Although USD/CHF rebounded on Friday, currency didn’t give up and pushed the exchange rate lower earlier today. Where will the pair head in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

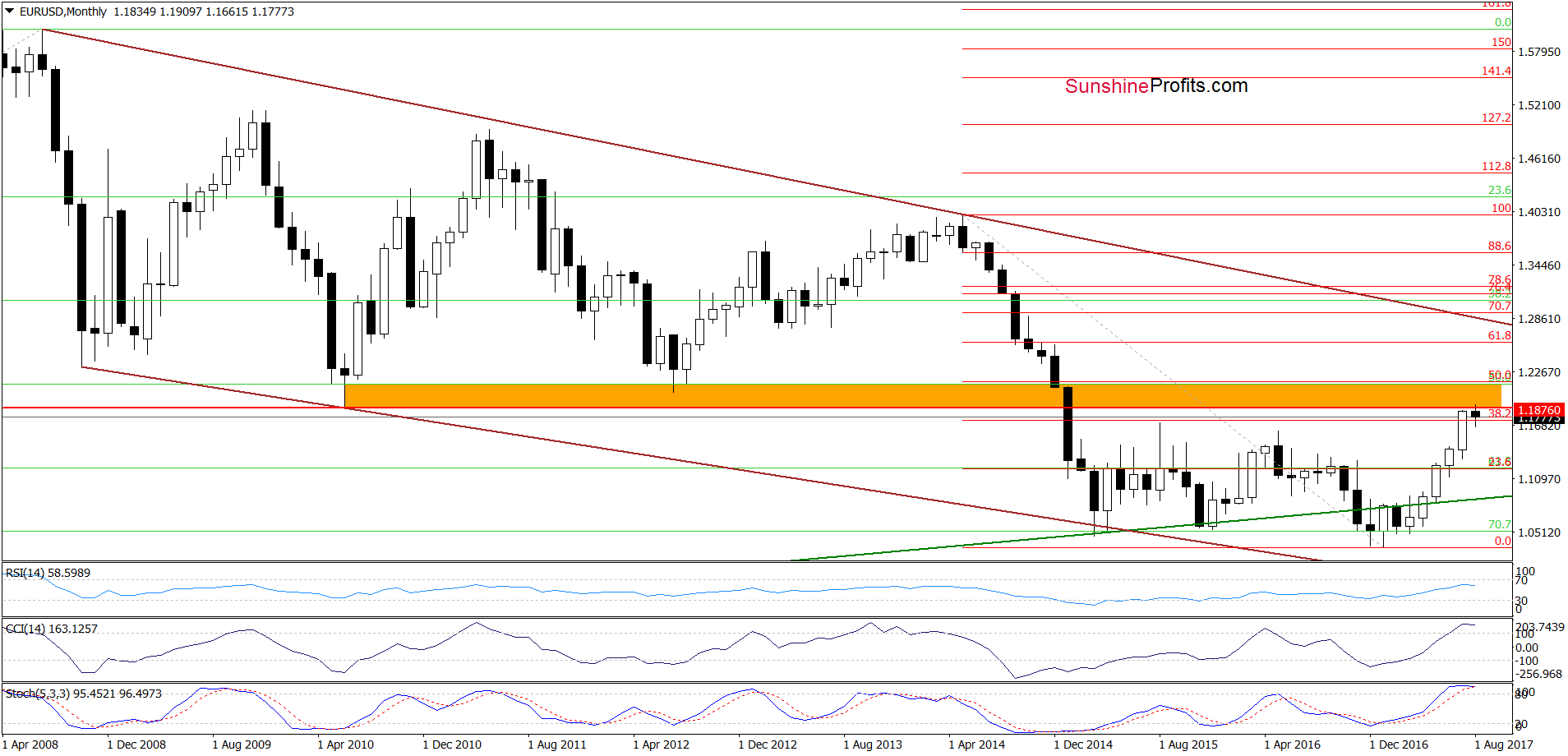

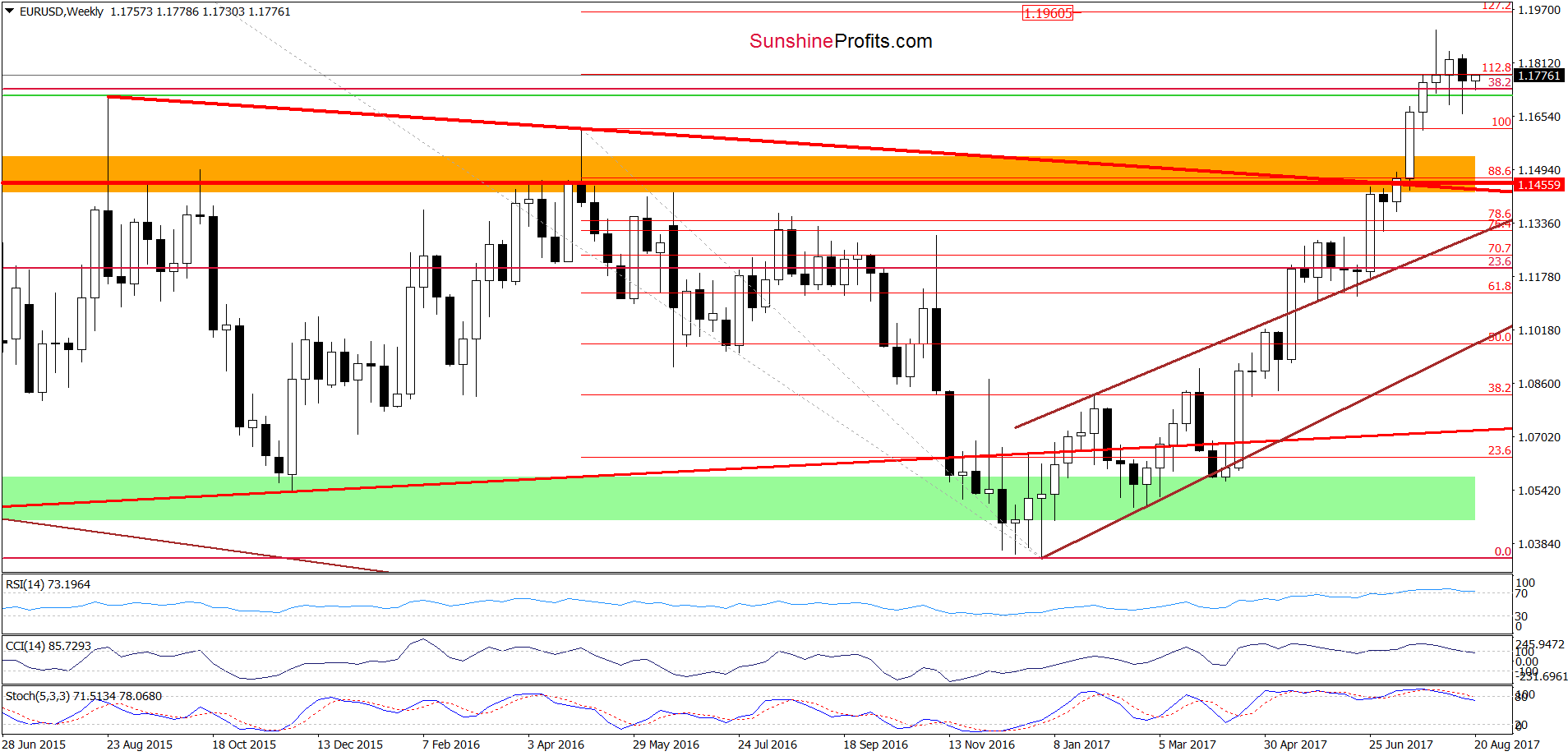

EUR/USD

From today’s point of view, we see that the overall situation in EUR/USD hasn’t changed much as the exchange rate is still trading around 38.2% Fibonacci retracement and the 112.8% Fibonacci extension. Nevertheless, the pair closed the previous week above the retracement and invalidated the earlier tiny breakdown under this support. Earlier this month, we saw a similar situation, which suggests that one more upswing and a re-test of the recent highs can’t be ruled out in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

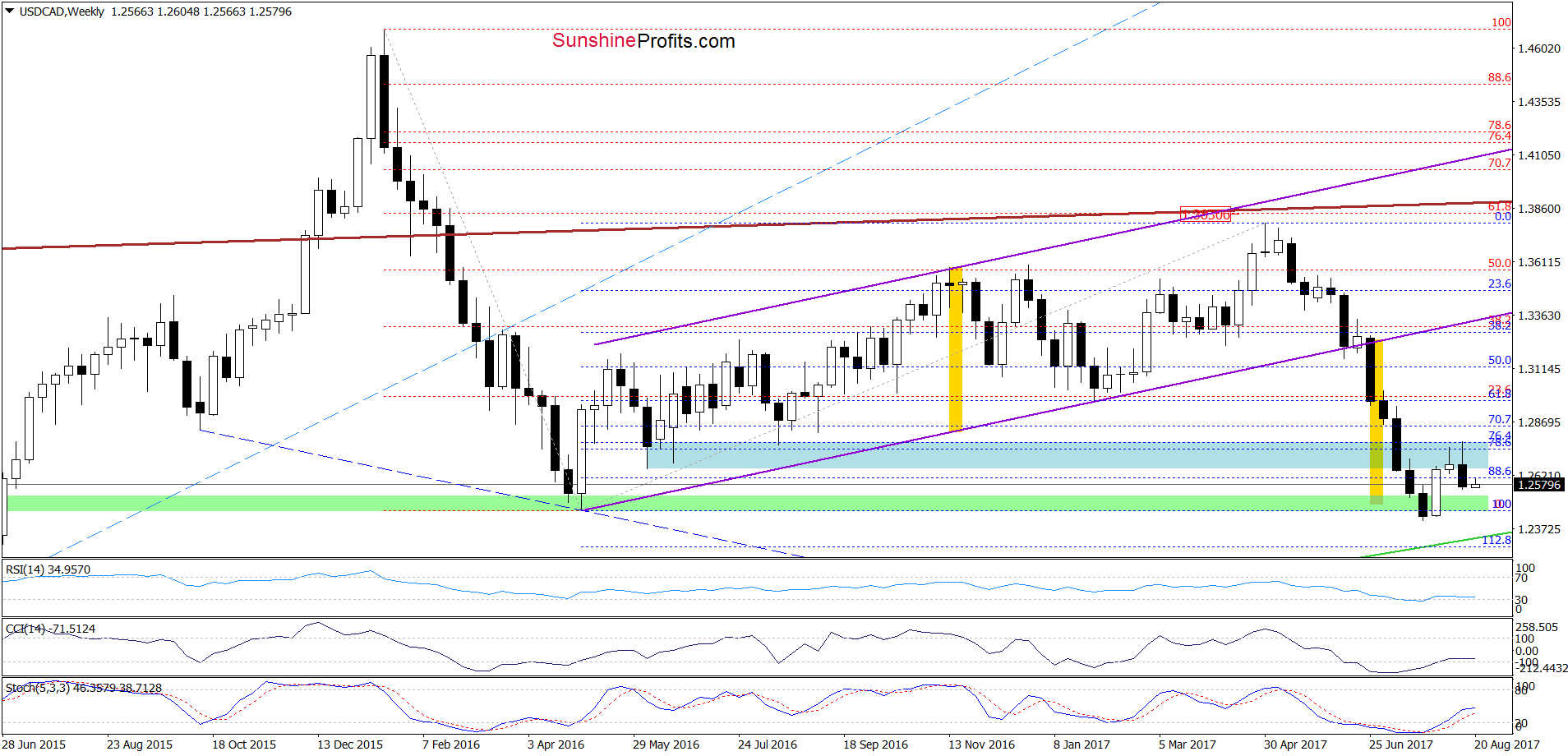

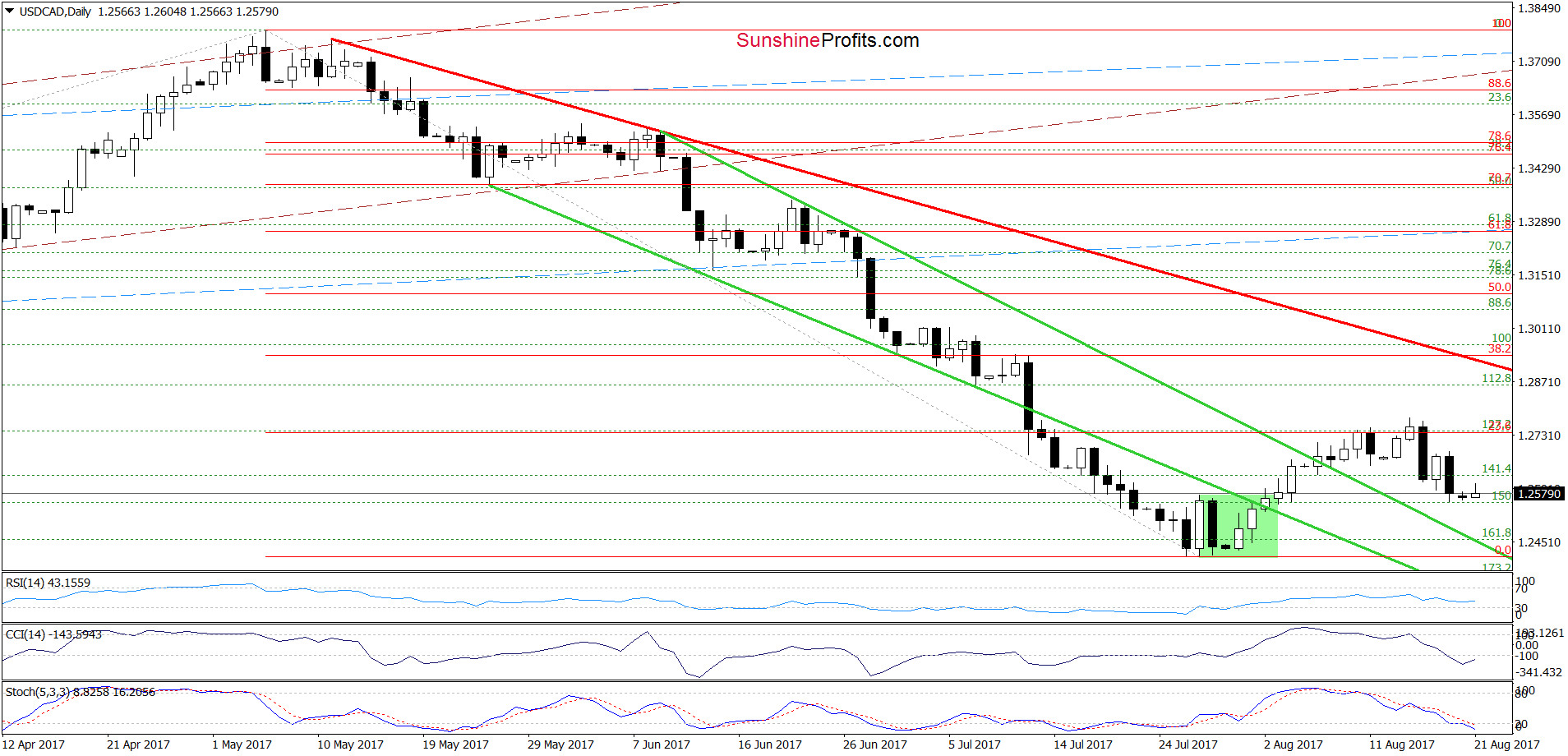

USD/CAD

Last Monday, we wrote the following:

If (…) USD/CAD reverses and decline, we will likely see a test of the green support zone (seen on the daily chart) and the upper border of the green declining wedge in the following days.

Looking at the daily chart, we see that the situation developed in line with the above scenario and USD/CAD reached our first downside target – the previously-broken upper border of the green consolidation. What’s next? Taking into account the size of Friday’s downswing and the lack of buy signals we think that another downswing is just around the corner and we’ll see the exchange rate on the upper border of the green declining wedge in the following days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

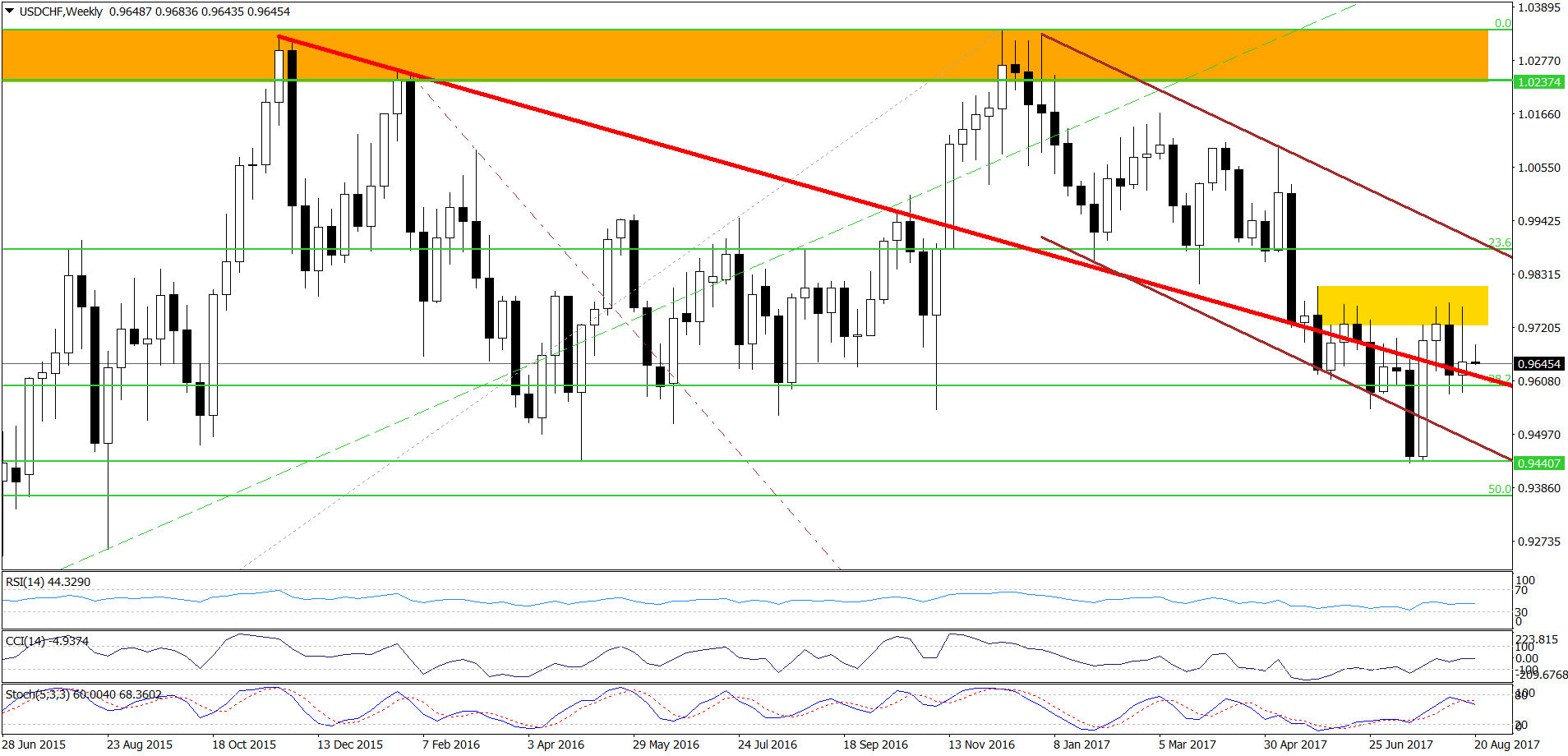

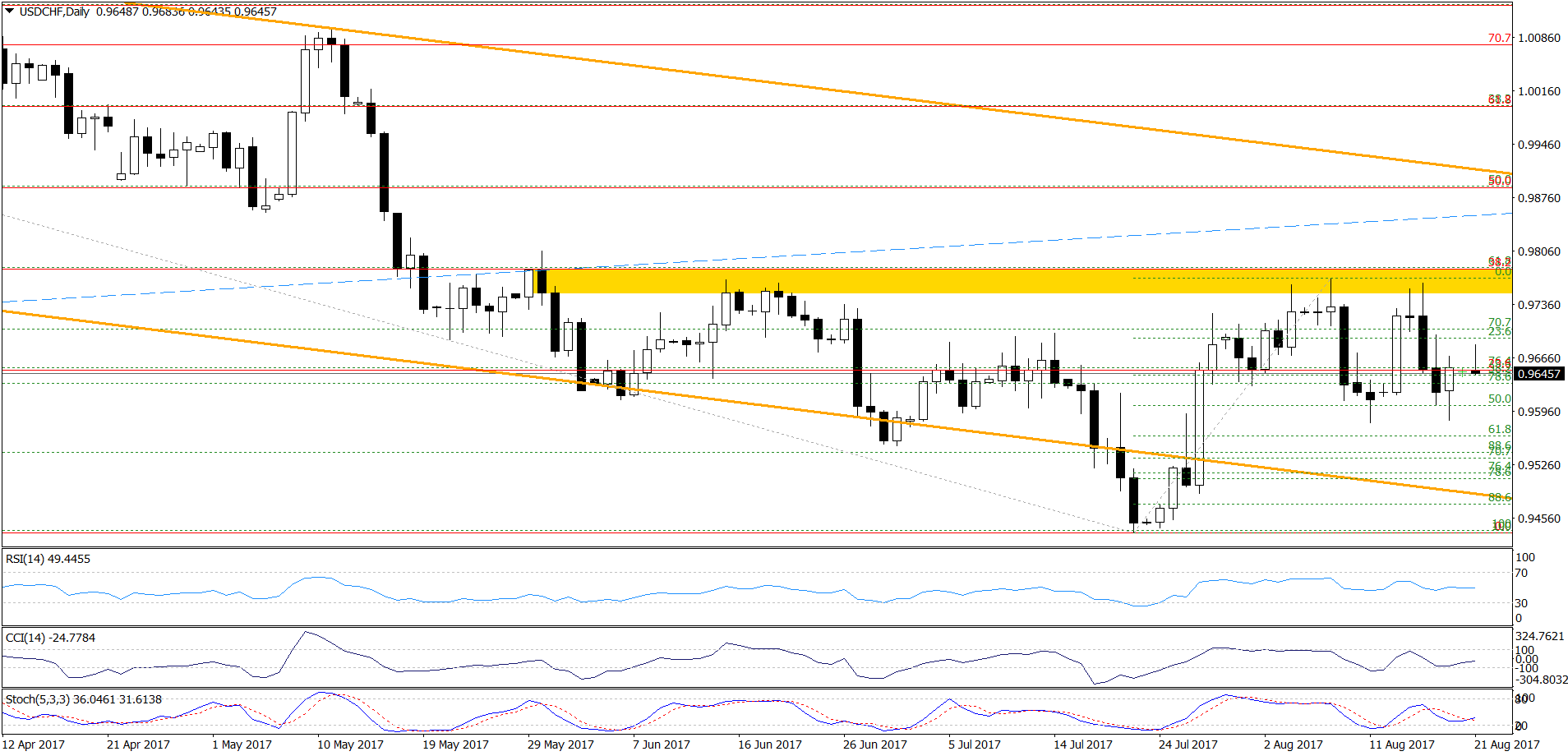

USD/CHF

Quoting our Thursday’s alert:

(…) the yellow resistance zone stopped currency bulls once again (as we had expected), which resulted in a sharp pullback yesterday. Additionally, the CCI and the Stochastic Oscillator generated the sell signals, which suggests that another downswing is just around the corner. If this is the case and the pair declines from current levels, the initial downside target will be the last week low of 0.9582.

On the daily chart, we see that currency bears pushed USD/CHF lower as we had expected and the exchange rate slipped to our downside target. Although the pair rebounded on Friday, the shape of today’s candlestick suggests that another downswing is just around the corner. If this is the case, we’ll see a re-test of the recent lows in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts