The most important event of today's session is a breakdown below the lower border of the short-term rising trend channel. Will the bears reach the next base in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

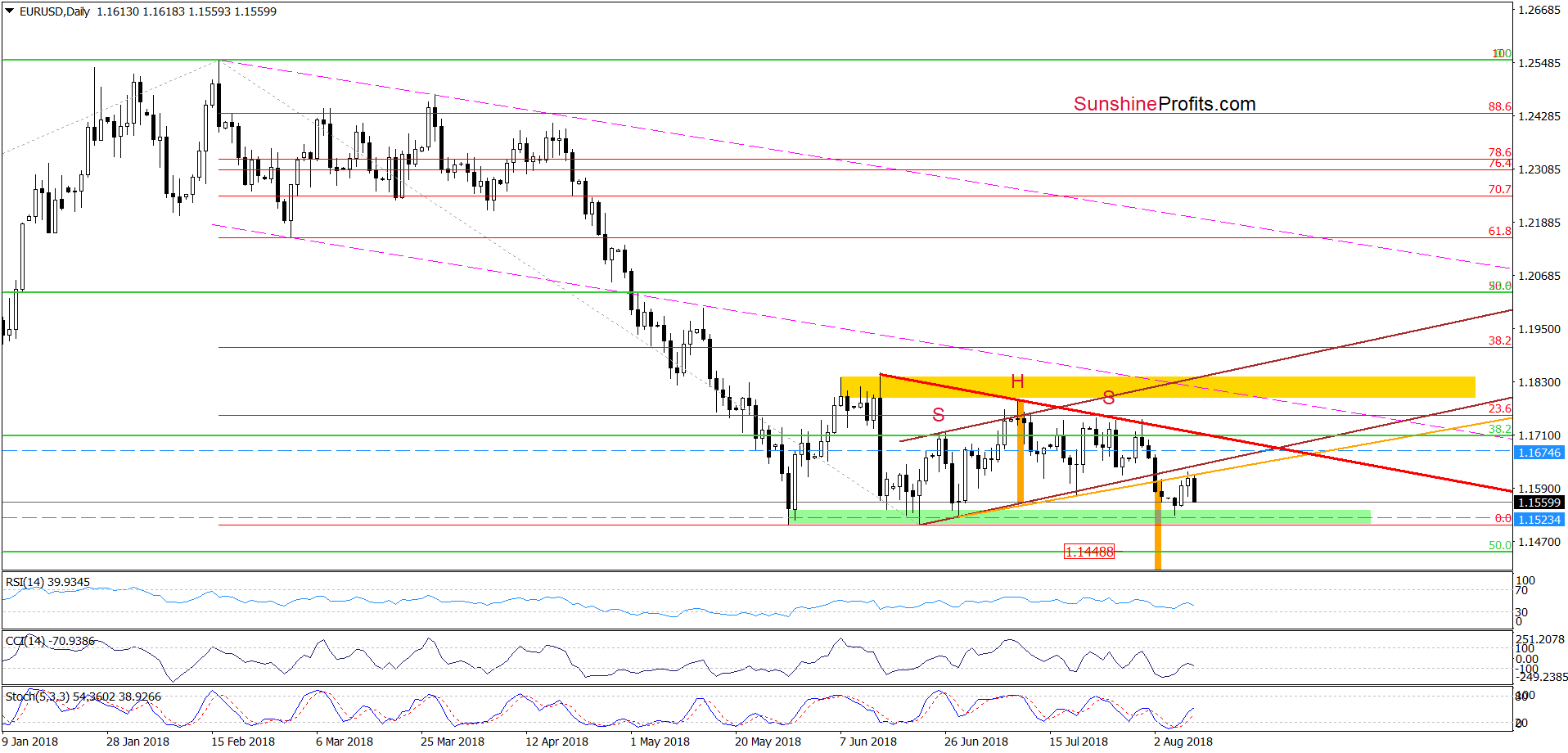

EUR/USD

Looking at the daily chart, we see that the orange resistance line stopped the buyers triggering a pullback yesterday. Such price action looked like a verification of the earlier breakdown under this line and encouraged currency bars to act earlier today.

As a result, the pair moved quite sharply lower, which suggests that we’ll likely see a re-test of the strength of the green support zone and recent lows in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

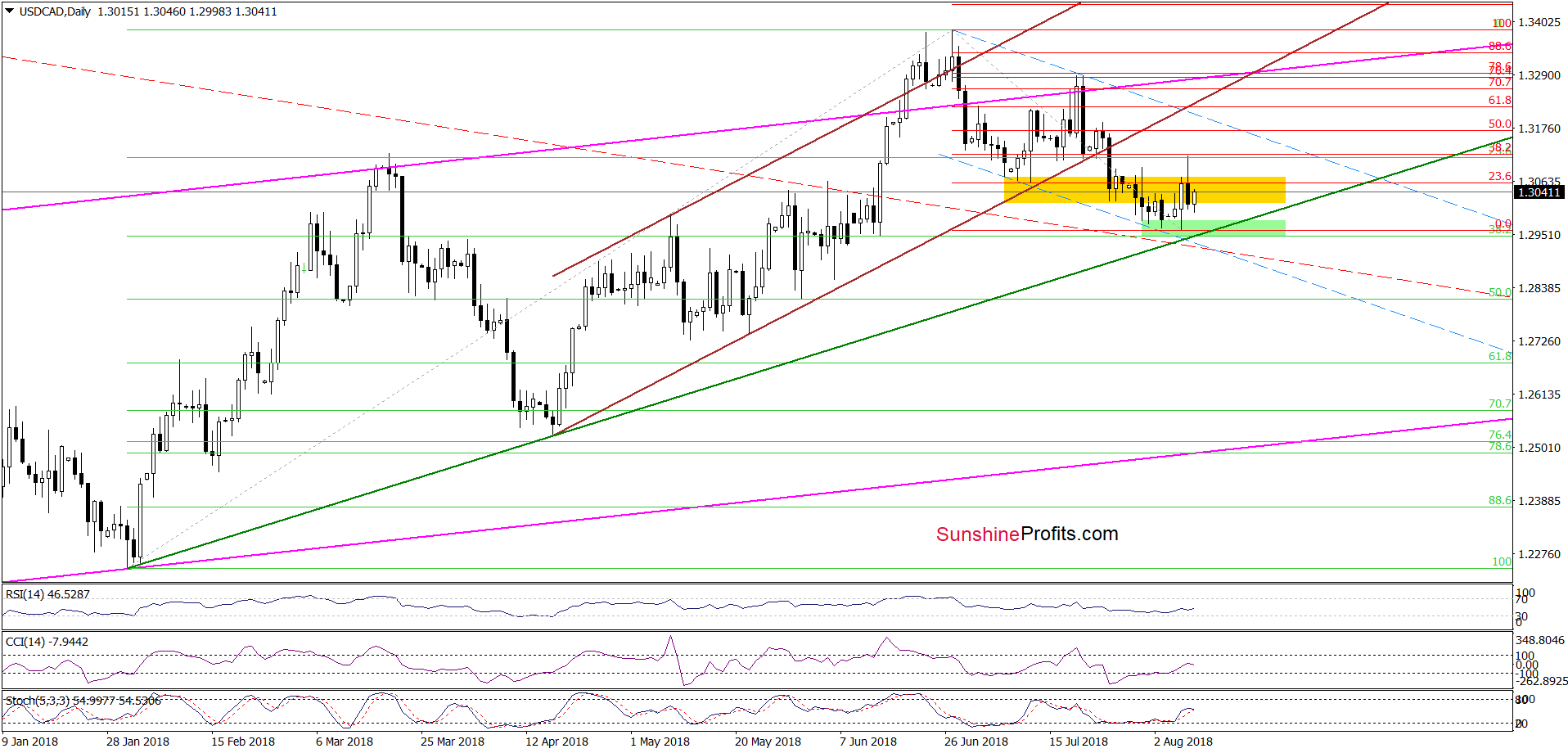

USD/CAD

Although the 38.2% Fibonacci retracement stopped currency bulls and triggered a sharp decline during yesterday’s session, the buyers didn’t give up and made another attempt to reach higher levels earlier today.

Will they make it? Taking into account the lack of sales signals, it seems to us that a re-test of the above-mentioned retracement should not surprise us in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

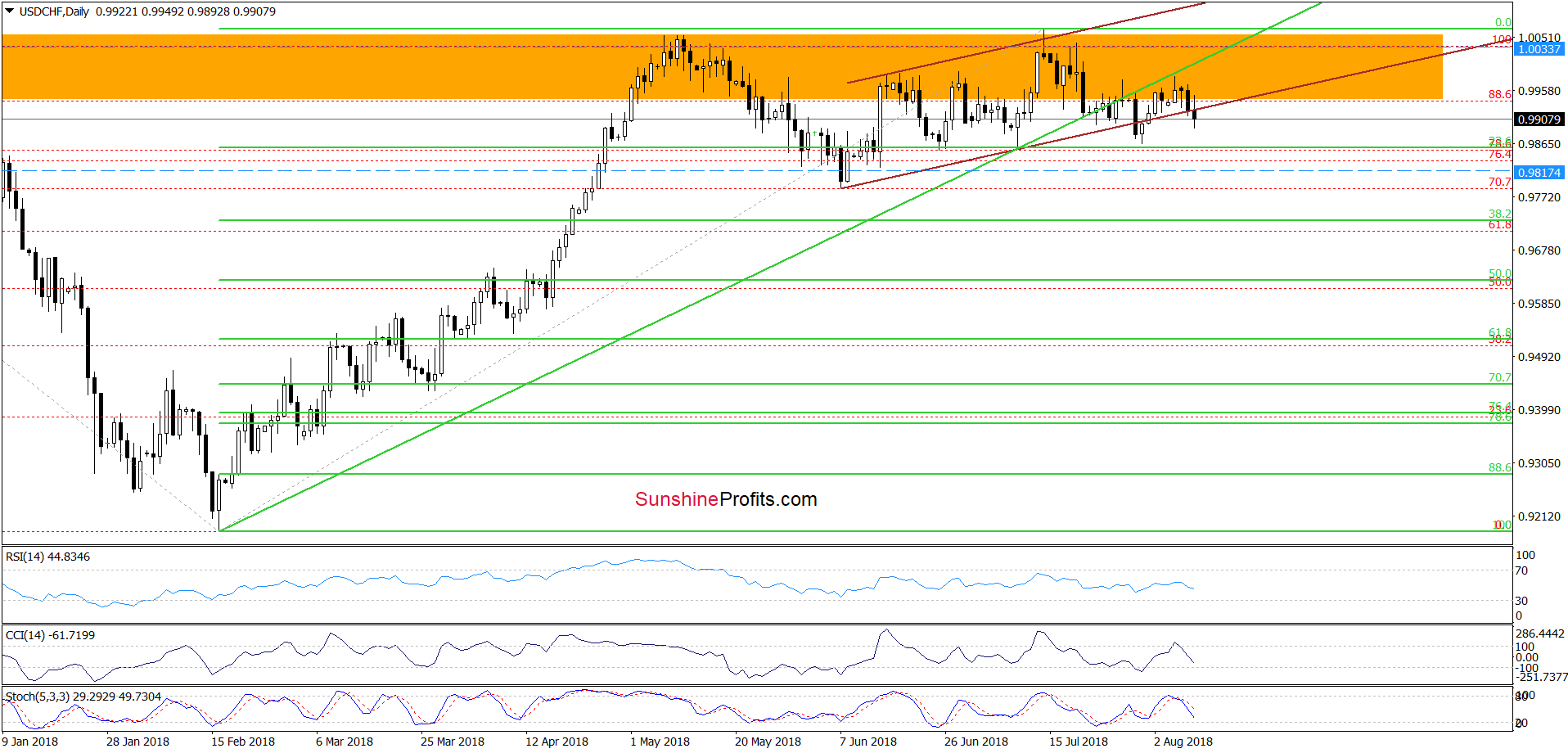

USD/CHF

On Tuesday, we wrote the following:

(…) USD/CHF extended gains (…), which approached the exchange rate to the previously-broken medium-term green support line based on mid-February and early July lows.

Despite this improvement, currency bulls didn’t manage to take the pair higher, which (…) suggests that yesterday’s price action was nothing more than a verification of the earlier breakdown under the green line.

If this is the case, we’ll likely see another not only a drop to the lower border of the brown rising trend channel, but also a test of the nearest support zone created by the 23.6% Fibonacci retracement, the last June and July lows in the following days.

As you see on the daily chart, the situation developed in tune with our assumptions and currency bears took USD/CHF under the lower border of the brown rising trend channel. This negative development significantly increases the probability that we’ll see a realization of the above-mentioned scenario in the near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts