In recent days, USD/JPY bounced off the support zone created by the Fibonacci retracement, but is this move as positive as it looks at the first sight?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1863; the initial downside target at 1.1408)

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

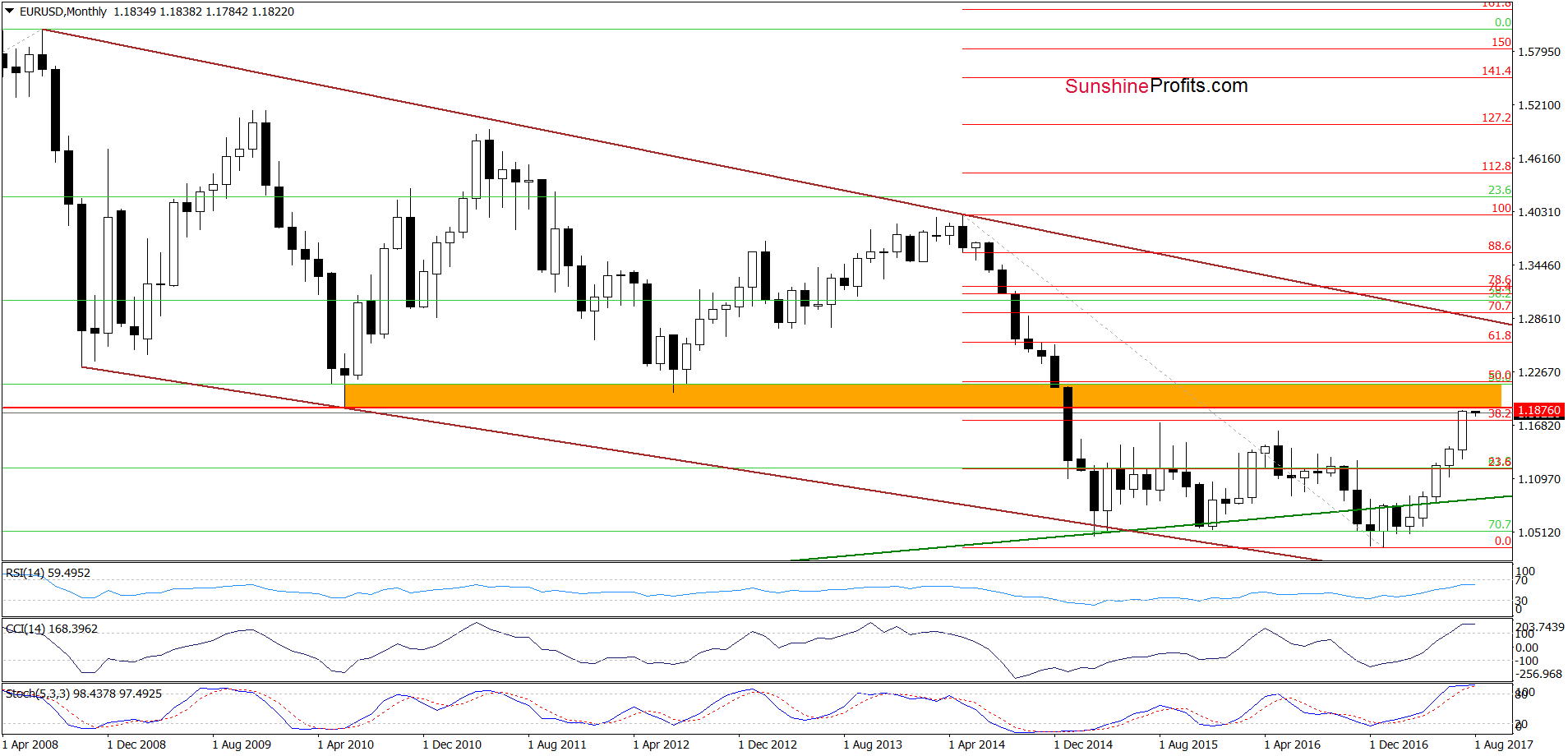

EUR/USD

Earlier today, EUR/USD increased a bit, but is still trading under this week’s highs, which means that what we wrote yesterday is up-to-date:

(…) the orange resistance zone created by the June 2010 and July 2012 lows (…) together with the current position of the daily and even monthly indicators suggests that reversal and lower prices are just around the corner (please note that there are also bearish divergences between the exchange rate and the daily indicators, which increases the probability of reversal in the coming days).

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1863 and the initial downside target at 1.1408) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

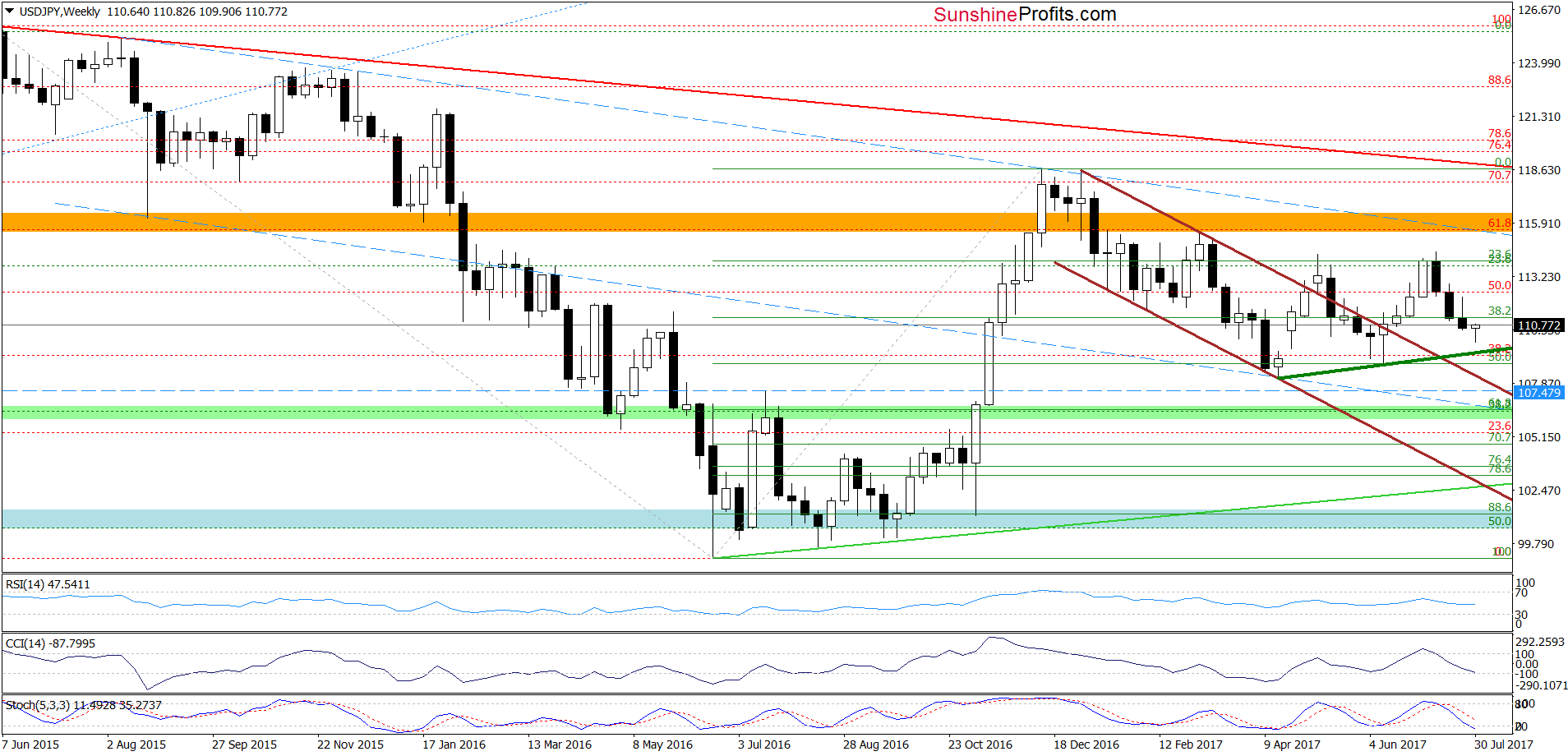

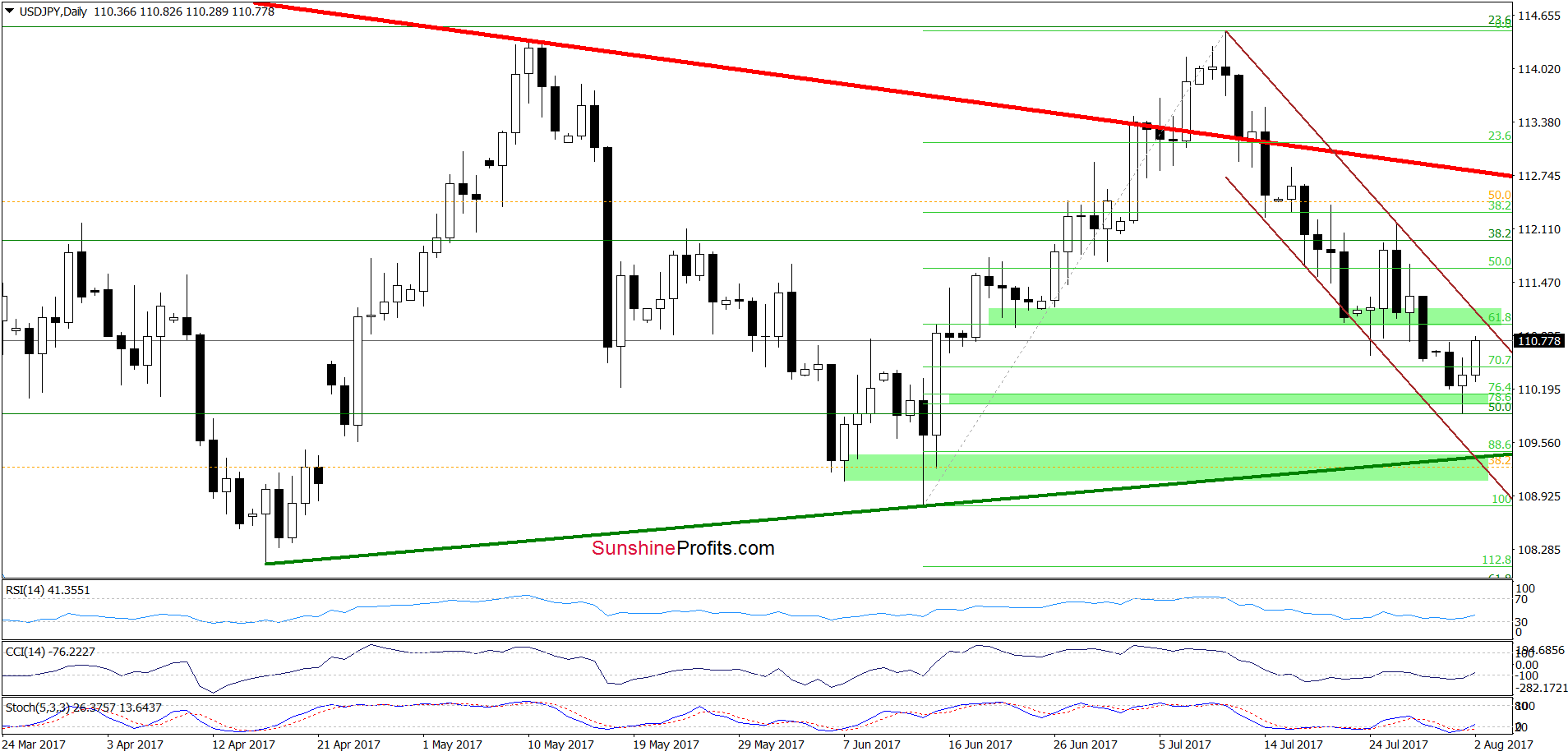

USD/JPY

On the daily chart, we see that the situation in the very short term has improved as USD/JPY bounced off the green support zone created by the 76.4% and 78.6% Fibonacci retracements. Despite this bigger upswing, we should keep in mind that the exchange rate is still trading in the brown declining trend channel under the previously-broken green zone created by the 61.8% Fibonacci retracement and late June lows. Additionally, the size of the move is smaller than the last week’s rebound, which doesn’t confirm currency bulls’ strength at the moment and suggests that one more move to the downside (and at least a test of the recent lows) can’t be ruled out.

What could happen if USD/JPY drops under the 76.4% and 78.6% Fibonacci retracements? In our opinion, we may see a drop to around 109.46, where the upper border of the next green support zone and the medium-term green support line based on the previous lows are.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

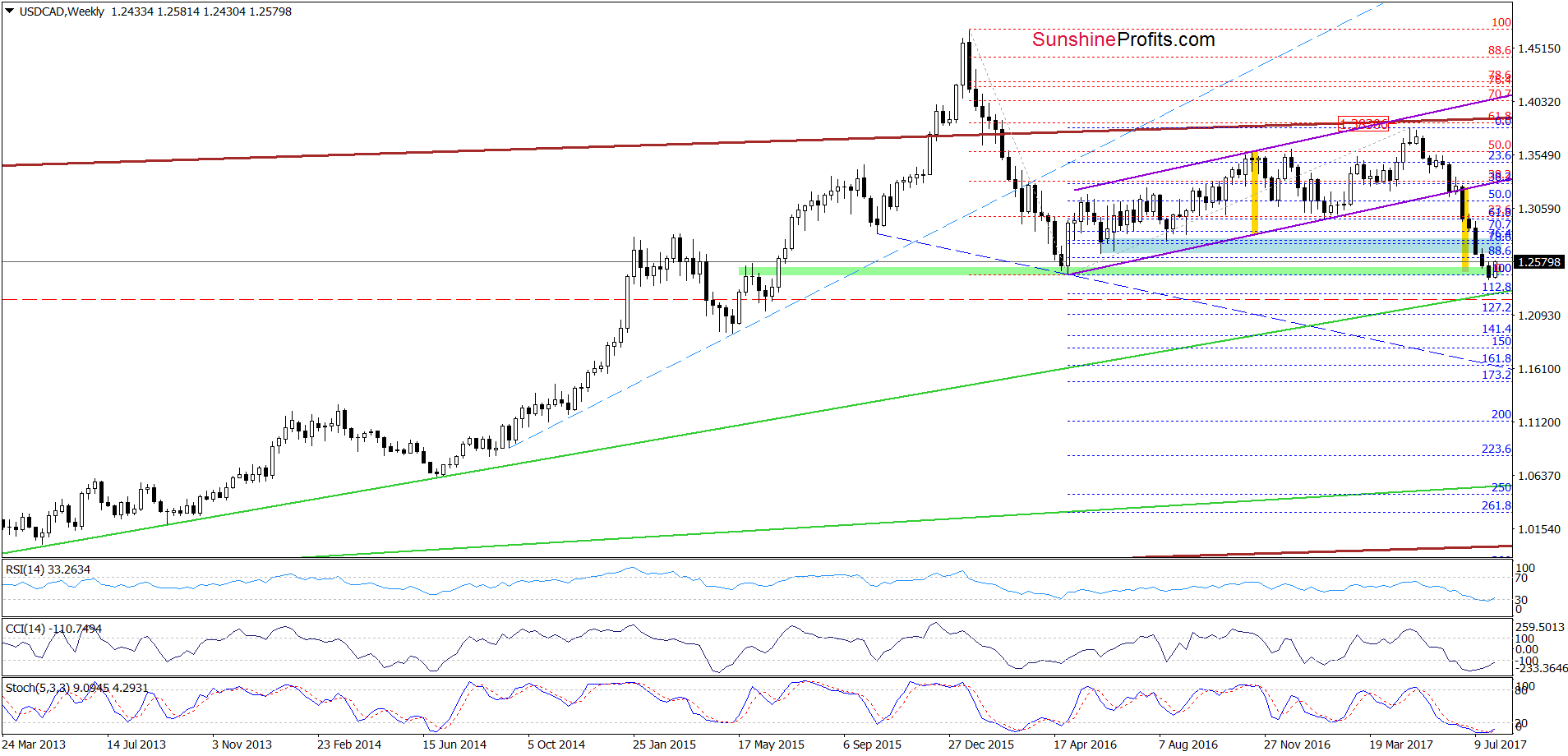

USD/CAD

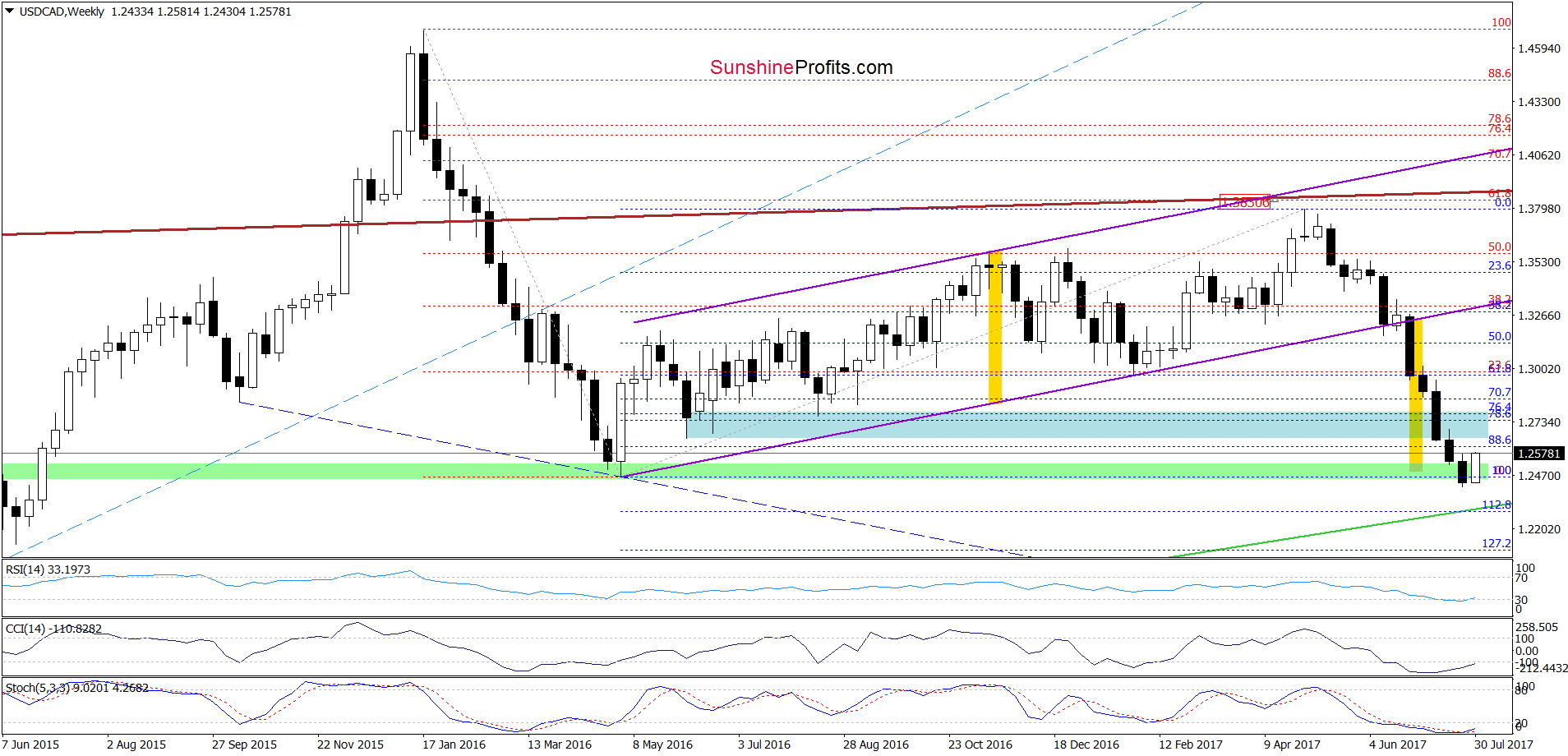

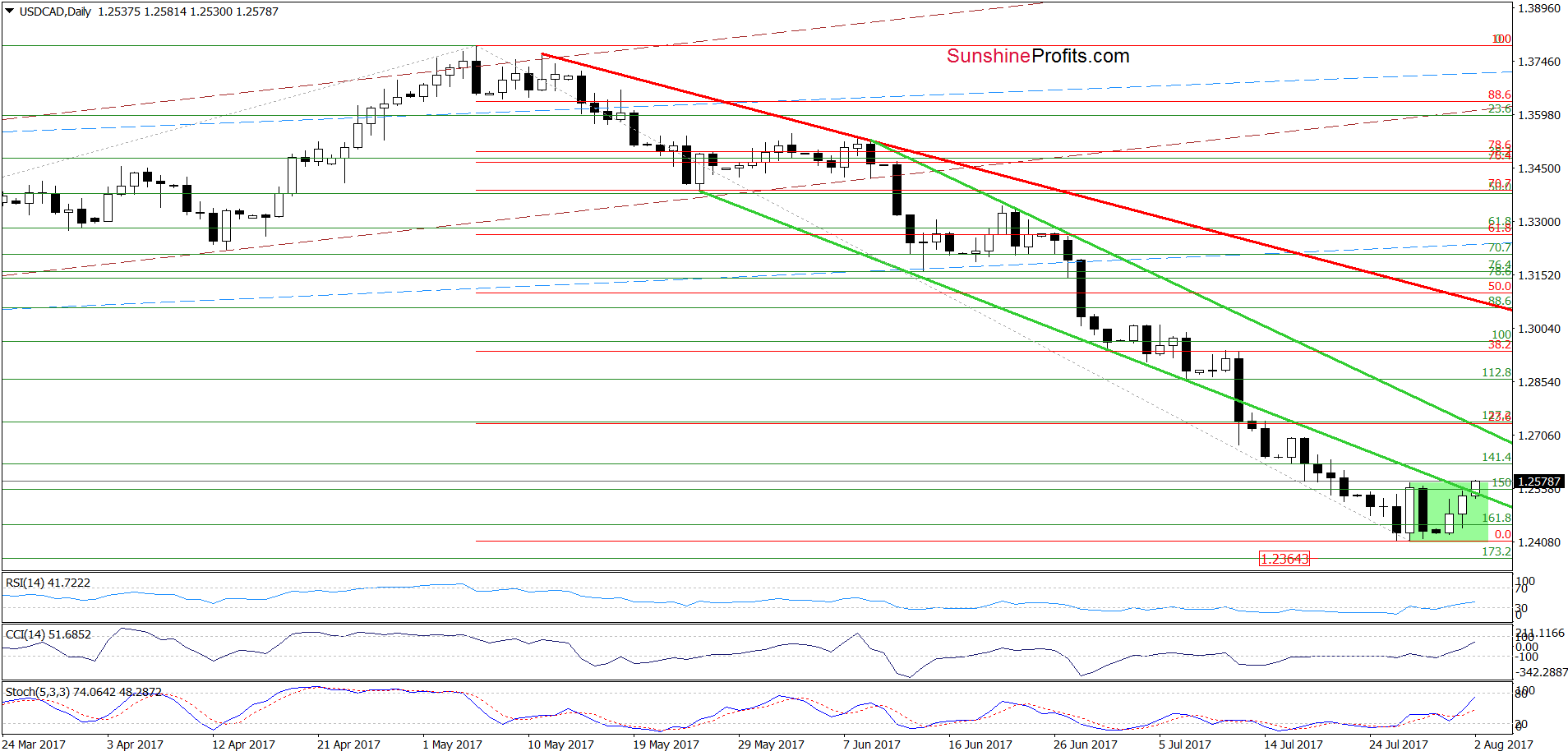

Looking at the charts from the broader perspective, we see that USD/CAD rebounded earlier this week, which resulted in invalidation of the breakdown under the May 2016 low and the green support zone.

How did this increase affect the very short-term picture? Let’s check.

Earlier today, USD/CAD moved higher and broke above the upper border of the green consolidation and the lower border of the green declining wedge, which is a positive development – especially when we factor in the buy signals generated by all daily indicators and the medium-term picture. Nevertheless, in our opinion, this improvement will be more stable and reliable if the exchange rate loses today’s session above the abovementioned support/resistance levels. If we see such price action, we’ll consider opening long positions.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Forex Trading Alert on Thursday and Friday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts