Today's session brought one more upswing, which took USD/JPY above the June high. Positive price action? Yes. Is it effective? This is a completely different story. If you want to know why bulls may have difficulties in the coming days, check this Forex Trading Alert.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3503; the initial downside target at 1.3003)

- USD/CHF: none

- AUD/USD: none

EUR/USD

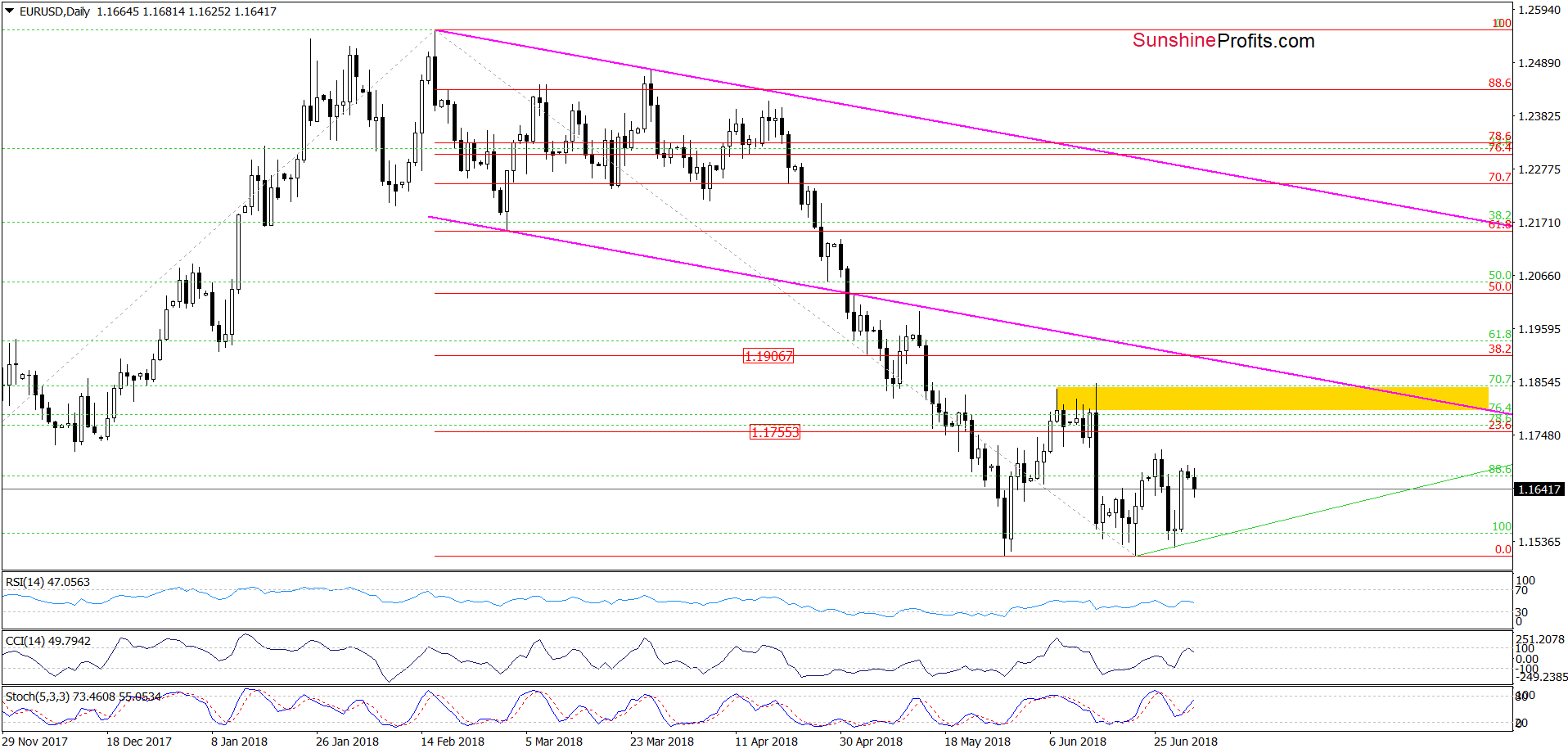

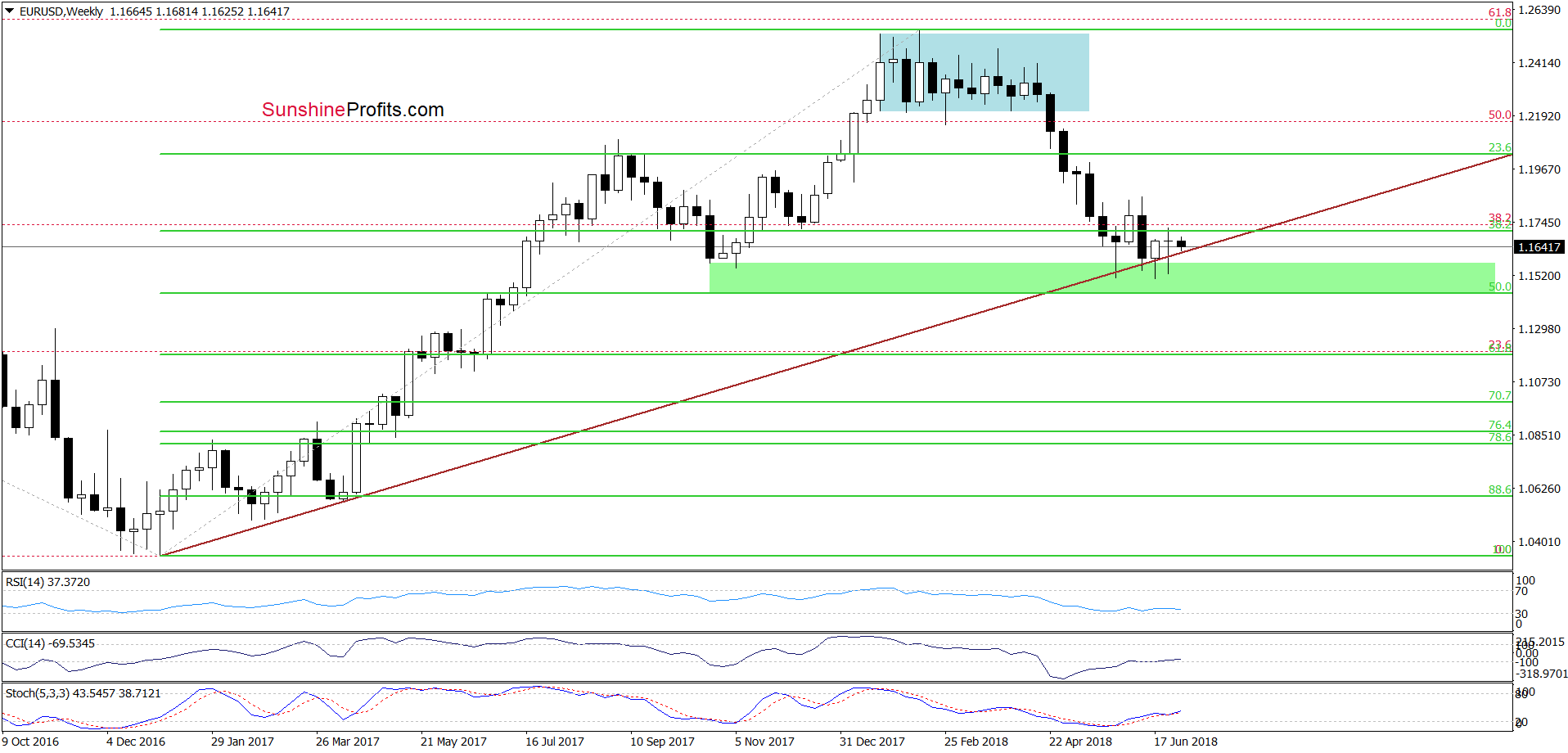

Looking at the daily chart, we see that EUR/USD reversed and declined a bit earlier today. Despite this move, the pair remains above the long-term brown rising line seen on the medium-term chart below.

Therefore, we think that as long as there is no weekly closure below it a sizable move to the downside is questionable. Why? Because we have seen four unsuccessful attempts to go below this important support line. As you see on the above chart, in all previous cases currency bulls were able to stop their opponents and trigger a rebound, which invalidated the breakdown. This means that they are very active in the green support area and as long as it holds another attempt to move higher can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

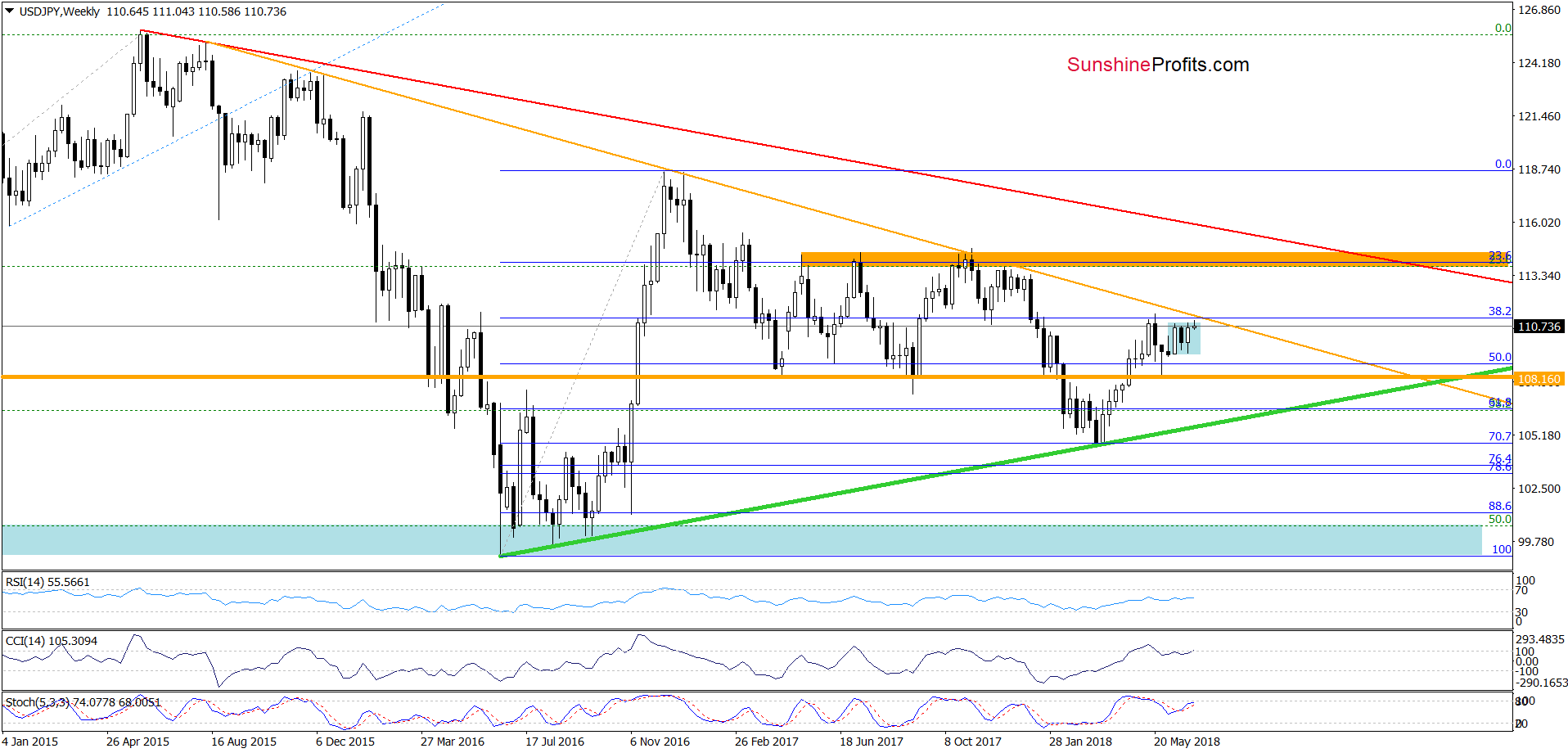

From the weekly perspective, we see that the overall situation in the medium term hasn’t changed much as USD/JPY is still trading in the blue consolidation slightly below the major resistance line based on the August, December 2015 and January 2017 peaks (marked with orange).

As you see, this line was strong enough to stop currency bulls in the last quarter of 2017, which means that as long as there is no breakout above it a sizable move to the upside is quite doubtful.

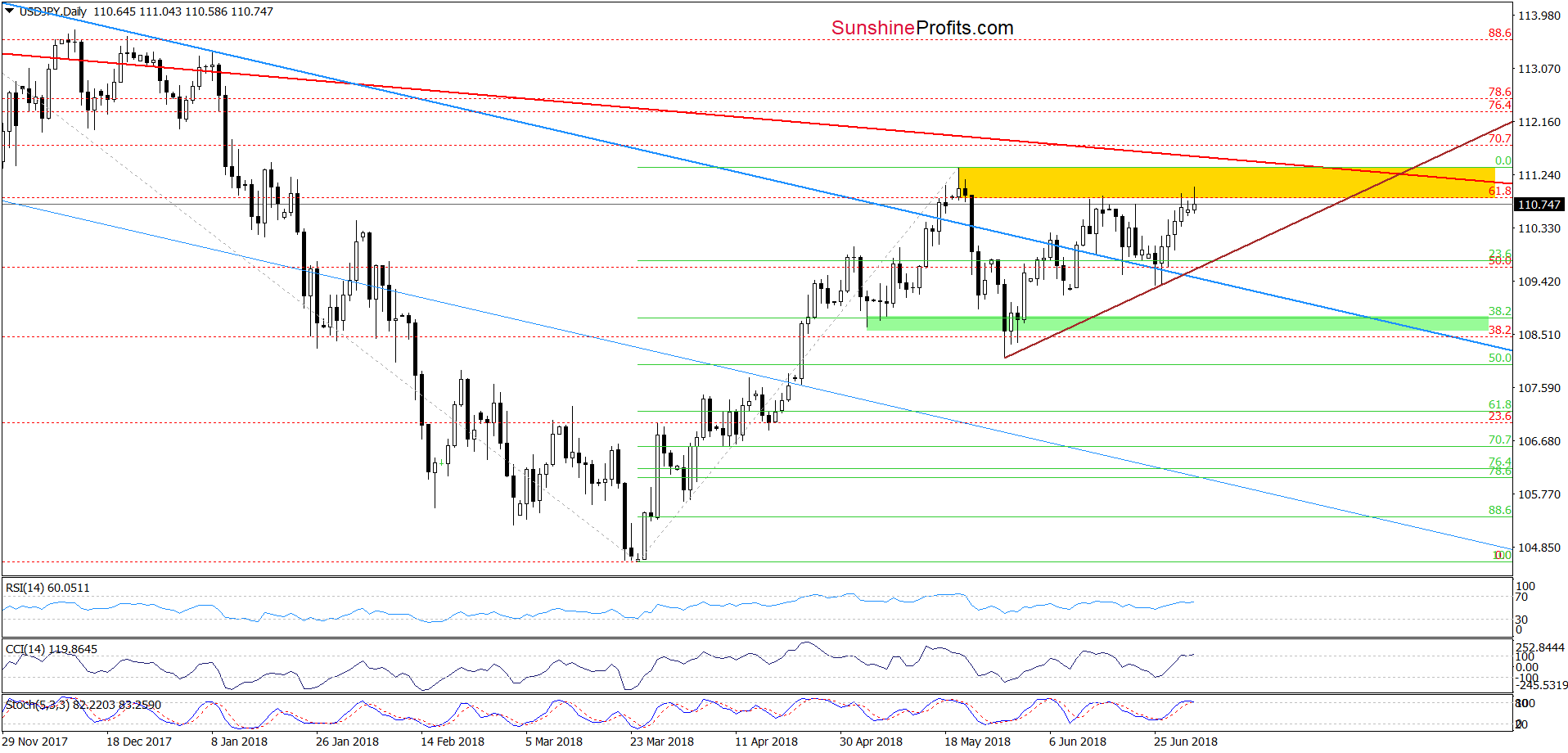

Will the very short-term chart currency bulls more hope for higher levels?

Not really, because from this point of view, the currency pair is trading under the yellow resistance zone based on the previous highs.

Additionally, the current position of the indicators also favors their opponents as the CCI and the Stochastic Oscillator climbed to their overbought areas, suggesting that sell signals are only a matter of time (probably a very short time).

Connecting the dots, if we see reliable signs of currency bulls’ weakness, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

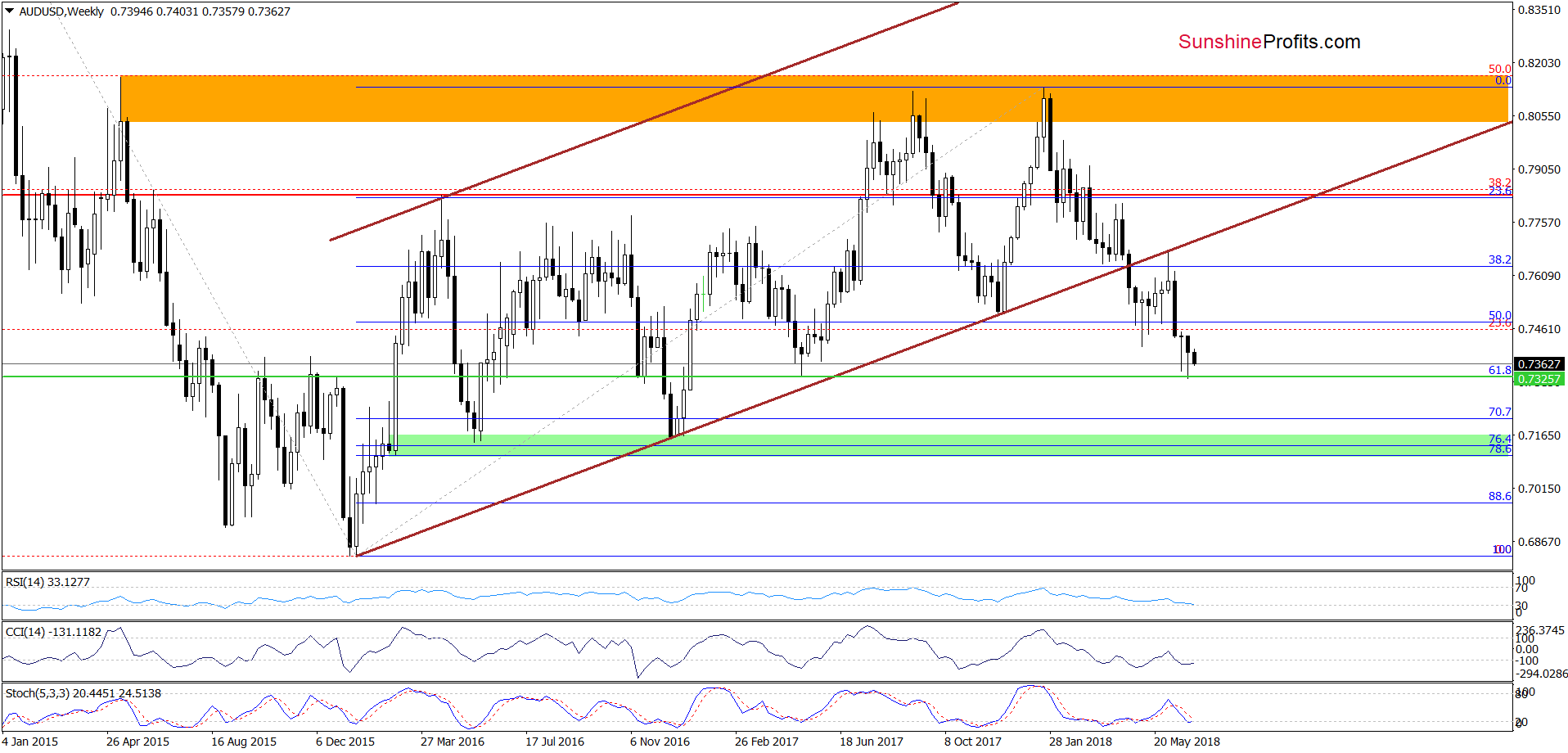

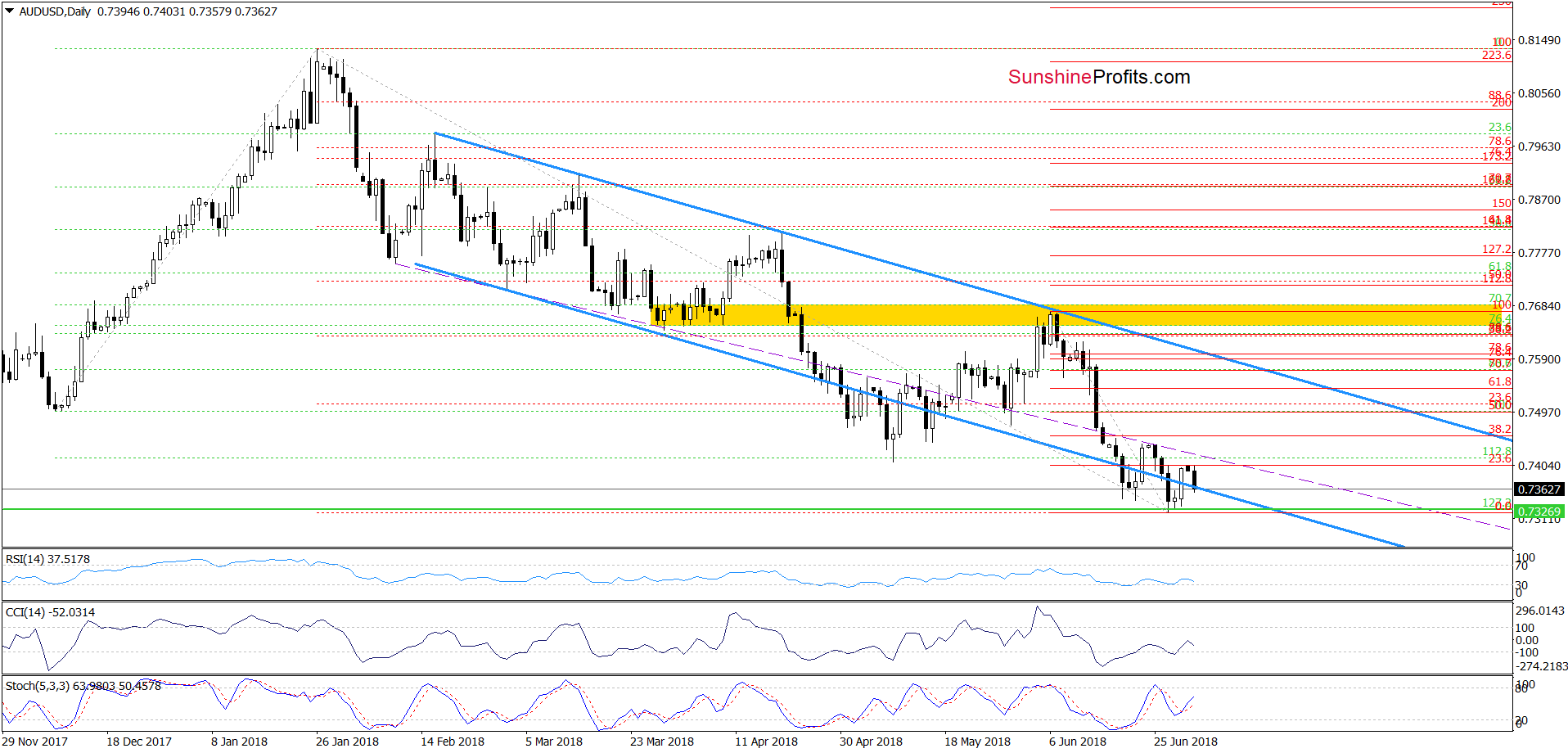

In the previous week, AUD/USD extended losses and tested the support area created by the 127.2% Fibonacci extension (seen on the daily chart) and the 61.8% Fibonacci retracement marked on the weekly chart.

Although this support zone triggered a rebound and a comeback above the previously-broken lower border of the blue declining trend channel, currency bulls didn’t manage to break even above the 23.6% Fibonacci retracement, which revealed their weakness and encouraged rivals to act.

Thanks to their attack, the pair slipped under the lower line of the trend channel once again, which suggests a test of the last week low and the nearest support area in the following day(s). If the buyers withstand the selling pressure we’ll likely see a test of the late June high, however, if they fail the way to (at least) 0.7238 will be open.

Depending on the outcome of the battle in this region, we will decide whether to open a short position or rather to hold back and wait for the show of currency bulls’ strength to open a long position. Stay tuned.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts