In recent days, the greenback moved higher against the Swiss franc, which erased almost entire November downward move. Earlier today, the exchange rate extended its rebound and USD/CHF approached the October peak. What’s next for this currency pair?

- EUR/USD: long (a stop-loss order at 1.1245 the initial upside target at 1.1544)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.62; the initial downside target at 111.84)

- USD/CAD: short (a stop-loss order at 1.3299; the initial downside target at 1.2934)

- USD/CHF: short (a stop loss order at 1.0128; the initial downside target at 0.9881)

- AUD/USD: none

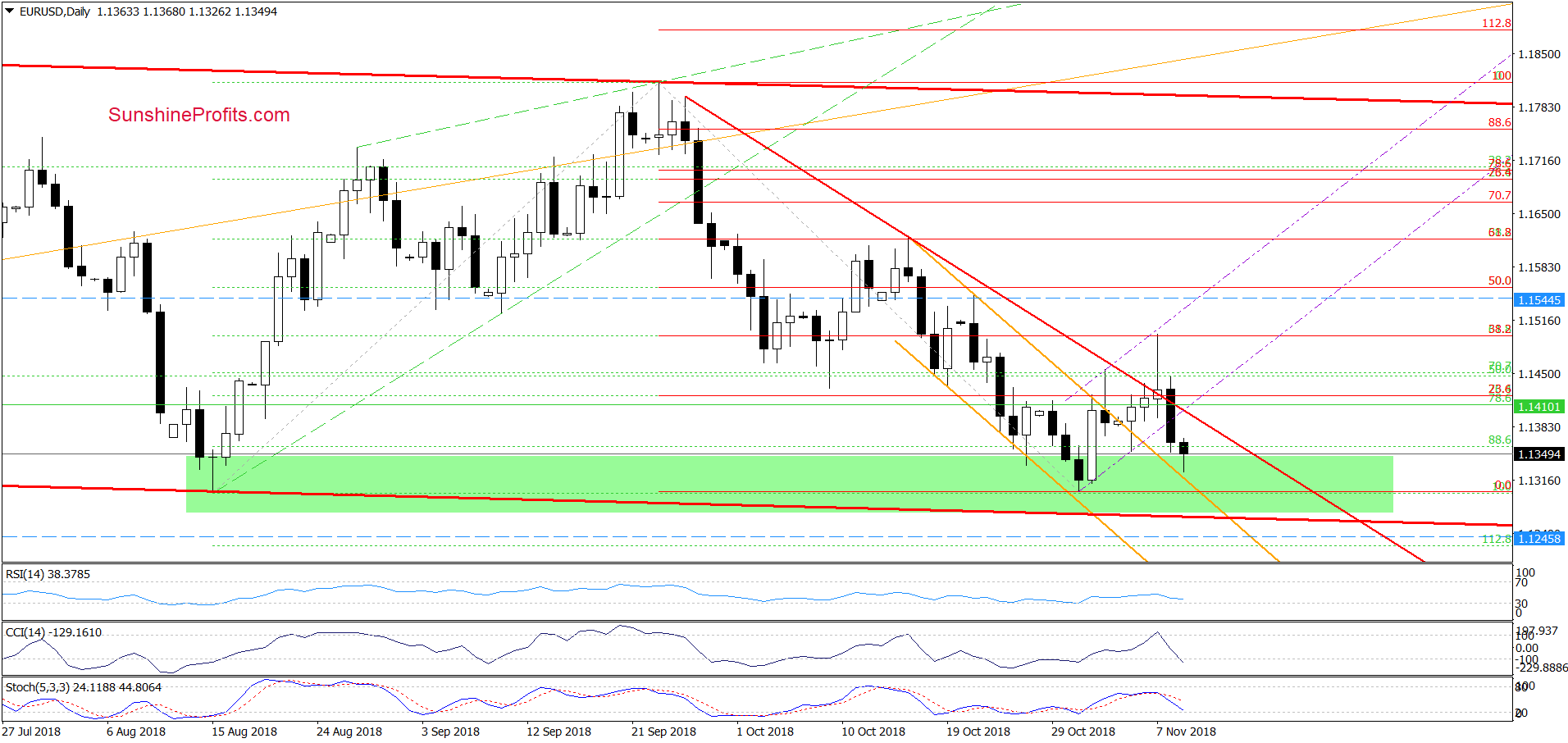

EUR/USD

From today’s point of view, we see that the 38.2% Fibonacci retracement triggered a quite sharp move to the downside, which invalidated the earlier breakout above

the short-term red declining line.

Thanks to yesterday’s drop the pair slipped to the green support zone and the previously-broken upper line of the orange declining trend channel. Such price action looks like a verification of the earlier breakouts and suggests that another rebound from this area is likely – especially when we factor in the proximity to the recent lows and the lower border of the red declining trend channel.

Trading position (short-term; our opinion): Long positions with the stop-loss order at 1.1245 (we decided to move it a bit lower) and the initial upside target at 1.1544 are justified from the risk/reward perspective.

USD/JPY

The first thing that catches the eye on the daily chart is yesterday’s breakout above the 76.4%, the 78% Fibonacci retracements and the upper line of the red rising wedge. Despite this positive development, USD/JPY pulled back earlier today, which together with the current position of the daily indicators suggests that further deterioration is just around the corner.

If this is the case and USD/JY declines from current levels, we’ll likely see a drop to the November lows around 112.63 or even the green support area created by the late-October lows and the 61.8% Fibonacci retracement.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 114.62 and the initial downside target at 111.84 are justified from the risk/reward perspective.

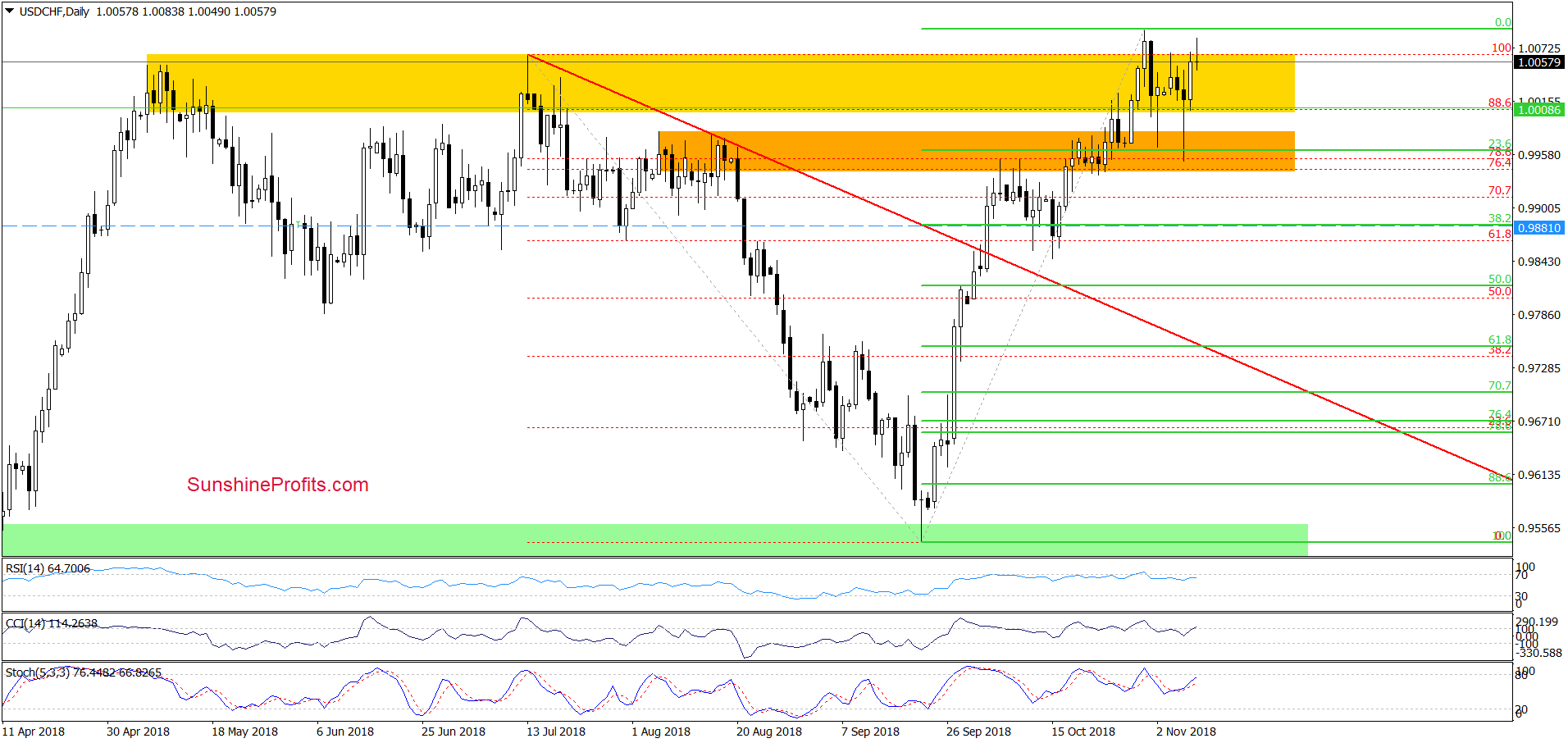

USD/CHF

Looking at the daily chart, we see that the 23.6% Fibonacci retracement in combination with the proximity to the lower border of the orange zone triggered a rebound, which approached USD/CHF to the October peak earlier today.

Although this is good news for currency bulls, we should keep in mind that the space for increases seems limited. Why? Let’s take a look at the medium-term chart below.

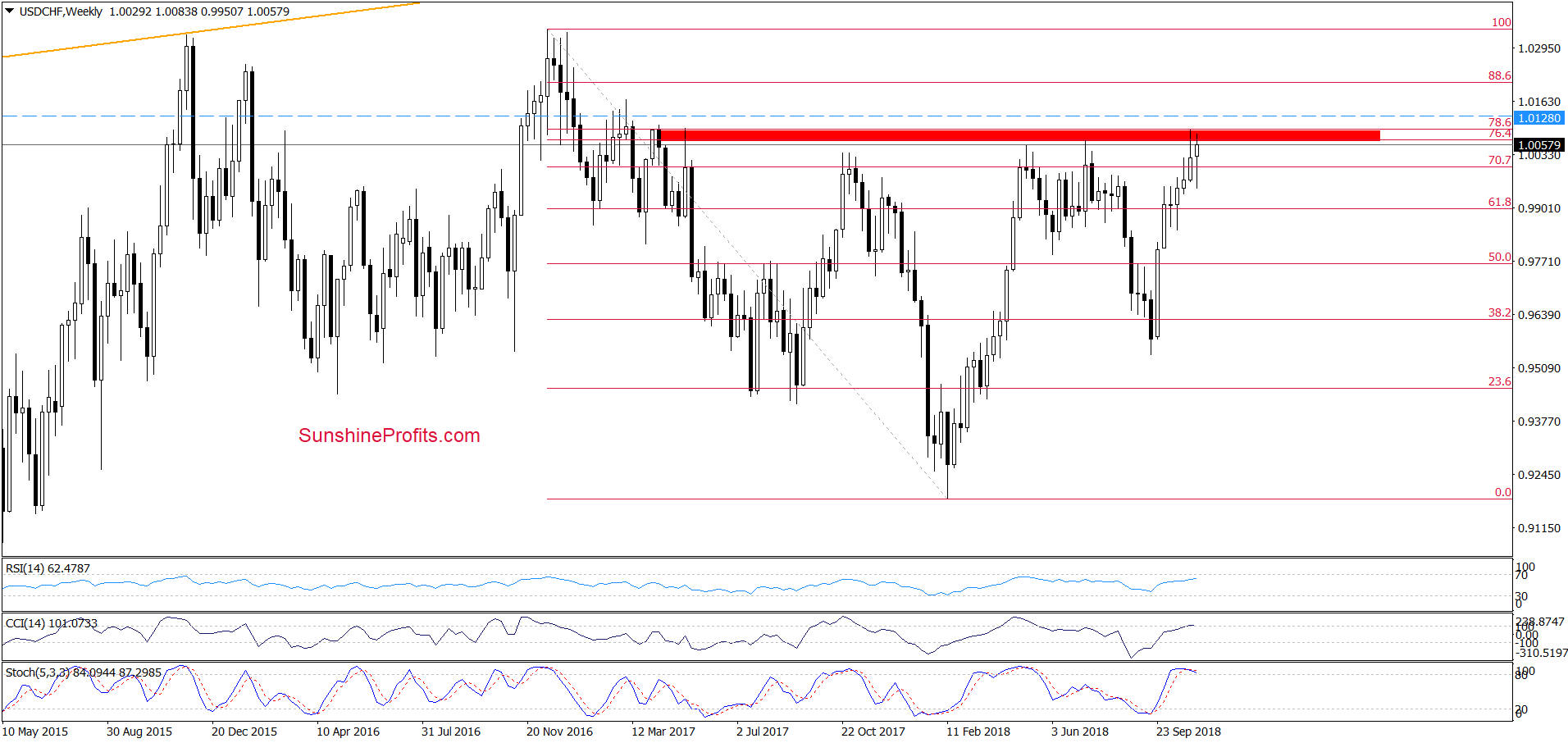

From this perspective, we see that the exchange rate increased to the red resistance zone (created by the 76.4% and the 78.6% Fibonacci retracements), which was strong enough to stop the buyers and trigger a reversal in May and July.

Therefore, in our opinion, further rally will be more reliable only if we see a successful breakout above the above-mentioned red zone. Until this time, another reversal and lower values of the exchange rate is more likely scenario.

Trading position (short-term; our opinion): Short positions with a stop loss order at 1.0128 and the initial downside target at 0.9881 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts