Last week’s quite sharp decline in USD/JPY took the exchange rate to the long-term support line, which was strong enough to stop the sellers three times in a row in October. Unfortunately (for the bulls) the beginning of this week brought a breakdown below it. What, then, can we expect in the coming days?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 113.67; the initial downside target at 111.84)

- USD/CAD: short (a stop-loss order at 1.3401; the initial downside target at 1.2934)

- USD/CHF: short (a stop loss order at 1.0192; the initial downside target at 0.9881)

- AUD/USD: none

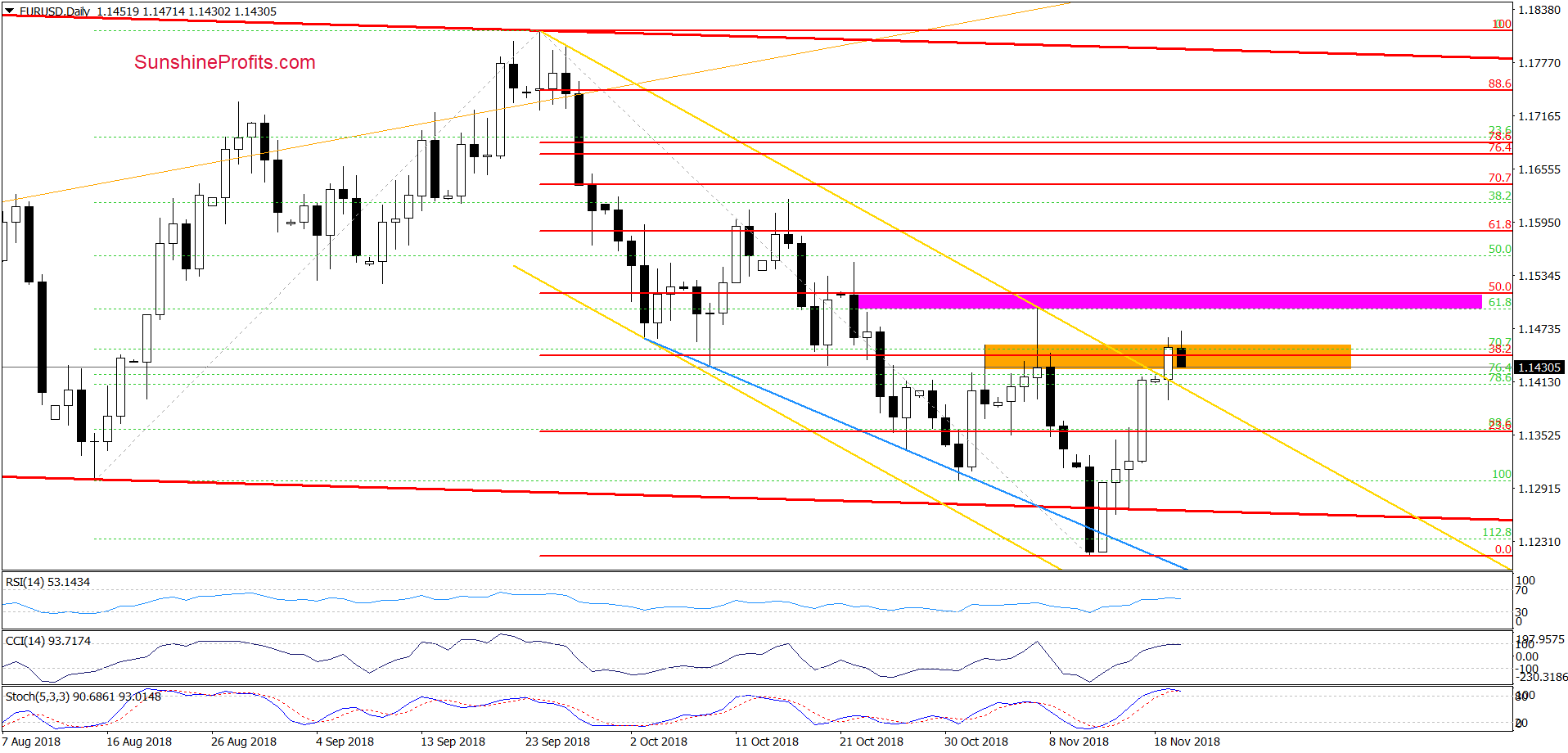

EUR/USD

Quoting our yesterday’s alert:

(…) the pair climbed above the yellow resistance line, which encouraged currency bulls to fight for higher values of EUR/USD.

As a result, the exchange rate moved above the 38.2% Fibonacci retracement based on the entire September – November declines, which suggests further improvement. Nevertheless, in our opinion, such price action will be more likely and reliable if the byers manage to close the day above the upper line of the range resistance zone.

From today’s perspective, we see that despite yesterday's strenuous attempts to climb to higher levels, the bulls didn’t manage to close the day above the orange resistance zone. This show of some weakness encouraged their opponent to act earlier today.

Thanks to the sellers’ attack, EUR/USD reversed, declined and invalidated the earlier breakout above the 38.2% Fibonacci retracement which in combination with the current position of the daily indicators looks quite gloomy (at least for the bulls).

However, just like we wrote yesterday, as long as there is no daily closure above/below important support/resistance line/level the situation can change. Therefore, in our opinion, if the pair finishes today’s session under the orange zone (and preferably even below the yellow support line), currency bears will then be able to think about the next bigger trip to the south (even to the lower border of the red declining trend channel). Until this time, another rebound attempt cannot be excluded.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective after the stop-loss order closed our short positions.

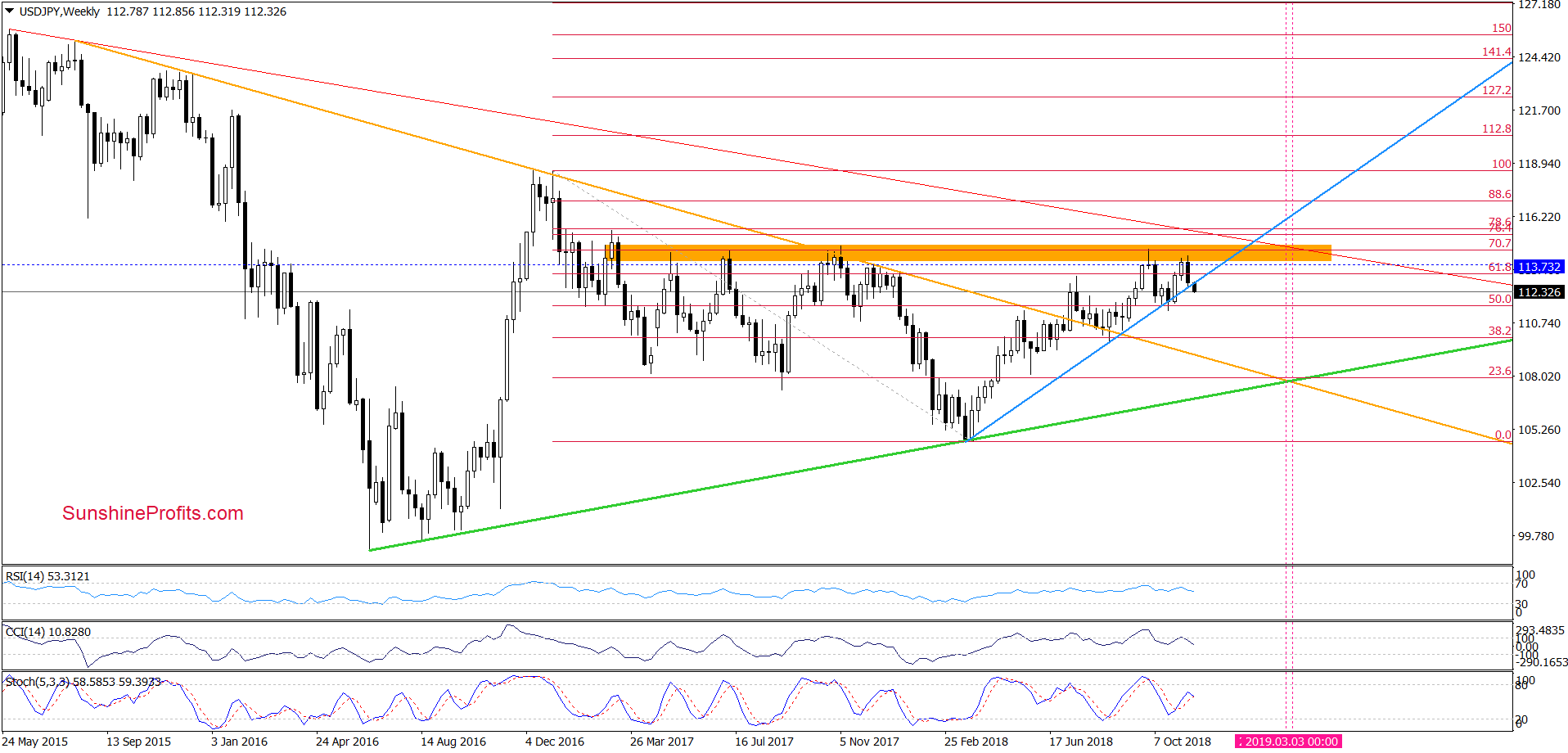

USD/JPY

In our last commentary on this currency pair, we wrote that the major resistance had stopped the buyers once again triggering a decline and erasing the last week’s rebound.

From today’s point of view, we see that this bearish development encouraged the sellers to push the pair even lower earlier this week. Thanks to this decline, the pair slipped under the long-term blue support line based on the March and August lows, invalidating the earlier breakout above this support.

Such price action doesn’t bode well for currency bulls and higher values of USD/JPY in (at least) near future. How low can the pair go? Let’s take a look at the daily chart.

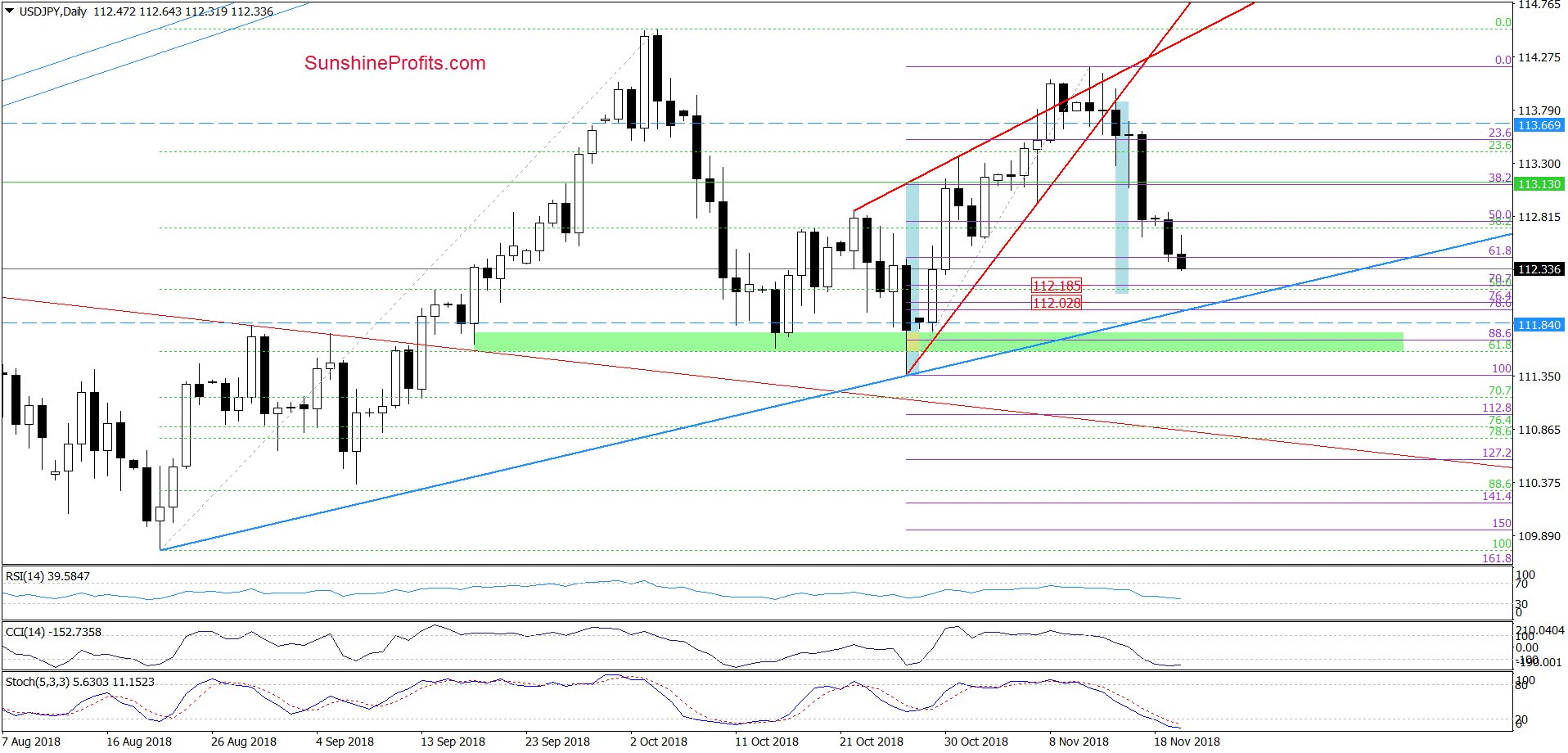

On Wednesday, we wrote:

(…) If this is the case and USD/JY declines from current levels, we’ll likely see a drop to the November lows around 112.63 or even a downward move to the green support area created by the late-October lows and the 61.8% Fibonacci retracement.

As you see on the very short-term chart USD//JPY broke below the early-November lows and closed yesterday’s session below them, which means that the way to the short-term blue support line (based on the August and late-October lows), the 76.4% and the 78.6% Fibonacci retracements is open.

At this point it is also worth noting that in this area the size of the downward move will correspond to the height of the red rising wedge, which could encourage the sellers to cover their short positions. Nevertheless, as long as there are reliable signs of the bulls’ strength short positions are justified from the risk/reward perspective.

Finishing today’s commentary on this currency pair, we would like to add that because of the recent declines, we decided to lower the level of our stop-loss order. Details below.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 113.67 and the initial downside target at 111.84 are justified from the risk/reward perspective.

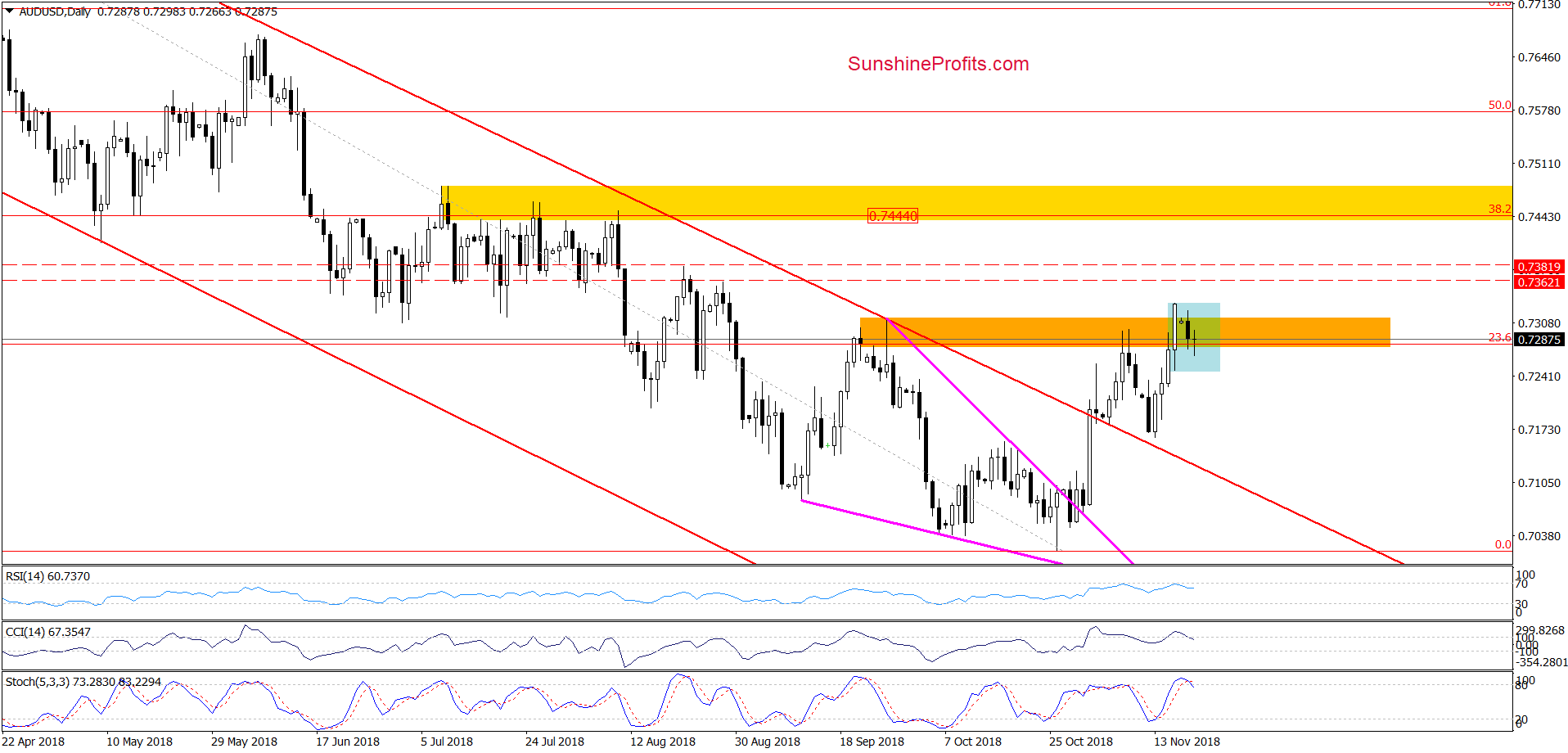

AUD/USD

Looking at the daily chart, we see that although AUD/USD closed the previous week above the upper line of the orange resistance zone and the September peak, currency bulls didn’t manage to hold gained levels, which resulted in a pullback during yesterday’s session.

Thanks to this price action, the exchange rate invalidated the earlier breakout, which in combination with the current position of the daily indicators suggests that further deterioration is ahead of us.

If this is the case and AUD/USD extends losses from here, we’ll see at least a test of the lower border of the blue consolidation. However, if it is broken, the sellers can push the pair even to the last week’s lows (around 0.7170) in the following days.

Therefore, if we see a daily closure under the blue consolidation we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Administrative Note Regarding This and Next Week’s Publication Schedule

The long Thanksgiving weekend is approaching. There will be no / limited trading in the final part of this week and we will be taking this opportunity to take some time off from our regular analyses. Tomorrow’s Alert will be published normally, and Wednesday’s Alert will likely be very brief. There will be no regular Alerts on Thursday and Friday. The Monday’s (November 26th) and Tuesday’s (November 27th) Alerts will most likely be very short as well.

However, the above does not mean that we will stop monitoring the market entirely. Conversely, the time is quite critical, so despite taking time off from regular tasks, we will be monitoring the market and if anything urgent happens, we will let you know through a quick intraday Alert.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts