The 2018 lows, or rather a line based on them, turned out to be a salvation for USD/ CHF. Thanks to this support, currency bulls erased some losses from previous days and gained a solid ally. Is it as strong as it looks at the first sight?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2806; the initial downside target at 1.2186)

- GBP/USD: short (a stop-loss order at 1.4548; the next downside target at 1.3685)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8222; the initial downside target at 0.7743)

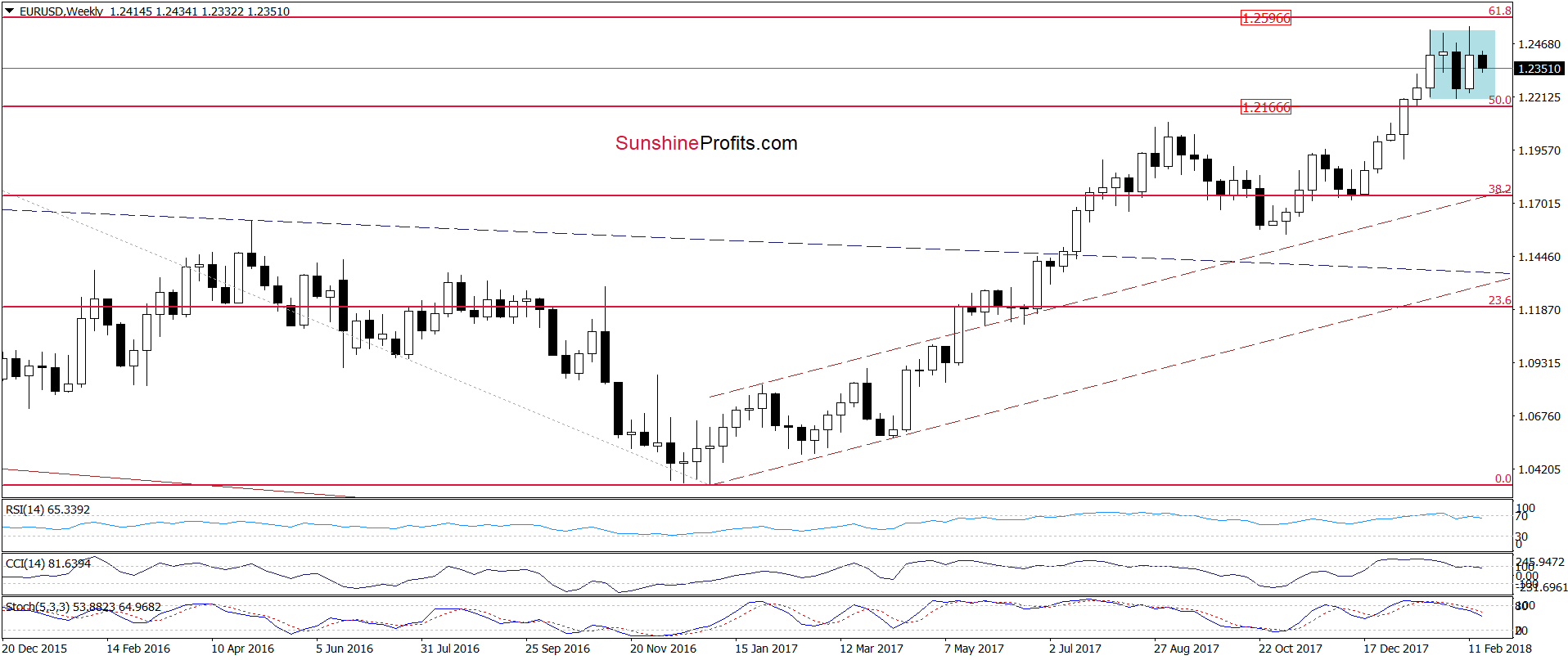

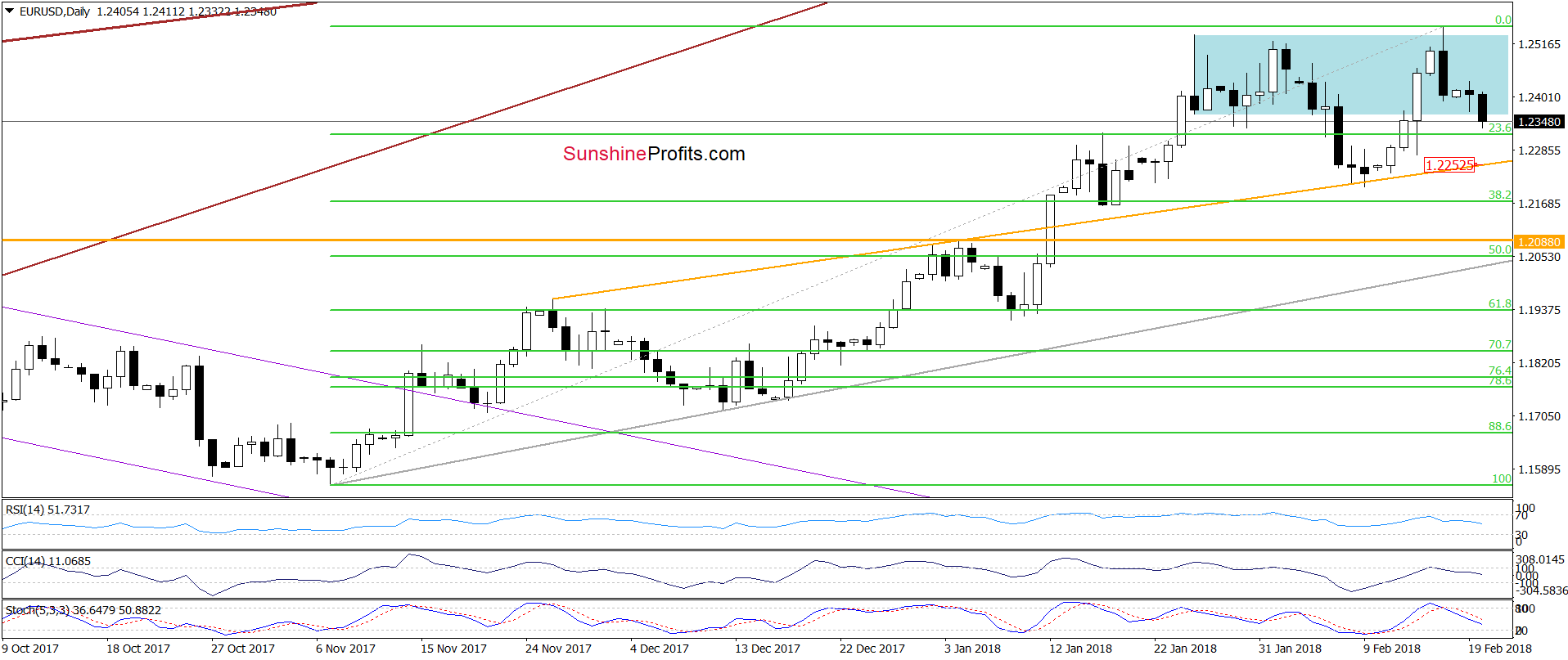

EUR/USD

On Friday, we wrote the following:

(…) currency bears took control and invalidated the earlier tiny breakout above the previous highs, which triggered further deterioration.

Taking this negative development (…) into account and combining it with the current position of the daily indicators (they are very very close to generating the sell signals), we think that another move to the downside is just ahead of us.

From today’s point of view, we see that currency bears pushed the pair lower as we had expected. As you see on the above chart, they took EUR/USD under the lower border of the blue consolidation earlier today, which doesn’t bode well for higher values of the exchange rate – especially when we factor in the sell signals generated by the daily and weekly indicators.

How low could the pair go in the coming week? In our opinion, the best answer to this question will be the quote from our last commentary on this currency pair:

(…) the first downside target will be (…) the orange support line (based on the November and early January highs).

Nevertheless, if this support is broken, currency bears will likely test the recent lows or even the 38.2% Fibonacci retracement in the following days.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2806 and the initial downside target at 1.2186) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

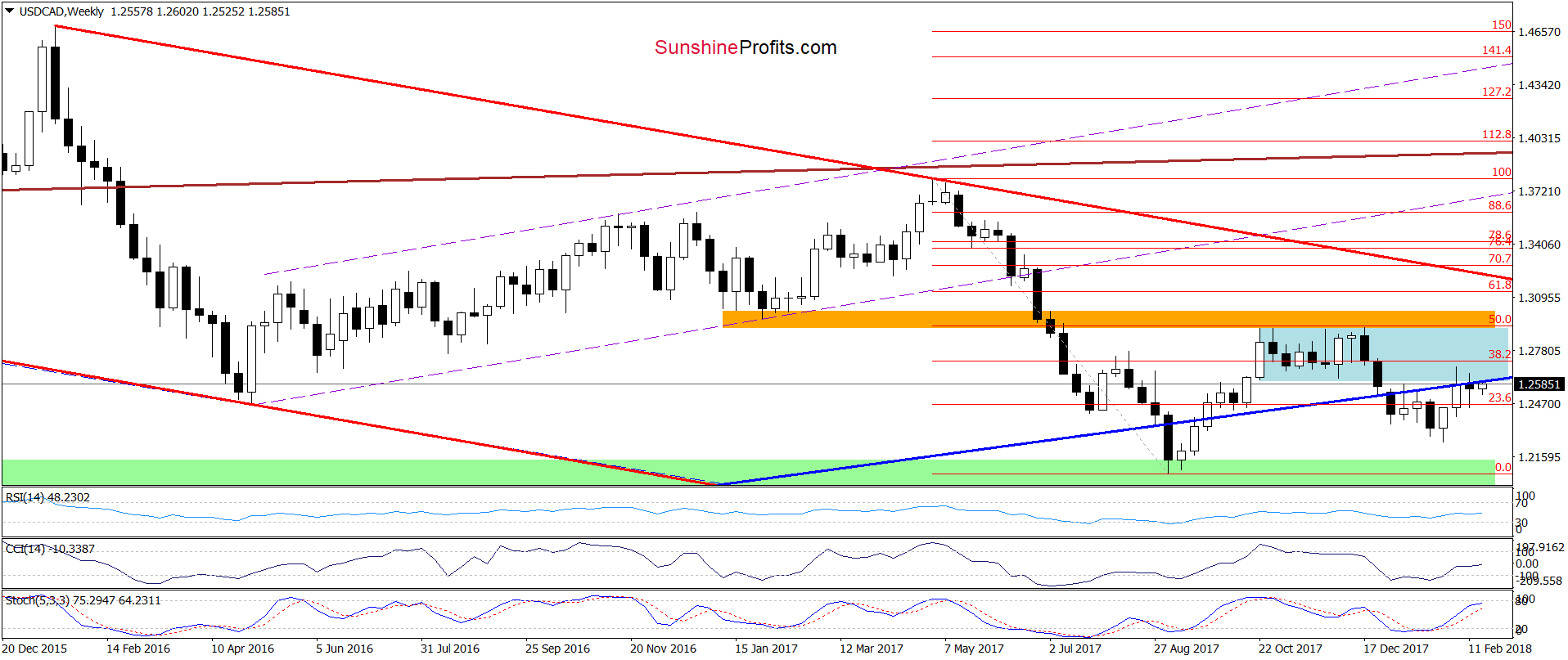

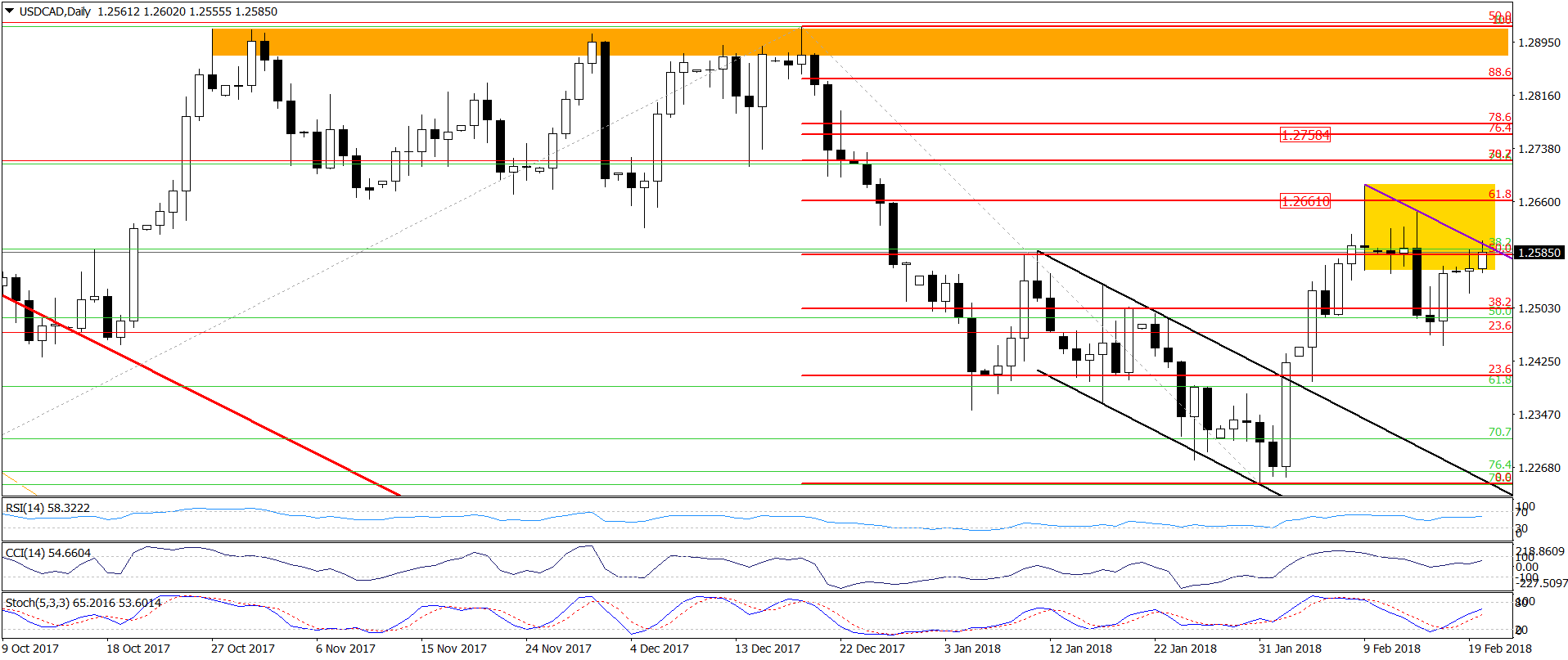

USD/CAD

On the daily chart, we see that although currency bears pushed USD/CAD sharply under the lower border of the yellow consolidation, their opponents didn’t give up and stopped them, triggering a rebound in the following days.

Thanks to this increase, the pair came back into the consolidation and climbed to the very short-term resistance line based on the previous highs. Let’s be honest, this line is not the strongest resistance, but when we zoom out our picture, we’ll notice that this area is also reinforced by the previously-broken long-term blue resistance line. This means that as long as there is no invalidation of the breakdown under this important line all upswings will be nothing more than verifications of the earlier breakdown.

Nevertheless, taking into account the buy signals generated by the daily indicators, we think that currency bulls will try to fight for higher prices in the coming day(s). If they succeed, we’ll see at least a test of the 61.8% Fibonacci retracement and the February peak.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

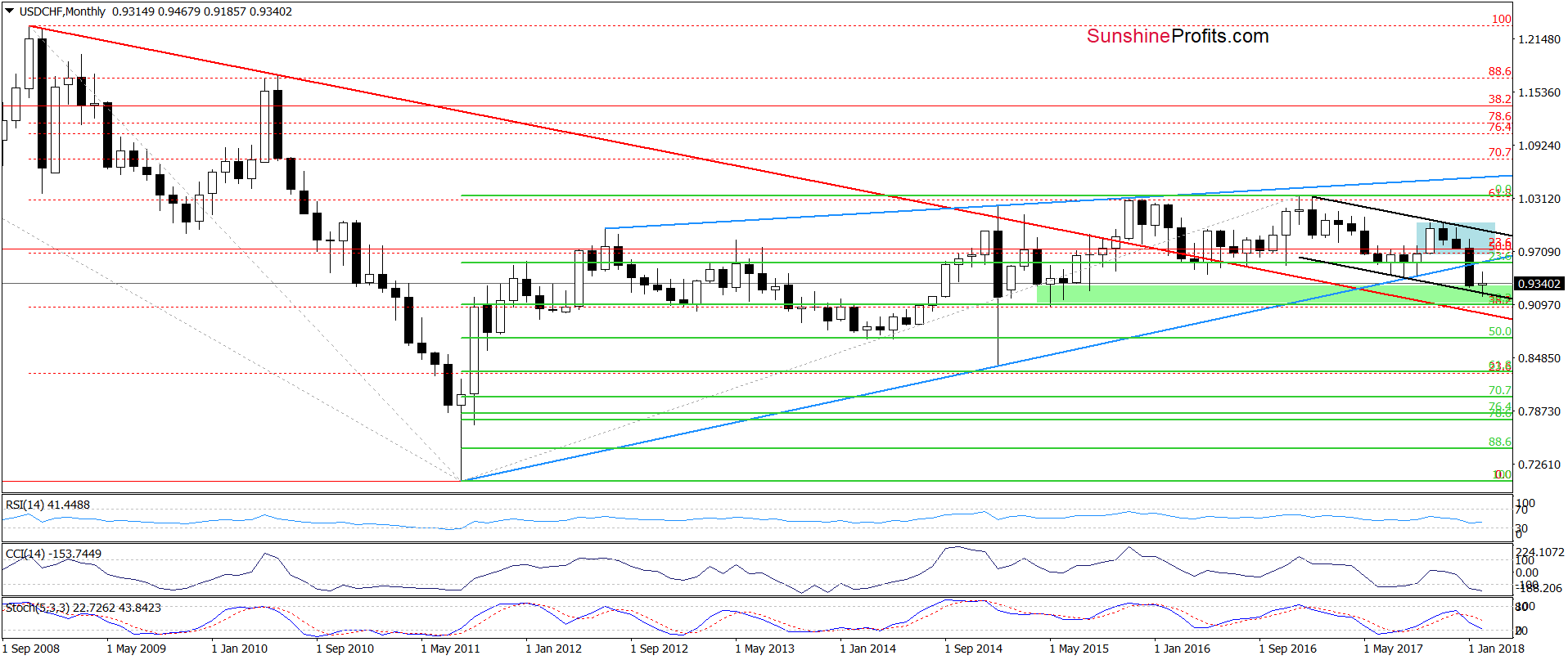

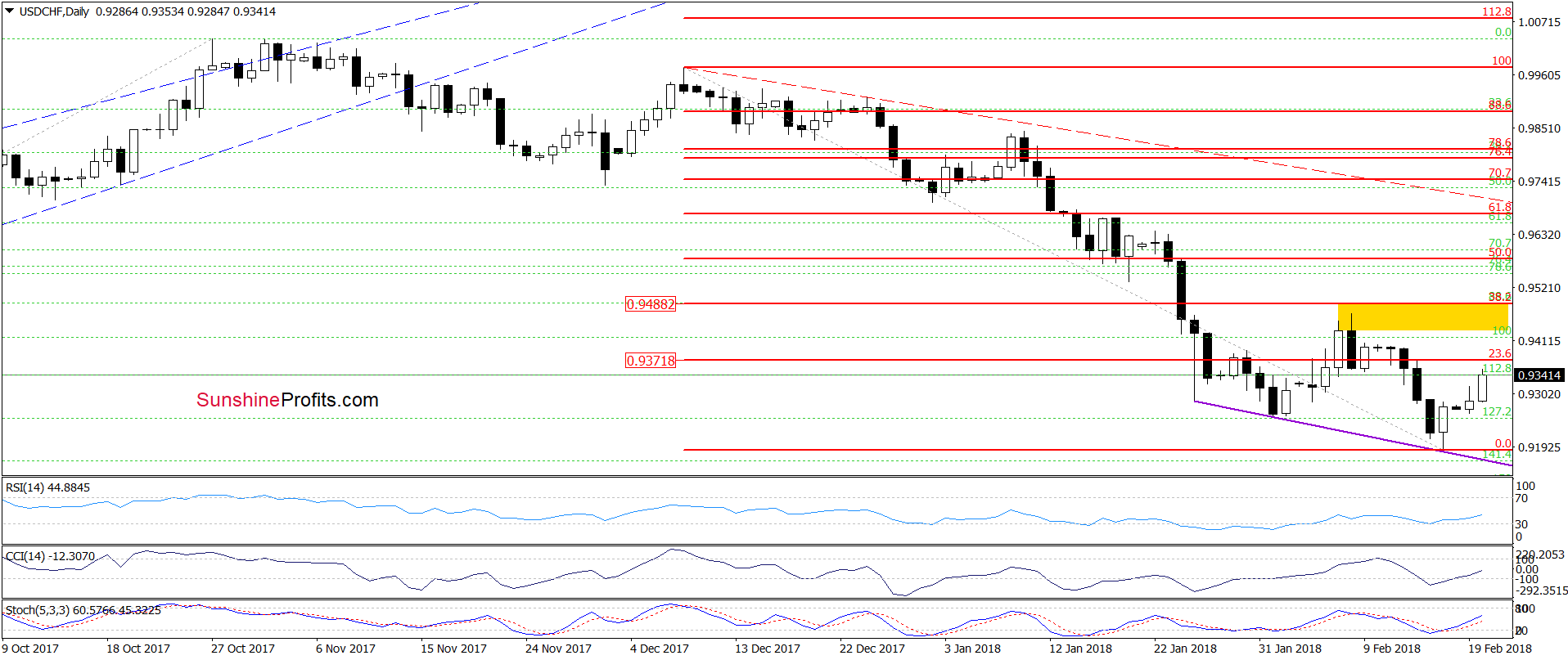

USD/CHF

Quoting our Thursday's alert:

(…) the pair re-tested the lower border of the black declining trend channel and rebounded slightly, which increases the probability that reversal is just around the corner.

In our opinion, this scenario is more likely at the moment of writing these words, but (…) what could happen if currency bears do not give up (…)? We think that currency bears’ victory could result in a drop to the purple declining support line based on the previous lows (…)

Looking at the above chart, we see that the situation developed in line with the above scenario and USD/CHF rebounded after a drop to the purple support line. Additionally, the exchange rate invalidated the earlier tiny breakdown under the lower border of the long-term black declining trend channel, which is a major bullish development at the moment of writing these words.

On top of that, all daily indicators generated the buy signals, which suggests that further improvement is just ahead of us. However, in our opinion, higher values of the exchange rate will be more likely and reliable if the pair breaks above the 23.6% Fibonacci retracement. Why? Because this resistance stopped currency bulls at the beginning of the month, triggering a decline.

Therefore, if we see a breakout above it, currency bulls will likely take USD/CHF to the yellow resistance zone created by the February highs and the 38.2% Fibonacci retracement in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts