Although the greenback moved sharply higher against the Swiss franc, the major resistance zone continues to keep gains in check. Will it withstand the buying pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

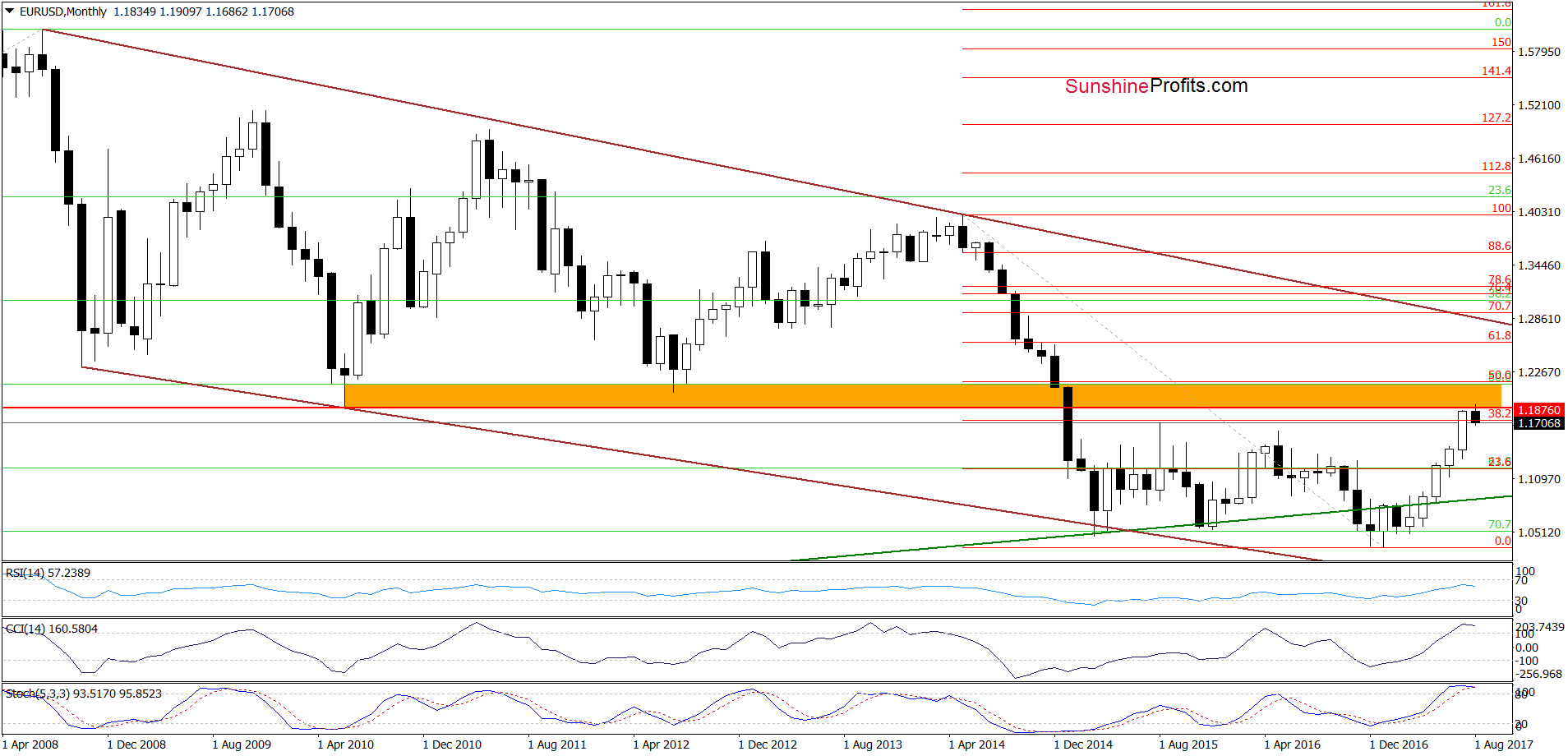

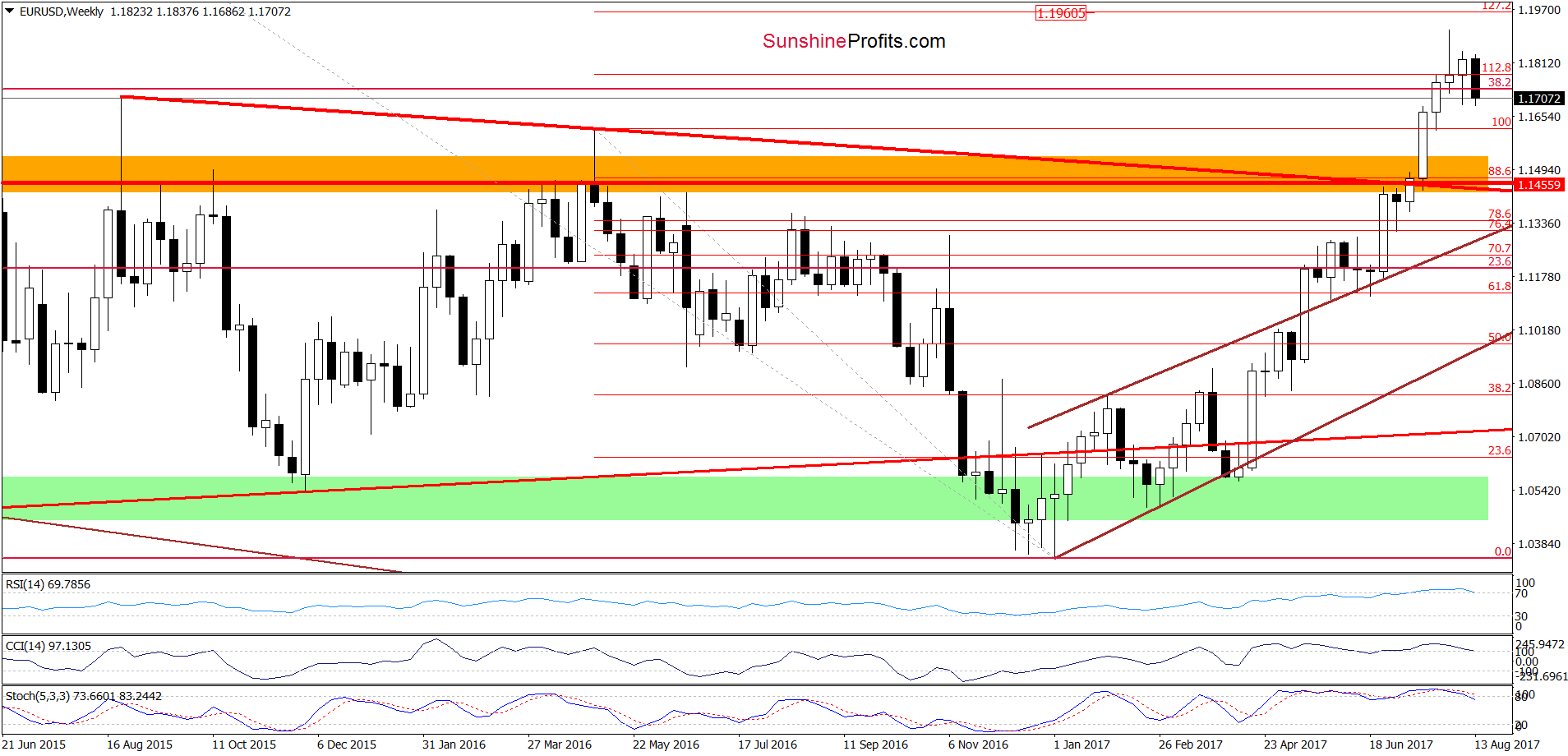

EUR/USD

Looking at the charts, we see that EUR/USD moved sharply lower and slipped below the previously-broken 38.2% Fibonacci retracement and the 112.8% Fibonacci extension. In this way, the pair invalidated the earlier breakout, which is a negative development. Nevertheless, in our opinion, this event will turn into bearish only if we see a weekly closure below these levels. Until this time another rebound (similar to what we saw in the previous week) can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

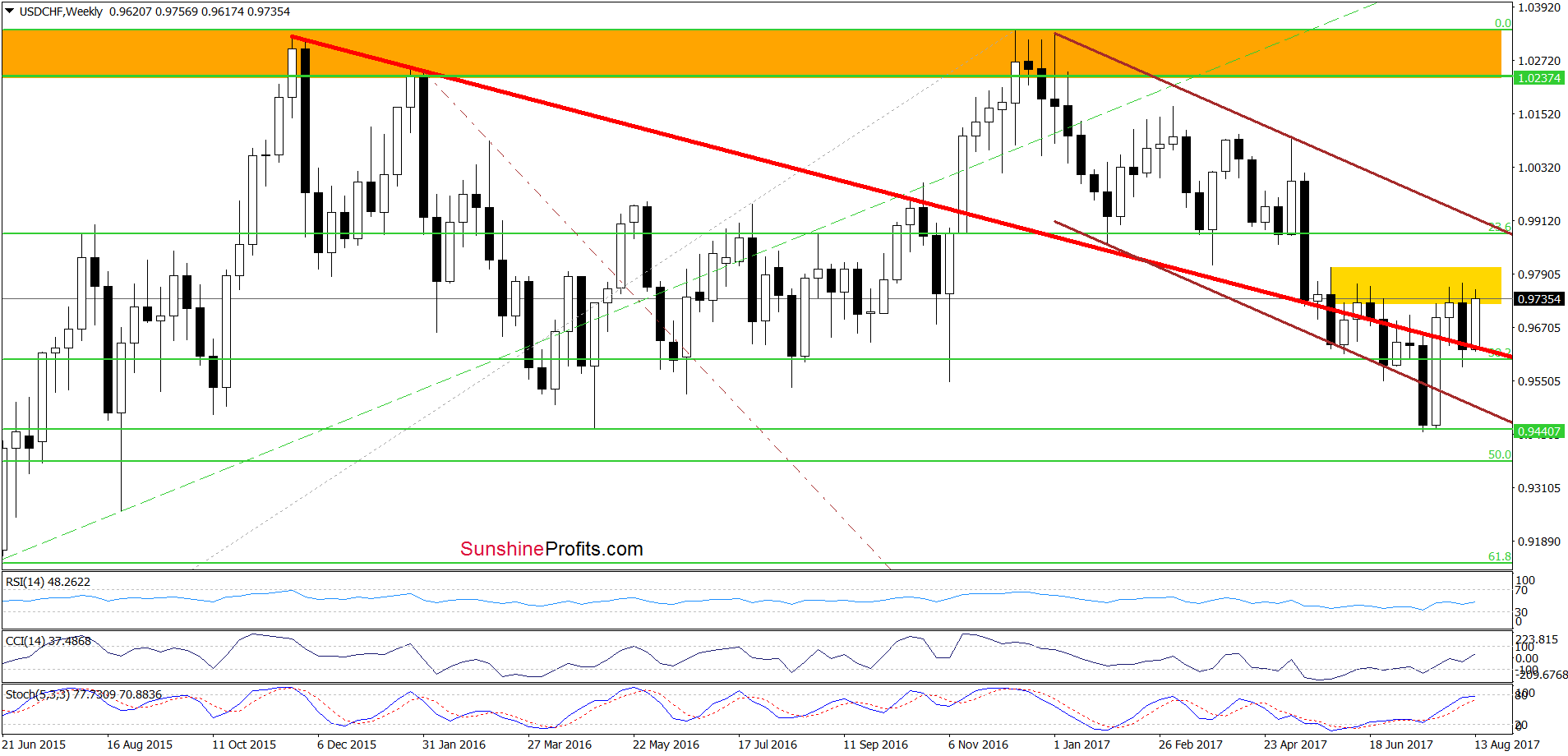

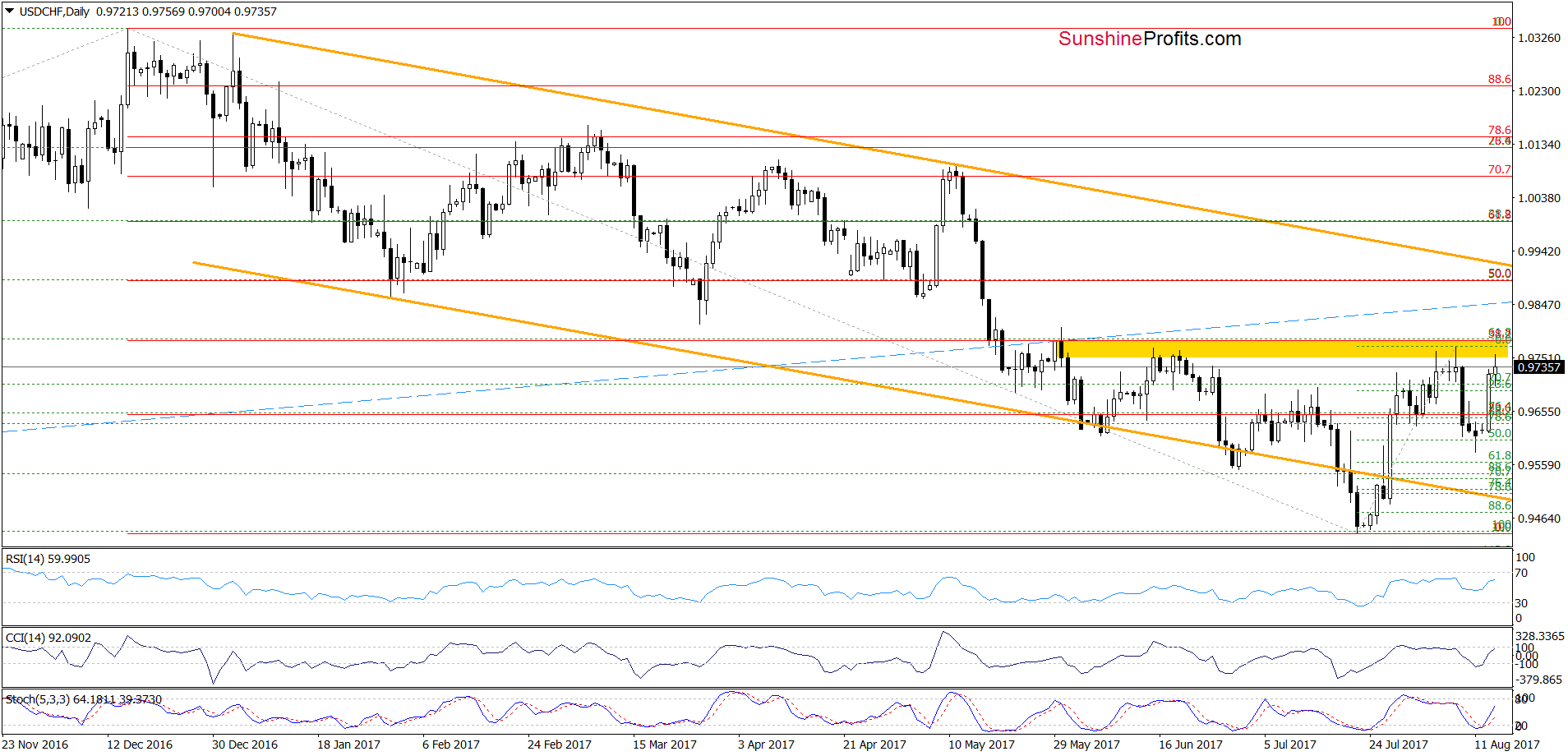

USD/CHF

From today’s point of view, we see that USD/CHF invalidated the earlier tiny breakdown under the 50% Fibonacci retracement, which together with the buy signals generated by the daily indicators encouraged currency bulls to act. As a result, the exchange rate extended gains and climbed to the yellow resistance zone once again. Although this is a positive development, we should keep in mind that we saw similar price action several times in the previous weeks. Therefore, in our opinion, a bigger move to the upside will be more reliable only if USD/CHF breaks above this major resistance area. Until this time, one more pullback can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

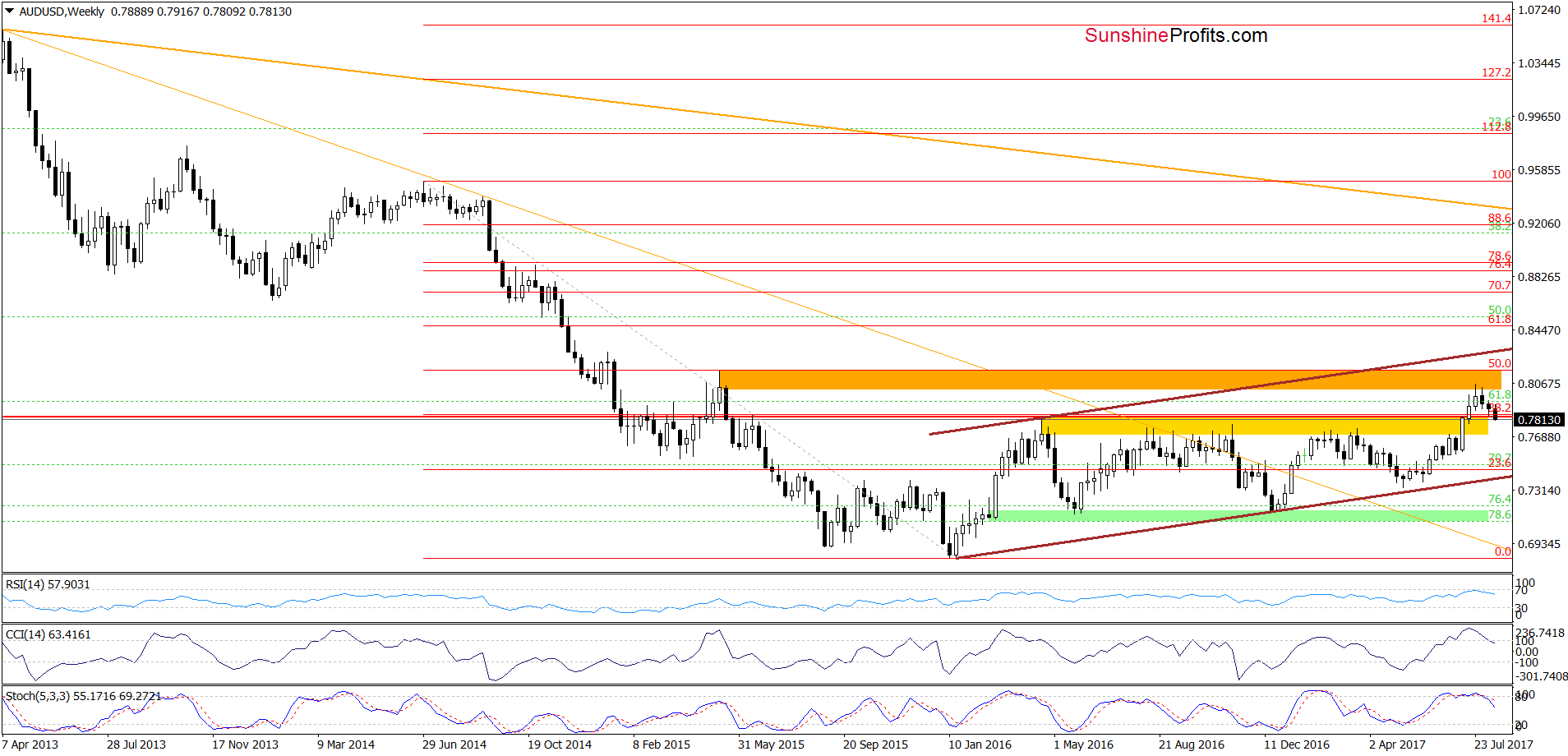

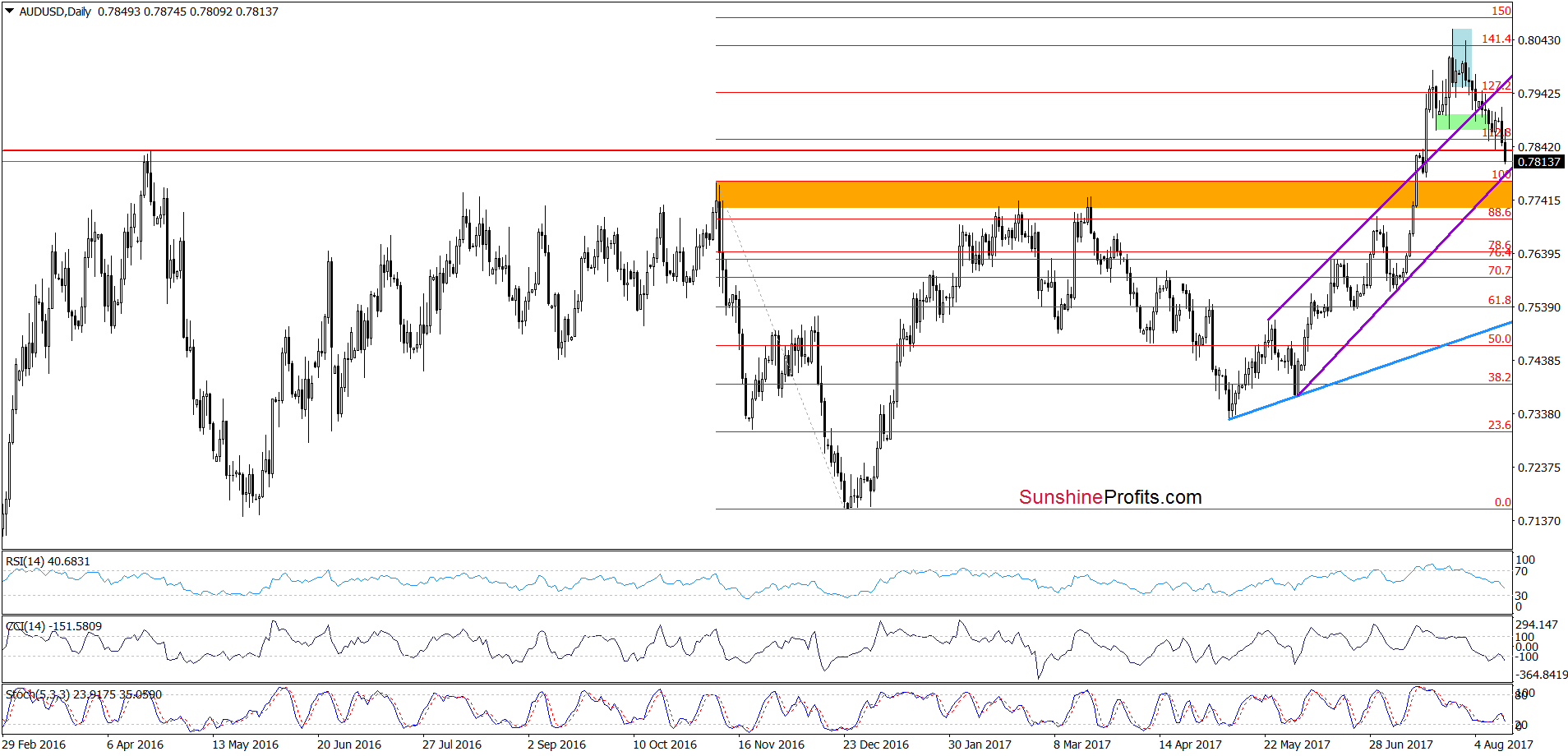

On the above charts, we see that AUD/USD extended losses, which resulted in the breakdown below the red horizontal line based on the mid-April 2016 high. In this way, the pair invalidated the earlier breakout, which is a bearish signal and suggests further deterioration. If this is the case and the pair moves lower from current levels, we’ll see (at least) a test of the lower border of the purple rising trend channel and the orange zone seen on the daily chart (which serves now as support). If these levels are broken, the way to lower levels will be open and we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts