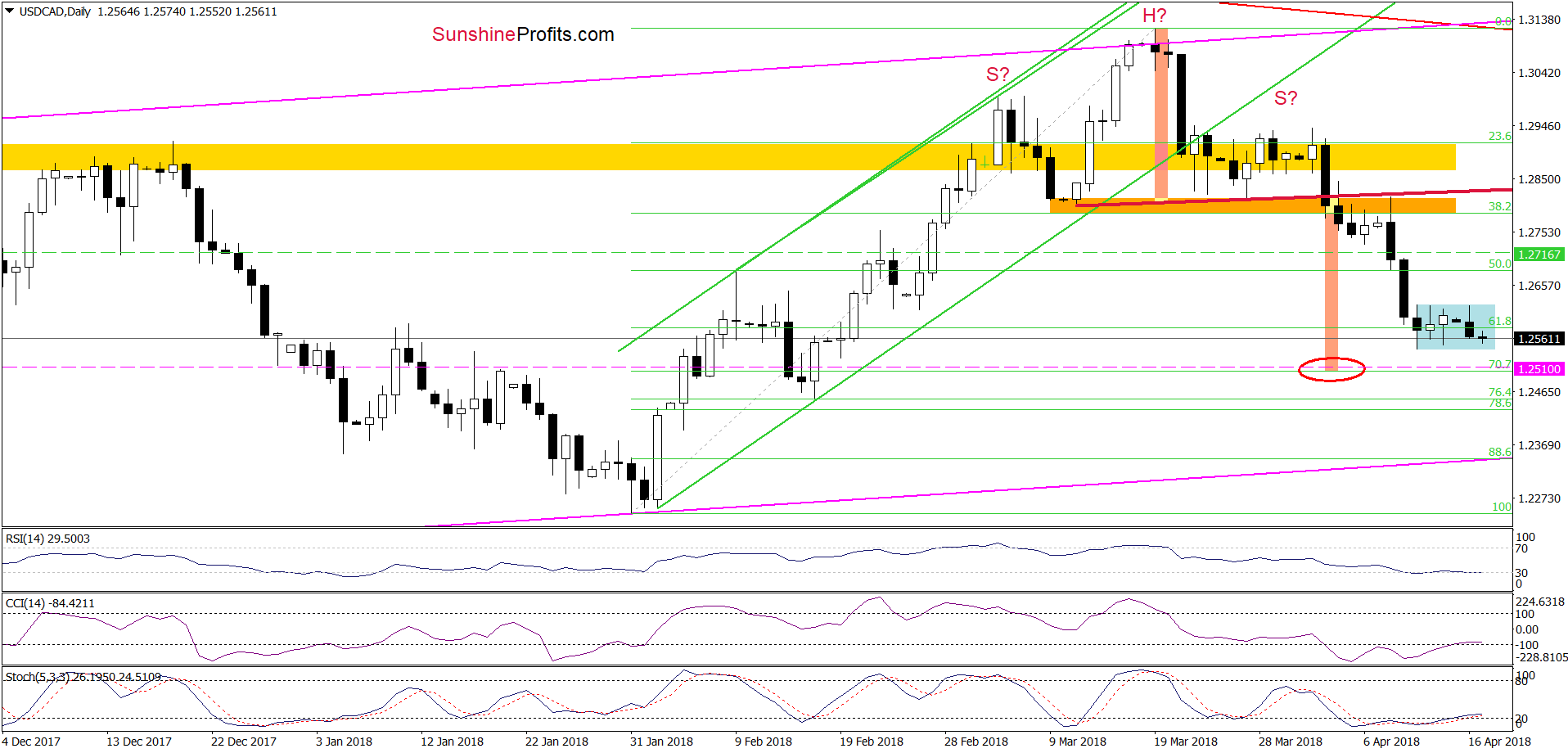

USD/CAD

As you see on the daily chart, the overall situation in the very short term hasn’t changed much as USD/CAD is still trading in the blue consolidation around the 61.8% Fibonacci retracement. This means that what we wrote on Friday remains up-to-date also today:

(…) the strength of sellers may decrease in the following days.

On top of that, the CCI and the Stochastic Oscillator are extremely oversold, which increases the probability of rebound in the very near future. Taking all the above into account, we decided to move our stop loss order lower (to 1.2717) to protect another part of our profits.

Nevertheless, our profitable short positions with the next downside target at 1.2510 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts