Recent bears’ attempts to come back under the previously-broken upper border of the trend channel failed, which means that the buyers are quite determined to keep this territory. What can this lead to in the next days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (the stop-loss level at 1.186; the initial target price at 1.1203)

- GBP/USD: none

- USD/JPY: long (the stop-loss level at 107.78; the initial target price at 113.88)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

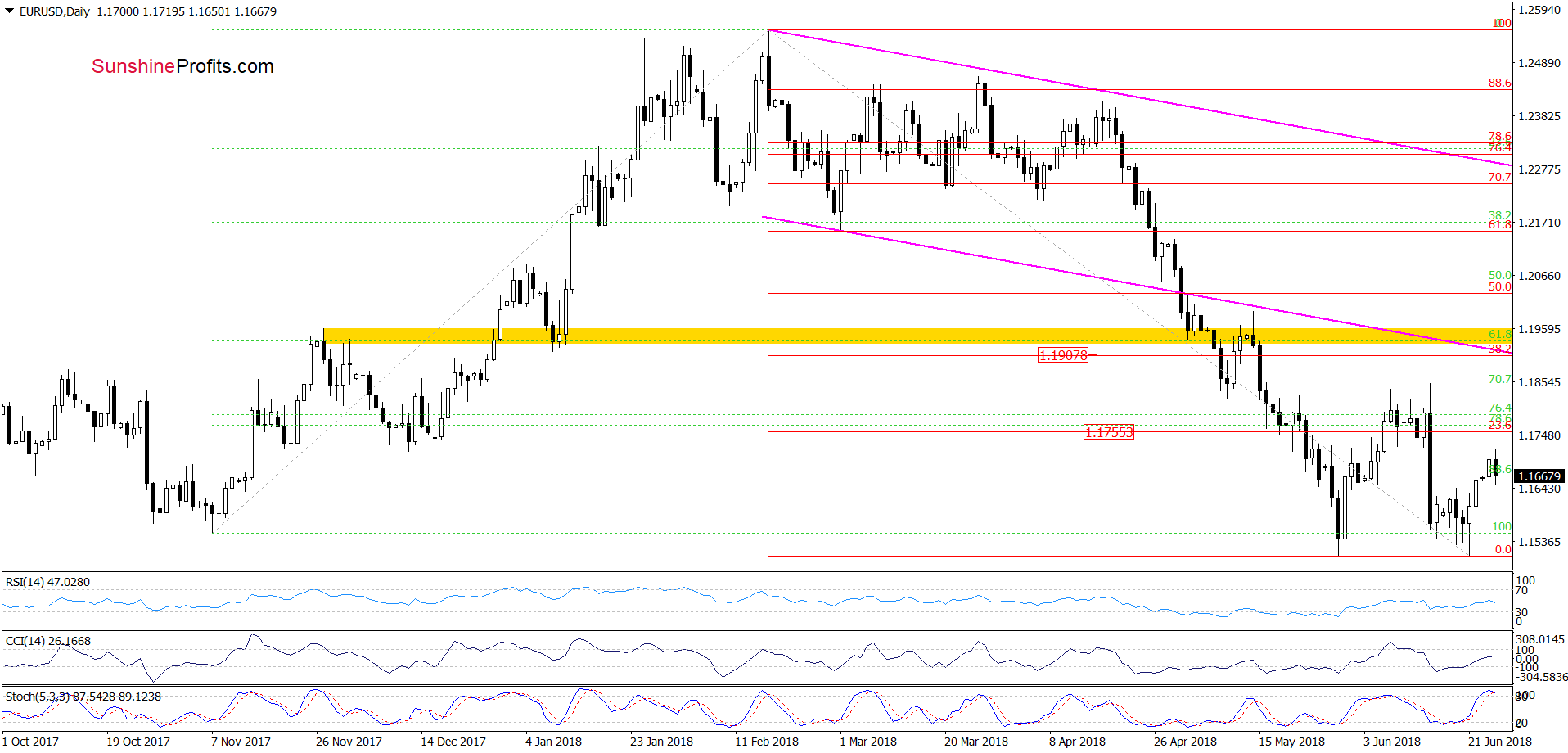

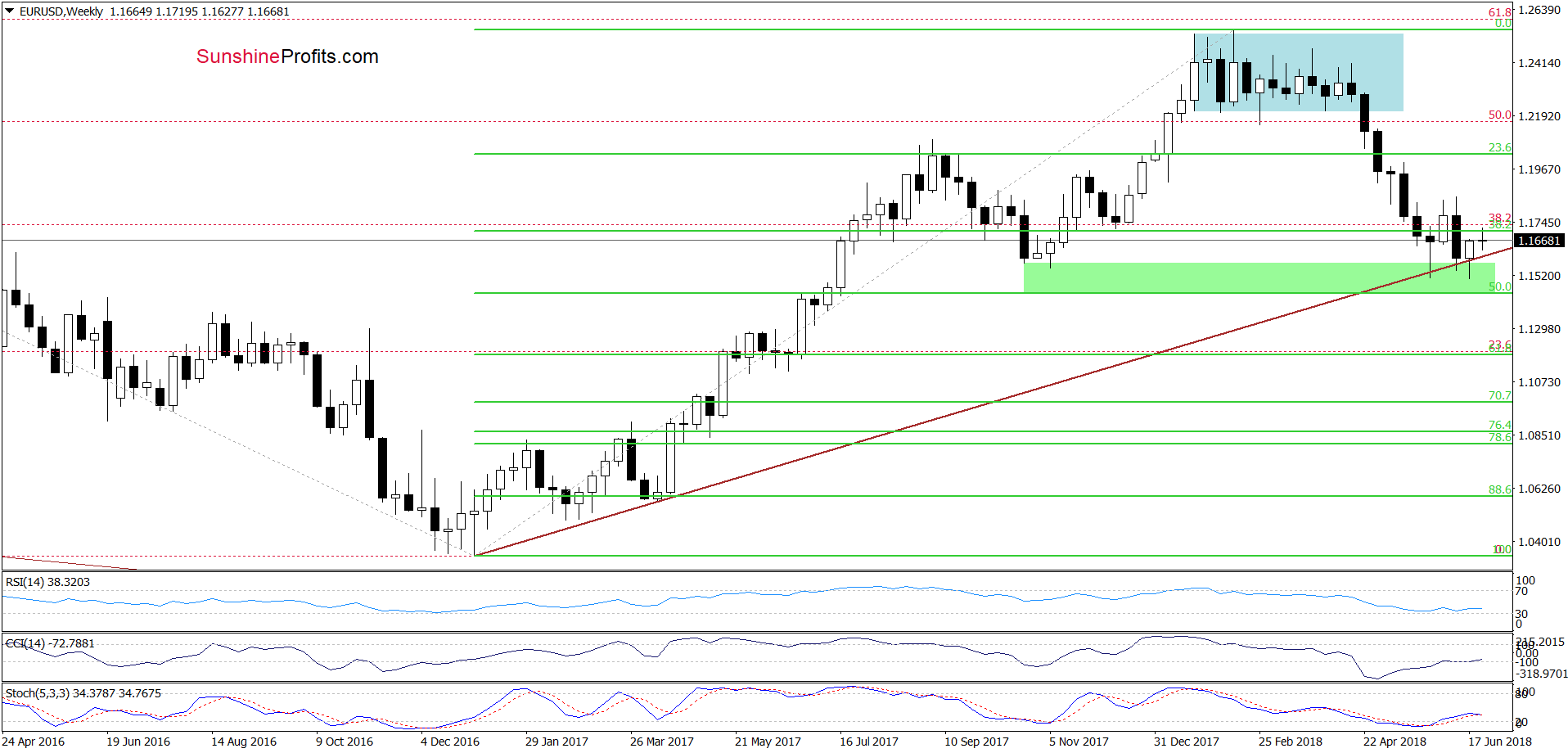

EUR/USD

On the daily chart, we see that although EUR/USD extended gains earlier today, this improvement was temporary, and the exchange rate reversed and declined in the following hours.

Such price action doesn’t confirm currency bulls’ strength - especially when we factor in the fact that the pair didn’t even manage to climb to the first Fibonacci retracement. Additionally, the Stochastic Oscillator is very close to generating a sell signal, which increases the probability that we’ll see a re-test of the long-term brown rising line seen on the weekly chart below (it serves as the nearest support at the moment of writing these words) in the coming day(s).

Trading position (short-term; our opinion): Short positions (with the stop-loss level at 1.186 and the initial target price at 1.1203) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

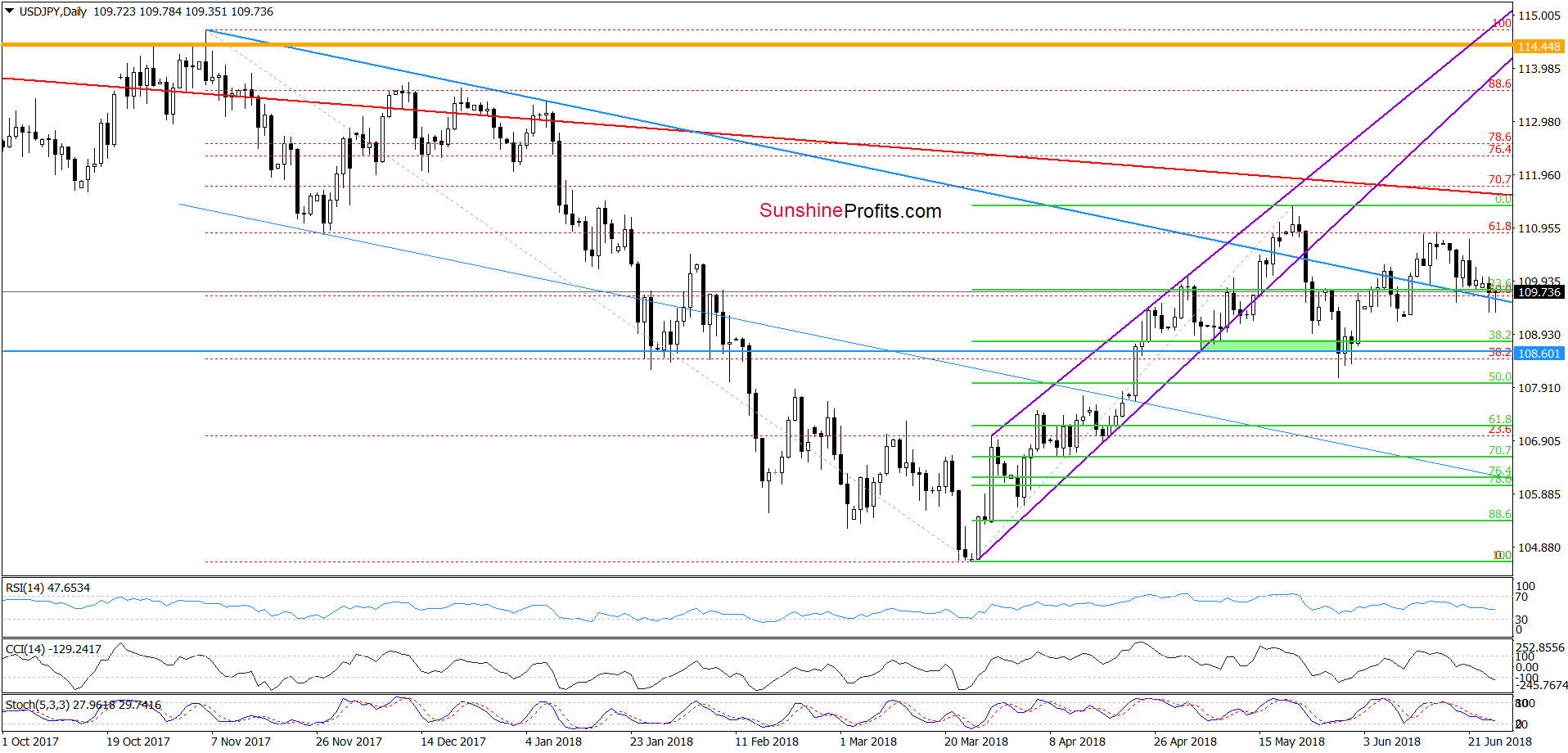

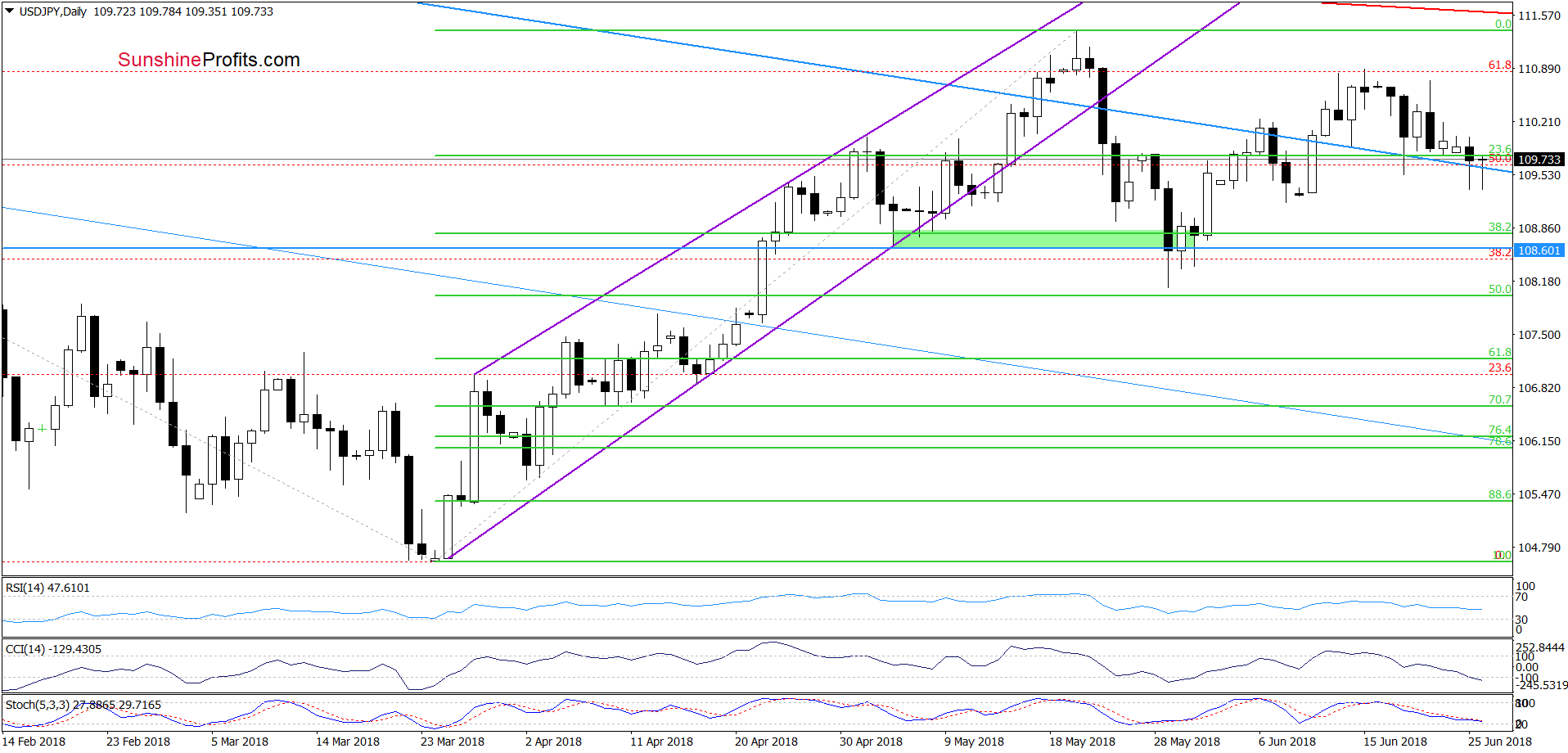

USD/JPY

To see more details, let’s zoom in a bit our daily chart.

From this perspective, we see that currency bears pushed USD/JPY below the previously-broken upper border of the blue declining trend channel during yesterday’s session. Nevertheless, despite this deterioration their opponents managed to stop them and trigger a rebound before the session closure. As a result, the exchange rate came back above this line, invalidating the breakdown.

Earlier today, we saw similar price action, but currency bulls didn’t fail once again and pushed the pair higher, which suggests that the buyers are quite active in this area. Additionally, the CCI and the Stochastic Oscillator dropped to their oversold zones, which increases the probability that we’ll see buy signals and higher values of USD/JPY in the following days.

If this is the case, the first upside target will be around 110.65-110.81, where the June peaks (in terms of daily closures and intraday highs) are.

Trading position (short-term; our opinion): Long positions (with the stop-loss level at 107.78; the initial target price at 113.88) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

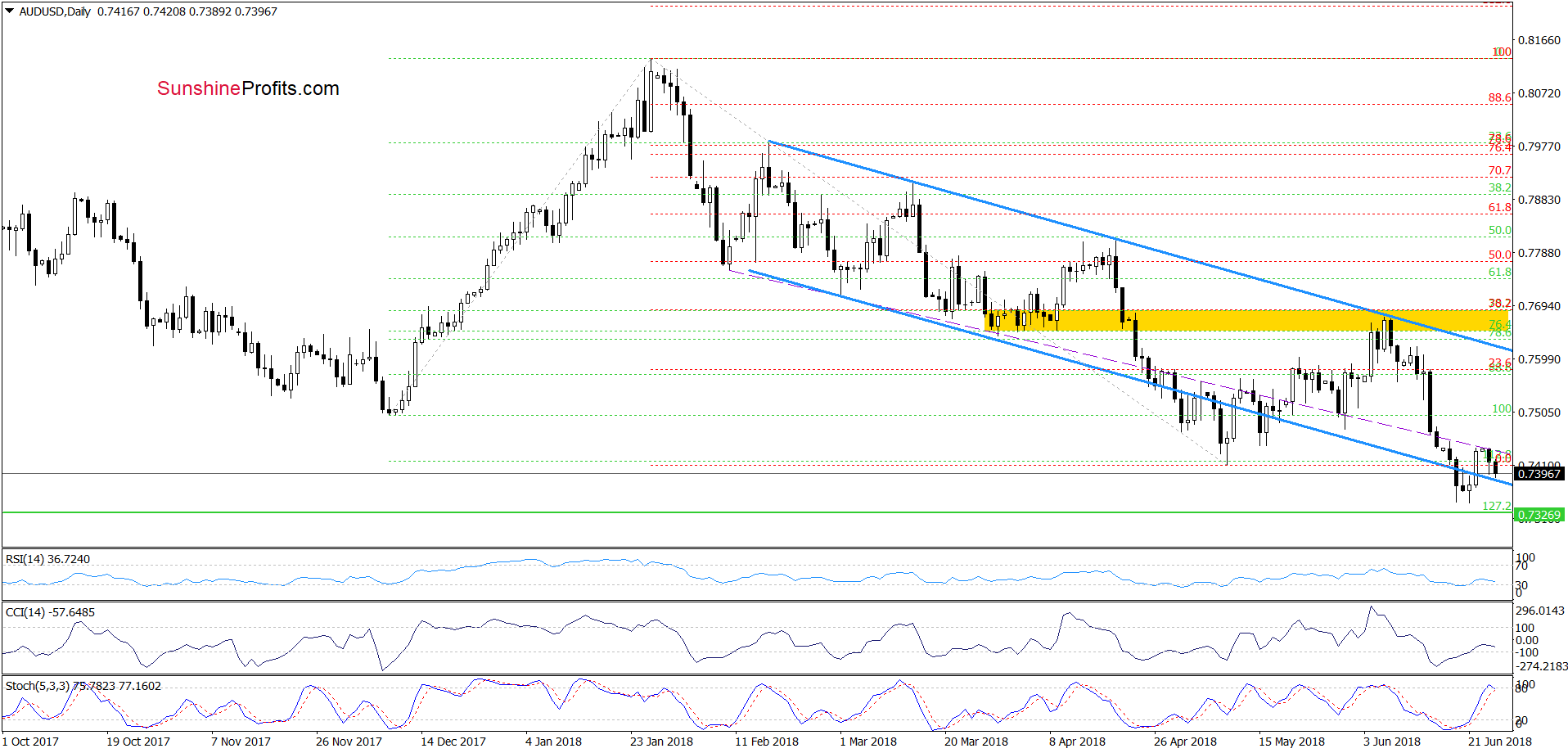

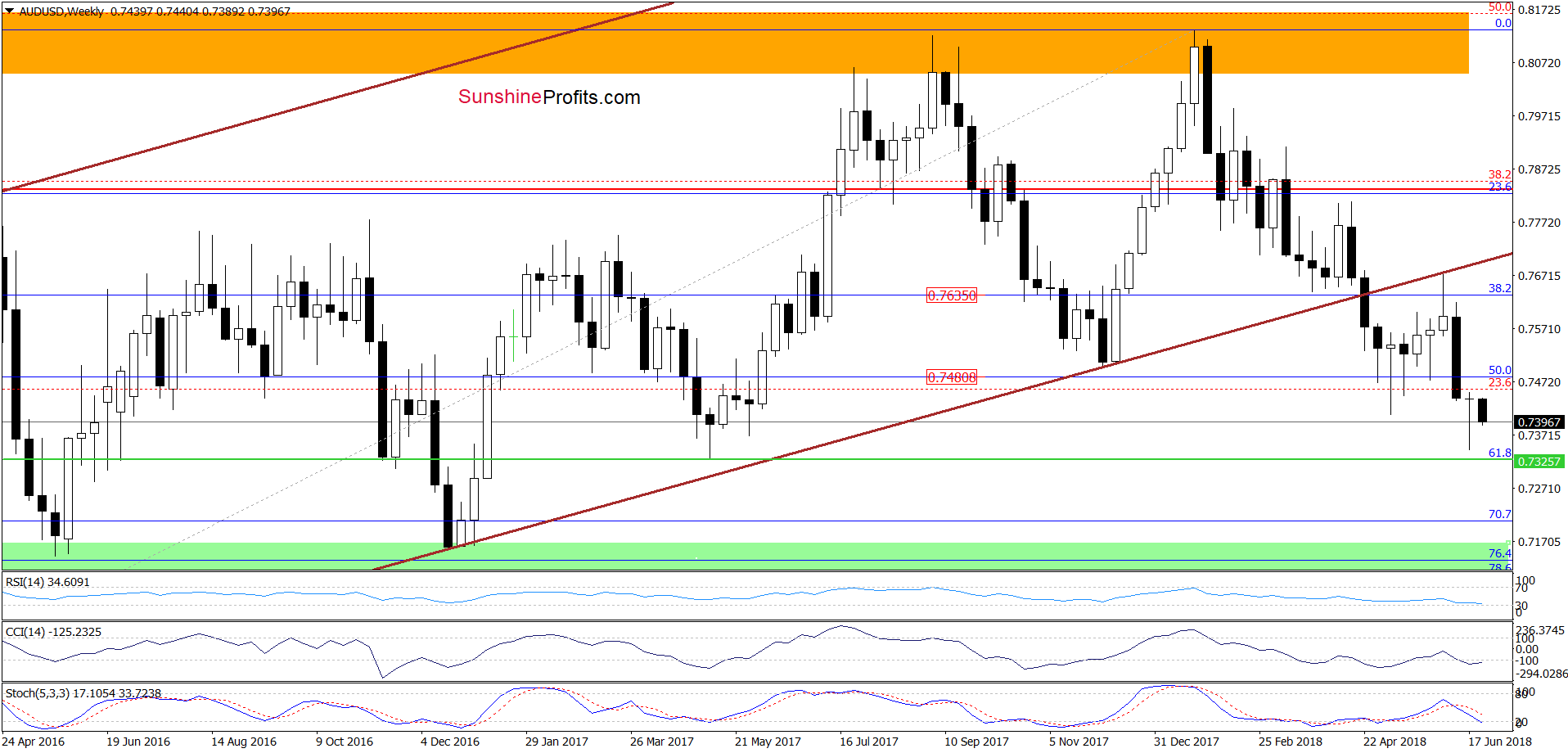

Looking at the daily chart, we see that the recent improvement in AUD/USD was quite temporary as the mid-June highs managed to stop currency bulls and further increases. Thanks to this price action the exchange rate came back to the previously-broken lower border of the blue declining trend channel.

Will we see a rebound from it? Well, in our opinion it’s quite doubtful – especially when we factor in the current position of the Stochastic Oscillator (it is very close to generating the sell signal). So, what does it potentially mean for AUD/USD?

In our opinion, further deterioration and a test of the 127.2% Fibonacci extension (the green horizontal line) in the following days. What’s interesting, in this area is also the 61.8% Fibonacci retracement (an important support) seen on the weekly chart below.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts