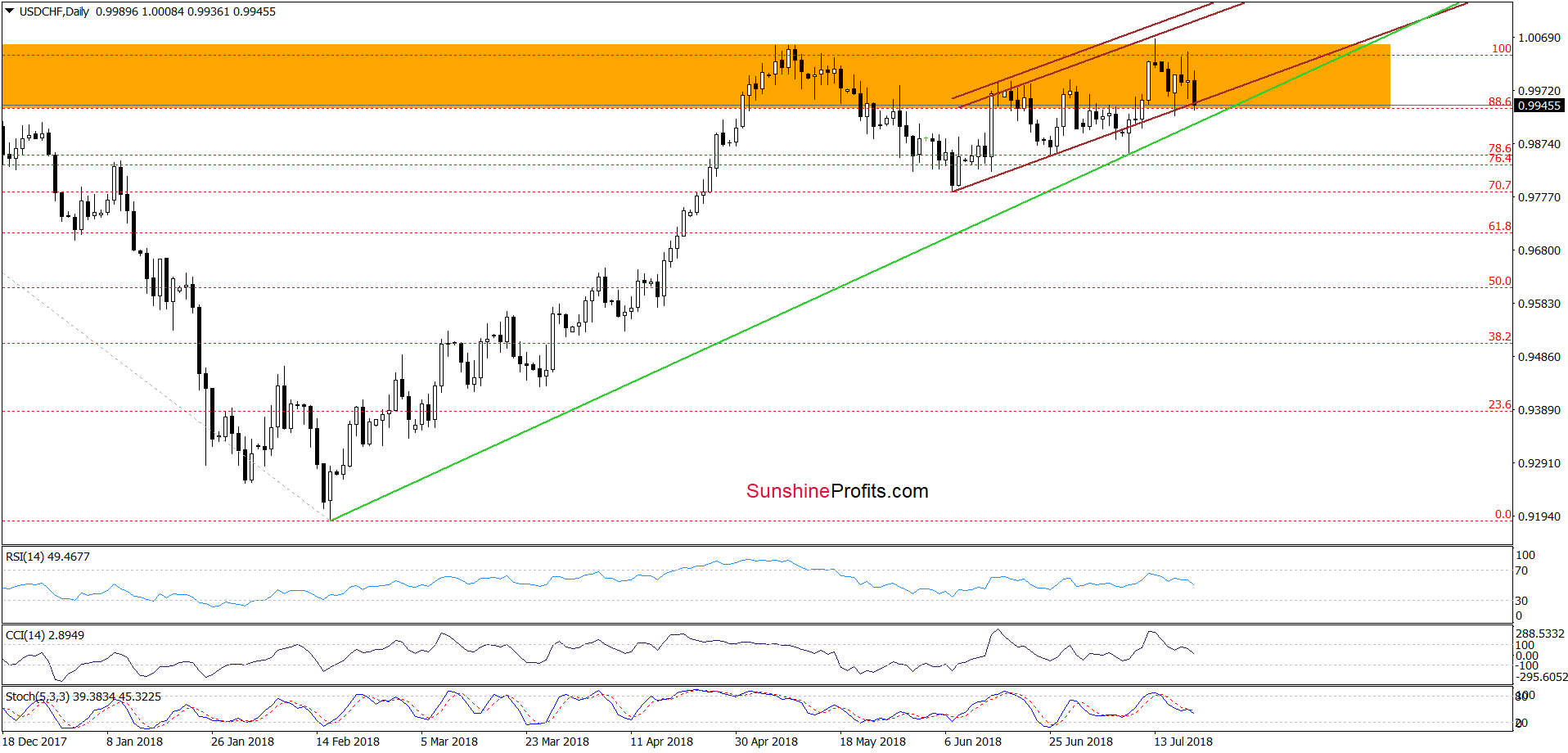

Earlier today, the U.S. dollar declined against the Swiss franc, which took USD/CHF to the lower border of the rising trend channel. Since the beginning of the month we saw several attempts to break below this line, but all of them ended in the failure of the bears. Will history repeat itself once again?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

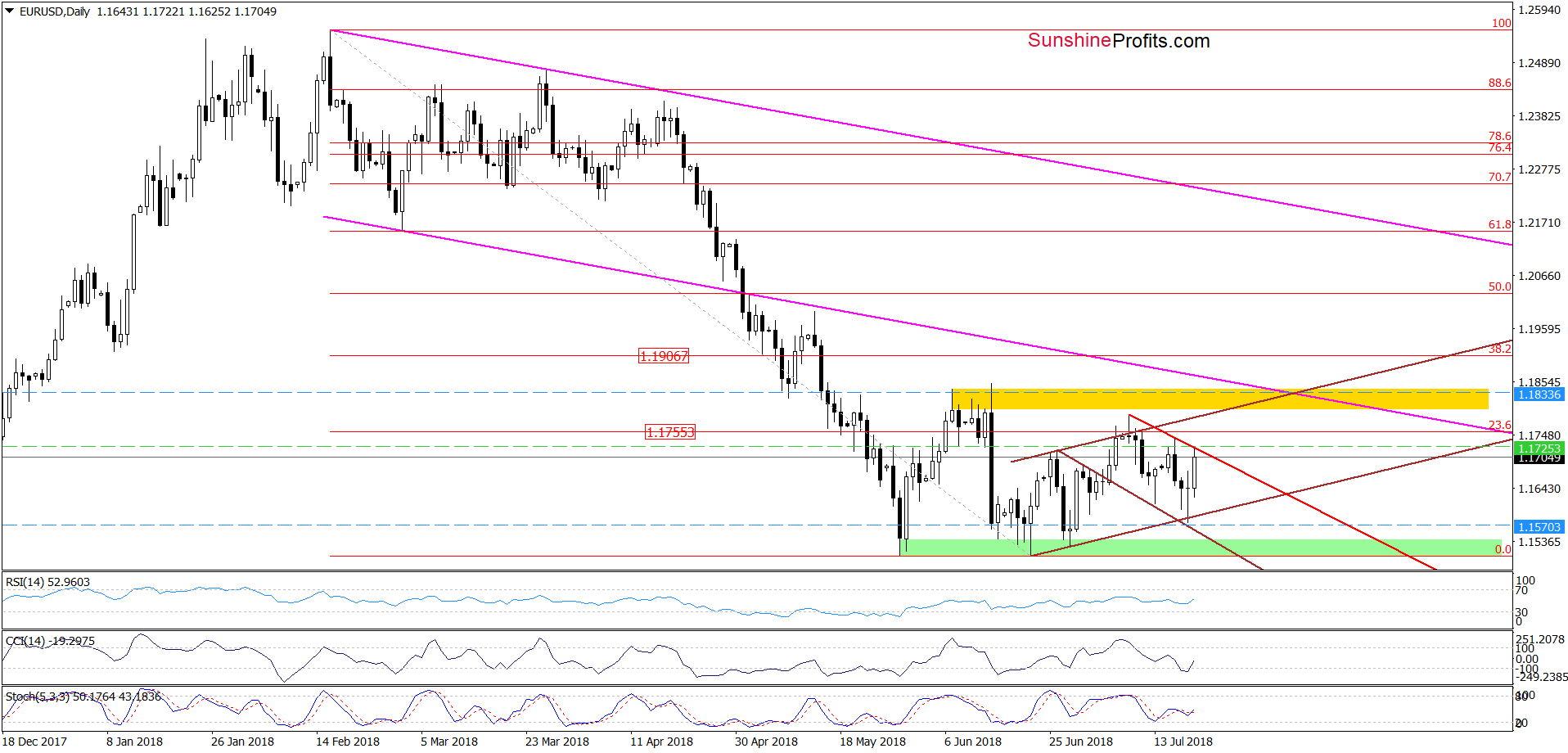

EUR/USD

Looking at the daily chart, we see that although EUR/USD moved higher earlier today, the pair is still trading inside the short-term brown rising trend channel and the very short-term red declining trend channel.

This means that the overall situation hasn’t changed much, and another reversal is just around the corner. If this is the case, the exchange rate will re-test yesterday’s low.

Trading position (short-term; our opinion): short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

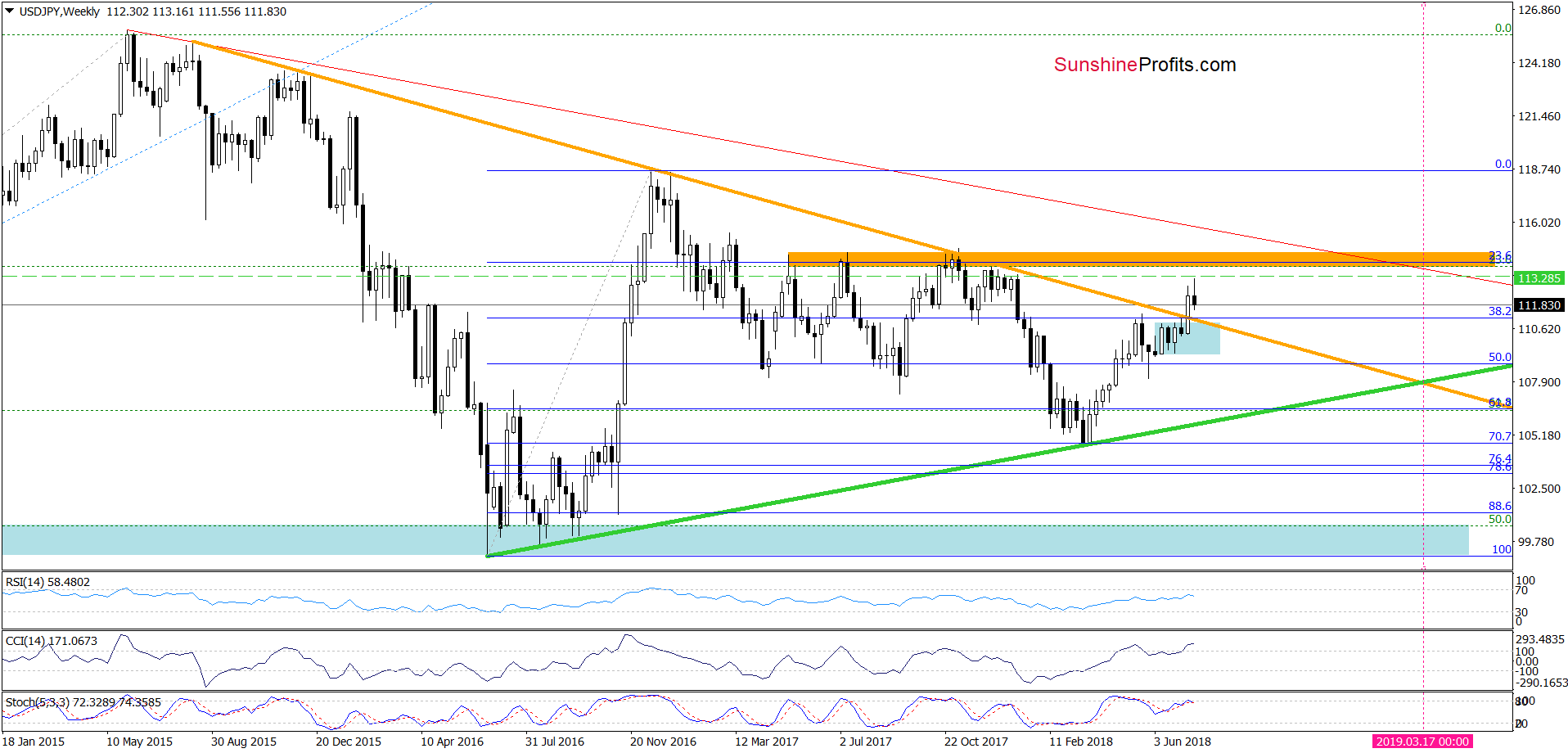

USD/JPY

From the medium-term perspective, we see that although USD/JPY moved lower, the pair remains above the previously-broken major resistance (the orange declining line based on the August 2015, December 2015 and January 2017 peaks), which means that the last week’s breakout and its impact on the pair is still in effect.

Nevertheless, we think that a test of the strength of this line should not surprise us. If it withstands the selling pressure, we’ll see a verification of the earlier breakout, which will be a bullish development.

Taking the above into account, we decided to lower our stop-loss level to avoid premature closing of the position. Details below.

Trading position (short-term; our opinion): long positions with a stop-loss order at 110.21 and the initial upside target at 113.50 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

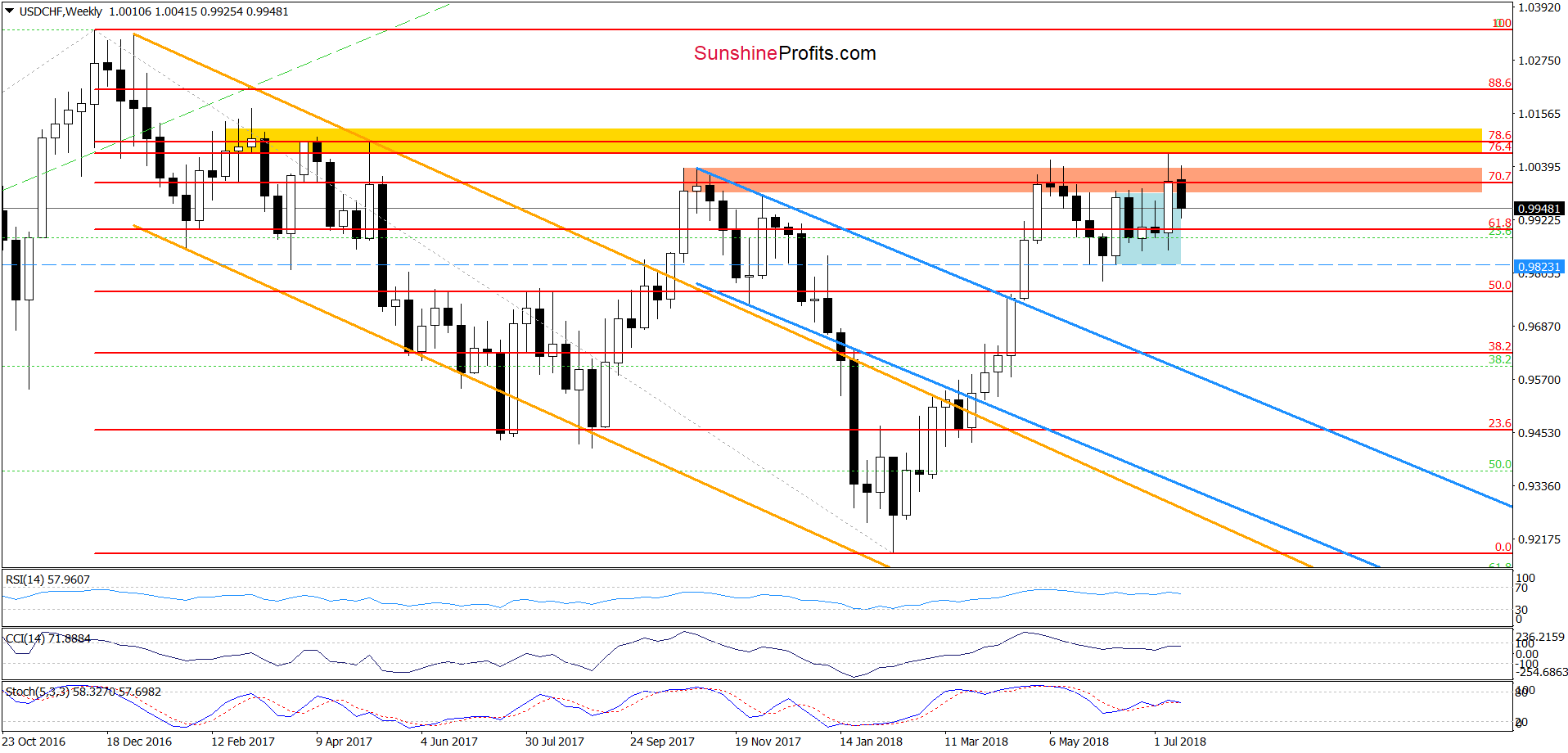

USD/CHF

From today’s point of view, we see that the upper border of the orange resistance zone stopped the buyers, triggering a move to the downside, which took USD/CHF to the lower border of the brown rising trend channel earlier today.

As we mentioned earlier, since the beginning of the month currency bears tried to push the pair under this line several times, but without result. In all previous cases, their opponents managed to stop declines and trigger a rebound in the following days.

Therefore, in our opinion, as long as there is no successful breakdown under the nearest support lines (the lower border of the brown rising trend channel and the green support line), a bigger move to the downside is not likely to be seen.

Taking all the above into account, we think that waiting at the sidelines for a profitable opportunity is justified from the risk/reward perspective. However, if the situation develops in line with the above scenario (the breakdown), we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts