Monday’s session brought a sharp rebound, which erased over half of the recent downward move. Yesterday, we saw further improvement. Is this the beginning of the next upward movement or rather the verification of the earlier breakdown?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.68; the exit target at 112.34)

- USD/CAD:none

- USD/CHF: short (a stop loss order at 1.0192; the exit target at 0.9850)

- AUD/USD:none

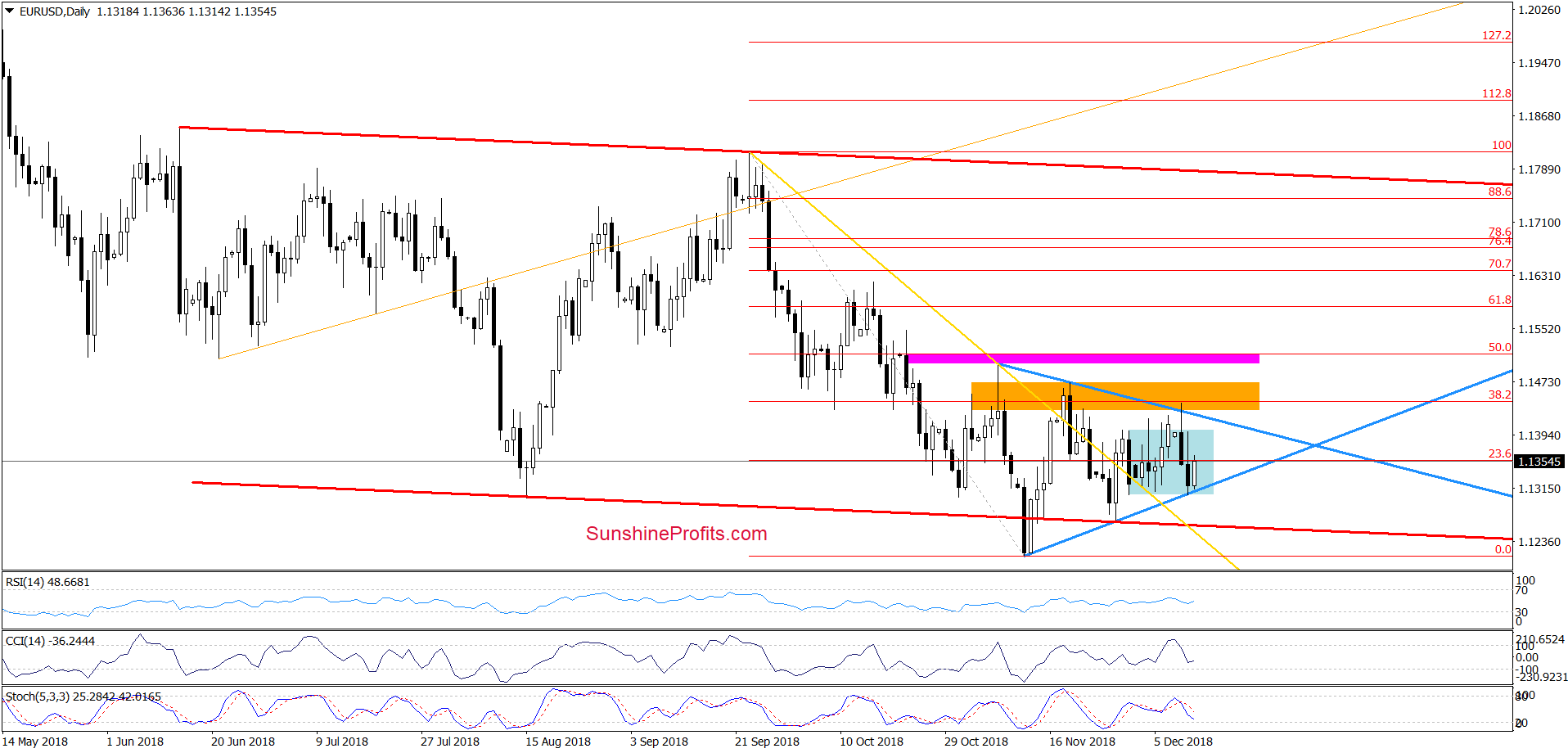

EUR/USD

Yesterday, we wrote the following:

(…) the orange resistance zone (created by the previous highs and the 38.2% Fibonacci retracement) successfully stopped the bulls during yesterday’s session, triggering a quite sharp pullback.

Thanks to his drop EUR/USD invalidated two earlier breakouts: above the upper line of the blue triangle and the upper line of the blue consolidation and closed the day inside the blue consolidation. Additionally, the CCI and the Stochastic Oscillator generated sell signals, suggesting that further deterioration is just around the corner.

If this is the case and the exchange rate declines from current levels, we’ll see a test of the lower line of the consolidation and the lower border of the blue triangle in the coming days.

Looking at the daily chart, we see that the situation developed in tune with the above scenario and EUR/USD slipped to our downside target during yesterday’s session.

Earlier today, the proximity to the lower line of the consolidation and the lower border of the blue triangle encouraged currency bulls to act, which resulted in a rebound, which erased over half of yesterdays decline.

Although this is a positive very short-term sign (which can translate into further improvement and a test of yesterday’s high and the upper border of the consolidation), we should keep in mind that the overall situation in a broader perspective remains almost unchanged as EUR/USD is still trading inside the blue triangle.

Therefore, the comments that we made a week ago are still valid:

(…) we continue to believe that as long as there is no breakout above the upper border of the triangle (or a breakdown under the lower line) another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

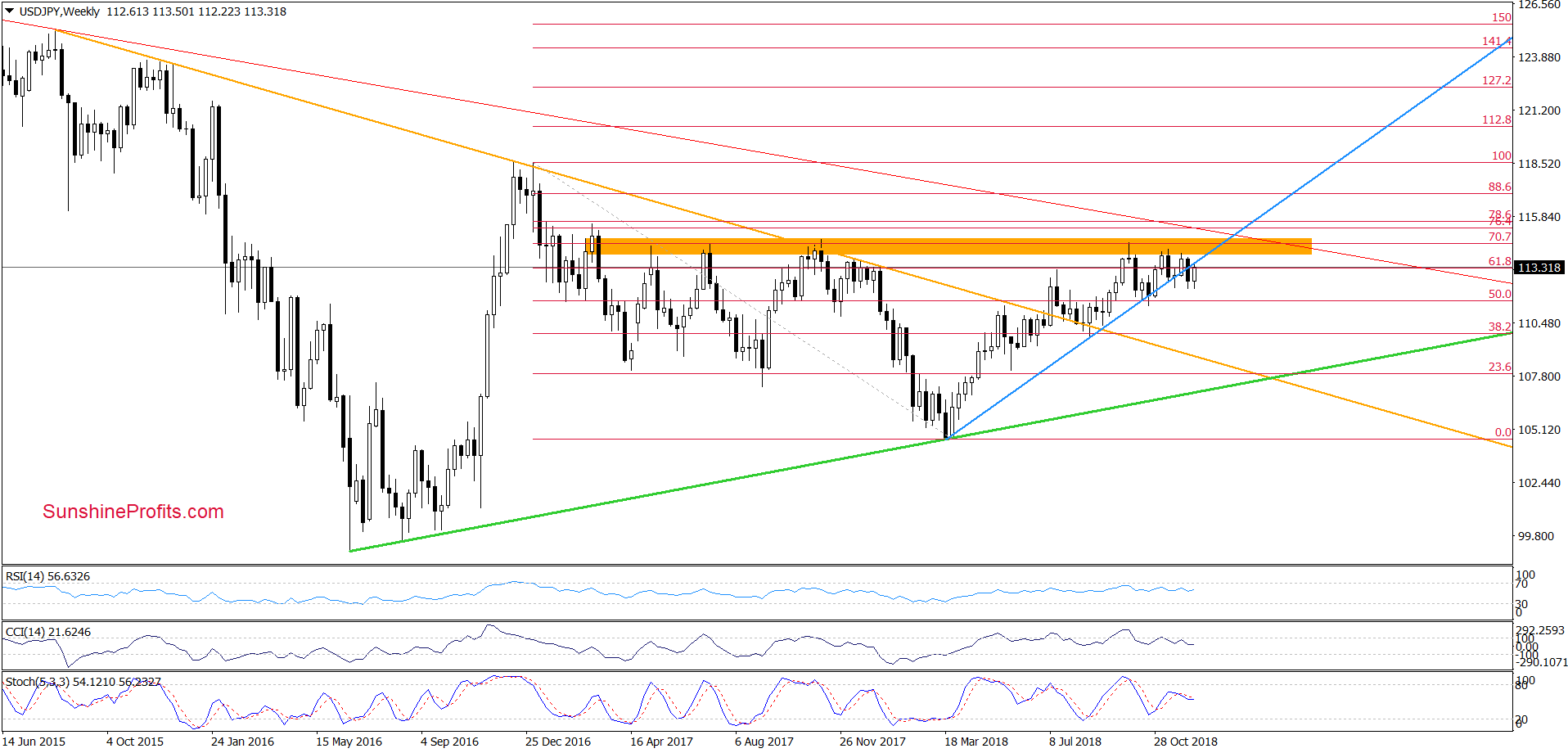

USD/JPY

Quoting our Monday’s commentary on this currency pair:

(…) USD/JPY closed the previous week not only below the major resistance zone (marked with orange, which continues to keep gains in check since March 2017), but also below the long-term blue line based on the March 2018 and August 2018 lows.

In this way, the pair invalidated the earlier breakout (for the first time successfully for many weeks), which doesn’t bode well for the buyers and higher values of USD/JPY in the broader perspective – especially when we factor in the sell signals generated by the weekly indicators.

Nevertheless, before we see the exchange rate lower a rebound from here and a verification of the last week’s breakdown below the blue line can’t be ruled out.

From today’s point of view, we see that currency bulls pushed USD/JPY higher (as we had expected), which resulted in a climb to the above-mentioned long-term blue line earlier this week.

As we mentioned earlier such price action looks like a verification of the earlier breakdown and suggests that reversal and lower values of the exchange rate might be just around the corner.

This scenario is also reinforced by the short-term picture. Let’s take a look below.

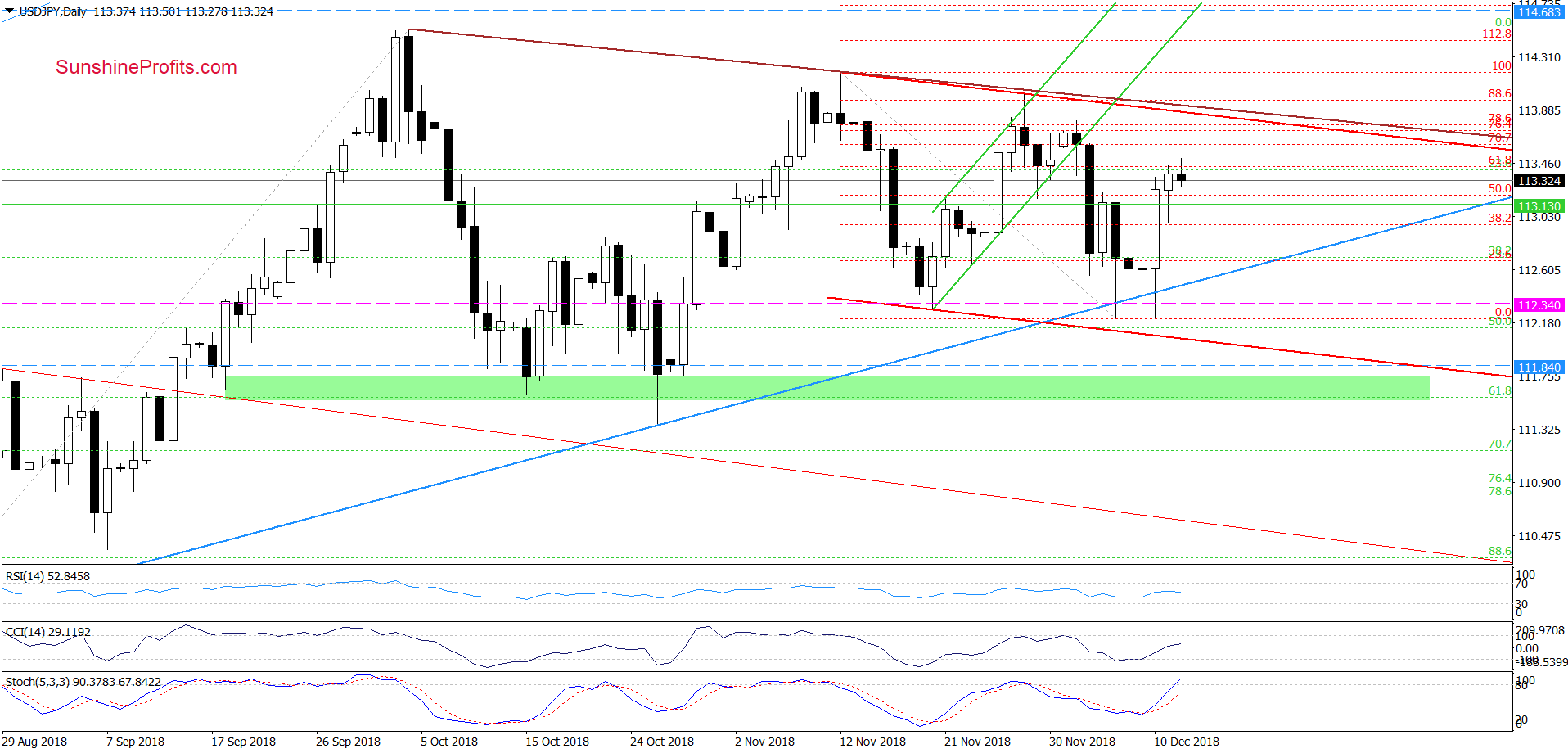

From this perspective, we see that an invalidation of the earlier small breakdown under the medium-term blue support line (based on the August and October lows) triggered a quite sharp move to the upside, which erased entire Friday’s drop.

This positive event in combination with the buy signals generated by the indicators caused further improvement and a climb to the 61.8% Fibonacci retracement in the following days.

As you see on the daily chart, this resistance in combination with the long-term blue line about we wrote above encouraged the sellers to act earlier today. Thanks to their attack, the pair slipped under the retracement, invalidating the earlier tiny breakout. This is a negative development, which will turn into bearish if the exchange rate closes today’s session under this resistance.

How low could the pair go if currency bears show their claws?

In our opinion, the first downside target will be around 112.48, where the blue support line (marked on the daily chart) currently is.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at 114.68 and the exit target at 112.34 are justified from the risk/reward perspective.

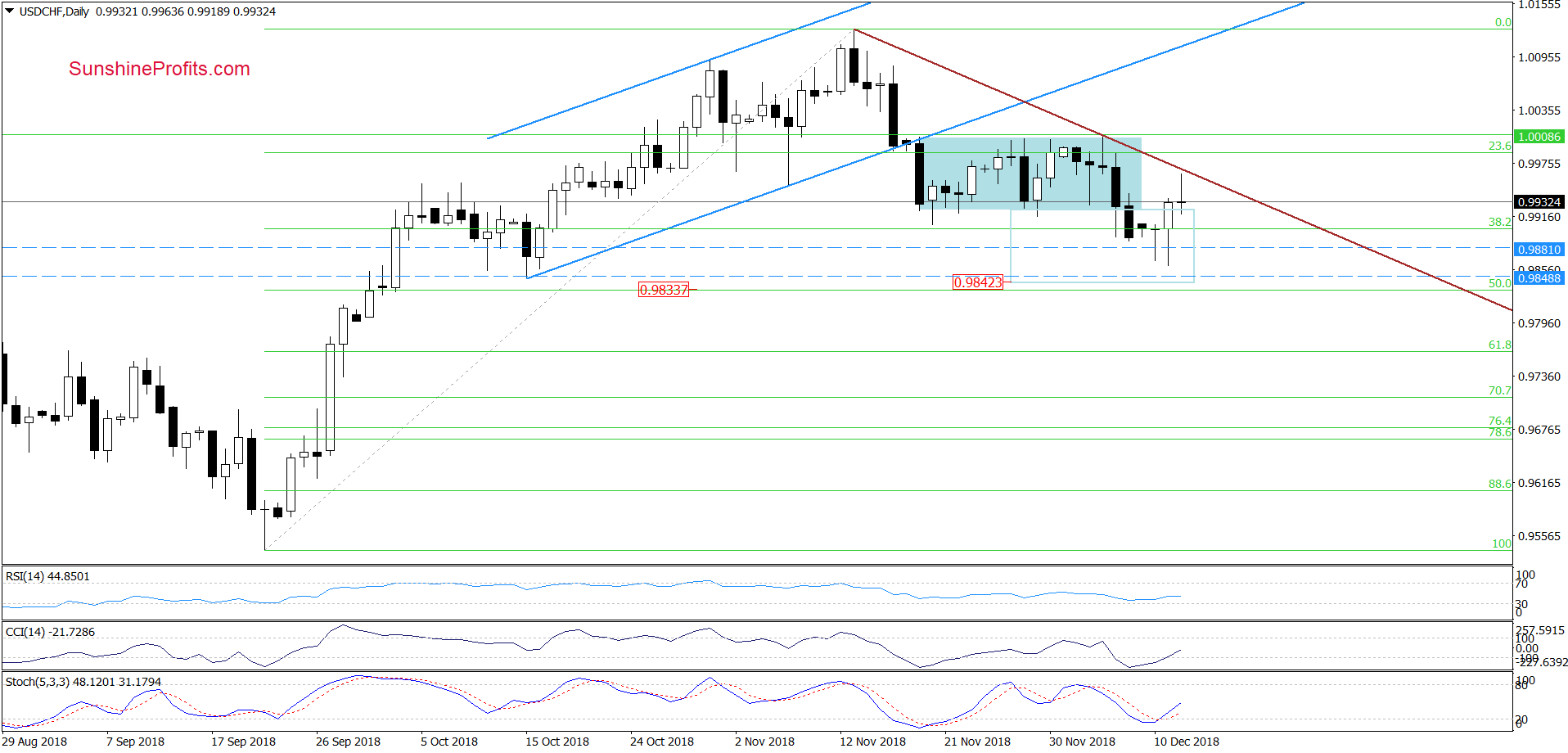

USD/CHF

On the daily chart, we see that USD/CHF invalidated the earlier small breakdowns under the 38.2% Fibonacci retracement, which caused an upward move during recent sessions.

Despite this improvement, currency bulls didn’t manage to push the exchange rate above the short-term declining resistance line based on the previous highs, which encouraged their opponents to act.

As a result, USD/CHF pulled back and came back to yesterday’s high, which suggests that currency bulls they may not be as strong as they might seem at the first glance. If this is the case and the pair extends losses from here, we’ll likely see a test of the mid-October lows and the 50% Fibonacci retracement in the following days (around 0.9833-0.9846).

At this point it is also worth noting that in this area the size of the downward move will correspond to the height of the blue consolidation, which increases the probability that the sellers will want to make profits in this area.

Trading position (short-term; our opinion): profitable short positions with a stop loss order at 1.0192 and the exit target at 0.9850 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts