Yesterday’s downswing took USD/CHF to our first downside target, but will the support zone be strong enough to stop the sellers in the following days?

In our opinion the following forex trading positions are justified - summary:

Today’s Forex Trading Alert is going to be quite brief, because the overall situation in the Forex market hasn’t changed much since our yesterday’s commentary.

Earlier today, EUR/USD rebounded and came back above the November 2017 low, which suggests that we could see a daily closure above this level and invalidation of the earlier breakout, which would be in line with our yesterday’s assumptions.

GBP/USD reacted quite similarly and moved slightly higher, which will likely trigger buy signals in all daily indicators in the very near future (maybe even later in the day or tomorrow).

USD/JPY despite yesterday’s move to the downside erased these losses and currently is testing the 38.2% Fibonacci retracement, while the CCI and the Stochastic Oscillator are preparing to generate buy signals.

USD/CAD remains under major resistances, while the sell signals generated by the daily indicators are just around the corner.

Connecting the dots, the comments that we made yesterday remain up-to-date also today and if you haven’t had the chance to read our yesterday’s alert, we encourage you to do so today:

USD Index and Its Opponents at the end of May

And what happened with USD/CHF and AUD/USD in recent days? Let’s check.

USD/CHF

In our Forex Trading Alert posted on May 16, we wrote the following:

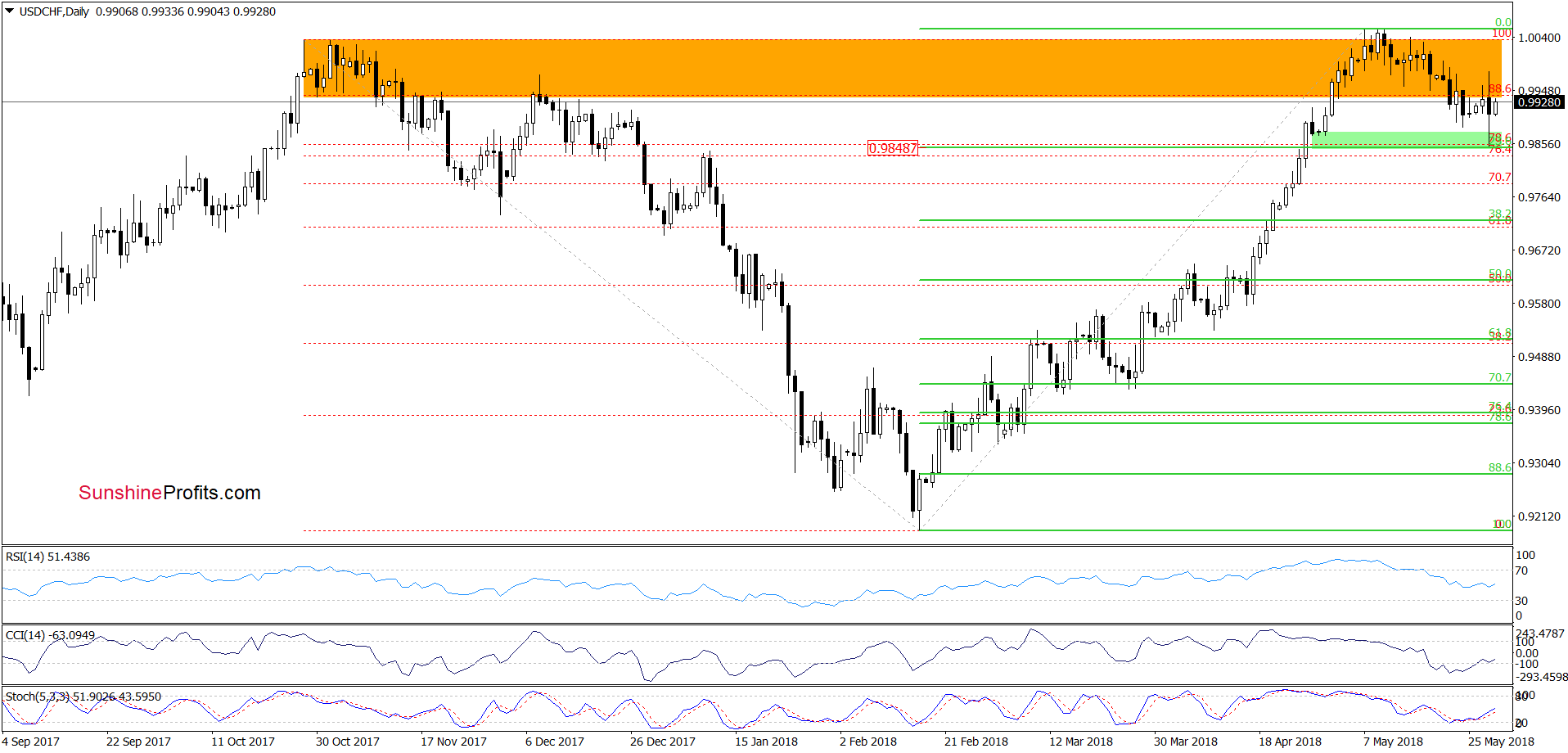

(…) what could happen if USD/CHF drops under the orange zone? In our opinion, if the exchange rate slips under the lower border of this area, we could see a drop to around 0.9850-0.9875, where the green support zone (marked on the daily chart) is.

Looking at the daily chart, we see that the situation developed in line with the above scenario and USD/CHF reached our downside target during yesterday’s session. As you see on the above chart, the green support zone together with the buy signals generated by the CCI and the Stochastic Oscillator encouraged currency bulls to act, which resulted in a rebound on Tuesday. Earlier today, the pair moved a bit higher, which suggests a test of the orange resistance zone (or even the recent highs) in the coming days.

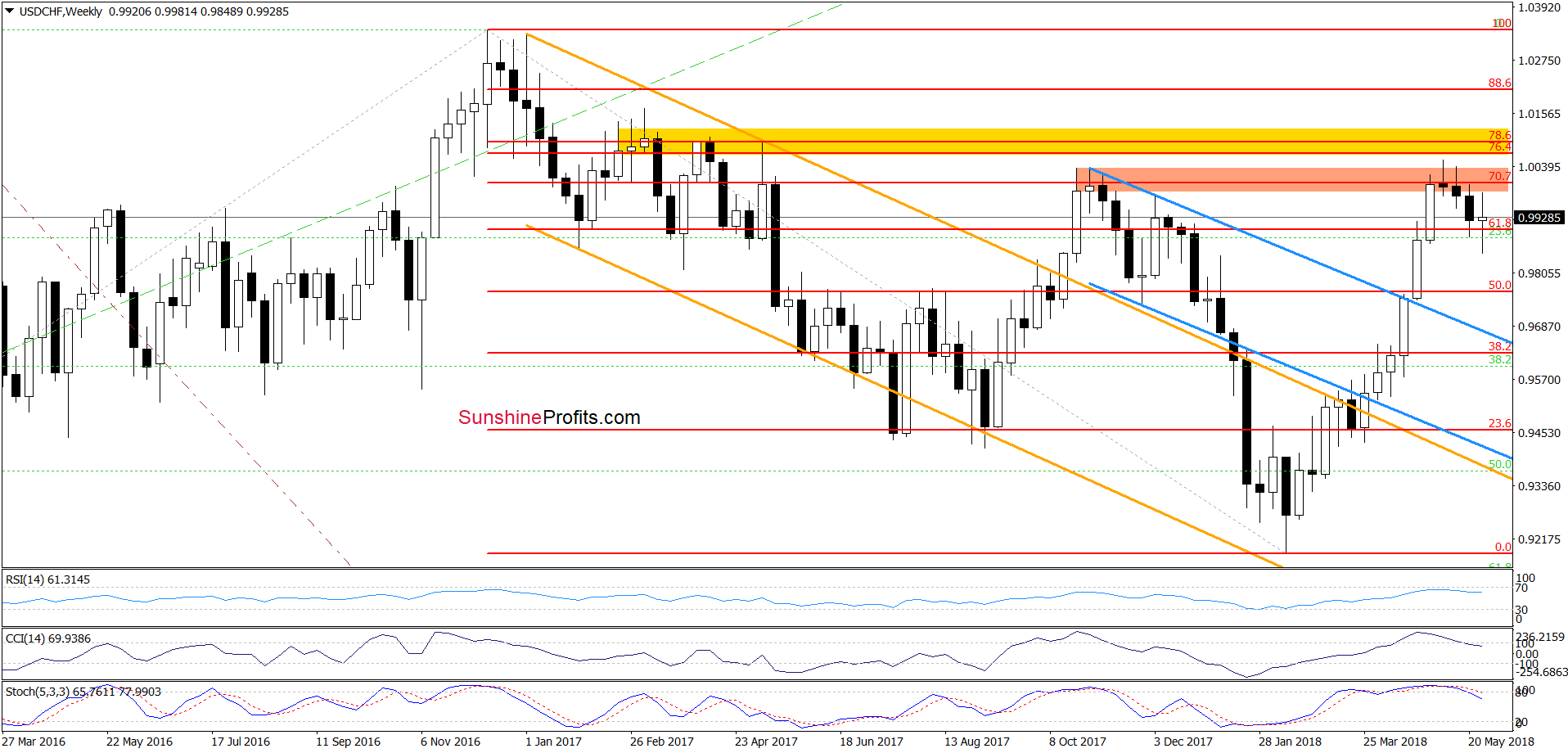

Nevertheless, we should keep in mind that the space for further gains (we mean above May peaks) is limited as the next resistance zone (marked with yellow on the weekly chart below) created by the 76.4%, 78.6% Fibonacci retracements and March, April and May 2017 highs is quite close.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

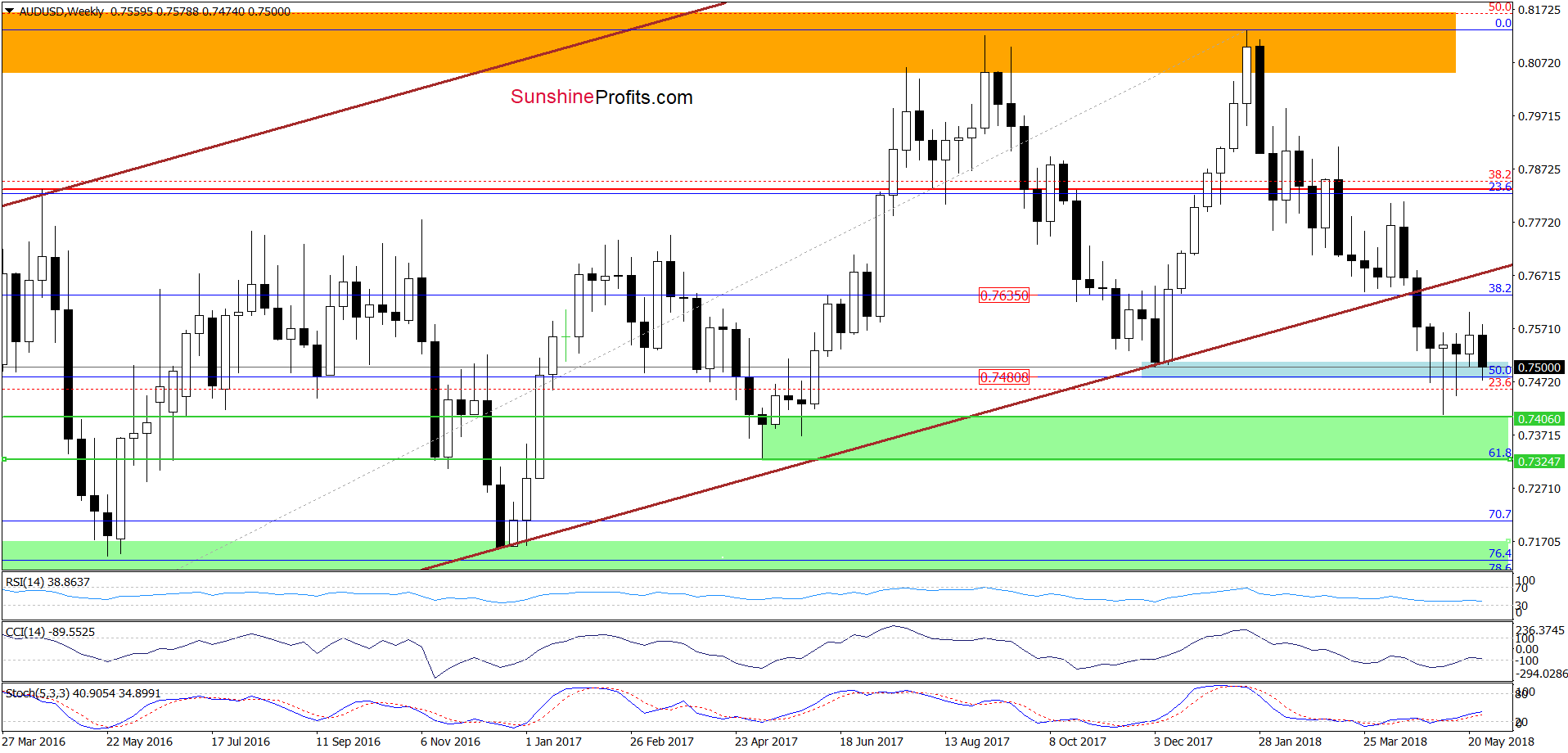

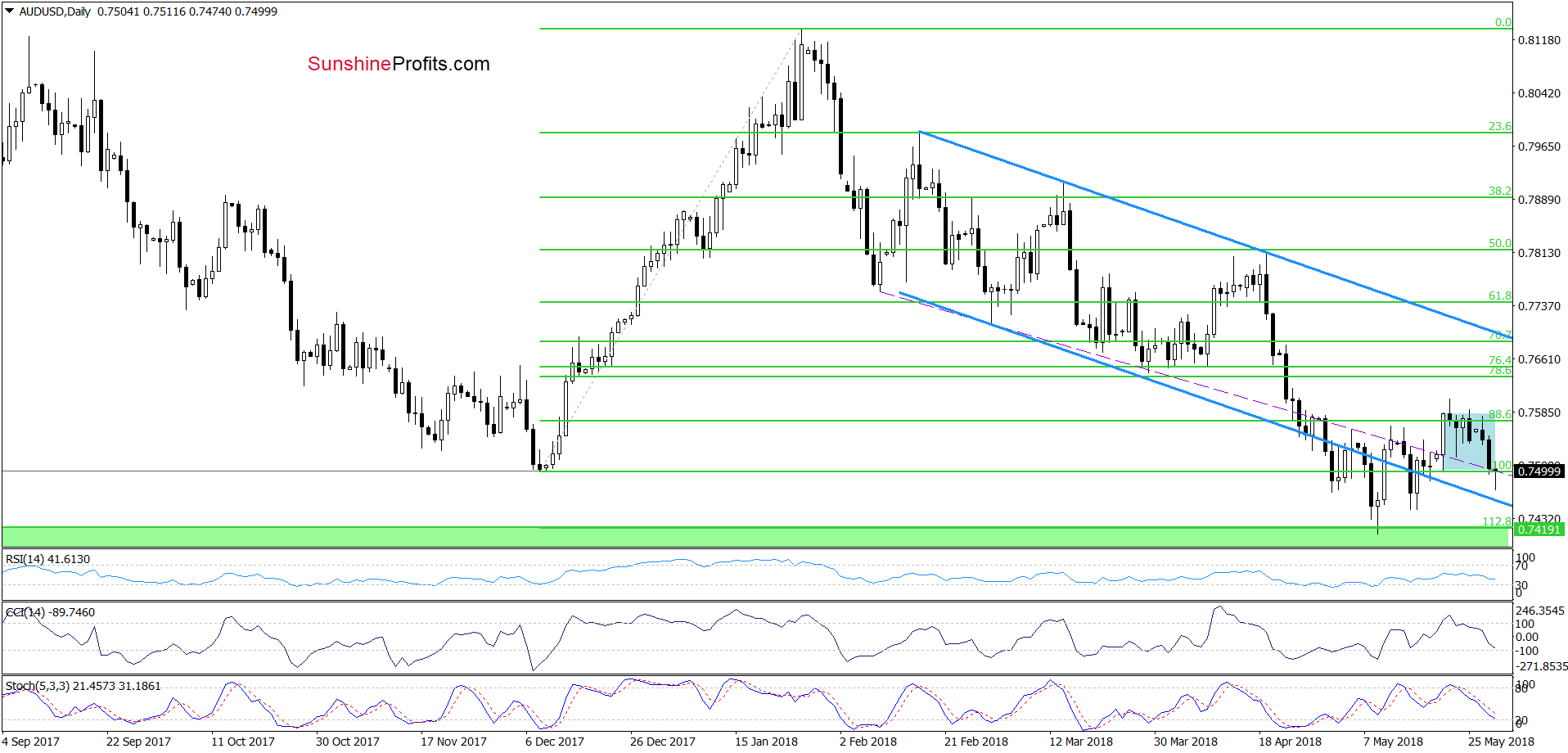

On the daily chart, we see that although currency bulls took AUD/USD above the previously-broken lower border of the blue declining trend channel, the pair stuck in the blue consolidation instead of continuing to increase.

Additionally, an unsuccessful breakout above the upper line of the formation discovered the buyers’ weakness, which together with the sell signals generated by the daily indicators encouraged currency bears to act in recent days.

Thanks to their action, the exchange rate slipped to the lower border of the formation and even slipped temporary below it earlier today. Taking this fact into account and combining it with the position of the indicators, it seems that the pair will test the previously-broken lower border of the blue declining trend channel or even the green support zone in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts