Although the greenback erased losses caused by the early April pullback in the previous week, USD/CHF stuck in consolidation. Why currency bulls have problems in this area and how will we be able to use it in our favor soon?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.2717; the take profit level at 1.2510)

- USD/CHF: none

- AUD/USD: none

EUR/USD

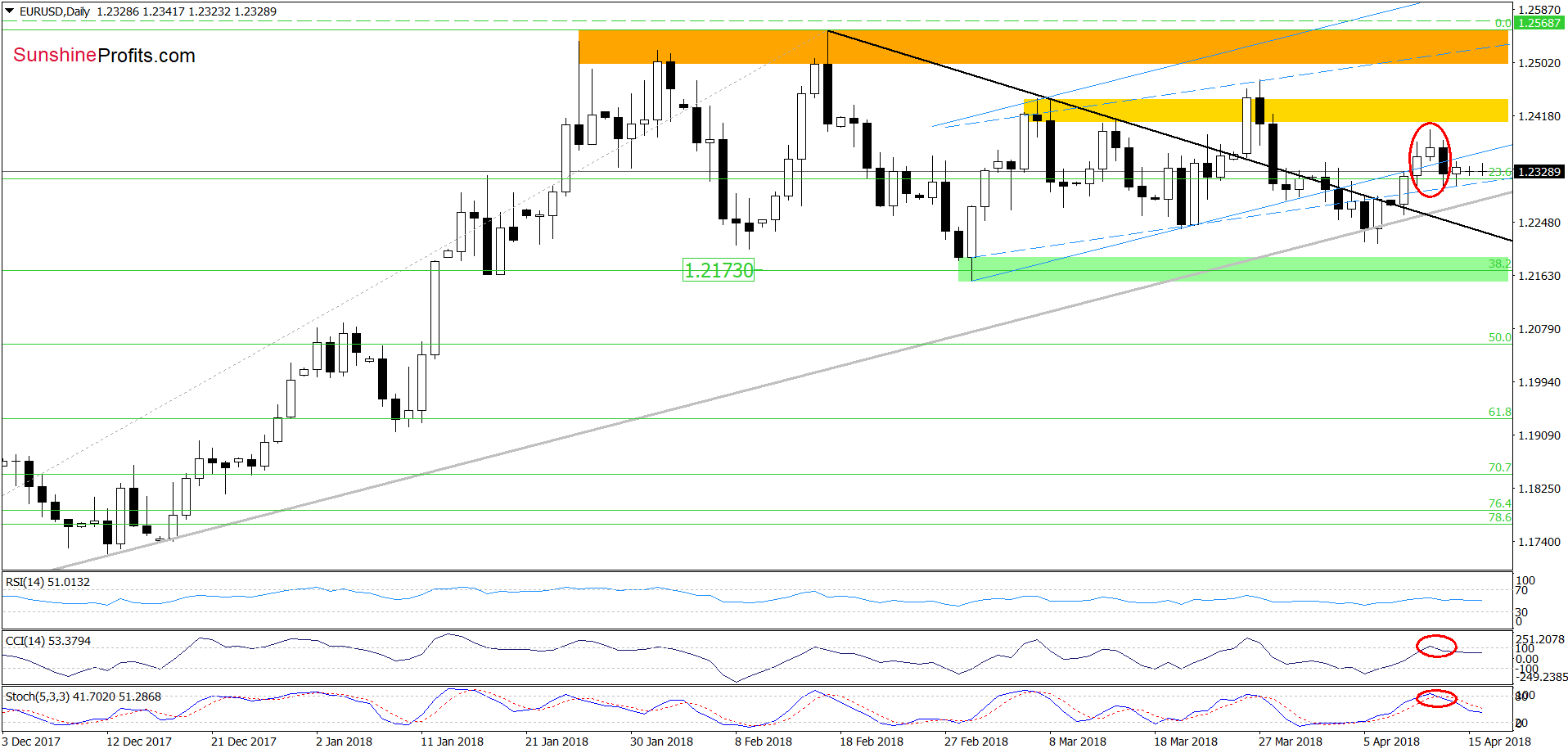

Looking at the daily chart, we see that the overall situation hasn’t change much as EUR/USD is consolidating inside Thursday’s black candle. This means that what we wrote on Friday remains up-to-date also today:

(…) the sellers pushed the exchange rate lower yesterday, which resulted in a comeback under the previously-broken lower line of the blue rising trend channel and created an evening star - a bearish candlestick pattern (we marked it with the red ellipse). Additionally, the CCI and the Stochastic Oscillator generated the sell signals, supporting further deterioration in the coming days.

Why we didn’t decide to open short positions? In our opinion, there are 3 major reasons:

First, the pair remains above the medium-term grey rising support line, which stopped currency bears in the previous week.

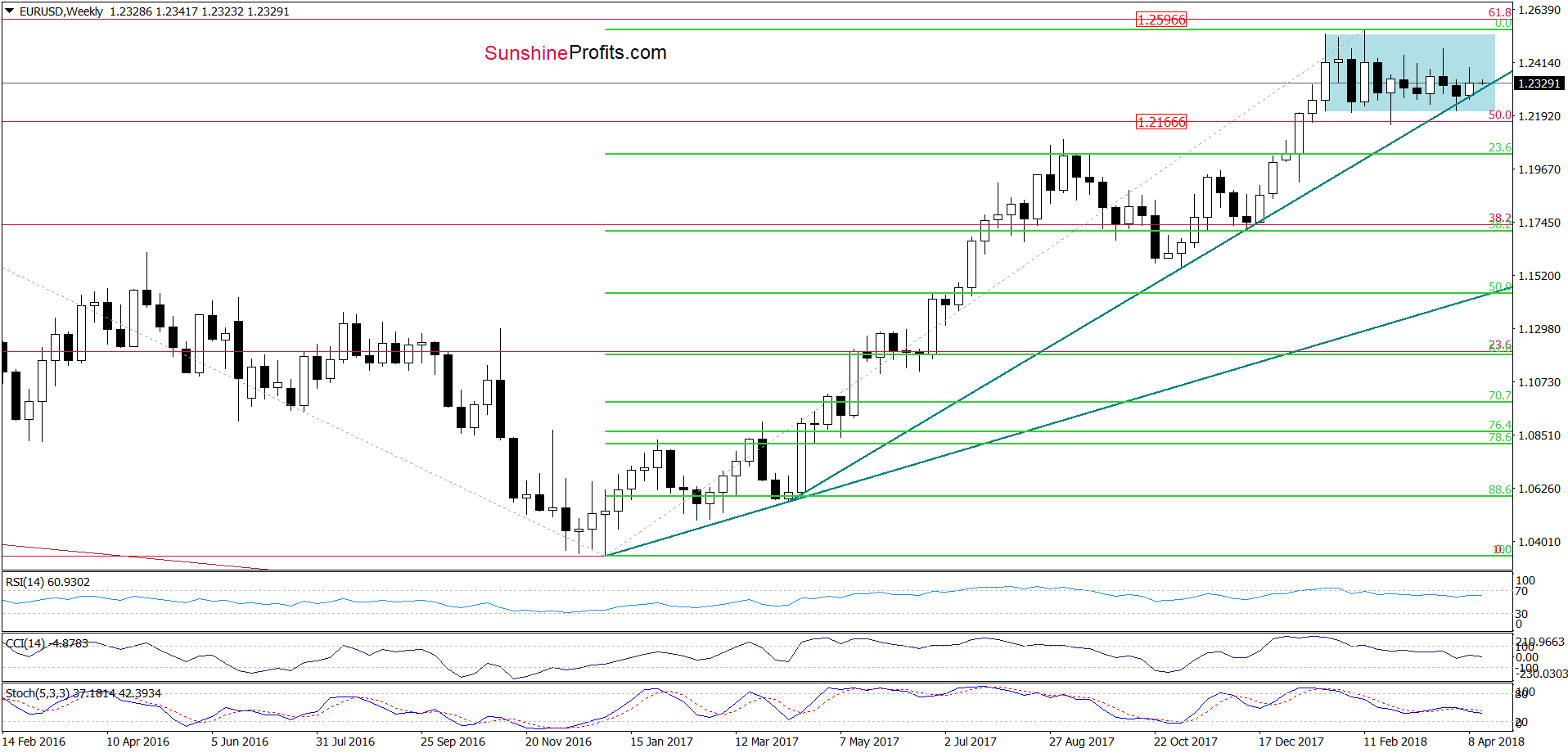

Second, the exchange rate is also trading above the long-term green line marked on the weekly chart below.

As you see, this line also supported the buyers in the previous week, which increases the importance of this area in the coming days and suggests that as long as there is no successful breakdown below the above-mentioned lines a bigger move to the downside is not likely to be seen.

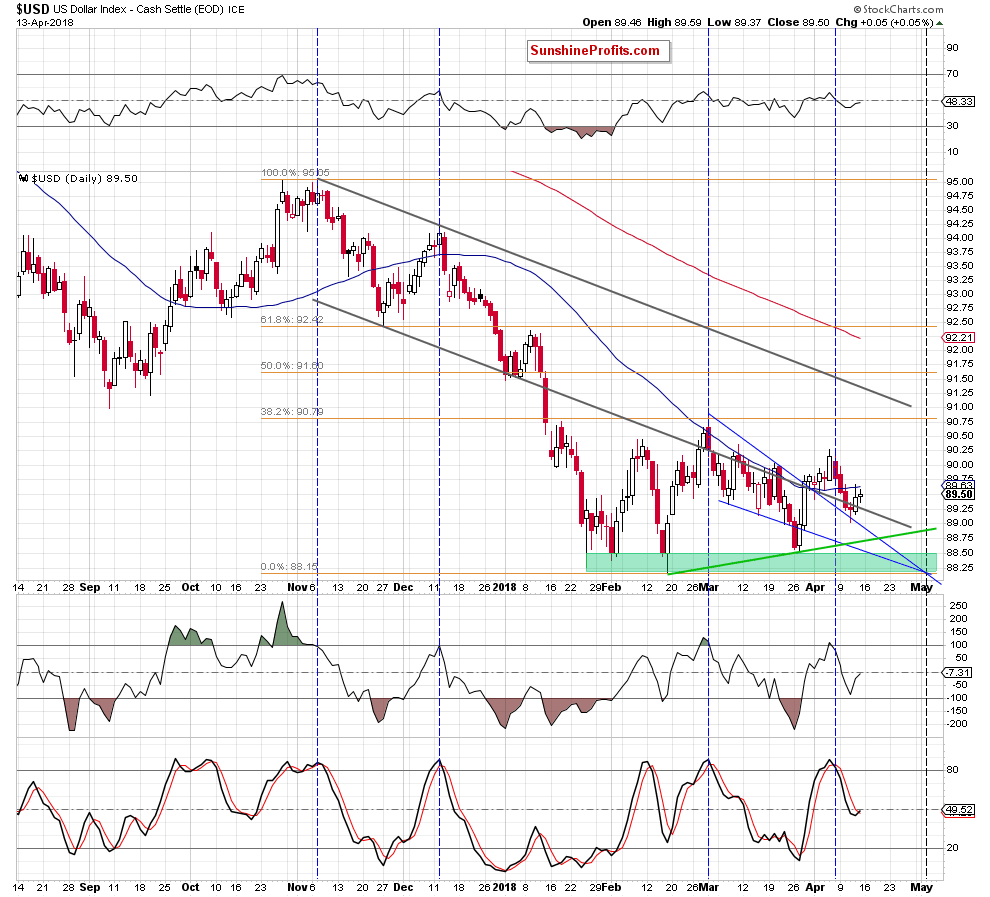

Third – the current situation in the USD Index.

Indecision of Buyers and the Greenback

Looking at the daily chart, we see that the overall situation in the very short term hasn’t changed much as the USD Index is trading in a very narrow range between the previously-broken lower border of the grey declining trend channel and the 50-day moving average.

When we take a closer look at the above chart, we notice that the Stochastic Oscillator generated a buy signal, suggesting another attempt to move higher. Is this a positive sign? Yes. Can we trust it? In our opinion, not yet. Why? Because we already saw similar consolidation slightly above the lower grey line at the turn of March and April. Back then, the greenback moved higher in the following days, but the buyers didn’t manage to push the U.S. currency above the first important resistance zone created by the March peak and the 38.2% Fibonacci retracement.

Taking this fact into account and combining it with the medium-term support line marked on the weekly chart of EUR/USD we think that waiting at the sidelines for another opportunity is the best investment decision at the moment of writing these words.

Are there any other disturbing factors, which confirm the above assumption? Let’s examine the current situation in GBP/USD and USD/CHF to find out.

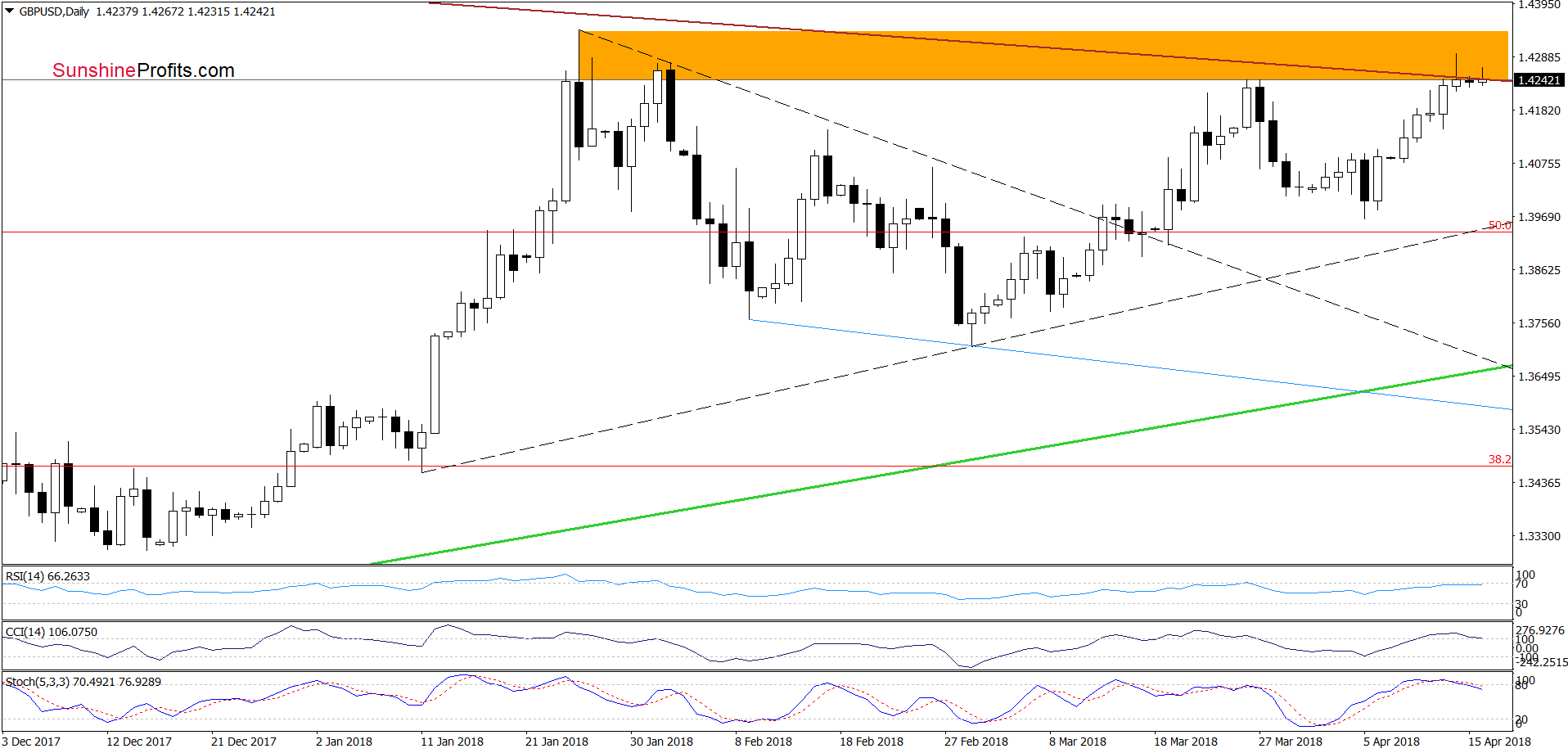

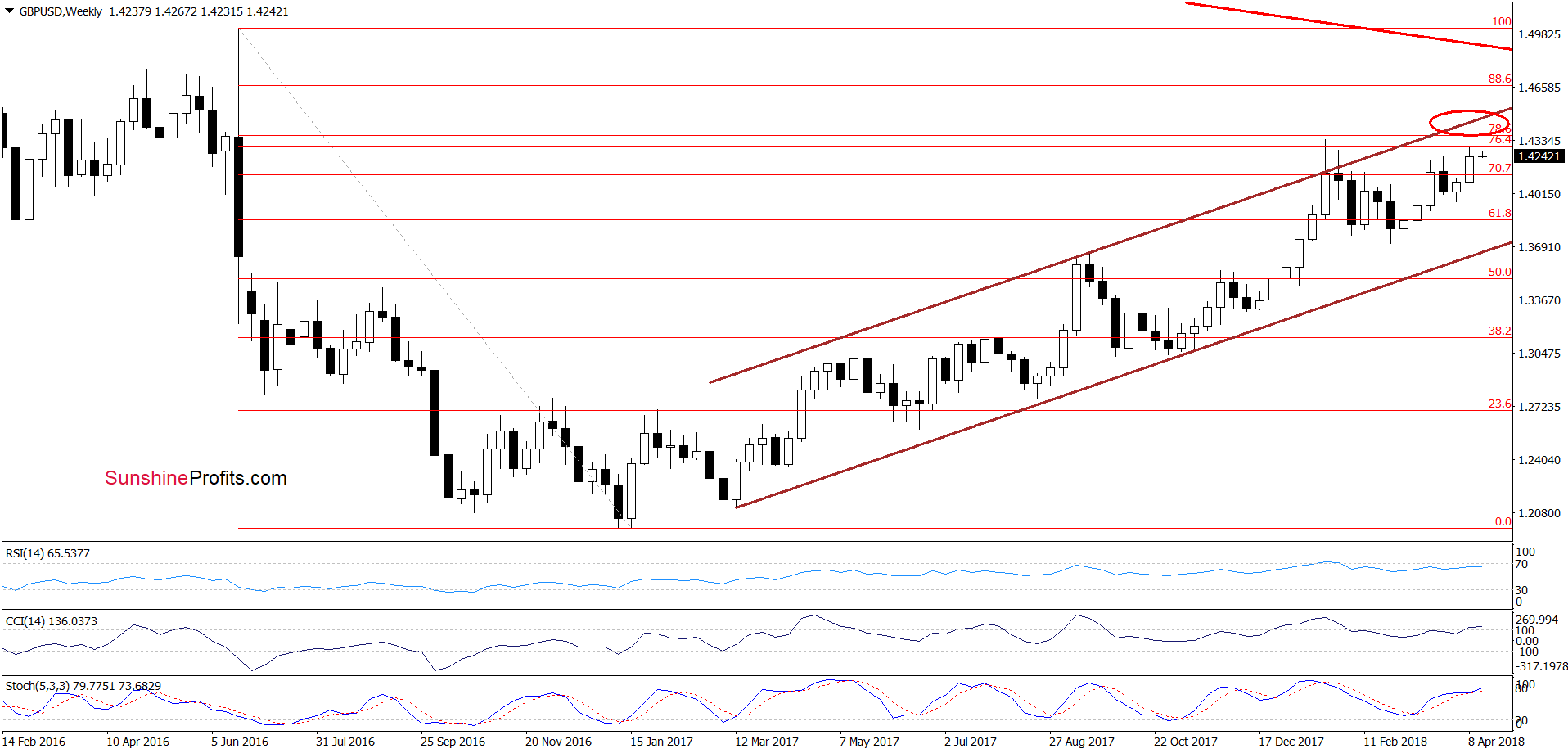

GBP/USD

On the daily chart, we see that GBP/USD climbed to the orange resistance zone, which stopped currency bulls in February and March. Despite this fact, the buyers tried to move higher on Friday, which resulted in a short-lived breakout above the medium-term brown line.

Although they failed, the RSI and the CCI didn’t generate the sell signals, which together with the buy signals generated by the weekly indicators, suggests that one more upswing can’t be ruled out.

What impact could in have on the exchange rate?

In our opinion, if the pair moves higher once again, it could re-test the previous 2018 peak (and the 78.6% Fibonacci retracement) or even the upper border of the brown rising trend channel in the coming week (we marked this area with the red ellipse).

Therefore, as long as there are no significant signs of currency bulls’ weakness, we think that opening short positions is not justified from the risk/reward perspective. What about long positions? Taking into account the proximity to important resistances they are also not justified at the moment of writing these words.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

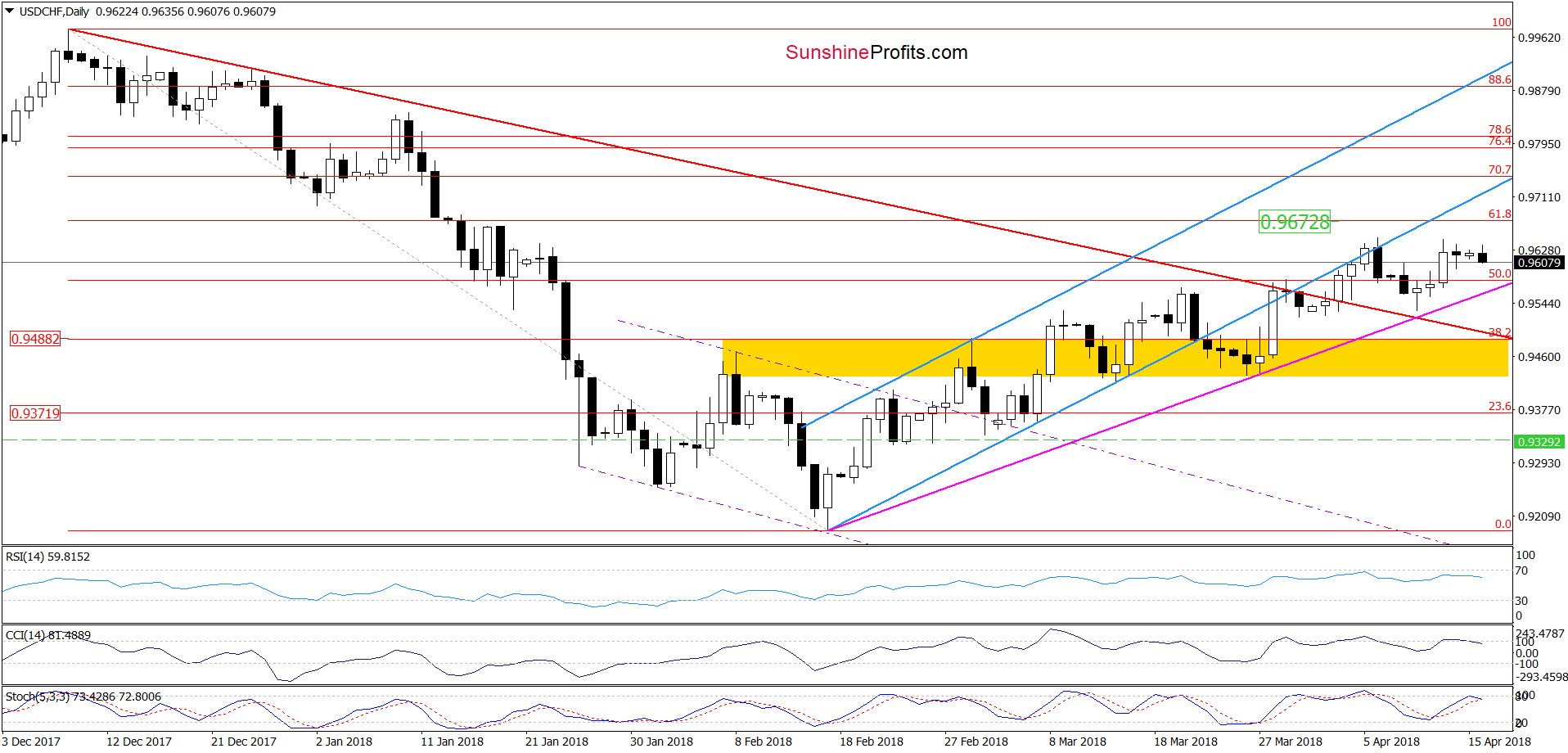

USD/CHF

From this perspective, we see that although USD/CHF moved lower in the previous week, the proximity to the previously-broken red declining line and the pink support line was enough to encourage currency bulls to act.

Thanks to their action, the pair rebounded on Thursday and came back above the 50% Fibonacci retracement. Despite this positive event, the pair stuck inside consolidation, which together with the current position of the indicators doesn’t bode well for higher values of the exchange rate in the coming days.

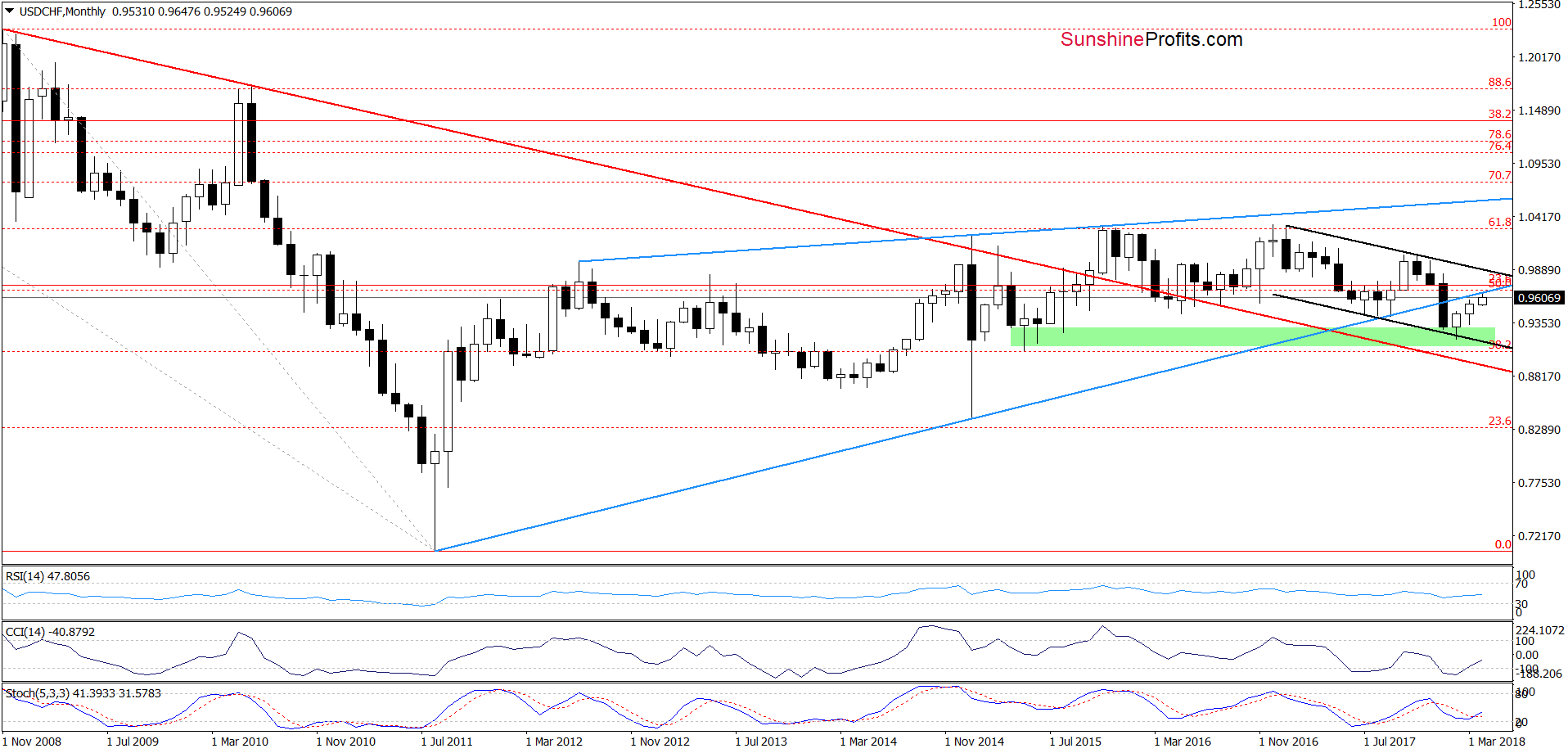

This scenario is also reinforced significantly by the long-term picture. What do we mean by that? Let’s take a closer look at the monthly chart.

From this perspective, we see that USD/CHF climbed to the previously-broken long-term blue line (the lower border of the blue rising wedge), which looks like a verification of the earlier breakdown under this important line.

If this is the case, the exchange rate will reverse and decline from current levels in the near future. Therefore, if the situation develops in line with our assumption and we see more bearish signs (for example, breakdown under the ink support line seen on the daily chart), we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts